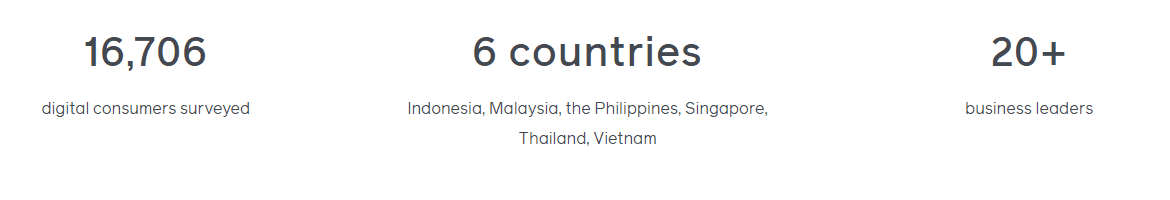

SYNC Southeast Asia is a thought-leadership series about keeping in tune with the consumers of tomorrow. Through this series, Facebook and Bain & Company take business leaders deeper into the emerging trends and rising opportunities shaping the vibrant region.

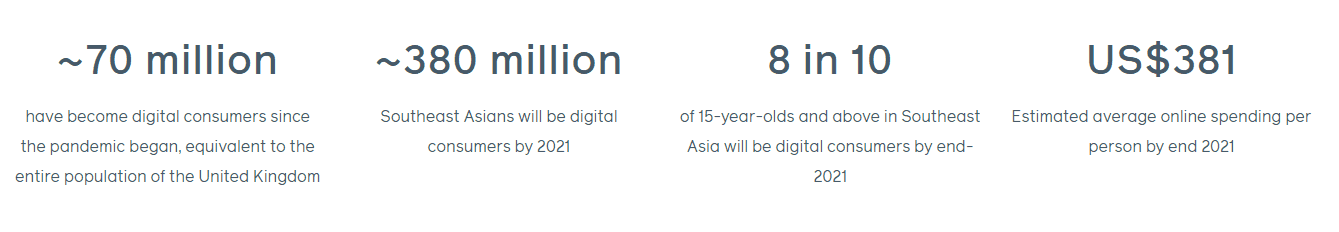

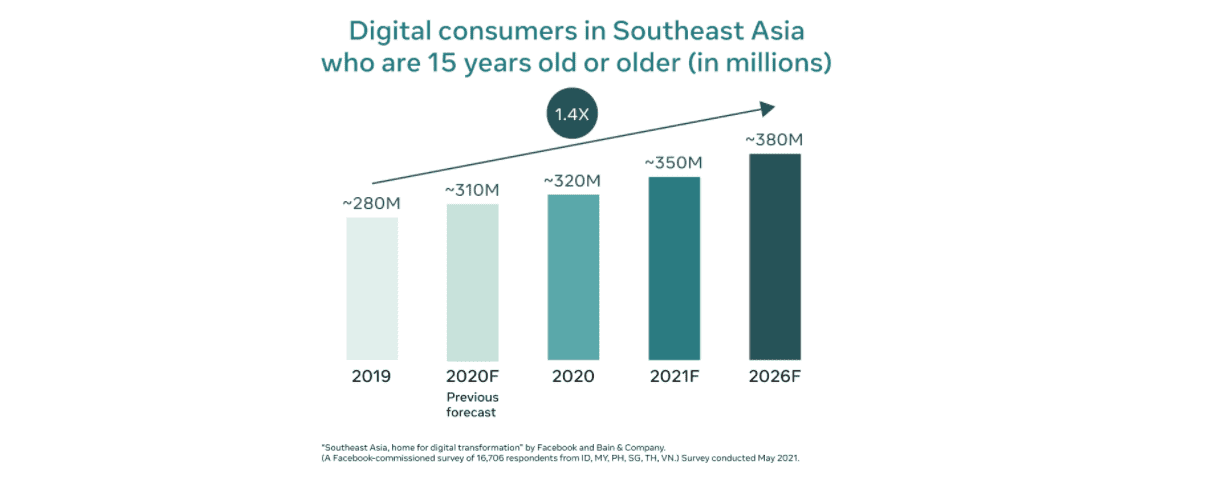

In 2020, Southeast Asia’s migration from the offline to the online economy surpassed our initial estimates and took off at an accelerated pace. Changes that were expected to take place over half a decade took place in just a year, partly because of the consumption habits brought about by the pandemic.

