The EY 2023 Work Reimagined Survey reveals employers and employees have distinctly different perspectives in the “next normal” of work.

Three questions to ask:

- How can organizations reinspire their workforce after years of disruption?

- How can generative technologies add value to the human experience of work?

- How can leaders better connect the “how” and “where” of work, to the “why” of work?

Years of disruption have propelled employers and employees into distinctly different worlds of priorities, pressures, and prospects.

Now in its fourth iteration, the latest EY 2023 Work Reimagined Survey reveals an emerging skyline for the “next normal” of work, detailing the contours of a rebalance in workforce realities and what factors contribute most to better outcomes.

Organizations are no longer purely driven by the lingering consequences of the COVID-19 pandemic. Employers now see their challenges through the cyclical lens of economic, labor and geopolitical pressures, requiring workforce strategy to more fully move beyond any one business function. Hybrid work has evolved to require more thoughtful considerations for how technology, office space and amenities influence productivity, culture, and trust, but also consideration of the risks involved with a more mobile workforce. Employees, meanwhile, are guided largely by structural workforce realities, retaining more perceived power in the labor market and being willing to change jobs to get what they want. Many employees are driven by a need for better total rewards packages amid high inflation and cost of living, by their desire for better well-being, and by a need to have the skills to succeed in a world of continued work flexibility.

The survey shows:

- Thirty-four percent of employees say they’re willing to change jobs in the next 12 months, with employers being more likely than employees to think economic challenges will reduce likely employee turnover. Pay remains the primary employee concern, keeping focus on comprehensive total rewards programs.

- Employers and employees believe the power balance has slightly shifted back toward employers in the last year, although employees have gained 8% in perceived power since 2019.

- Cultivating trust and having a people-centric leadership model is linked to significantly better organizational outcomes, including perceptions of better culture and productivity.

- Skills-building and training are top priorities for employers looking to upskill and reskill their workforce and for employees looking to remain competitive in a still strong labor market.

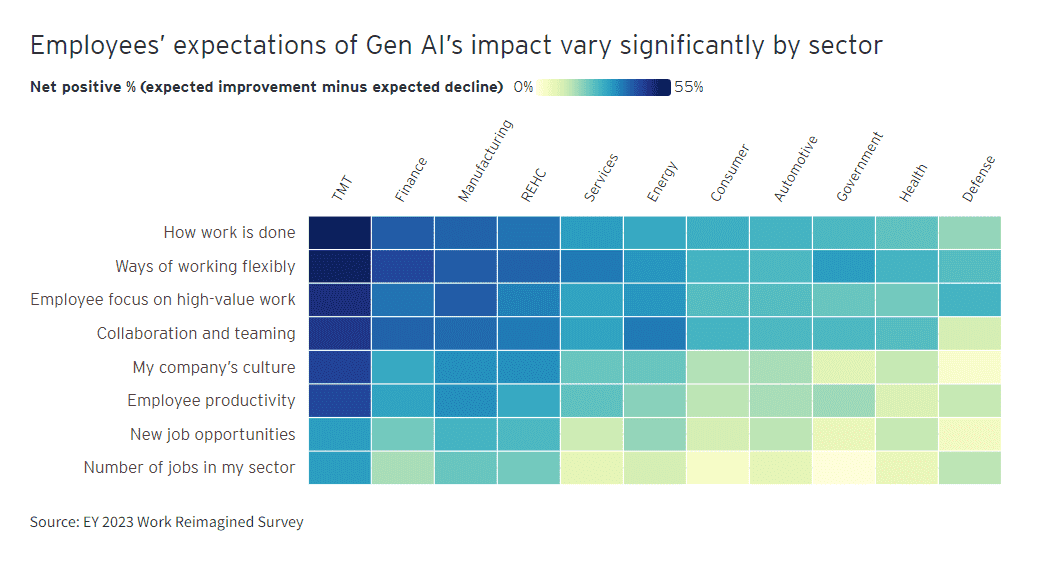

- Both employees and employers show enthusiasm for Generative AI (GenAI), with a net positive 33% expecting benefits to productivity and new ways of working, and 44% net positive for impacts on flexible working. But both groups see GenAI training as a low priority.

