The EY CEO survey highlights how CEOs navigate between immediate profits and future sustainability aspirations.

In brief

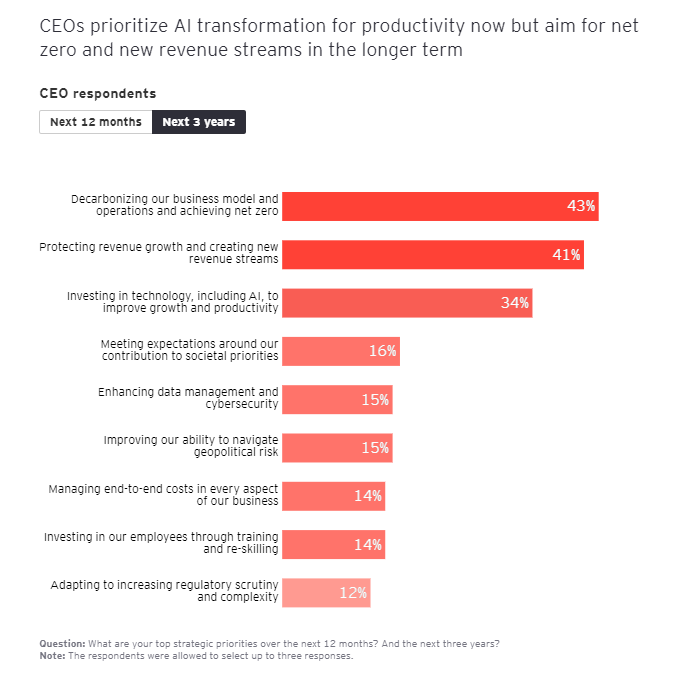

- CEOs prioritise AI transformation for productivity now but aim for net zero and new revenue streams in the longer term.

- Joint efforts by businesses, investors and policymakers can spur a speedy shift to a sustainable, net-zero future.

- CEOs and investors see an M&A uplift in 2024, with increased acquisitions and divestitures.

There is a clear sense that global CEOs in 2024 are more confident about controlling what they can and managing what they can’t. Resilience has fueled a more positive outlook about their own growth and profitability, and they are more comfortable navigating external challenges outside their own authority.

Right now, CEOs are focused on technology, especially artificial intelligence (AI) transformation, as a means to boost productivity and growth. But when they look into the not-too-distant future, their focus shifts to achieving net zero by decarbonising their business and creating new revenue streams.

Juggling profit with broader ambitions reflects the CEOs’ need to both create financial value for shareholders and to deliver on societal demands in accelerating the sustainability journey.