This “new normal” resulted in new purchasing habits, new ways to discover, new preferences and new expectations. A new consumer way of life has emerged from these transformations. But which changes are transient and which ones will last? How will consumption patterns change when restaurants, cinemas and borders reopen?

In this year’s report, we hope to give a sense of what this post-pandemic consumption could look like. We can’t tell you what the future holds, but we can tell you that the the many business executives we spoke with and the thousands of consumers we surveyed agree that the digital economy, from ecommerce to online groceries to social media to e-payments, will continue to play an outsized role in daily life, even after COVID-19. The digital transformation is here to stay, and it is happening right now in Southeast Asia.

In this year’s report, discover the rise of home-centric digital trends and uncover the new expectations set to transform the region.

1. Southeast Asia leads digital transformation in Asia-Pacific

Southeast Asia’s digital economy continues to expand by almost every metric. Even after the accelerated growth seen in 2020, the region has more digital consumers, and they are purchasing more and more categories online.

With more people structuring their spending around online platforms, digital-centric consumption looks increasingly likely to stay. Digital spending continues its expansion amid the pandemic, with spending per person and overall ecommerce sales both seeing explosive growth year-on-year.

Southeast Asia’s online retail penetration growth also outpaced that of Brazil, China or India, going from 5% in 2020 to 9% in 2021. This represents an 85% growth from last year compared with 14% for Brazil, 10% for India and 5% for China.

” What we see in China and the US is more of a channel shift from offline to online, whereas in Southeast Asia the growth in consumer spending and retail is driven by online channels. In the future, we will be talking about digitalised commerce instead of gross merchandise value and penetration, so businesses will need to focus on driving the most value out of the omnichannel purchase journey.”

Magnus Ekbom, Chief Strategy Officer – Lazada Group

2. The pandemic has changed the consumers’ purchase journey

During the pandemic, new digital habits arose as consumers coped with the change.

