McKinsey’s latest ConsumerWise Survey finds consumers in the region reacting differently to ongoing economic uncertainty. Companies should take note.

Consumers in leading Asia-Pacific (APAC) markets have become more cautious and thoughtful since the beginning of this year. McKinsey’s latest ConsumerWise Survey finds that a growing number of consumers are trading down to save money, although many are also inclined to selectively splurge. The survey also finds that consumer confidence remains higher in India and China than in APAC’s more advanced economies, which may result from the growing number of consumers ascending to the middle and upper classes.1 Below are the survey highlights.

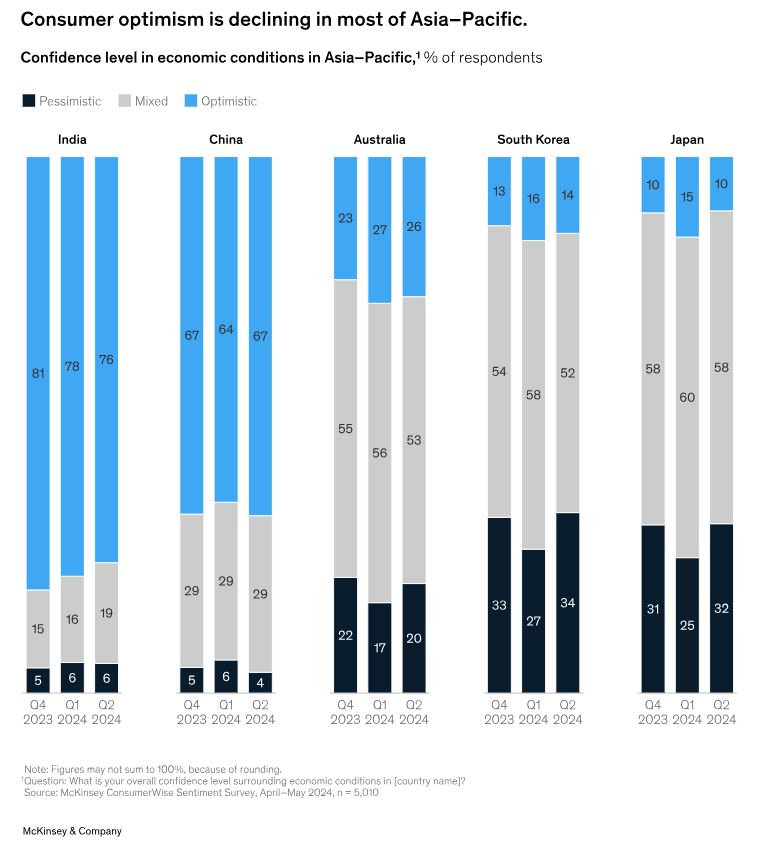

Declining Consumer Optimism

Consumer sentiment appears less buoyant in advanced APAC economies than in Europe and the United States. In Australia, economic activity has virtually stalled, and Japan’s economy contracted in the second quarter, primarily because of the repercussions of the Noto earthquake in early 2024 and slowing economic growth.[1] While South Korea’s economy expanded faster than anticipated,[2] consumer confidence there has declined. However, there is a pronounced generational divide: Gen Xers and baby boomers are more pessimistic about the economy than millennials and Gen Zers.[3] Consumer optimism in China increased in the second quarter, primarily fueled by younger generations, while confidence dipped in India ahead of the national election results. This decline was particularly pronounced among baby boomers.