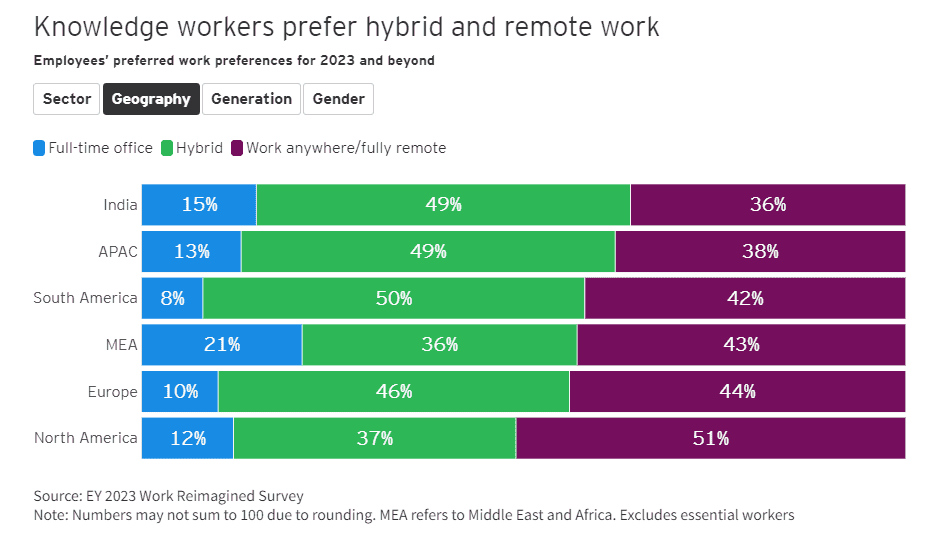

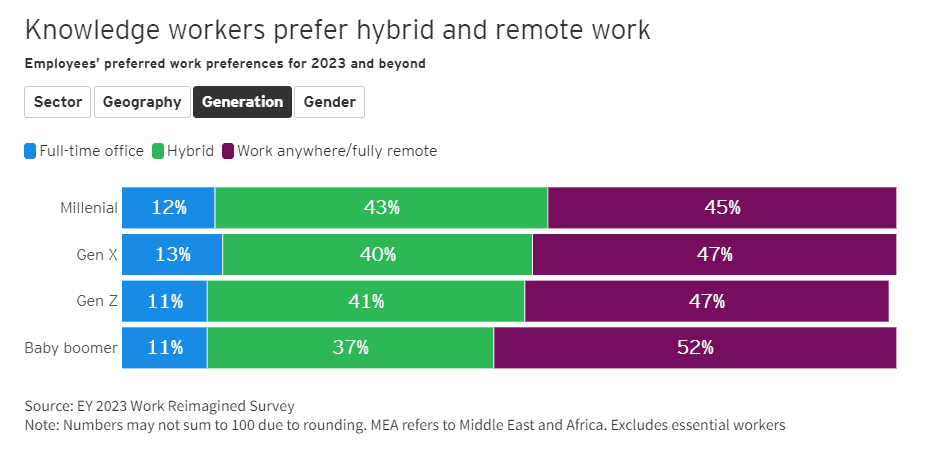

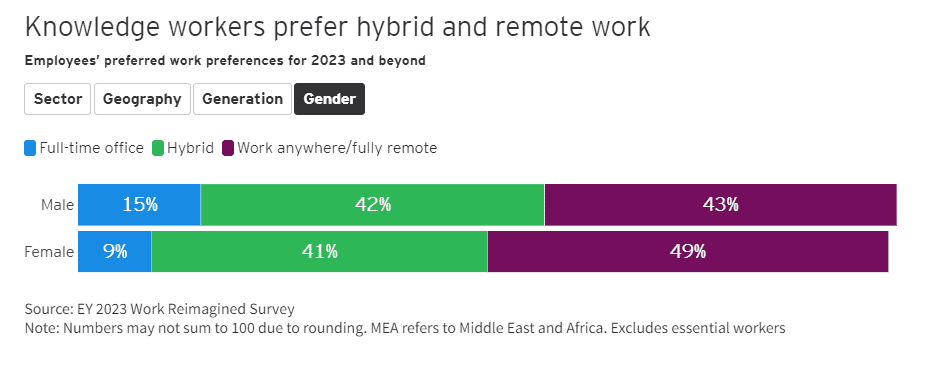

- Among knowledge workers whose work is traditionally based primarily on using analysis or subject expertise in a professional office setting, more than a third prefer to work fully remote, with stronger preference shown among women than men. Just a fifth of employers prefer fully remote, with a majority wanting employees to work at least two or three days per week in an office.

- Better quality commercial real estate is not enough to attract employees back to the office on its own, but organizations with higher-graded workplaces are also more likely to report better productivity, culture, and a decreased likelihood of employees wanting to quit.

Cyclical and structural pressures have revealed stark and persistent differences between employer and employee priorities. Navigating the way forward will rely on leaders seeing this Great Rebalance as an opportunity to re-energize their workforce strategy to be technologically evolved yet inherently people-centric, agile and resilient.

Between June and August 2023, EY conducted the fourth installment of the Work Reimagined Survey to better understand the continued changes in new ways of working around flexibility, talent retention and turnover, and the balance of power between employers and employees. An anonymous online survey was conducted by a third-party vendor, of 17,050 employees and 1,575 employers across 25 different sectors and over 20 geographies covering the Americas, Asia-Pacific, and EMEIA (Europe, the Middle East, India and Africa).

The Work Reimagined Survey included a total of 1,050 employees and 200 employers from four countries in Southeast Asia (SEA) — Indonesia, Malaysia, the Philippines and Singapore.

In SEA, 39% of employees are likely to leave their jobs within the next 12 months, desiring improved wellbeing programs, competitive salaries and opportunities for career advancement. Pay is the primary concern for both employees (39%) and employers (36%). This is followed by maintaining fairness for jobs with fixed locations or schedules (employees 30%, employers 32%) and workplace flexibility (employees 26%, employers 32%).

There is also a disparity between employee and employer expectations regarding the likelihood of employees quitting during an economic downturn. Fifty-five percent of employees believe the likelihood will fall, compared with 62% of employers. This suggests that employers may be underestimating the volatility of the labor market.

Employers have traditionally maintained a greater level of influence and control in the workplace. However, the number of respondents who perceive the balance of power to be in favor of employers has fallen, compared with the pre-pandemic period.

Flexible work arrangements are now a baseline expectation, with 55% of employers expressing support for fully remote work or a limited office presence.

The survey also reveals that 64% of SEA employees have a positive outlook on the potential of generative AI (GenAI) to enhance working flexibility. Eighty-six percent of employers share similar sentiments. Although 94% of employers are already using or planning to use GenAI within the next year, only 25% of them intend to provide GenAI-related skills training.

