As an independent audit firm with a unique vantage point into companies, we are often asked what we see in the area of corporate governance. Investors, policy makers, regulators and, of course, corporate directors themselves want to know: What is working? What needs to be improved? These questions are more important now than ever, with an increased focus on governance: the “G” in ESG.

To learn more, Tim Ryan, PwC’s US Chair and Senior Partner, had discussions with over 30 board members at America’s top companies—representing over 85 companies. He gathered unvarnished perspectives, and found that while the state of corporate governance is strong, together we have the opportunity to take it to a whole new level.

Strategy: Don’t Just Approve It. Measure It, Check It, Change It.

It’s management’s job, of course, to set company strategy. But board oversight is absolutely critical, and to really get it right, many boards could be even more involved. Specifically, boards could spend more time analyzing strategic options that were considered and rejected—not just the path that was taken. Also important: monitoring whether the strategy is really working. The typical once a-year discussion just doesn’t cut it anymore.

What the best boards are doing

- Go over the “chess board” at every board meeting. Review trends, discuss possible disruptors, examine upcoming transactions in the industry, and evaluate M&A opportunities and implications.

- Use dashboards and metrics to monitor progress on strategy at every board meeting. Boards need quantitative and qualitative reports on progress. Review whether agreed-upon financial and non-financial metrics and milestones are being met.

- Push a course correction when needed. The metrics will show when strategy isn’t working. Push management on why goals were missed and what changes need to be made.

- Take the outside-in perspective. Spend time thinking and analyzing data like an activist. Understand the company’s vulnerabilities from an outsider’s perspective—not just management’s

CEO Performance: Move On When Things Don’t Work Out.

While the board is tasked with oversight over the entire company, the most important piece of that job, by far, is hiring, overseeing—and, sometimes, firing—the CEO. Having the right leader in place really is the most important thing.

Sometimes boards get it right, but the truth is that they many times don’t. It is hard to know how well an individual will perform until they step inside the pressure cooker. Failure isn’t forcing an untimely CEO change—it’s keeping the wrong CEO in place for too long.

What the best boards are doing

- Don’t be afraid to provide frequent, honest and challenging feedback to the CEO. A formal evaluation process with frequent touchpoints should be in place to measure the CEO’s success. Where there are shortcomings, board leadership needs to come up with a plan forward.

- Watch for early warning signs. The board needs to keep a very careful eye on progress and performance. At a certain point, coaching is no longer useful, and the focus needs to turn to making a leadership change.

- Don’t be afraid to make a change. Boards should be ready to act when a leadership change is needed. Have the courage to voice your opinion and initiate action.

Board composition: address the elephant in the room.

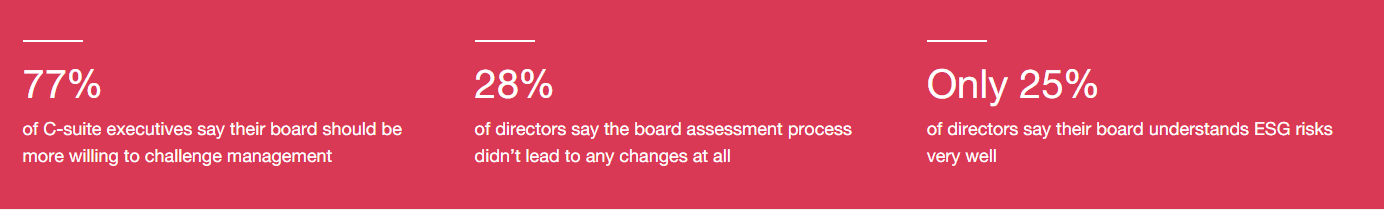

By and large, boards look different than they did a decade or two ago—but it’s not enough. Boards need to not only diversify and bring in new directors, they also need to hold themselves to the highest level of excellence.

Assessments are one of the most important tools in this discussion. Yet many boards still only evaluate the board or committees as a whole, avoiding candid individual assessments. When assessments are conducted, feedback isn’t shared, and little changes as a result.

What the best boards are doing

- Conduct individual director assessments every year. Board chairs or lead directors should hold a one-on-one meeting with each director and share honest, candid (especially if uncomfortable) feedback each year.

- Expect honest self-assessments, too. Each board member needs to do their part as well. Each year, honestly answer the question: “Am I still the right fit for this board?”

- Embrace shorter board tenures. Set an expectation that at least some directors will leave after five or seven years. This can encourage fresh thinking about renewing boards.

ESG: Be Ready for the ESG Tsunami.

ESG dominates boardrooms today. Directors tell us that ESG is the number one topic shareholders want to discuss directly with directors. Some boards have just begun to incorporate ESG into their strategy and processes. Others have established new board committees to oversee certain ESG topics, like sustainability or environmental issues.

Currently, many boards take an ad hoc approach to ESG oversight. With such a large and sprawling topic, it’s easy to lose sight of the forest for the trees and to focus on the wrong topics.

What the best boards are doing

- Establish clear ESG oversight among board committees. Have a clear roadmap of which committee oversees which issue, and how they can work together.

- Embed ESG goals in the strategy and business plan. Identify the company’s key financial and non-financial ESG goals and embed them into company strategy. Make them a clear part in the business plan.

- Be transparent with your shareholders. Don’t just wait for the questions to come from your investors. Look for ways to proactively tell the company’s ESG story and share its strategy in an open and transparent way.

Next Level Board Challenges

- Avoiding audit committee overload. For years, audit committees’ agendas have continued to grow. When new risks emerge, it can seem natural to allocate oversight to the audit committee. But with already packed agendas, boards need to resist the urge to overload the audit committee.

- Looking for culture red flags. It is hard to measure corporate culture, and to know if the board is getting it right. Metrics can help, but boards need to be alert and connect the dots on what they see and hear—a challenge intensified in a remote or hybrid work environment. Look for a defensive management team, a lack of transparency or executive failure to admit mistakes.

- Evaluating the looming talent war. Understand what the company is doing now to differentiate itself and attract talent, and how that strategy will evolve in the future. Take a close look at diversity, equity and inclusion and make sure the approach and advancement of goals are happening.

- Staying ahead on cyber. Cybersecurity is one of the most challenging areas of oversight for boards. Make sure the board has access to cyber expertise to guide decisions. Double down on education sessions by internal resources and third parties to really understand what’s happening.

- Navigating the proxy advisors. The power and influence of proxy advisors has waxed and waned over the years, but when it comes to corporate governance, they continue to be a significant driver of shareholder expectations and agenda-setting. Being an engaged public company director means understanding the proxy advisors’ positions and their views on your company.

Act Now: Push the Bar Further

Businesses are becoming ever more complex, competition is increasing, and investor expectations are increasing. And, risks and opportunities multiplying. Trust today is becoming both more important and harder to come by. While there’s evidence that businesses are actually more trusted than the government, media or NGOs, that trust is tenuous and businesses must continue to earn it.

In short, board oversight is not getting any easier. What is considered good governance today won’t be enough to adapt to the challenges of tomorrow. And while most corporate boards are doing well and governance is strong, directors should take the challenge to push the bar further and take board governance from good to great.

The article was first published here.

Photo by Evangeline Shaw on Unsplash.

5.0

5.0