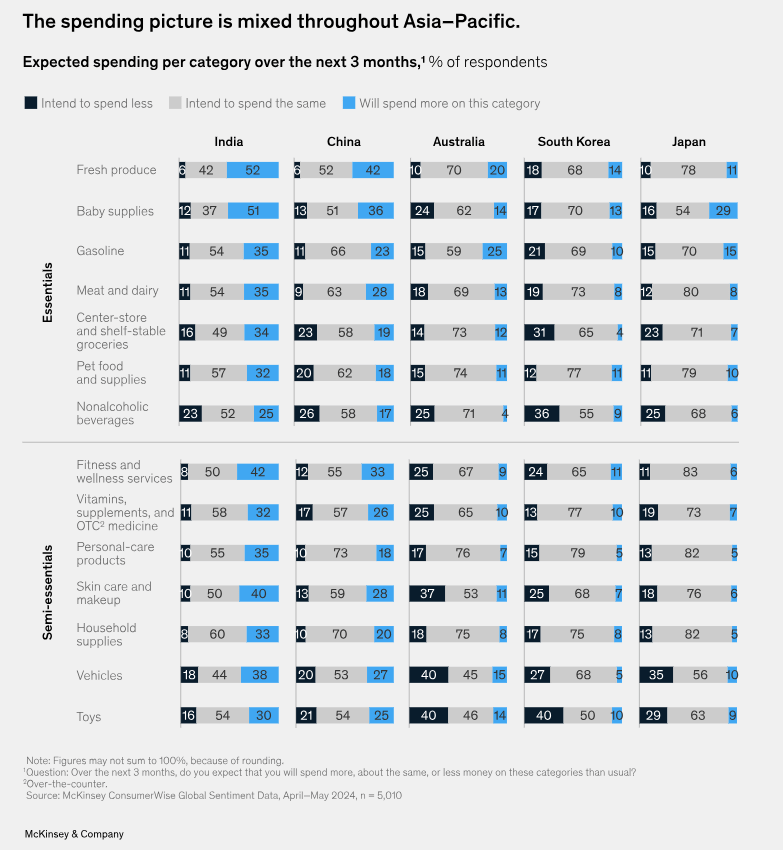

A Mixed Spending Picture

While spending intentions for the coming quarter are positive in some APAC markets, they are predominantly negative in others. In India, consumers consistently express net positive spending intent for both essential and semi-essential items, including fresh produce, baby supplies, fitness, skin care, and international travel. Conversely, Chinese consumers intend to spend more in categories such as fresh produce, baby supplies, and fitness and wellness, but less on cruises, food delivery, and nonalcoholic beverages. In Japan and Australia, net spending intent is largely negative, except for a few essential categories such as groceries and gasoline. Consumers in these countries show the least inclination to spend on luxury and nonessential items such as jewelry, furniture, hotels, short-term rentals, dining out, and accessories. Overall spending intent remains negative across all categories in South Korea.

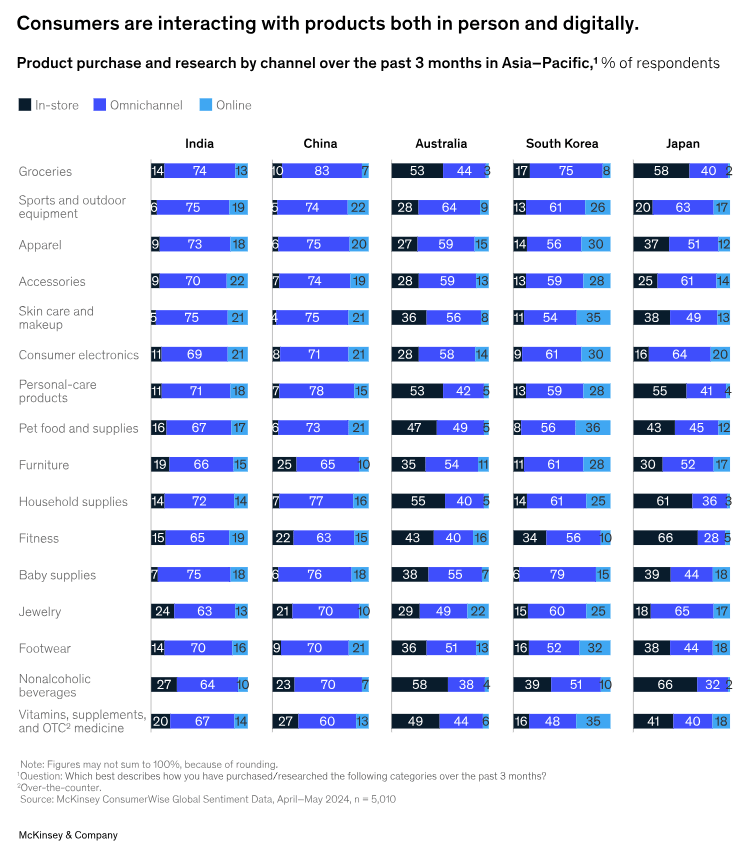

Consumers Getting ‘Phygital’

Consumer demand is rising for the seamless integration of physical and digital retail offerings, or a so-called phygital experience.[1] According to the survey, consumers are using a broader range of channels than ever before to purchase groceries and other goods, with South Korea, China, and India showing particularly high levels of omnichannel engagement. In those countries, more than 50 percent of consumers expect to use multiple channels for shopping across all categories (except vitamins, supplements, and over-the-counter medicines in South Korea). Australian and Japanese consumers prefer a mixed shopping approach, tending to favor in-store purchases for groceries, personal-care products, vitamins, over-the-counter medications, household supplies, and nonalcoholic beverages. Yet for categories such as sports and outdoor equipment and consumer electronics, Australian and Japanese consumers prefer an omnichannel approach.