Based on these findings, it is crucial for SEA employers to prioritize concerns of employees and be aligned with them on new, preferred ways of working. Additionally, investing in upskilling and re-skilling efforts is essential for the successful implementation of emerging technologies like GenAI.

Chapter 1: Structural and Cyclical Tension

Navigating the workforce landscape depends on recognizing a rebalance of power

The emerging “next normal” of work is rooted in the interplay of cyclical and structural pressures, and how those pressures are informing employee and employer decisions. For employers, this has meant basing decisions on the realities of high inflation; on economic slowing and weaker market demand; on geopolitical instability; and on the need to secure their talent pipeline.

Employee decisions are also influenced by the economic climate, with real wages continuing to face pressure in many markets through the first half of 2023. But employees are also reacting to the reality of an aging and shrinking workforce. By 2030, projections show the talent gap could reach 85 million jobs, as new roles and technologies like Generative AI increase the demand for new skills and reduce demand for others.

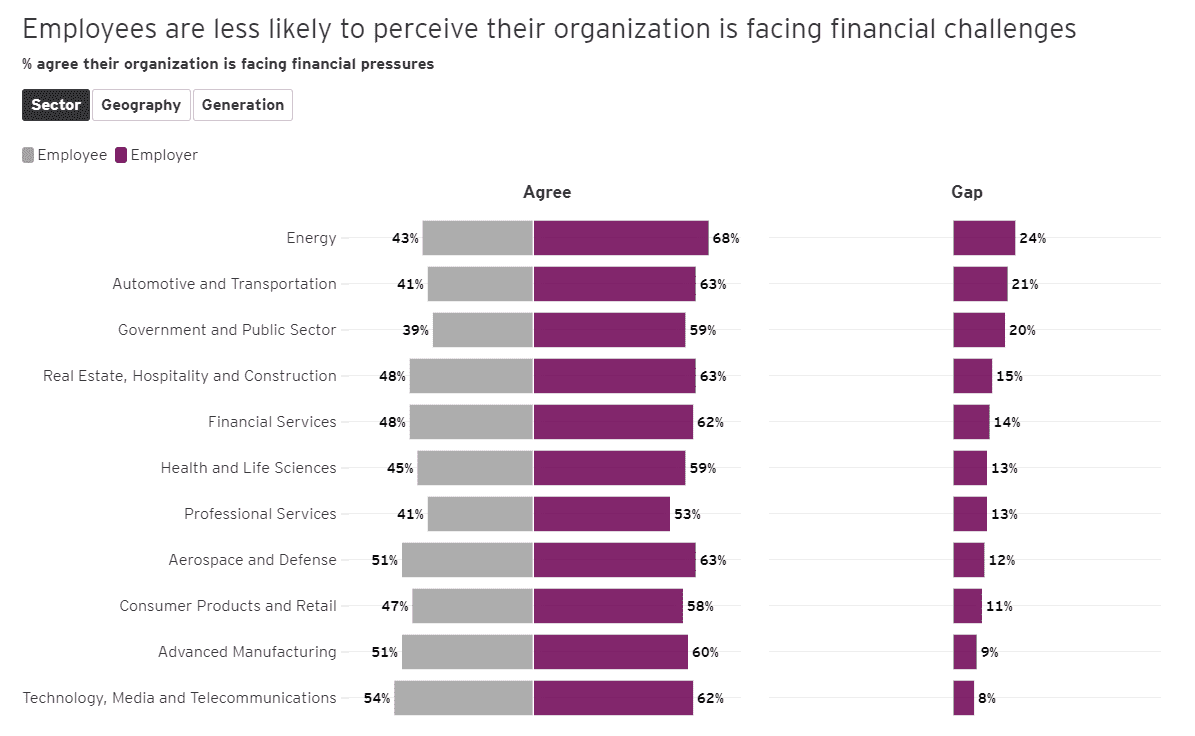

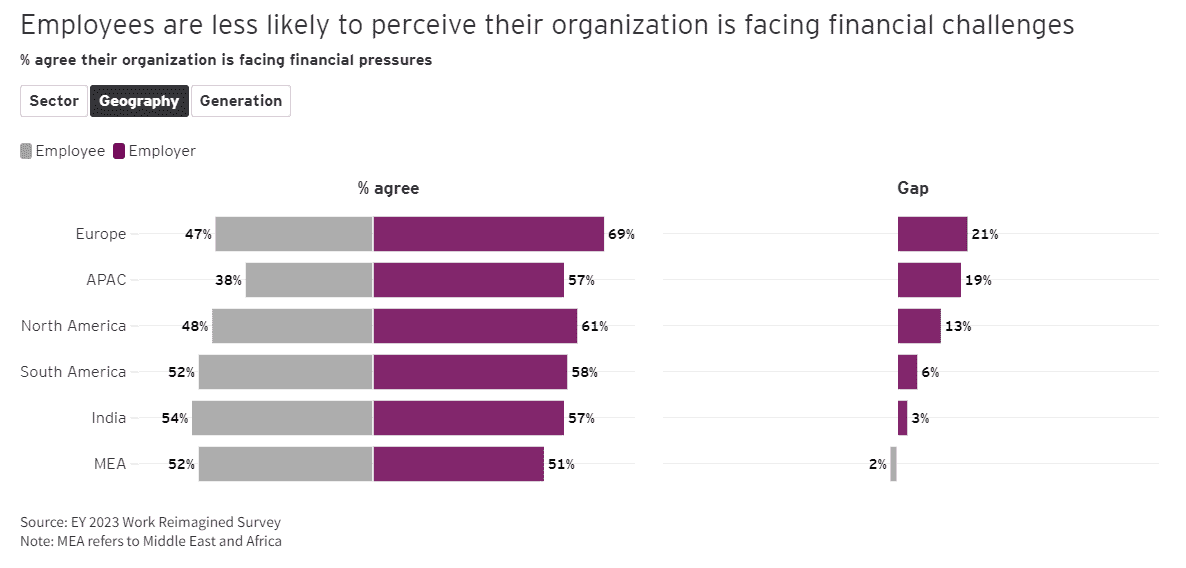

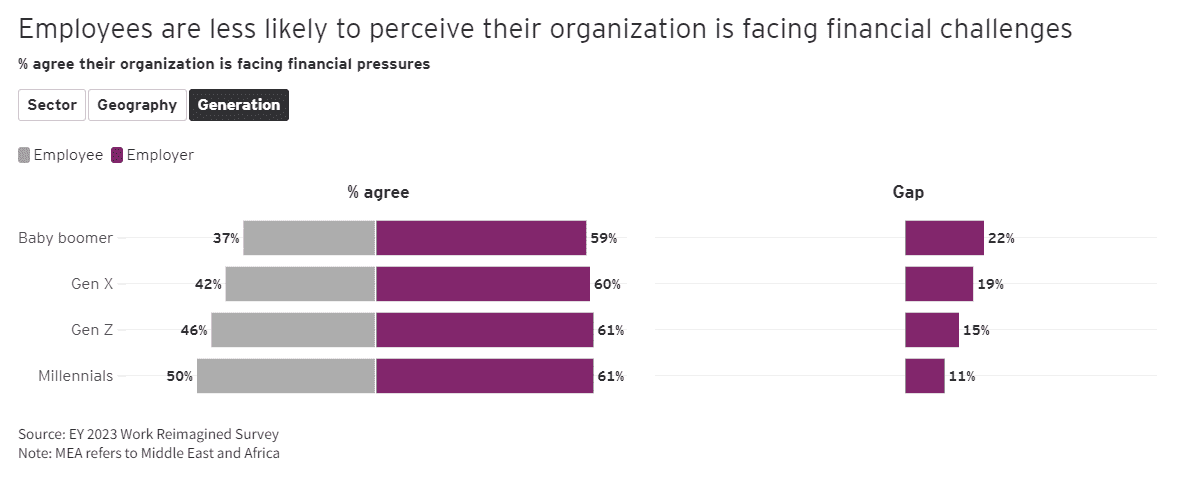

Interpreting present market conditions through different lenses may influence how employers and employees see one another’s challenges and likely course of action. Employers, for example, are more sensitive to the perception that organizations are facing financial challenges. Just 47% of employees agree their organization is under growth or profit pressure, compared to 61% of employers. That gap in perception varies greatly by region, industry, and generation, perhaps reflecting the sense of economic instability or health across demographics.

A chart showing sector, geography and generational differences in the percentage of employees and employers who agree their organization is facing financial pressures, with employers generally more likely to perceive the pressure. For industries, the greatest gaps between employee and employer perception are seen in the energy, automotive and transportation, and government and public sectors.

Employers (57%) are also more likely than employees (47%) to believe a more challenging economic climate will reduce employee likelihood to seek new jobs. This may be underestimating the fluidity of the labor market, and the extent to which employees’ desire to improve their total compensation will move them toward new opportunities. The number of employees who say they are willing to leave their jobs in the next 12 months is still relatively high (34%), though lower than in 2022 (43%). Pay continues to be the primary concern for employees, while employers rank it third.

Most employees (80%) and employers (79%) agree there is a need for moderate to extensive changes to total rewards programs. But the goal of any changes should align to internal and external needs. Total rewards, for example, includes consideration of time off, recognition, well-being, health and retirement. Through both market benchmarking and internal surveys, organizations can work toward creating offerings that attract and retain talent by enhancing the employee value proposition (EVP). By reshaping total rewards programs around the larger goal of the EVP, these programs can influence sentiments around change and transformation, new ways of working, and leadership strategies.