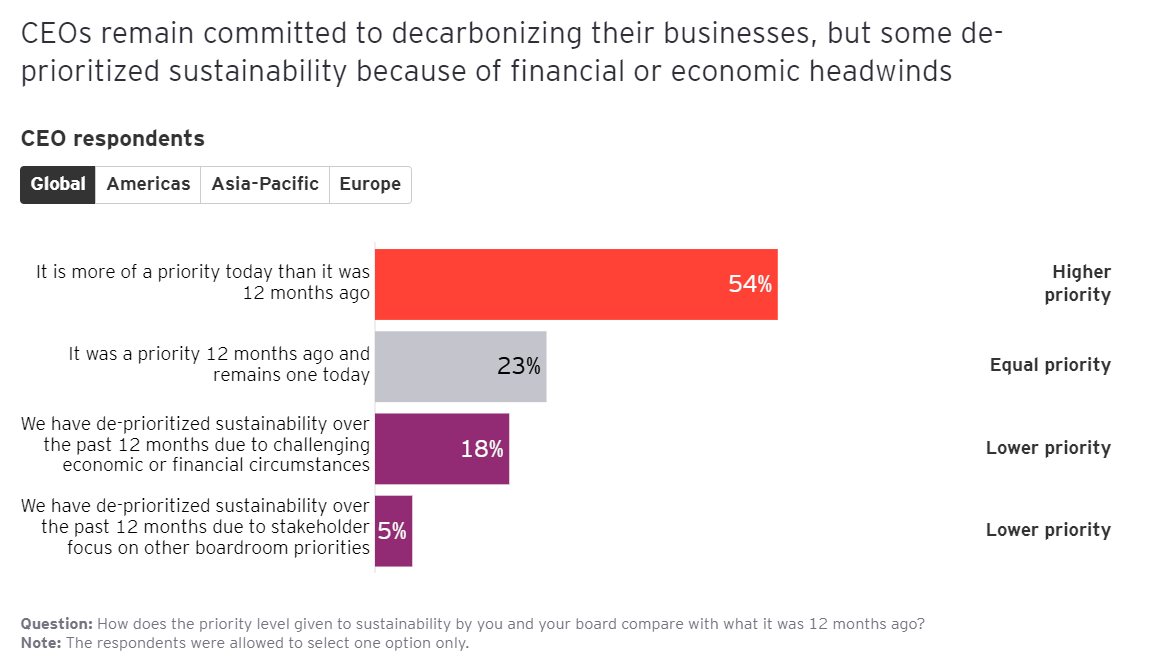

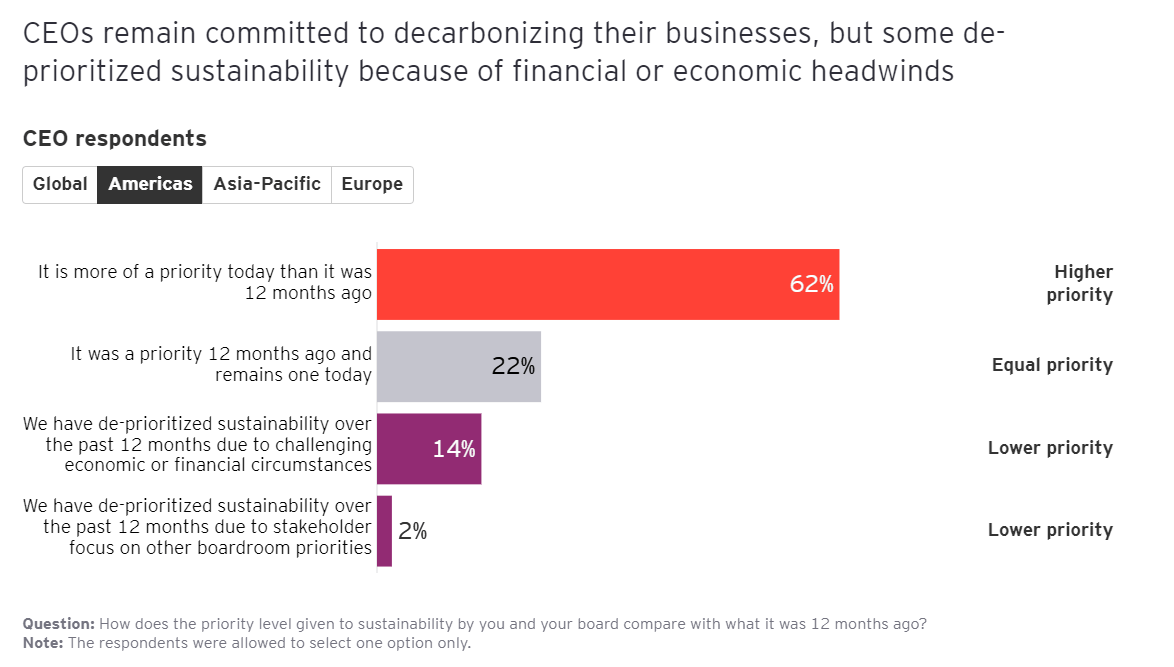

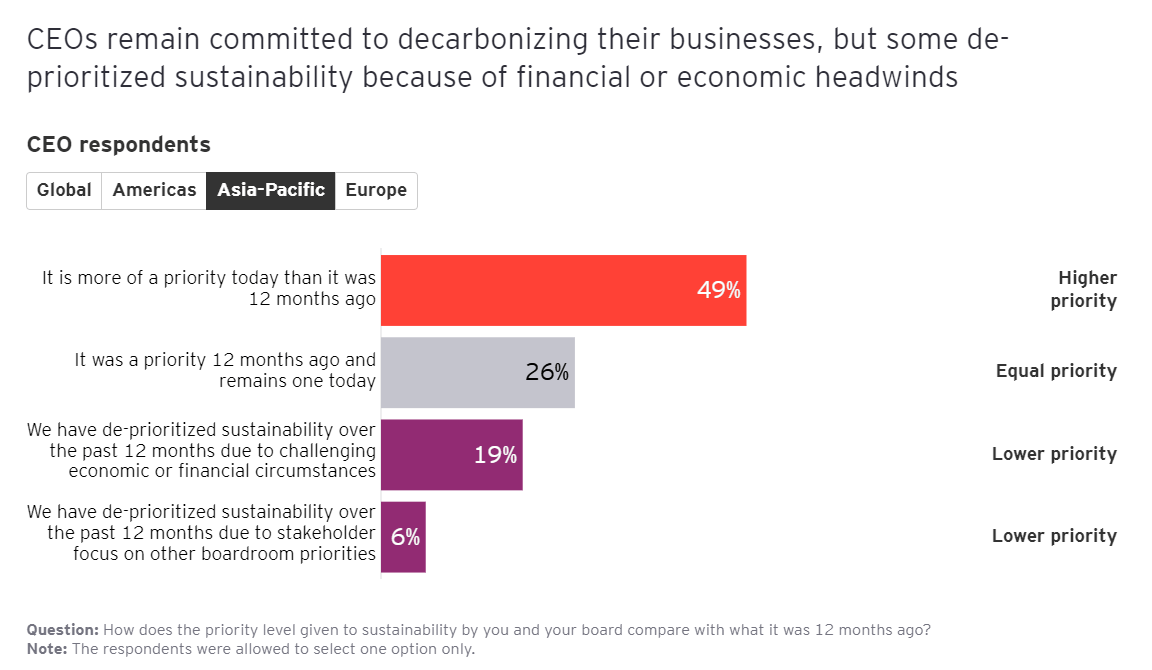

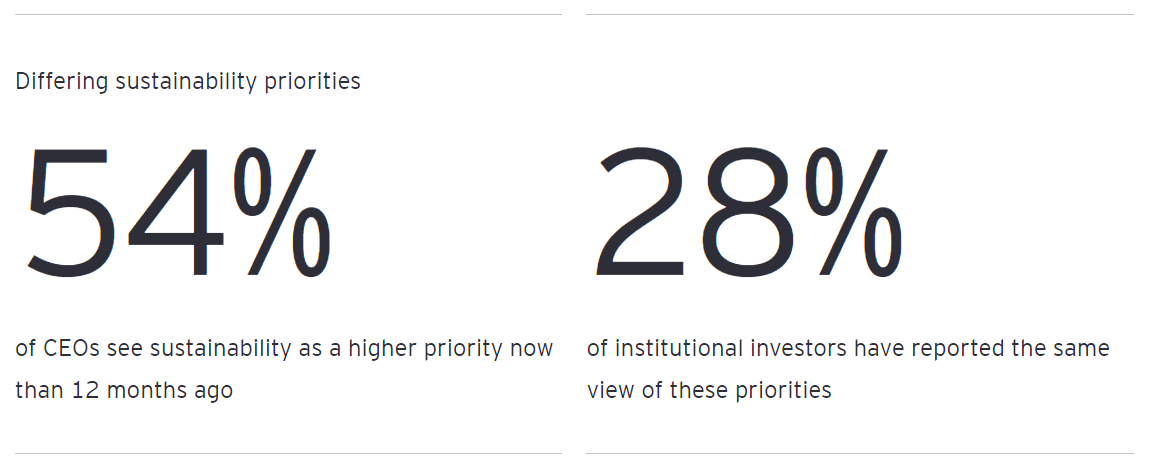

Over half of CEOs globally (54%) see sustainability issues as a higher priority than they did 12 months ago. Comparably, only 28% of institutional investors have reported the same. But this misalignment, which heightens the priority of short-term financial returns at the expense of achieving sustainability targets more swiftly, may be shortsighted.

Achieving sustainability targets can be challenging – particularly in a difficult, cost-focused market. Our report shows that greater collaboration between corporates, investors and policymakers could unleash a new wave of bottom-up initiatives that could help accelerate the road to net zero and unlock a more sustainable future.

Elsewhere, CEOs and institutional investors have a positive outlook for mergers and acquisitions (M&A) in 2024, albeit compared to a subdued 2023 for deals. More CEOs are looking to make acquisitions, and even more are planning to divest assets. The majority of institutional investors (61%) anticipate a stable deal environment, with a third (34%) expecting an acceleration of deals.

The quarterly EY CEO Outlook Pulse survey of 1,200 executives globally is the backbone of our latest edition in the CEO Imperative series. It provides insights on boardroom agenda items such as capital allocation, investment and business transformation strategies within a rapidly evolving global economic landscape. This edition also features the additional views of 300 institutional investors, reflecting their unique outside-in understanding and insights across the sectors and geographies in which they invest.

In this edition:

On behalf of the global EY organisation, in March and April 2024, FT Longitude, the specialist research and content marketing division of the Financial Times Group, conducted two comparative surveys:

- An anonymous online survey of 1,200 CEOs from large companies around the world that aims to provide valuable insights on the main trends and developments impacting the world’s leading companies as well as business leaders’ expectations for future growth and long-term value creation. Respondents represented 21 countries (Brazil, Canada, Mexico, the United States, Belgium, Luxembourg, the Netherlands, France, Germany, Italy, Denmark, Finland, Norway, Sweden, the United Kingdom, Australia, China, India, Japan, Singapore and South Korea) and five industries (consumer and health; financial services; industrials and energy; infrastructure; technology, media and telecoms). Surveyed companies’ annual global revenues were as follows: less than US$500m (20%), US$500m–US$999.9m (20%), US$1b–US$4.9b (30%) and greater than US$5b (30%).

- An anonymous online survey of 300 institutional investors, indicating that respondent group’s unique insights into current macroeconomic environment and the role of sustainability factors in investment decision-making. Respondents represented 21 countries (Brazil, Canada, Mexico, the United States, Belgium, Luxembourg, the Netherlands, France, Germany, Italy, Denmark, Finland, Norway, Sweden, the United Kingdom, Australia, China, India, Japan, Singapore and South Korea). Surveyed institutions’ assets under management (AUM) were as follows: less than US$1b (20%), US$1b–US$9.99b (40%), US$10b–US$49.99b (20%) and US$50b or more (20%).

Chapter 1: AI Transformation Drives Individual Priorities

Most are looking at AI and technology now to position themselves for the future. But long-term priorities vary based on measures of success.

The global economic outlook is improving or, at least, not deteriorating. The International Monetary Fund has upgraded its outlook for growth in 2024, reflecting the continuing resilience of the US economy, stronger-than-anticipated Chinese performance in the first quarter, and a more robust economic situation in Europe.¹

Additionally, improving labor markets and the resulting robust consumer spending, even in the face of lingering high inflation, have created a more positive outlook for CEOs and institutional investors – perhaps a sense that the worst is in the past even though challenges remain.

And those challenges are significant. There is armed conflict in many parts of the world. There are increasing trade tensions, especially in strategically sensitive sectors, with governments using trade as a geopolitical lever. The path forward is not certain. Inflation, though less of an issue, remains “sticky” in many markets, and while consumer confidence is improving, it remains somewhat fragile. Finally, we are in an election supercycle, which could create uncertainty in many key markets and stall a sustained rebound in confidence.

