Cloud technology enables better and more efficient ways of working and serves as a crucial part of a broader digital transformation.

- There is a growing awareness that cloud computing is the environment in which digital transformation must take place.

- Misconceptions about the cloud can keep finance and accounting professionals from taking advantage of its capabilities for their business.

- The most successful companies are driving their move to the cloud with a mix of finance, procurement and HR, as well as operations and supply chain.

As we near the end of a year marked by unprecedented disruption and seemingly never-ending challenges, we can now begin to see some emerging trends and reflect on the many lessons learned. One thing is increasingly clear: companies that had already embarked on digital transformation initiatives before the COVID-19 pandemic have adapted more easily to remote work, restricted travel and the technology required to maintain day-to-day operations in this new world.

The crisis exposed many shortcomings in how well finance and accounting could properly execute a variety of functions, from closing the books to forecasting and reporting, all remotely — but some companies have fared much better than others.

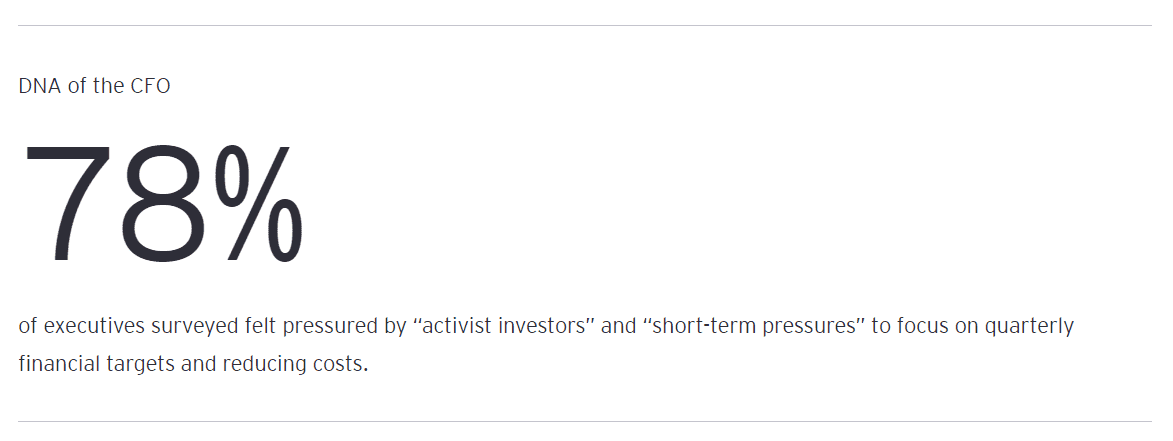

Our recent DNA of the CFO survey of CFOs and other senior finance executives conducted in the early part of the pandemic indicated that 78% of these executives felt pressured by “activist investors” and “short-term pressures” to focus on quarterly financial targets and reducing costs. And 71% stated that “traditional back-office behaviors and mindset” were slowing their modernization of finance and accounting.

The bottom line is that CFOs are under even more pressure as they continue to accelerate or start digital initiatives. At the core of these initiatives is a growing awareness that cloud computing is the environment in which digital transformation must take place.

The idea of cloud computing, or “the cloud,” has been around since the 1960s, and the term “cloud” has been in use since the early ’90s. Yet, as cloud computing has taken on new importance, there is still much uncertainty as to how it works, what the costs and benefits are, and ultimately why it matters so much to the CFO and other C-level executives. To that end, this article shares some key ideas on the current state of cloud computing, starting with a short primer that might be useful for CFOs and other non-IT executives.

Chapter 1 – Cloud Computing 101

The technology enables an array of services and is available in public, private, or hybrid forms.

One way to think about cloud computing is as a set of distributed on-demand technology services that enable your business. Traditionally, these services were internal to the business and took place on the premises of the business, or “on-prem.” They were fully housed and maintained (within a data center) by the company that operated, maintained and used the services.

In the cloud model, we instead subscribe to those services on an on-demand basis from a third-party provider. They include prebuilt infrastructure, software and other features that ultimately provide speed to value and flexibility in how a business operates.

The trade-off, of course, is the very common concern about security, flexibility and a perceived loss of control. Before addressing those, it’s worth describing what services the cloud provides with a few comments on the two main deployment models: public and private cloud.