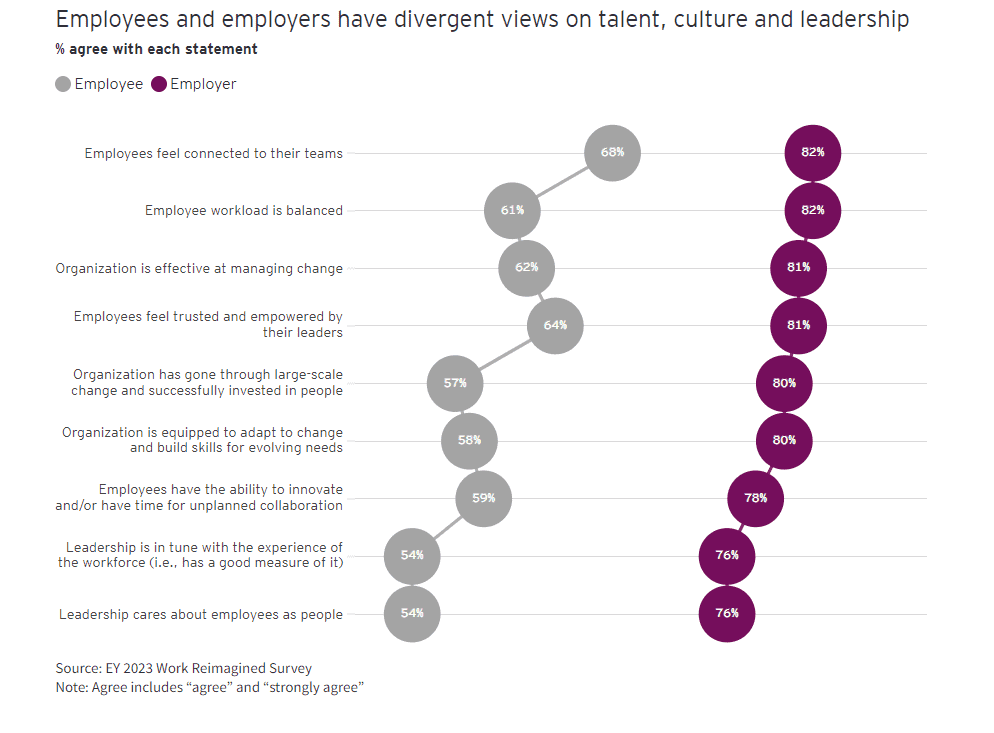

A chart showing percentages of employees and employers who agree with statements related to transformation, new ways of working, and leadership. Only 68% of employees feel that employees feel connected to their teams, compared to 82% of employers feeling that. The same number of employers (82%) believe employee workload is balanced, compared to just 61% of employees, for example.

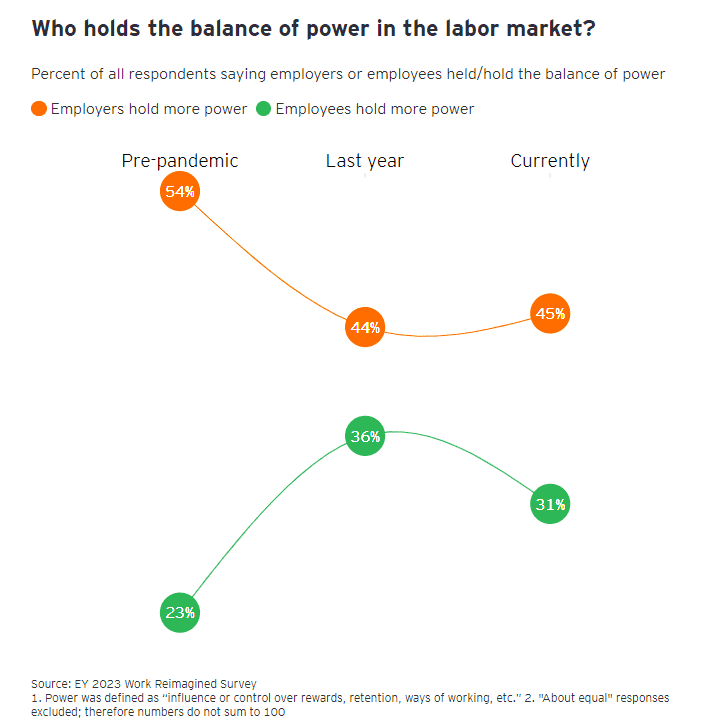

Employees and employers believe employers have reclaimed some ground in perceived balance of power, which has seen employees gain 8% of perceived power over the last three years. Employees also indicate moderately less confidence in their leverage in the labor market, with 31% believing labor market conditions are now in their favor, compared to 37% last year.

A line chart showing the perceived balance of power in the labor market was firmly in the favor of employers before the COVID-19 pandemic, with the gap narrowing last year, with slight shift back to employers (45%) from employees (31%).

Despite the perception of having gained leverage, employers remain concerned by their access to talent and in-demand skills, and how to remain productive with increasingly distributed teams. Attracting new talent and retaining existing talent are first and second on the list of employer-identified workforce risks, with employee compensation coming in third. Employees cite compensation levels and increases as their main concern, followed by talent retention and addressing burnout and well-being. Addressing these risks depends on the ability of organizations to weave their approaches to hybrid and remote work, real estate use and new technologies and skills into a comprehensive strategy.

Chapter 2: Reinventing the Hybrid Workplace

Hybrid and flexible working conditions are still a preference, but the realities of real estate are more complicated.

The “next normal” data shows the staying power of hybrid work, as there is little appetite for returning to a full work schedule in a physical office, and there is no single policy or practice to change that sentiment.

A sticking point is how “hybrid” work is defined.