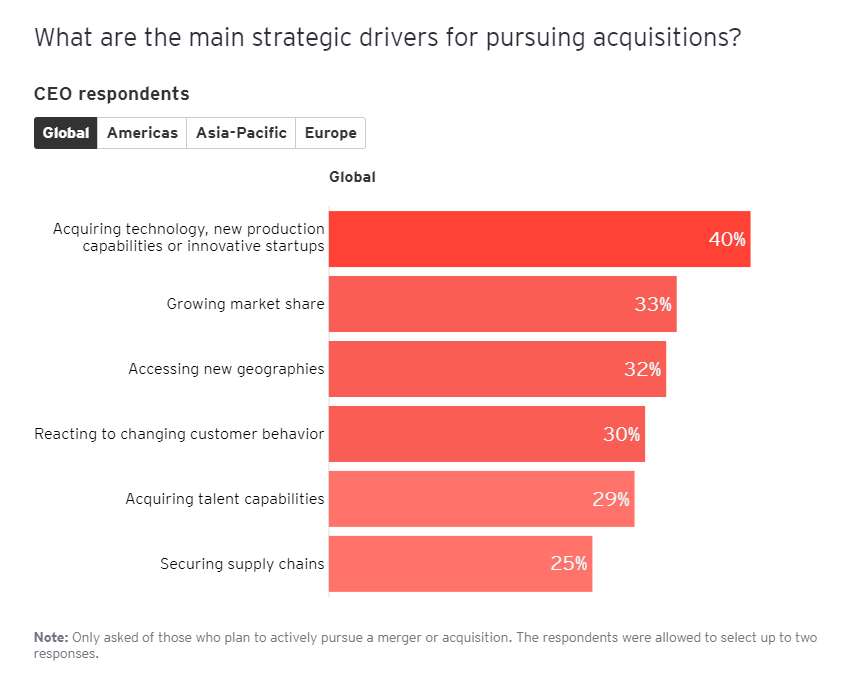

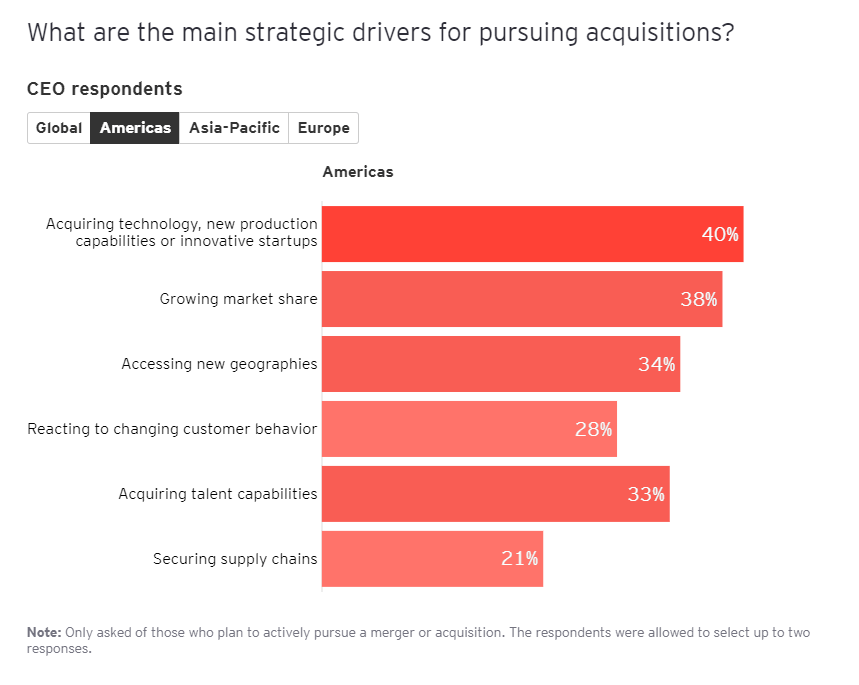

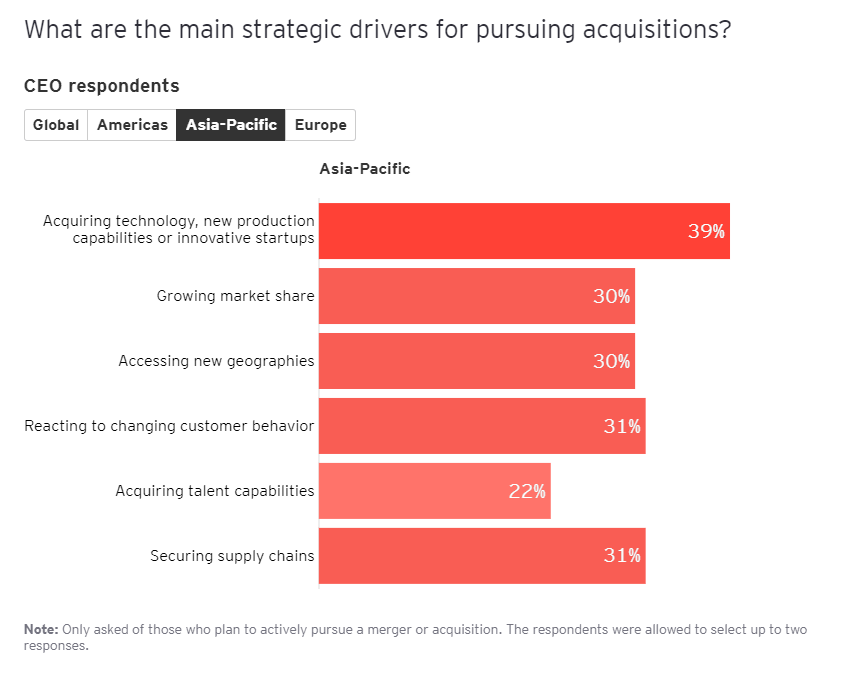

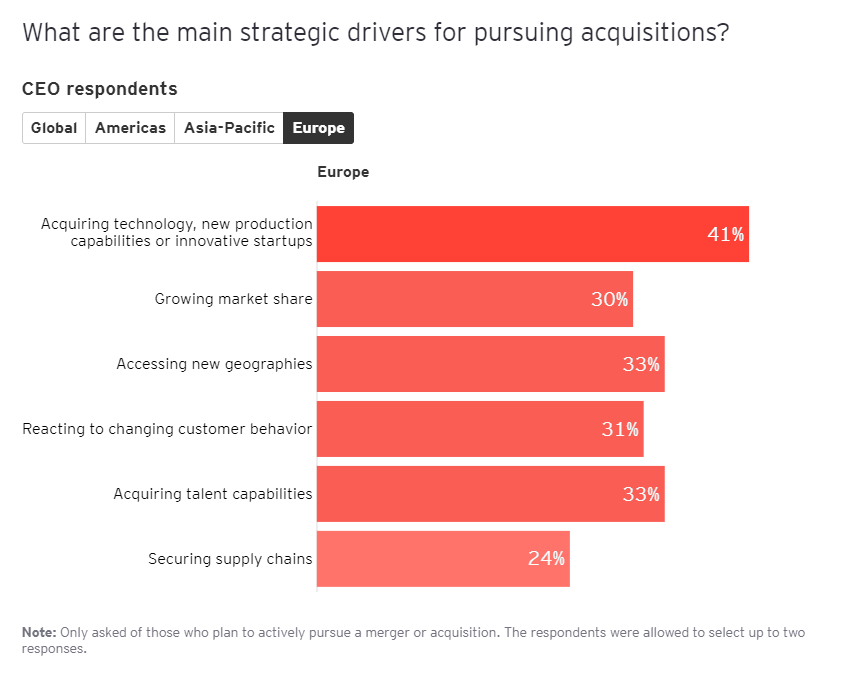

For CEOs, by far the most compelling immediate actions involve enhancing existing technology to improve growth and productivity, as well as boosting data management and cybersecurity. This is also reflected in their M&A strategy, with the top deal driver being acquiring technology, new production capabilities or innovative startups.

There remains a keen focus on managing end-to-end costs, a critical focus of investors even as economic conditions, including inflation and input costs, have tempered.

An interactive bar chart showing CEOs’ top strategic priorities over the next 12 months and the next three years. “Investing in technology, including AI, to improve growth and productivity” drew the highest response (47%) for the next 12 months, while “decarbonizing our business model and operations and achieving net zero” (43%) drew the highest response from the perspective of the next three years.

Looking out over a three-year horizon, CEOs expect to shift their focus to decarbonising their business to reach net-zero targets, protect and enhance growth, and continue investing in technology.

All sectors and geographies are taking part in an AI-powered technology race that will be a significant driver of growth and opportunity. EY analysis (via EY.com US) estimates that global GDP could see an uplift of between US$1.7t (in a baseline scenario) and US$3.4t (in an optimistic case) over the next ten years – the equivalent of adding an economy the size of India in a decade. This significant boost would reflect the accelerated adoption and integration of transformative generative AI (GenAI) technologies across major economies.

CEOs do need to look beyond the short-term efficiency and mid-term productivity gains that AI promises. One priority three years out is revenue growth. But the potential for emerging technologies and AI to accelerate revenue growth through new products and services or accessing adjacent or new markets needs to be activated now.

The EY 2023 Global Cybersecurity Leadership Insights Study found that only one in five chief information security officers (CISOs) and C-suite leaders consider their approach effective for the challenges of today and tomorrow. This comes even after we witnessed a higher number and wider range of major cybersecurity incidents in 2023, from nation-state espionage campaigns to attackers leveraging software supply chain vulnerabilities.

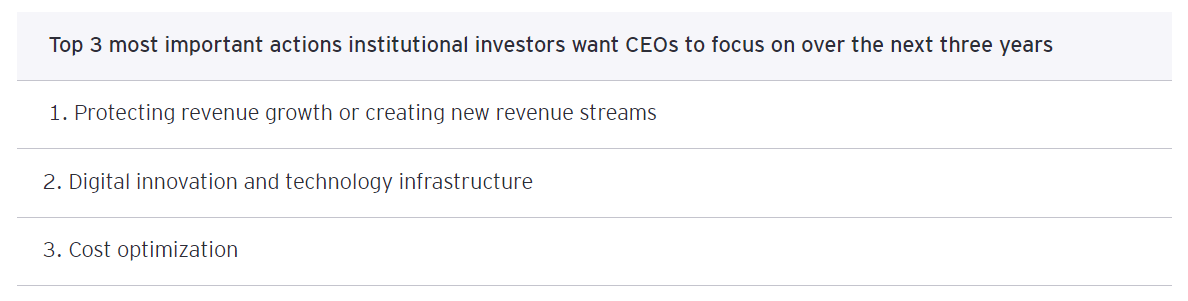

The CEO view of the three-year horizon maps closely to expectations from institutional investors, albeit with a lower focus on decarbonisation by investors. Investors are more focused on maintaining a balance of growth, profitability and cost optimisation.