At the simplest level, cloud computing provides the following services:

- Infrastructure-as-a-Service (IaaS) is base computing architecture (hardware) but not the operating system, drivers, applications or other software provided by the user based on their requirements. While an oversimplification, it’s actually similar to the original time-share computing model of the early ’70s minus the analog phones and modems.

- Platform-as-a-Service (PaaS) adds an additional layer of capability to IaaS, adding in the operating system and associated services while leaving the user to determine what apps will be used and what types of data will be stored.

- Software-as-a-Service (SaaS) is a cloud model that hosts the entire application stack and associated data, greatly simplifying the work required around upgrades, maintenance and operations. Examples include cloud-based platforms like BlackLine which address specific finance needs.

One additional and important distinction is the difference between private and public cloud, which essentially refers to whether the cloud environment has dedicated hardware (private) or simply a virtual space on common hardware (public). Additionally, it is not uncommon to see “hybrid” models that combine elements of public, private and on-prem to achieve business objectives.

There are many cloud providers, especially in the SaaS space where, as mentioned, innovative companies like BlackLine are delivering purpose-built cloud-based solutions. At the same time, specifically the PaaS and IaaS space, there are a few major providers offering a complete platform enabling an ecosystem of software and services either stand alone or in conjunction with SaaS providers. An example of this would be the Microsoft Azure Platform, which comes pre-built with a host of services and capabilities that can be quickly deployed. There is also a set of cloud-based applications focused on the emerging field of data science providing a layer of analytics-type services on cloud.

Chapter 2 – Common Misconceptions

Security and control loom as large concerns, but don’t assume that on-prem is less risky. Other factor also merit attention.

With this overview in mind, it is worth addressing some of the common misconceptions we’ve observed, specifically within the ranks of finance and accounting professionals:

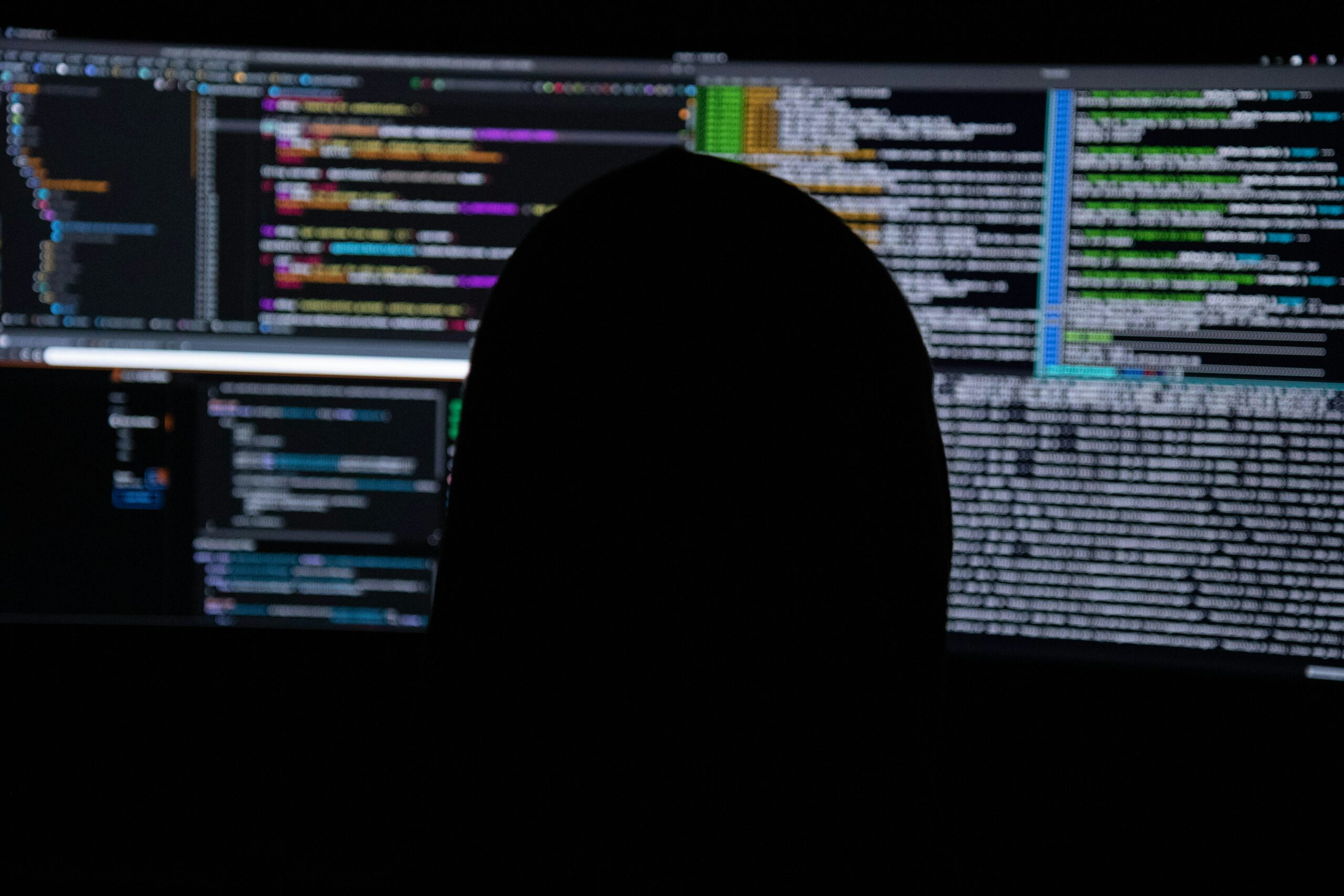

Security

The largest area of concern is around the security and control aspects of housing business-critical data and applications in a cloud environment. To many companies, the move to the cloud can seem daunting and risky. This is especially true in companies with a large footprint of on-premises applications that can be seen as very secure over the cloud.

The bottom line, however, is that on-prem doesn’t necessarily mean less risky. Cyber criminals are increasingly sophisticated in their approach to stealing data and penetrating systems, and there is a case to be made that cloud companies, with their entire existence predicated on keeping customer data and applications safe, are much more secure than on-prem environments. In fact, a recent global survey of senior IT security professionals by the UK domain registry service Nominet indicated that 61% of security specialists believed cloud-based data and apps were more secure than on-prem data and apps, a marked shift from traditional views.

The Role of IT

Another misconception is that the decision to move to the cloud and the timing are technical questions for the IT function to answer. While IT is an important stakeholder, the reality is that business process, business data and business operations are what is moving to the cloud — therefore, it’s a business decision on how and when this will occur. IT has a role in this journey, but the most successful companies are driving their move to the cloud with a business mix of finance, HR and operations leading the way, with the support of IT.

The bottom line is that any assessment of cloud readiness, cloud planning and timing or an evaluation of cloud capabilities need to be a business-led process. IT is also directly impacted, but the transformational aspects of the move versus the technology aspects should be the reason for a move to the cloud.

Data Quality and Data Governance

Many companies don’t fully appreciate the level of effort required to address data quality and data governance issues prior to making a move. While the cloud environment allows speed to value and shorter implementation times, it also requires a fair amount of discipline to prevent customization of the system. This places a premium on data quality and governance, and while these actual processes eventually run smoother on the cloud, the prep work beforehand can be significant.

The Broader Digital Transformation

Cloud capability is just one piece of a digital transformation. It’s an important piece, but without attention paid to other elements of the finance operating model, a move to the cloud will fall well short of expectations. The cloud is an enabler, not an end state. It is critical to optimizing processes and enables important technologies like artificial intelligence and robotics, which must be properly coordinated.

It is important to understand the role that the cloud will play in the future of your company. If you don’t have a plan or an understanding of the road map, it’s time to begin that work now. A well-thought-out road map of the move to the cloud is critical, given some of the investments required and the very real chance of missteps along the way.

It’s also important to do this within the larger context of digital transformation and understand the role the cloud will play within it. Many options and choices must be made that could impact the overall transformation, so have the right business focus and understand the many issues in play with a move to the cloud.

There are huge opportunities for those who get in front of cloud adoption in all parts of their business. Correspondingly, there are huge challenges for those who do not. In any case, the good news is that moving to the cloud is a process filled with options where you can move quickly with manageably sized initiatives while minimizing impact on the organization. In today’s demanding business environment, moving to the cloud is very much a case where moving forward, rather than standing still, is almost always the right choice.

Summary

While there are a host of factors to consider — including what services to use and whether to pursue a public, private or hybrid deployment — CFOs who get in front of cloud adoption can seize on the opportunity to be more adaptable and resilient while managing costs and driving greater value.

5.0

5.0