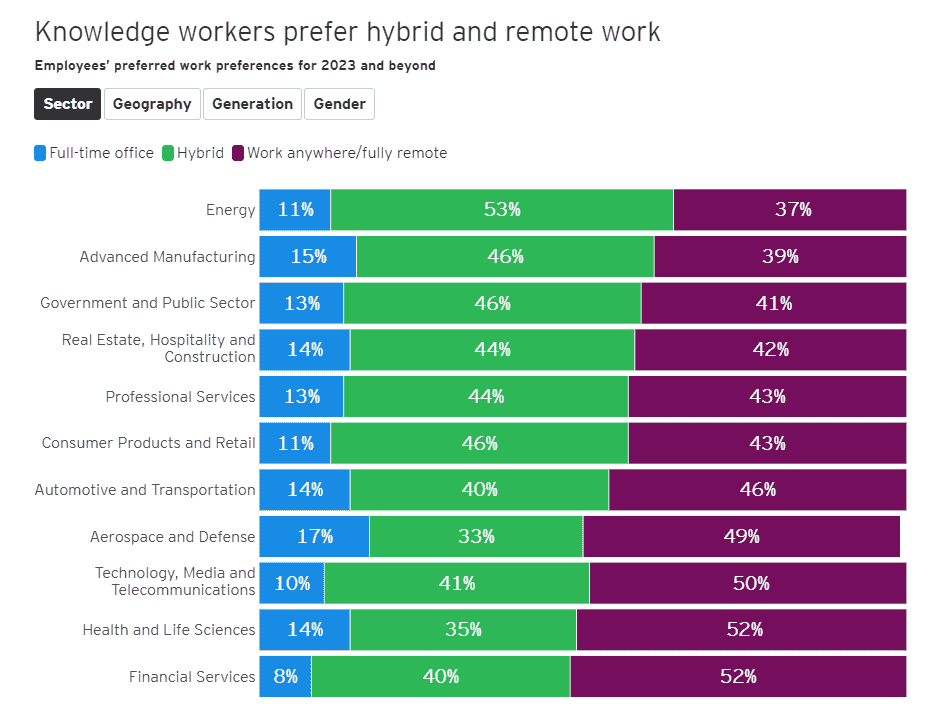

For knowledge workers — whose work is traditionally based primarily on using analysis or subject expertise in a professional office setting — both employers (47%) and employees (37%) show the greatest preference for two or three days of remote work per week. Given a choice, however, half of employees would prefer no more than one day in the office per week, and 34% would like to be fully remote. Just a fifth of employers prefer fully remote work for knowledge workers.

Employee sentiment shifts significantly based on industry, region, age and gender. Women are more likely to prefer fully remote work (49%), with hybrid work as their second preference (41%). Men show little difference in preference between hybrid work (42%) and fully remote work (43%). The financial services and health and life sciences industries were all more likely to prefer fully remote work (52%) compared to employees in the energy industry (37%), for example.

A detailed chart of full-time office, remote or hybrid work preferences across industries, geographies, generations, and gender.

The realities of hybrid and remote work have reshaped how teams interact and build culture, while also changing how individuals present themselves. For example, only about 49% of employees say they regularly go on camera for virtual meetings, compared to 72% of employers. The flexibility of scheduling, appearance, and the tools of working outside of the office have also changed how employees interact with the physical office. Instead of being a singular, regular location for work, the office has become more like a destination, a hub for social connection, team-building, and cultural experience. More than any physical feature of the office by itself, like co-working spaces or pinball machines, employees cite the ability to remain socially connected to their colleagues as the primary draw of the office.

No matter how developed and modern an office may be, this attitude of the office as a social hub remains, meaning investing in high-quality real estate is, in and of itself, not enough to attract employees, but there may be other benefits.

Survey respondents who identified themselves as having access to Class A office space — the highest-quality classification of premium real estate in central business districts with modern amenities — employees were more than twice as likely to want to be fully remote instead of preferring to work full-time in that prime real estate. Among respondents with the least developed Class C office space — typically lower-cost, older real estate which often needs renovations — there was no significant difference of preference in work location, showing a slight preference to be in the office.

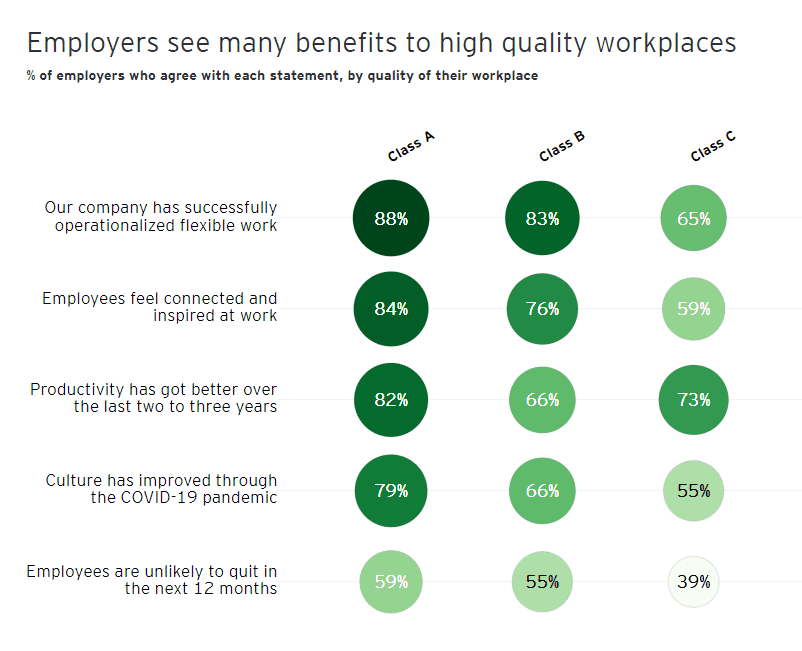

While this may appear to be evidence of employers with higher-rated real estate not being able to benefit from employees using it, employers with Class A real estate saw substantial benefits in company culture, productivity, and attrition as compared to those with Class C office space. Ultimately, organizations might consider employee pulse surveys or a cultural diagnostic of their workforce to determine how employees are working, and how healthy is the organization’s culture, and then make efforts to align real estate strategy to the desired outcomes.

A bubble chart showing the percentage of employers who agree with statements about organizational productivity, culture, and talent retention, segmented by the class of office space they maintain. Employers with the highest quality real estate show better results in each category compared to those with lowest quality real estate.

Even with the shifts in hybrid and remote working, it’s not clear that employers are fully building the policy infrastructure to accompany the physical infrastructure.

A more distributed workforce can open employers up to unintended tax or compliance risks depending on how long employees are working remotely and from where. Only 14% of employers cited addressing tax risks connected to remote work as a top concern, despite governments showing increased movement on remote working legislation and compliance requirements. Even more tellingly, just 7% of employees cited the same tax risks.