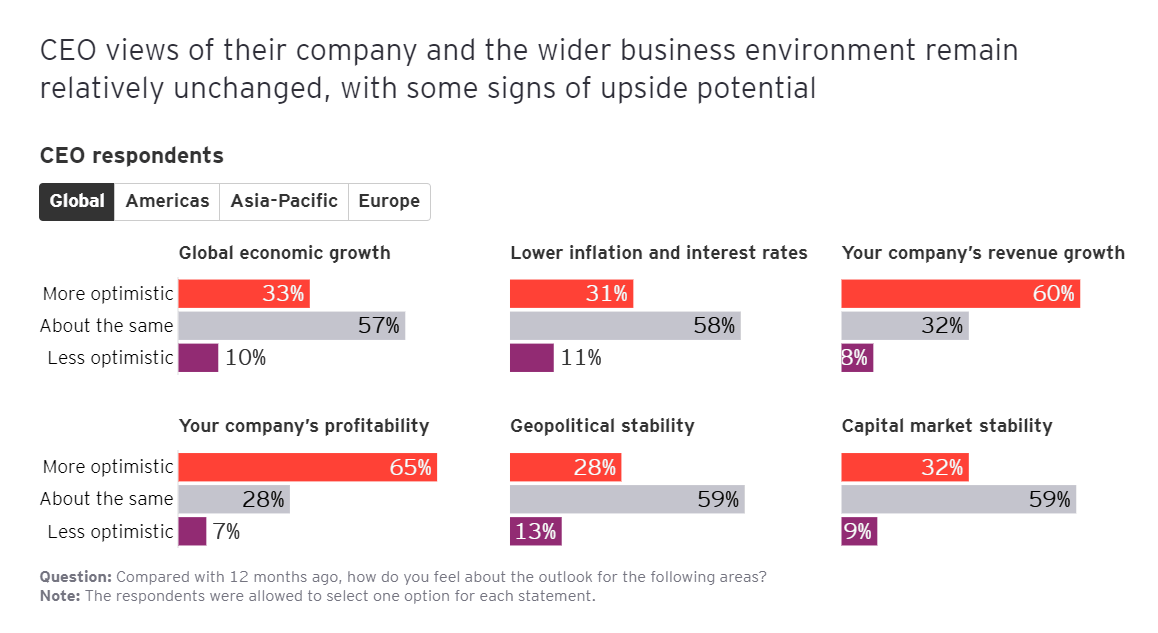

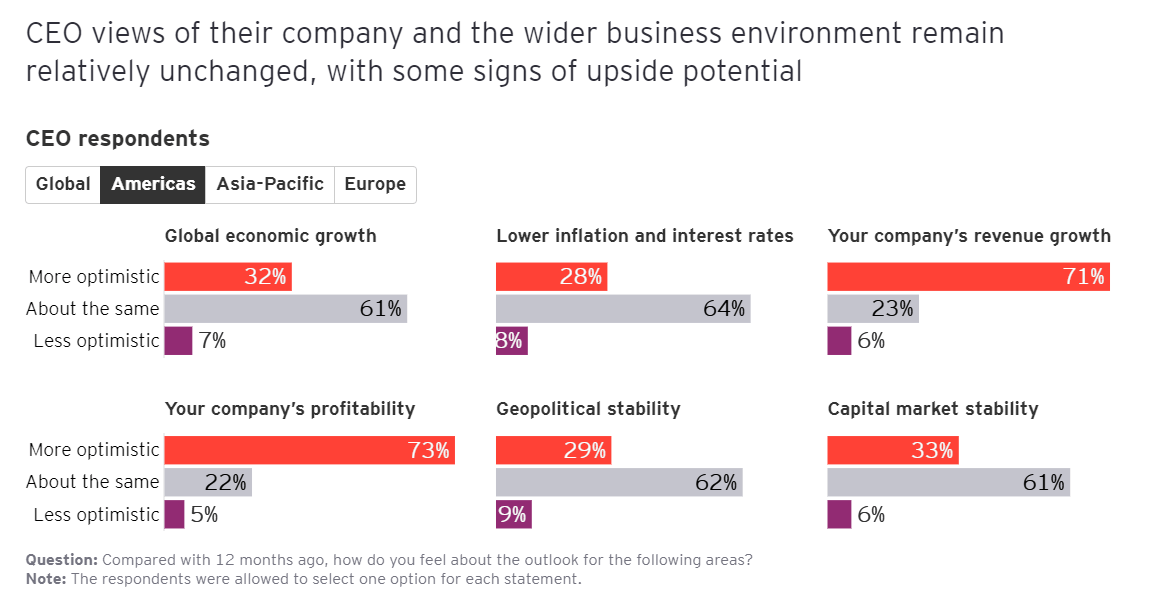

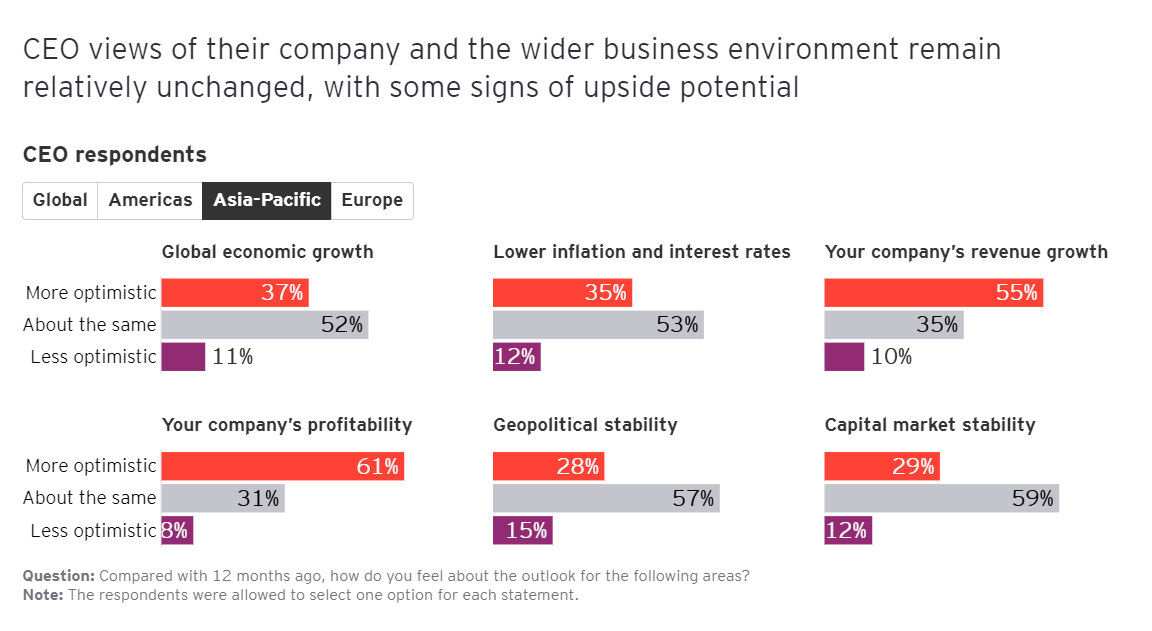

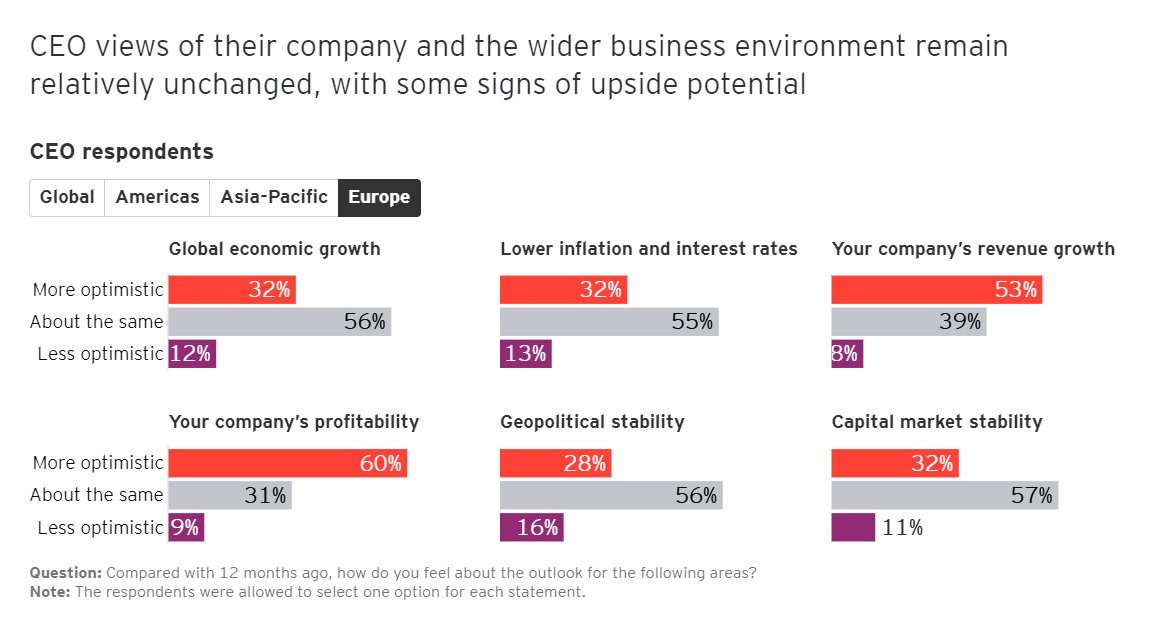

Six interactive bar charts presenting how global and regional CEOs feel about the rate of global economic growth, prospects for lower inflation and interest rates, company revenues, profitability, geopolitical stability and capital market stability.