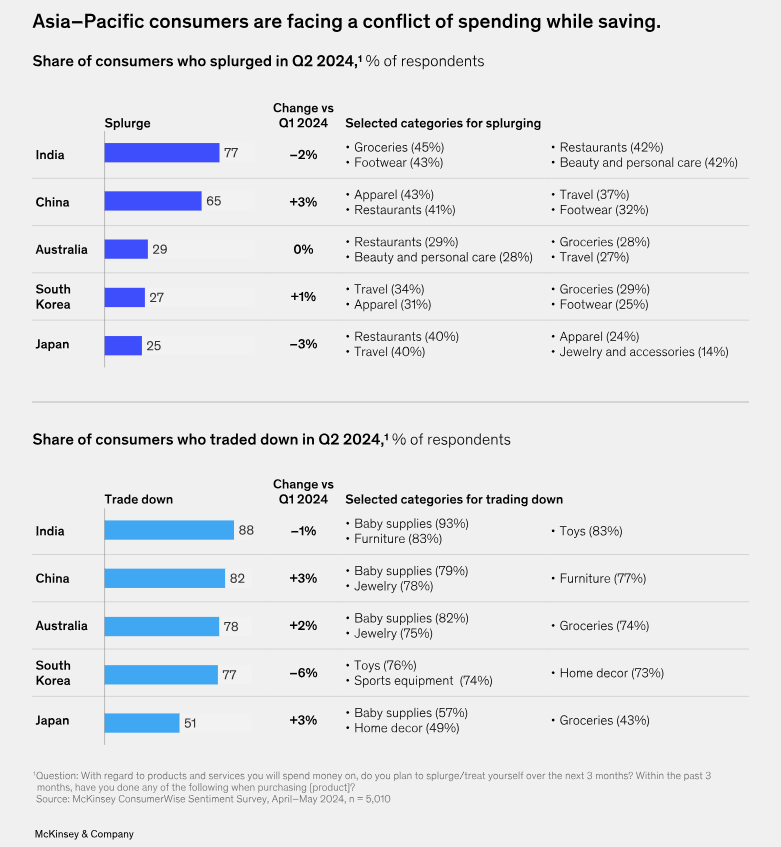

Saving but also Splurging

Despite economic uncertainty promoting increased saving, APAC consumers are increasingly willing to spend more in select categories. Between 60 and 80 percent of consumers in India and China are increasing their spending overall, while less than a third of consumers in Australia and South Korea are splurging on travel and restaurant experiences. Notably, Japanese consumers are increasing their spending on jewelry and accessories. And while overall economic optimism has declined since the start of the year, with more than three-quarters of consumers across critical APAC markets switching to alternatives that are more budget-friendly across numerous categories, fewer South Korean shoppers are opting to trade down compared with the previous quarter.

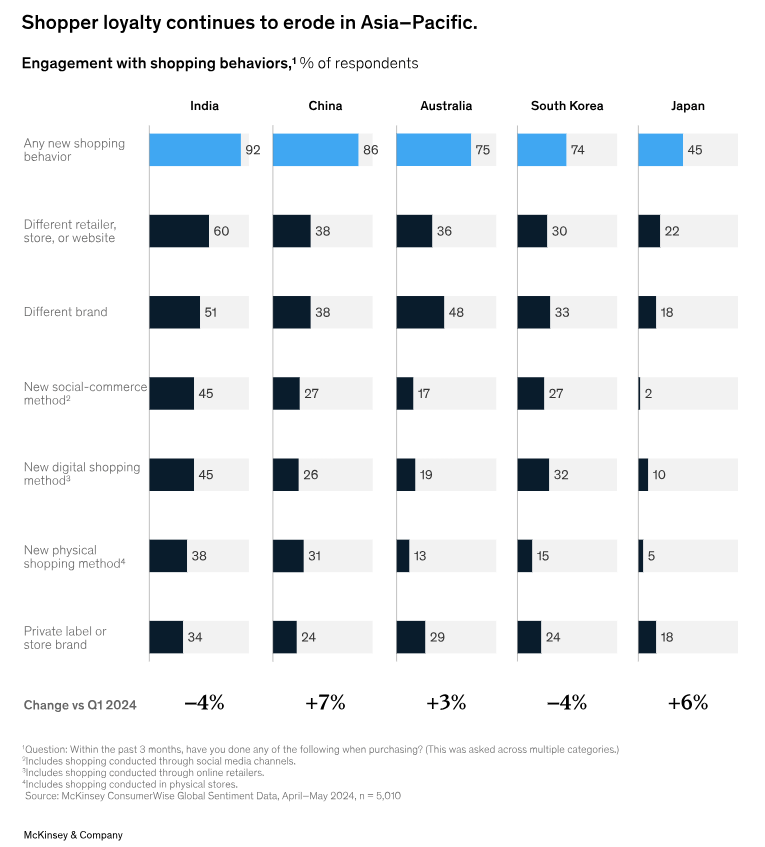

Eroding Shopper Loyalty

APAC consumers are actively adapting their shopping habits—for example, switching brands, trying new digital shopping methods, and opting for private-label brands. Across the region, more than 60 percent of consumers say the primary motivation for switching brands or retailers is the pursuit of better value. Quality and novelty also play crucial roles in influencing consumer behavior. The shift has been particularly significant in China: 86 percent of consumers have altered their shopping behavior in search of greater value, an increase of seven percentage points from the previous quarter. In contrast, consumers in Japan are changing their behavior at a slower pace, demonstrating greater brand loyalty and a preference for familiar shopping channels.

Economic uncertainty is persisting throughout critical APAC markets. Will consumers gain confidence or pull back their spending? Watch this space for regular updates on the state of the APAC consumer, and visit our ConsumerWise page for more insights.

ABOUT THE AUTHOR(S)

Abhishek Malhotra is a partner based in McKinsey’s Mumbai office, and Resil Das is an expert in the Bengaluru office.

The authors wish to thank Eitan Urkowitz and Rhythm Ahuja for their contributions to this article.

The article was first published by Mckinsey & Co.

Photo by Ivan Samkov.

1.0

1.0