The increasing sophistication of digital tools and virtual work environments is also affecting how employees and employers are weighing short-term business travel. Of employers, 56% envision moderate to extensive reduction in business travel and mobility spending in the future, linked to enhanced virtual approaches to work. Just over half (52%) of employees expect moderate to extensive business travel in 2023, compared to the 60% who want it.

As the expectations for further flexible, remote and cross-border work shift with the broader acceptance of new technologies, it’s important that the human experience of work is prioritized in a talent strategy which accounts for potential risk, while realizing the full potential of the workforce.

Chapter 3: Generative AI and the Skills Gap

A broader reimagining of digital work depends on understanding new technology, while cultivating workforce skills to realize its potential.

GenAI, which has only recently broken into the mainstream technology conversation, is a disruptive technology in a broader reimagining of digital work. GenAI can interpret and integrate disparate data streams and create a unique output in a particular style. One of the strengths of this technology is the potential to create a “first draft” of work, which can then be evaluated and progressed by people.

While GenAI’s potential is still being realized, it’s expected to have an outsized impact on the labor market, on career and learning pathways, and on the realities of work. With AI and machine learning specialist job categories expected to balloon in the next five years, employees and employers are also already building expectations and investments around the technology.

There is a 33% net positive sentiment of employers and employees who believe GenAI will boost productivity and new ways of working, and an even greater 44% net positive of those who expect the technology to enable greater flexible working. This overwhelmingly positive sentiment toward GenAI may be rooted in the promise of the technology, as opposed to direct experience, given how few employees (49%) actually are, or expect to be, using GenAI in the next 12 months compared to 84% of employers.

Perhaps unsurprisingly, technology, media and telecommunications sector employees (73%) and employers (91%) appear more likely to be using the technology in the coming year.

A heat map showing the net positive perception of the impact of GenAI based on sector. Organizations in the technology, media and telecommunications industry are generally more positive about GenAI than those in the defense industry, for example.

Despite the anticipation for the potential effects of GenAI on productivity and flexible working, this technology will not fundamentally change the imbalance between in-demand skills and labor market churn.

Even with the availability of a powerful tool like GenAI, employers are still having to consider how to upskill and reskill their workforce when employees could leave at any moment. Employees too are reassessing the importance of skills-building, both to be prepared for technological leaps ahead, but also to maintain attractiveness in a competitive job market.

With learning and skills development as top priorities for both employers and employees, organizations will need to prioritize areas tuned to how their workforce operates now and will operate in the future. Perhaps surprisingly, given the positive sentiment toward GenAI and the anticipated increased use of it, the bolstering of GenAI skills remains a low priority for all respondents. Just 17% of employees and 22% of employers name training in GenAI skills as one of their top priorities. Training to improve remote working skills and tools is the top priority for both employees (41%) and employers (52%). Even with the promises of the new technology, larger segments of the employee and employer groups are more focused on wanting to gain skills to improve the overall experience of work, as opposed to purely focusing on GenAI.

This new reality of work is one that highlights the need for agility and intention in workforce decisions. It requires organizations to assess their skills — both technical skills in fields like GenAI, but also soft skills like critical thinking and resilience — and measuring how their overall talent strategy is supporting business goals, commitments to diversity, equity and inclusion (DE&I), and an organizational culture built on trust.

Chapter 4: Reimagining Work with People-First Mindset

Leaders should not underestimate the importance of trust and empathy to build a stronger team and lead to better outcomes.

The “next normal” of work is marked by complex internal and external pressures facing employers and employees alike, all requiring solutions that are deeply focused on the needs and experiences of people.

It’s in times of disruption and transformation that leaders most need to build toward a “we not me” approach, fostering collaboration, driving consensus and ultimately building a culture underpinned by trust.