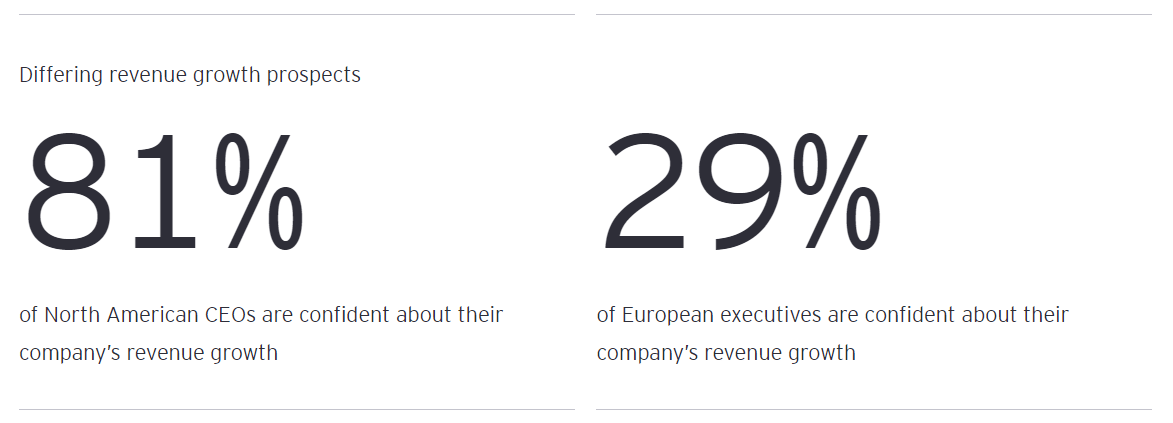

CEOs have been dealing with many of the same external issues for some time and are now more comfortable about their companies’ ability to manage them. There is also a significant gap between the outlook of CEOs in the Americas, who are far more optimistic about their own prospects compared with their counterparts in Europe and Asia, even if the outlook for external indicators is more balanced. This reflects the continuing strength of the US economy, especially compared with major European economies.

The prominence of supply-side factors will mean that inflation is more likely to bounce on top of the 2% mark rather than bounce up against it in the coming years, which will challenge the views of any CEOs expecting a return to ultra-low inflation and interest rates.

This becomes more apparent when considering where companies do the larger part of their business. Only 29% of companies that primarily serve the European market are more confident about their company’s revenue growth, compared with 81% for companies that primarily serve the North American market.

There is also a difference in geopolitical outlook between CEOs in the Americas and those in Asia and Europe. The latter are more pessimistic compared with a year ago, reflecting recent events that are closer to home. CEOs are pricing in increasing pressures to navigate political and geopolitical uncertainty, and resulting risks will continue to rise through 2024.

Institutional investors are also more settled in their outlook. A smaller percentage of that group anticipates a strong outperformance in their own operations compared with CEOs. There is also a higher share of institutional investors with a more pessimistic view on geopolitical stability. This may be due to a wider range of issues in the portfolio of investments they oversee as opposed to a single-line business CEO, with greater exposure to more current issues of concern.

Chapter 2: Shifting Focus to ESG for a Net-Zero Future

CEOs remain committed to decarbonising their business to reach net zero.

The world saw another year of climate extremes in 2023 with exceptional heat waves and droughts, extreme storms and catastrophic floods. The global average temperature was 1.48 degrees Celsius above the pre-industrial average, with impacts across geographies and sectors. Agricultural output has been squeezed, while waterborne supply chains have been closed or restricted. Power supplies have been challenged by both heat-induced demand and the impact on infrastructure.

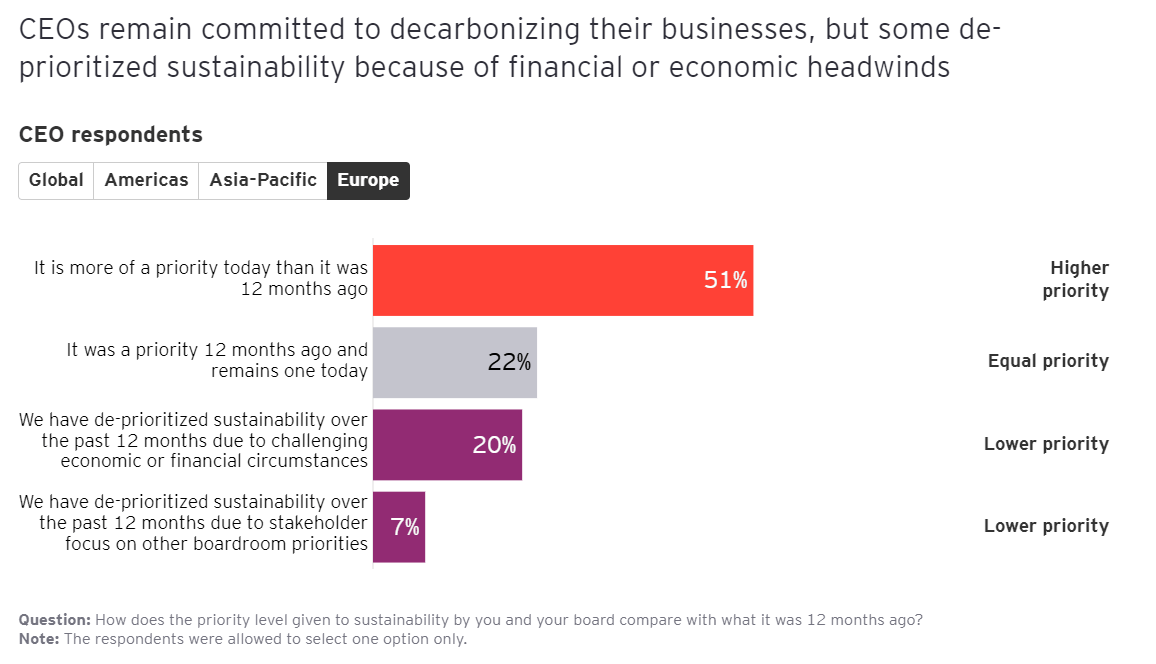

In that context, most CEOs remain committed to decarbonising their business to reach net zero, with over half (54%) of the global survey population saying it is a higher priority now than it was 12 months ago. However, a quarter have de-prioritised sustainability, mainly in the face of short-term financial or economic headwinds, which will be disappointing for those who look to companies to set the tone on this topic.

An interactive bar chart highlighting the priority given to sustainability by global and regional CEOs compared with 12 months ago. The chart is broken down as follows: the Americas, Asia-Pacific, Europe and globally. More than half of CEOs globally (54%) stated that sustainability is a higher priority today than it was 12 months ago.

While years of business investment have led many companies to make progress on sustainability, the 2023 EY Sustainable Value Study suggests that the period of early wins, with progress on early phase initiatives focused on “low-hanging fruit,” is coming to an end.

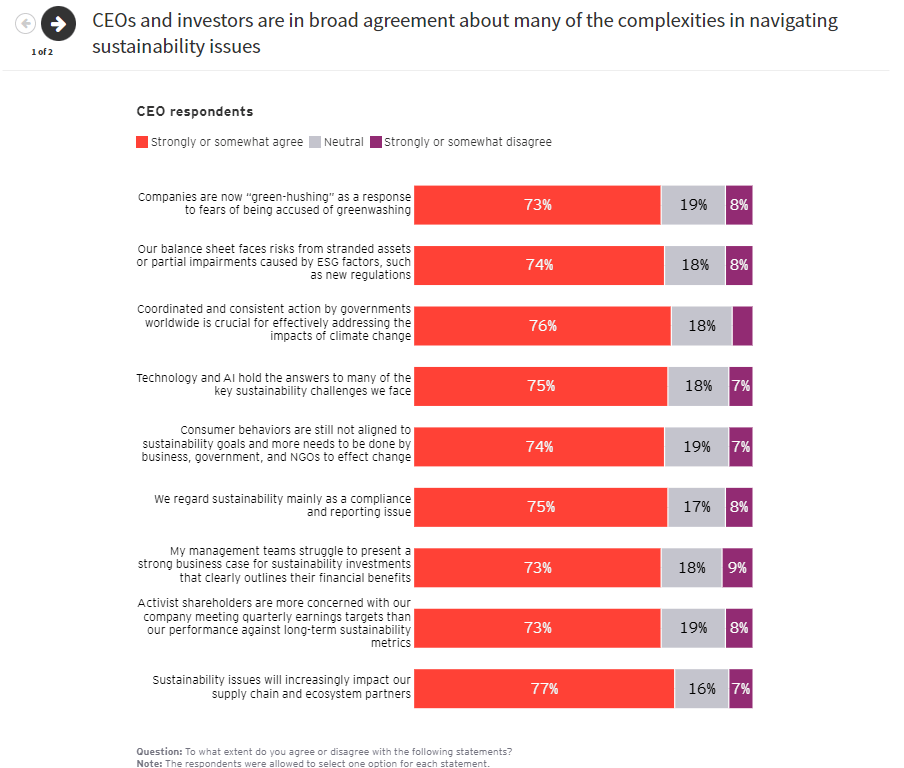

The majority of CEOs agree that sustainability issues will increasingly impact their supply chain and ecosystem partners (77%); that coordinated and consistent action by governments worldwide is crucial for effectively addressing the impacts of climate change (76%); and that technology and AI hold the answers to many of the key sustainability challenges they face (75%).