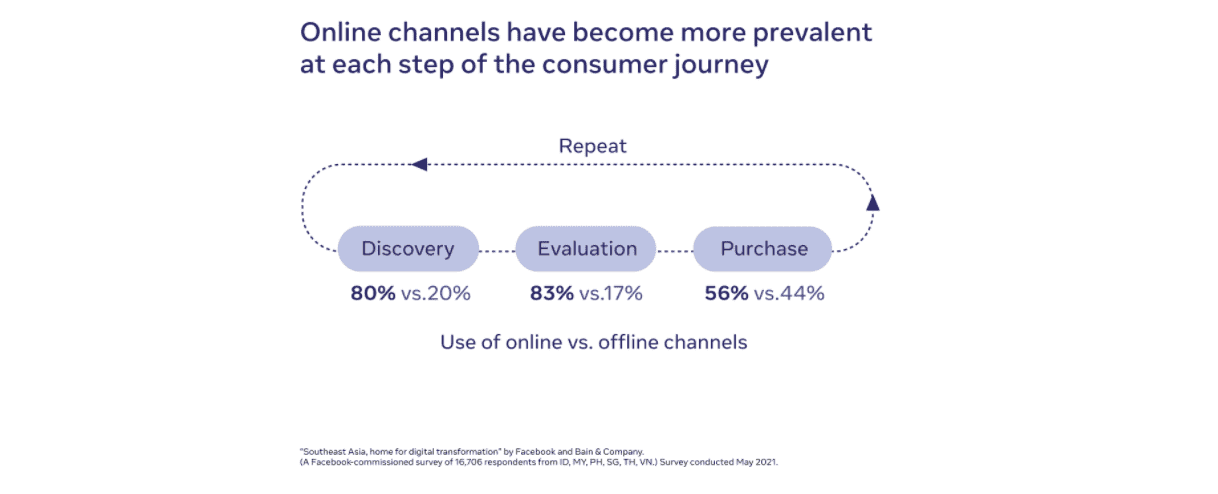

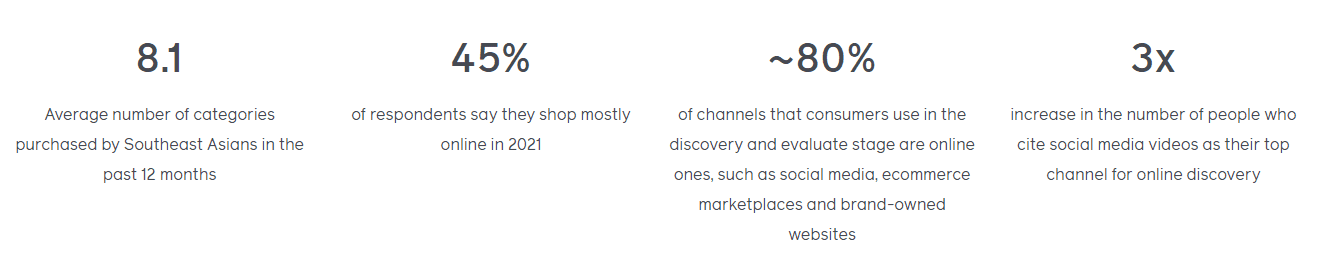

Southeast Asian consumers are buying online more often and are doing so for a wider range of categories compared with 2020. Around 80% of channels that consumers use in the discovery and evaluate stage—in other words, the main channels they use before arriving at a purchase decision—are online.

In this report, we give a breakdown of how Southeast Asian consumers think and behave in every stage of the purchase journey. How do they discover new products? What channels do they turn to, and when, during their research? Learn how consumers browse, research, compare brands and make their purchase using social media, ecommerce marketplaces and even offline channels.

“Consumers are more willing to try new brands and platforms, and loyalty changes accordingly as a result. The key to maintaining loyalty comes down to the overall experience consumers get. In the past, consumers’ decision-making process was about physical reach and access to products, but now it relies more on elements of convenience.”

Tirayu Songvetkasem, Chief Digital Officer – Makro

“Over the past year, we have not only seen rapid growth in the digital consumer population but also broadened expectations from buyers. Users are increasingly coming to our platforms to discover, be entertained, and shop on the go across a wider selection of products and categories. This pace of change will continue in Southeast Asia and brands and sellers will need to innovate to sustain engagement with these mobile-first consumers.”

Santitarn Sathirathai, Group Chief Economist – Sea

3. In the battle for loyalty, product quality and experience, not just price, win over consumers

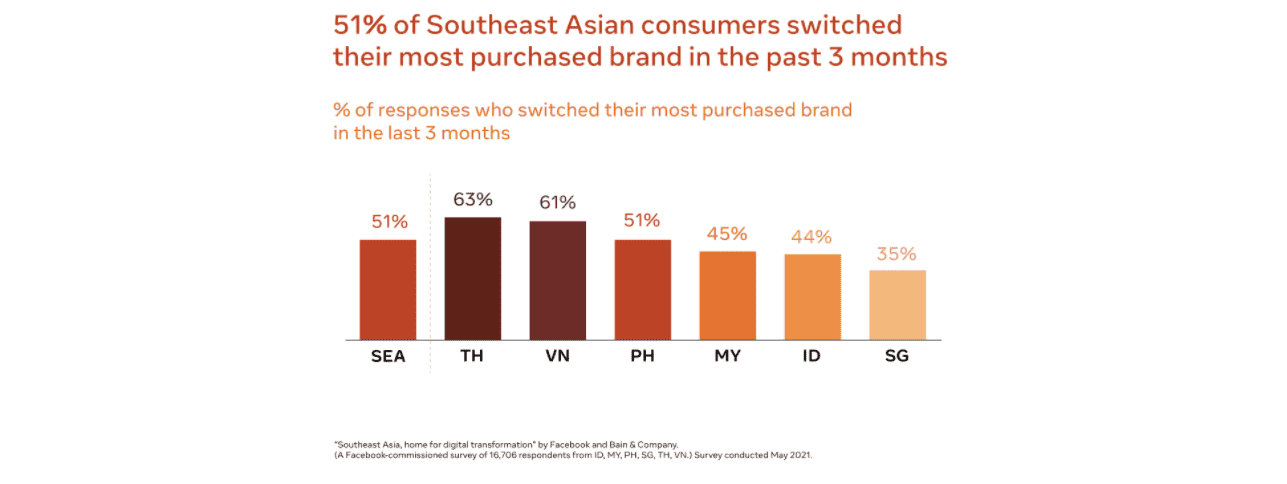

Digital consumers shop across even more platforms on average now—7.9 websites in 2021 compared with 5.2 in 2020. More than half of consumers, 51%, also say they’ve switched from their most purchased brands in the past 3 months.

While price remains an important reason for switching, people cite other reasons too. Better product quality, better availability and faster delivery times all feed into consumer decisions on which sites to use the most.