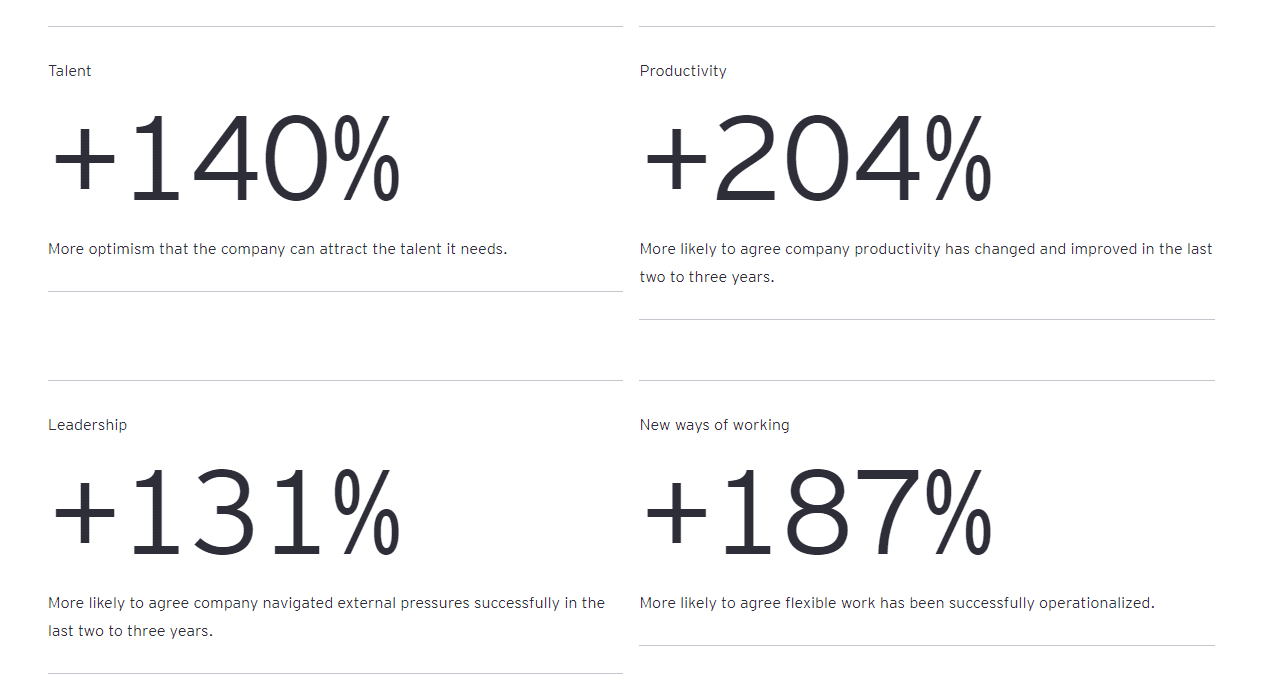

Organizations that prioritize people in their workforce decisions report seeing markedly better outcomes. There is a subset of organizations (about 20%) who meet the criteria for success in key areas related to leadership, DE&I, skills-building and ways of working.

The indicators of success include having:

- Employees who trust leaders and feel trusted, empowered

- Leadership that cares about employees as people

- Employees who feel connected and inspired at work

- Employees who feel well informed

- A diverse workforce

- Efforts to building skills for the future

- A leadership team aligned on new ways of working

These organizations reported distinctly better outcomes compared to those who struggled on the same measures of success. This includes being 2.5 times more likely to have employees who feel connected to their teams and who are four times more likely to report having a balanced workload. As a sign of how these organizations are able to build resilience, their employees are five times more likely to agree their organization can adapt and build future skills, and twice as likely to be optimistic that the organization can attract the talent it needs. Productivity and culture metrics are also notably higher.

Improved outcomes for “Thriving” organizations

To better understand employers who are effectively meeting employees’ changing needs and creating the organizational climate required for future competitiveness and growth, we created a framework based on the research of Klein, Rudolph, and Zacker. We used latent class analysis to segment employers based on six key characteristics: care, communication, connection, inclusion, navigation of the future, and trust.

Through this modeling, we identified “Thrivers” — organizations who displayed the characteristics that help their employees adapt to the future of work. On the other end of the spectrum were Strugglers, who were the furthest behind in these areas.

Even as the tools and technologies of work are transforming the talent landscape, organizations should recognize that better outcomes are clearly tied to actions that are more human-centered and inclusive. Piecemeal solutions that aren’t built with people in mind won’t create as agile and resilient a workforce as is needed to meet both cyclical and structural challenges with positive momentum.

As the “next normal” presents a vision of how work has been reimagined, organizations should consider evolving their strategies in five areas:

Reinvent with intent for the Great Rebalance:

Organizations need to position themselves to deal with cyclical market challenges, while understanding that structural changes in employee priorities around total rewards, hybrid work, and overall culture require adaptation and resilience. Legacy talent strategy models and organizational structures aren’t built for this dynamic environment.

Equalize the internal and external labor markets with EVP and learning pathways:

Securing in-demand skills relies on your organization’s ability to find and build talent within your current population or future hires. Companies need to ensure total compensation and careers are equalized in internal and external labor conditions. This includes internal adjustments of total compensation packages to match inflation, and total rewards programs that promote well-being for a diverse workforce. Refining approaches to talent sourcing and upskilling/reskilling can promote workforce stability and capability growth.

Define and cultivate a people-first culture (humans at center) with trust:

Leaders should not underestimate the importance of trust and empathy to driving better outcomes. Shifting from a “me” mindset to a co-created “we” mindset will unlock productivity and connection through teaming. One way to build trust is through transparency and measurement of behaviors, attitudes, and outcomes from a variety of data sources. Understanding the metrics can then lead to more fully activating a sustainable “we” and “enterprise” mission, purpose and culture.

Right-size and elevate the “destination office” and experience:

For knowledge workers especially, work flexibility is a baseline expectation, with more than a third wanting to be fully remote. Organizations should assess which roles can be most efficiently done remotely, and build touchpoints, technologies, and processes to customize hybrid work, learning and culture for this new normal. A “head in the sand” approach to workforce mobility ignoring tax and legal rules doesn’t position an organization for success. Sourcing talent across jurisdictions requires guardrails to limit exposure while maximizing the benefits of flexible work for the business, and for the mobile employee experience. Real estate is not a primary driver for employee sentiment, but it does drive culture and productivity and intent to stay, so having the right amount of well-designed real estate that promotes social connections and collaborations will have high ROI.

Prioritize people amid generative technology:

Optimism around the potential of GenAI and the importance of a seamless user experience with technology represents an opportunity for employers and employees to co-create new expectations around benefits, capacity and safety. New technologies present challenges around cybersecurity, compliance and workforce equity. Technology won’t completely upend the structural talent issues facing employers, but to fully benefit from new tools, the workforce needs to be trained and empowered to reimagine work in a way that embraces new capabilities, and still keeps humans at the center.

Summary

Years of disruption have prompted an end to the status quo of work, pushing employers and employees into distinctly different worlds of priorities, pressures, and prospects rooted in cyclical and structural concerns. To successfully bridge the perception gap, leaders should consider this a moment for a Great Rebalance that results in organizations benefitting from the latest tools and technology while encouraging a people-centric, agile, and resilient organizational culture.

The article was first published here.

Photo by Austin Distel on Unsplash.

1.0

1.0