CEOs are also aligned on the danger of stranded assets or partial impairments caused by environmental, social and governance (ESG) factors, such as new regulations, with 74% agreeing. Future-proofing portfolios, particularly through a sustainability lens, necessitates striking a delicate balance so that operations are both resilient and reflective of global sustainability trends.

Two-thirds (67%) of institutional investors also fear that their portfolio faces risks from investee companies with stranded assets or partial impairments caused by ESG factors, such as new regulations.

An interactive bar chart showing the level to which CEOs and institutional investors agree with sustainability-related issues. A significant majority of both respondent groups either strongly agree or somewhat agree with the statements.

For institutional investors, there are similar and related areas of agreement. More than three-quarters (78%) are aligned on the importance of coordinated and consistent action by governments. But institutional investors also say that regulators and politicians are increasingly scrutinising investors’ ESG investment strategies (74%), and that consumer behaviors are still not aligned to sustainability goals and more needs to be done by business, government and NGOs to effect change (73%).

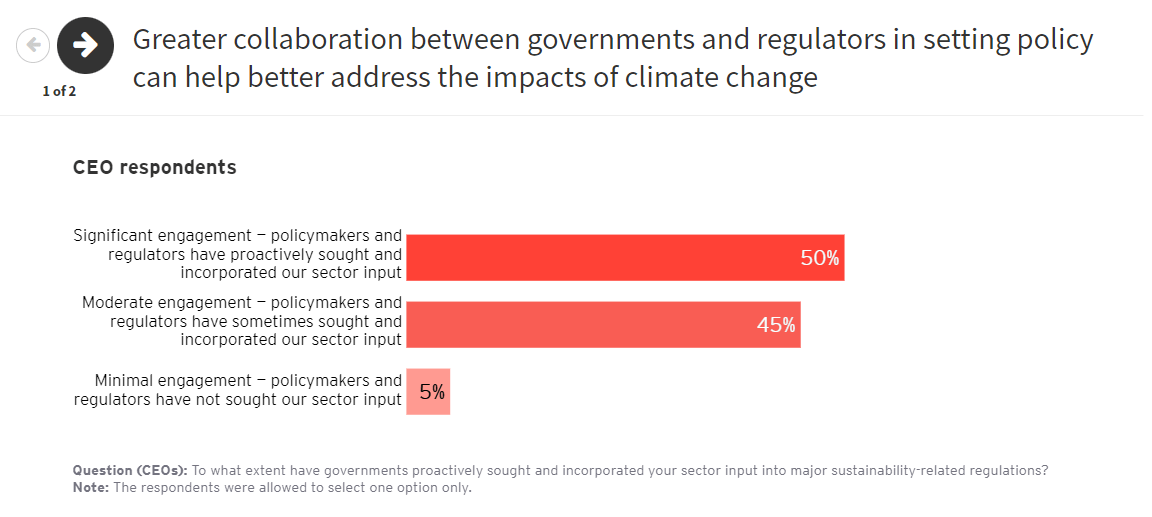

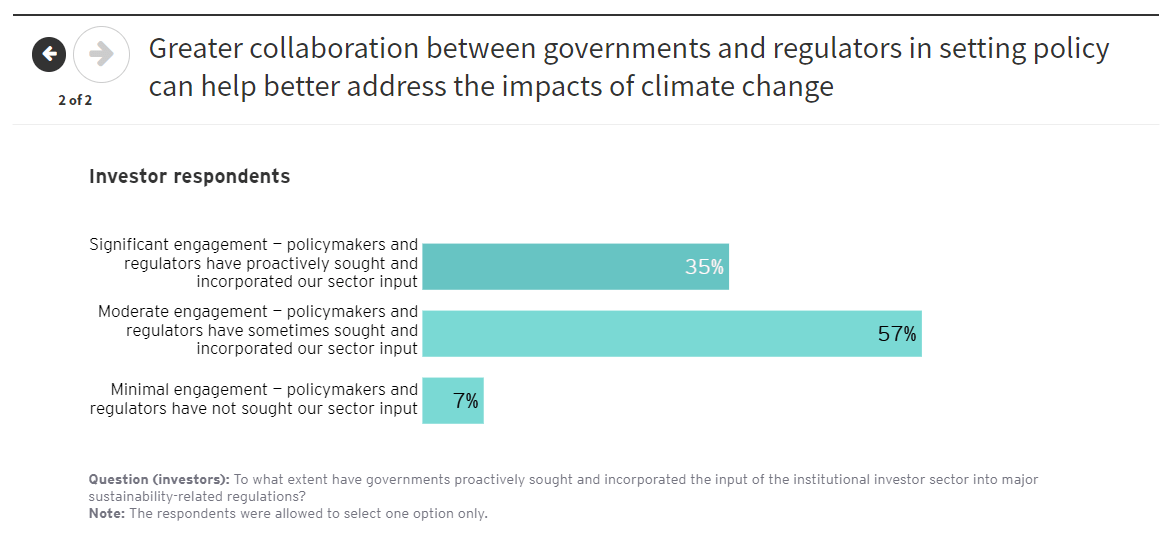

Both cohorts of respondents recognise that greater collaboration between governments and regulators in setting policy can better address the impacts of climate change. Half of CEOs (50%) say that policymakers and regulators have proactively sought and incorporated their sector input when forming major sustainability-related regulations. Another 45% acknowledge moderate engagement, and just 5% report minimal engagement. We see similar numbers across institutional investors – with only 7% saying they have not been consulted in that matter.

An interactive bar chart highlighting the extent to which governments have proactively sought and incorporated sector input into major sustainability-related regulations. Half of CEOs vs. a third of institutional investors reported significant engagement from policymakers.

There is also agreement that incentives are a better policy tool than penalties when it comes to incentivising companies to accelerate their journey to net zero.

CEOs clearly recognise and support the benefit of subsidies and tax relief for investment in green technologies, such as those incentives offered under the EU Green Deal or the US Inflation Reduction Act. Other major economic powers, including China and India, have stepped up investment and raised renewables targets in response.

This increased competition should speed up development of nascent green technologies and accelerate the energy transition. But there is concern some markets could be left further behind. While domestic renewable energy could accelerate markets’ broader economies, the increased pressure on supply chains will require new partnerships to be developed – and quickly.

Despite these reservations, increased policy support for renewables is creating a unique opportunity for the renewables industry worldwide to stimulate demand and accelerate the drive for global decarbonisation.

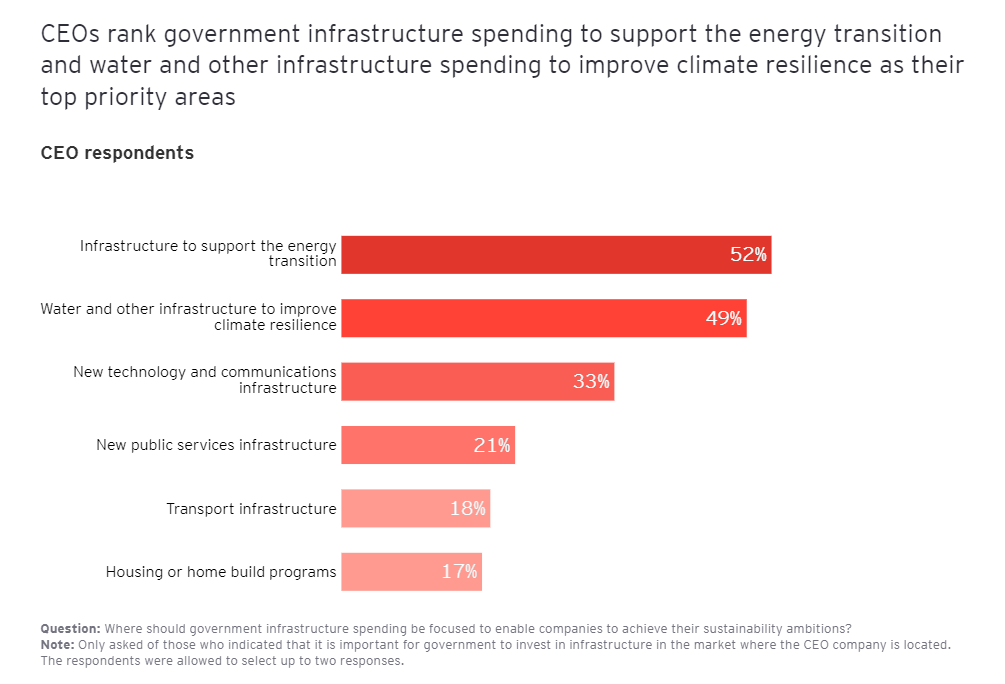

There is also broad agreement that government investment in infrastructure, such as renewable energy infrastructure, will be supportive for driving companies’ growth and sustainability agenda.