4. Environmental and sustainability factors now compel consumers to switch brands—and pay more for them

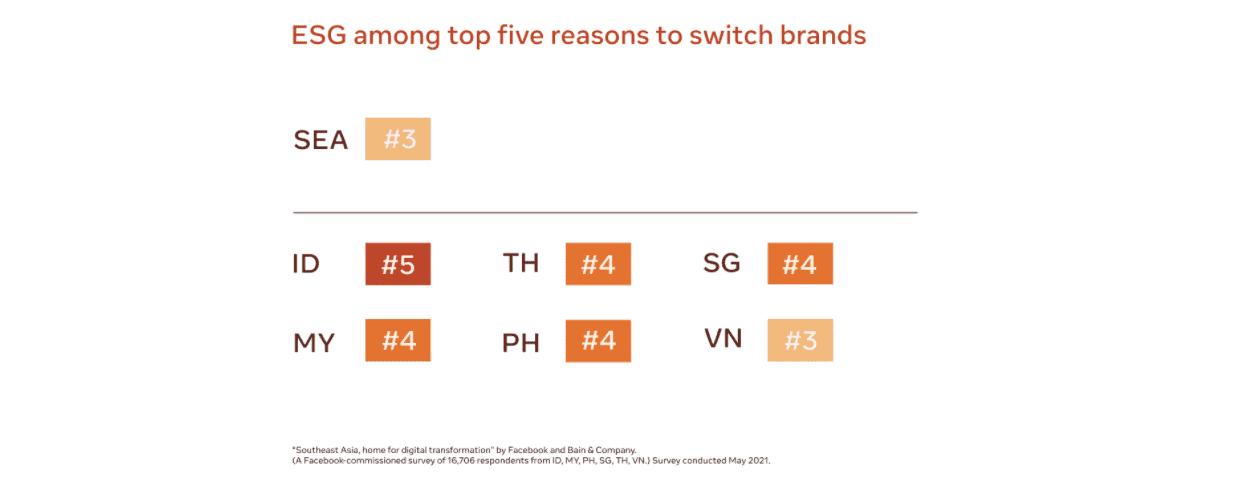

We also examine a new frontline in the battle for customer loyalty: Environmental, Social and Governance factors. ESG now counts as among the top cited reasons consumers switch brands in Southeast Asia. People are willing to pay more for a product that’s sustainably and responsibly sourced, although some product categories are more sensitive to ESG factors than others.

Discover the role ESG plays for consumers, how much premium they’re willing to pay and which categories are most affected.

5. Home-centric lifestyles to persist beyond the pandemic

With stay-at-home orders changing from country to country, how much spending is taking place from home and how much of it will remain once restrictions are lifted?

Even when COVID-19 restrictions ease and no longer poses a big risk to the majority of the population, 86% of food delivery and 75% of time spent shopping online from home will remain.

We share more details about how some of these buying activities will change and which categories are most likely to benefit, as well as some perspectives from business leaders on the future of work.

6. Investments fuel digital disruptions in the region

Investments continue to flow regardless of the pandemic, providing a much-needed boost to emerging companies. The value of all private equity and venture capital investments reached around US$3.6 billion in Q4 2020 alone, exceeding quarterly levels last seen in 2019. Southeast Asia’s deal value for the whole year totalled US$9.5 billion, higher than Brazil’s (US$5.6 billion).

In this report, we discuss in detail the type of firms likely to benefit and the trends driving investor appetite.

“The opportunities for Southeast Asia is immense. The region will be a growth market for at least the next 10 years as new verticals, industries and products emerge. The pandemic drove tremendous interest for certain verticals like financial services and tele-health. These sectors are giving access to the underserved and are creating employment opportunities that were not possible before.”

Justin Hall, Partner -Golden Gate Ventures

Where do we go from here? The Six Rs

As Southeast Asia becomes the new ecommerce powerhouse, the report lays out 6 crucial strategies for companies and chief marketing officers to implement to take advantage of the region’s digital boom. We call these “The Six Rs”:

- Rewrite a digital-first agenda

- Rewire your business model

- Reimagine consumer engagement

- Refresh product offerings

- Re-envision the role of sustainability

- Re-align to the post-pandemic hybrid lifestyle

Along with the insights we’ve presented in this report, these 6 strategies define the path that brand owners and chief marketing officers need to take at this pivotal moment to capitalise on the growth of Southeast Asia.

The article was first published here.

Photo by Markus Winkler on Unsplash.

1.0

1.0