A bar chart showing areas of government infrastructure spending that CEOs rate as the most important for companies to achieve their sustainability ambitions. The highest responses are:

- Infrastructure to support the energy transition (52%)

- Water and other infrastructure to improve climate resilience (49%)

- New technology and communications infrastructure (33%)

The world’s journey, however, to a new energy future will not be linear or singular. EY modeling of global trends, technology breakthroughs and consumer engagement highlights the complexity and diversity of the changes ahead. There is not one energy transition, but multiple, unfolding at different paces and in different ways across the world.

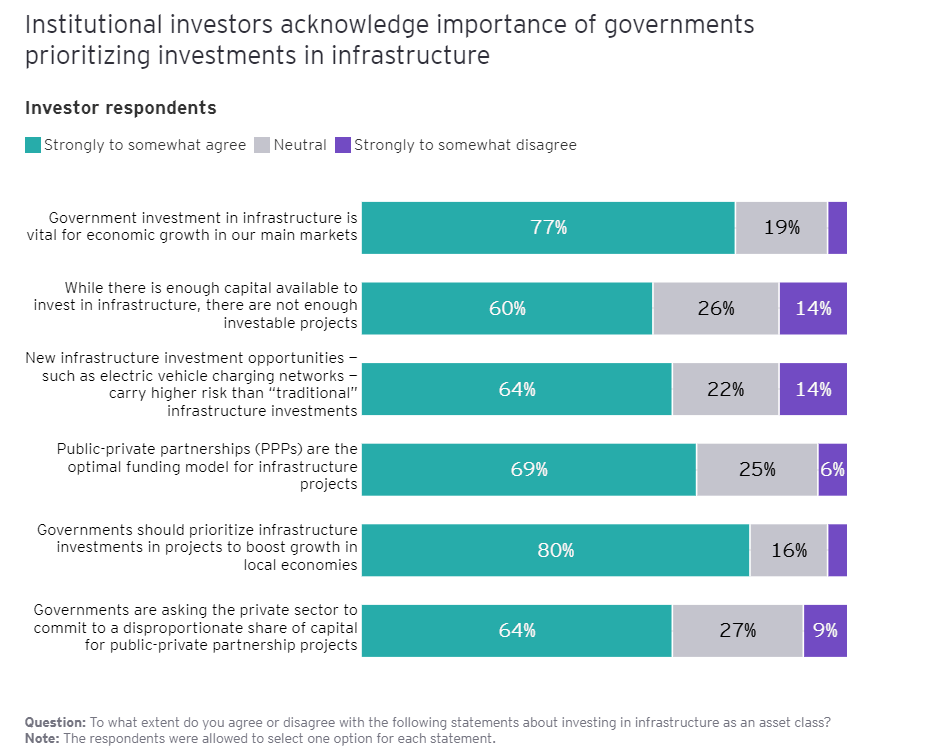

Institutional investors are also broadly positive about the need for governments to focus on supporting infrastructure investment. More than three-quarters (77%) agree that government investment in infrastructure is vital for economic growth in their main markets, and 80% agree that governments should prioritise infrastructure investments in projects to boost growth in local economies.

They also agree that new infrastructure investment opportunities – such as electric vehicle charging networks – carry higher risk than “traditional” infrastructure investments, and that while there is enough capital available to invest in infrastructure, there are not enough investable projects.

A bar chart presenting how institutional investors evaluate various statements relating to investing in infrastructure as an assets class. On average, two-thirds of investors agree with the following statements:

- Government investment in infrastructure is vital for economic growth in our main markets

- While there is enough capital available to invest in infrastructure, there are not enough investable projects

- New infrastructure investment opportunities carry higher risk than “traditional” infrastructure investments

- Public-private partnerships (PPPs) are the optimal funding model for infrastructure projects

- Governments should prioritize infrastructure investments in projects to boost growth in local economies

- Governments are asking the public sector to commit to a disproportionate share of capital for public-private partnership projects

Investors also agree that while public-private partnerships (PPPs) are the optimal funding model for infrastructure projects, there is an issue with the current models and that governments are asking the private sector to commit to a disproportionate share of capital for PPP projects.

The path to achieving net-zero emissions is a challenge that requires collaborative efforts from all stakeholders, including companies, investors and governments. Each plays a crucial role in accelerating the sustainability journey, and their cooperation is essential for achieving meaningful progress.

Companies, as major contributors to greenhouse gas emissions, have the responsibility to implement sustainable goals throughout their operations and supply chains. Institutional investors, with their financial resources and influence, can drive positive change by directing capital toward sustainable initiatives and companies that prioritise sustainability as a core pillar of their strategy. Governments, on the other hand, have the authority to create and enforce regulatory frameworks that promote sustainability and provide incentives for environmentally responsible behavior.

Transitioning to a low-carbon economy will require significant investments and technological advancements, which can be better facilitated through partnerships between companies, investors, and government. Only through collective action and a shared commitment to sustainability can a prosperous and resilient planet for generations to come be achieved.

Chapter 3: The Momentum for M&A Should Continue Through 2024

CEOs look to M&A to accelerate technology and transformation.

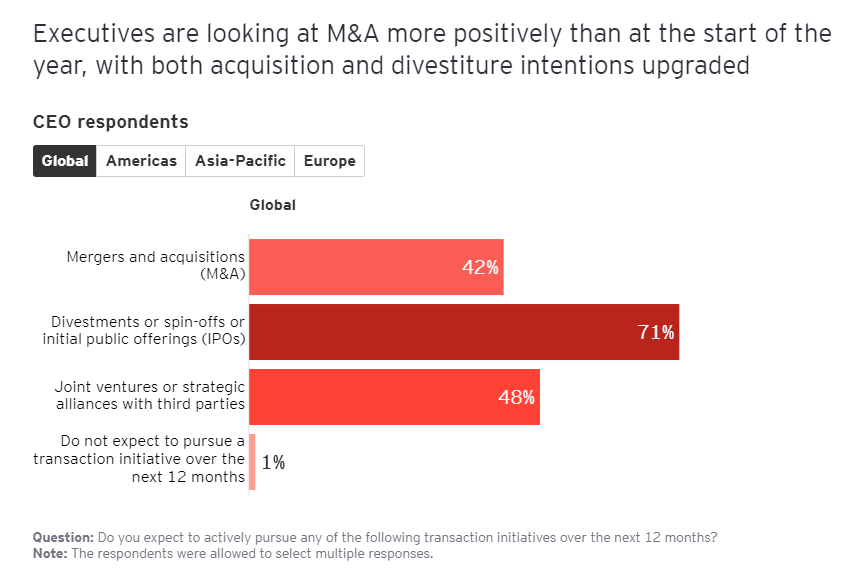

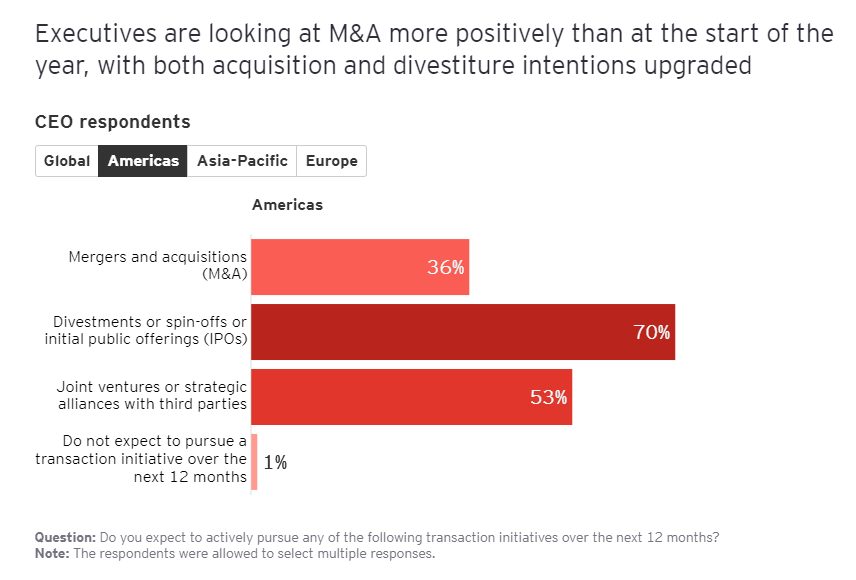

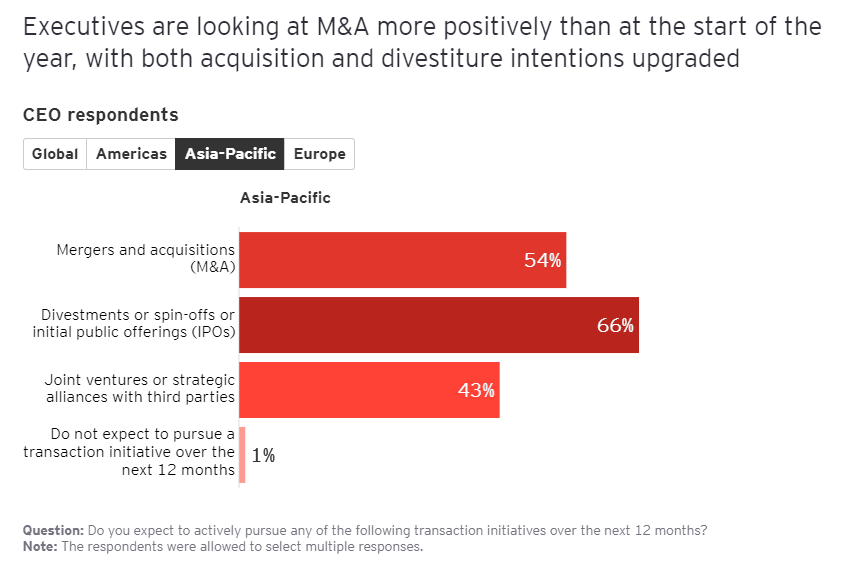

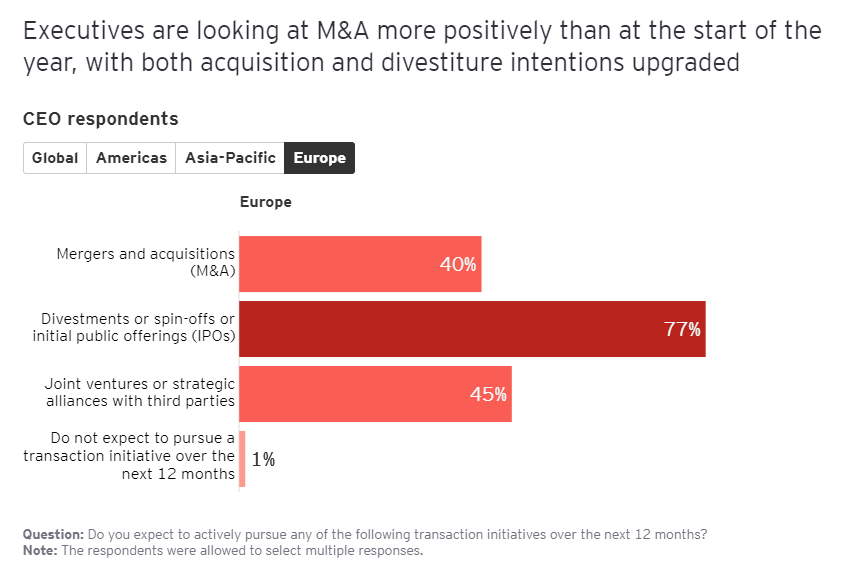

CEOs are looking at M&A as a key lever to address their near-term priorities, with deals largely driven by the desire to acquire technology, new production capabilities or innovative startups. They are also looking at their current portfolio of assets and operations and considering what will help their longer-term ambitions. The spike in intentions to divest assets over the next 12 months, which is broad based across geographies and sectors, highlights how far CEOs are along their path to future-proofing for a different environment.

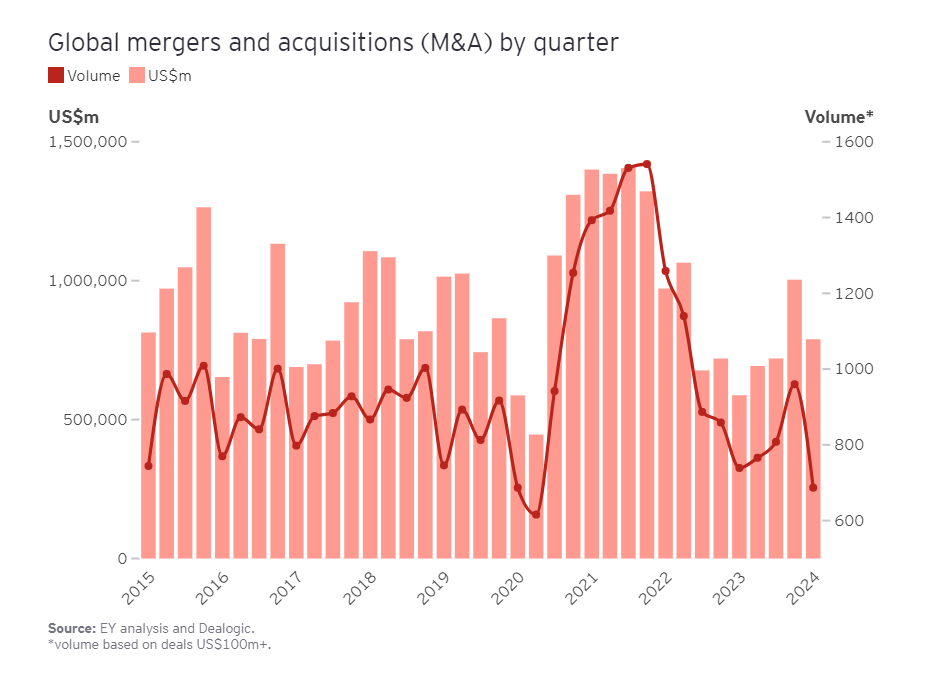

There were US$796b of deals announced in the first quarter of 2024, a healthy 36% increase over the same period in 2023. At a headline level, this is good news. There were areas of significant strength, particularly in the US and in the energy and life sciences sectors, globally. There was also an uplift across Europe, especially in the UK, and an acceleration of deal-making in financial services and a return of technology asset acquisitions.

That performance, however, was driven by a strong flow of mega-deals (US$10b+) with 16 deals in the quarter, the highest number since 3Q 2021, at the height of the M&A supercycle that lasted from July 2020 to June 2022.

There are still major areas of weakness in the broader M&A market. Private equity (PE) activity – both acquisitions and exits – did not rise significantly, and deal activity in sectors such as consumer and retail remained at a lower level.

But executives are looking at M&A more positively than at the start of the year, with both acquisition and divestiture intentions being upgraded since the CEO survey in January.

Most striking is the sharp uptick in intentions to divest an asset or part of the business, either through a trade sale, a sale to PE, or a spin.

In 2024, more companies are likely to look toward offloading parts of their business to either bring greater focus to their core operations or to raise capital for investing in their remaining portfolio.

Overall global debt capital market (DCM) activity totaled US$2.9t during the first quarter of 2024, up 16% compared with the first quarter of 2023, marking the strongest opening period for DCM activity since records began in 1980. Similar analysis shows equity capital markets activity totaling US$141b during the first quarter of 2024, a 1% increase compared with the first quarter of 2023 and the strongest opening period for global equity capital markets activity in three years.

With global funding markets currently more open in 2024 than 2023, acquirors should be more confident in securing funding. But markets could quickly tighten again, as significant voting in this global election supercycle comes closer.

Companies looking to divest will also be supported by increasing appetite for new issues on exchanges and the long-awaited return of PE as a competitive buyer, however the exact time of the return of PE as a major player in M&A is still to be determined. There may have to be a settling of monetary policy path before a more robust and sustained return.

An interactive chart presenting global and regional CEOs’ expectations toward pursuing transaction initiatives over the next 12 months, with seven in 10 of respondents (71%) planning a divestment activity.

Aligned to their overall strategy, CEOs’ top M&A priority is accessing the technology or new product capabilities needed to stay ahead of innovative competitors, as well as acquiring innovative startups.

An interactive chart showing what global and regional CEOs perceive as the main strategic drivers for pursuing a transaction. “Acquiring technology, new production capabilities or innovative startups” drew the highest response (40%).

Institutional investors are also upbeat about the deal market, where a majority (61%) anticipate a stable deal environment but a third (34%) expect an acceleration of deals.

M&A is another area where CEOs and institutional investors can work better together to help create long-term sustainable value.

The message from institutional investors is clear: CEOs need to make a very clear case as to how deals can either accelerate growth or unlock new opportunities.

There also needs to be a very clear roadmap that shows how any returns on deals are significantly better than other, less risky investments.

Three actions to balance short-term priorities and long-term ambitions:

Strength in numbers: by working together – particularly in what remains a challenging market – companies can access the necessary funding and incentives from investors and governments, enabling them to accelerate their transition toward more sustainable operations. Investors can leverage their influence to drive positive change within the companies they invest in, while governments can create an enabling environment that fosters innovation and encourages the adoption of sustainable practices.

Don’t get stranded: CEOs have to be an active participant in engaging with governments as key stakeholders when deciding sustainability policy. They are well informed and ideally placed to advise on what could be the most effective mechanisms to support policy objectives while minimising economic downsides.

Tell a better story: investors are broadly positive about the outlook for dealmaking. But they would prefer that companies clearly articulate why returns on acquisitions will be higher than organic investments in a more compelling way.

The article was first published here.

Photo by William Bayreuther on Unsplash.

1.0

1.0