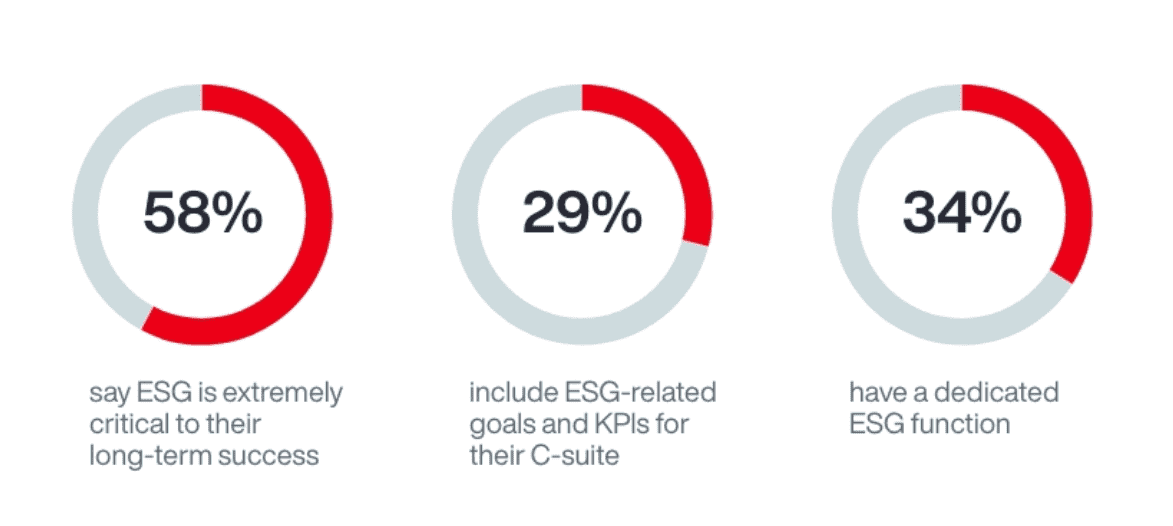

Aon plc (NYSE: AON), a leading global professional services firm, have surveyed board members, C-suite executives and senior leaders from more than 255 companies spanning 14 Asia Pacific locations to explore the various environmental, social and governance (ESG) issues impacting the region. We also investigated emerging approaches to ESG reporting, human capital management and decision making.

This report captures data and insights from the survey and includes guidelines that can help to inform your ESG strategy, no matter where your company is on the path to achieving measurable, real-world ESG outcomes.

Key Insights

The Top 3 ESG Priorities:

There is a need and desire for more ESG training, especially in markets where regulatory requirements are growing.

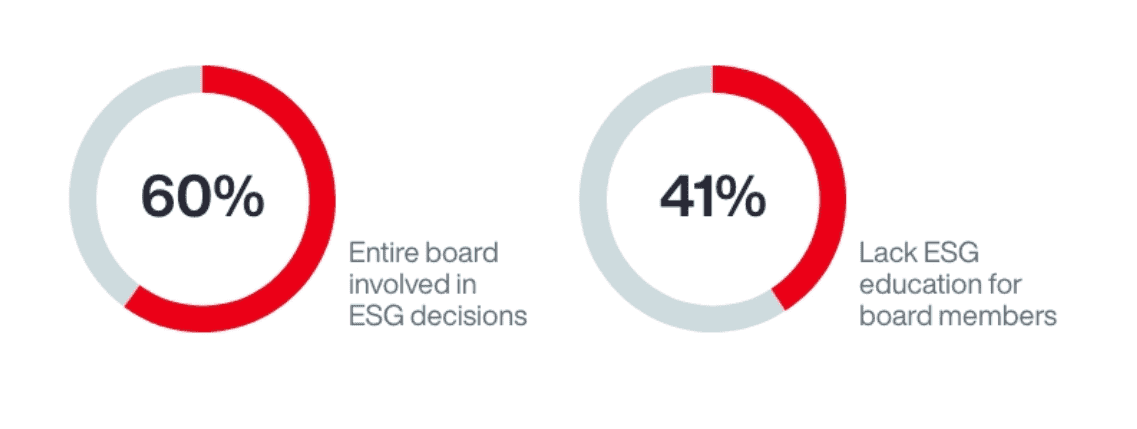

Given the complexity and interconnectedness of ESG issues, board members need to be informed about ESG risks, opportunities, trends and evolving practices to make sound decisions.

However, whilst the survey found that most companies involve their entire board in ESG decisions, many lack formal ESG training and education for board members.

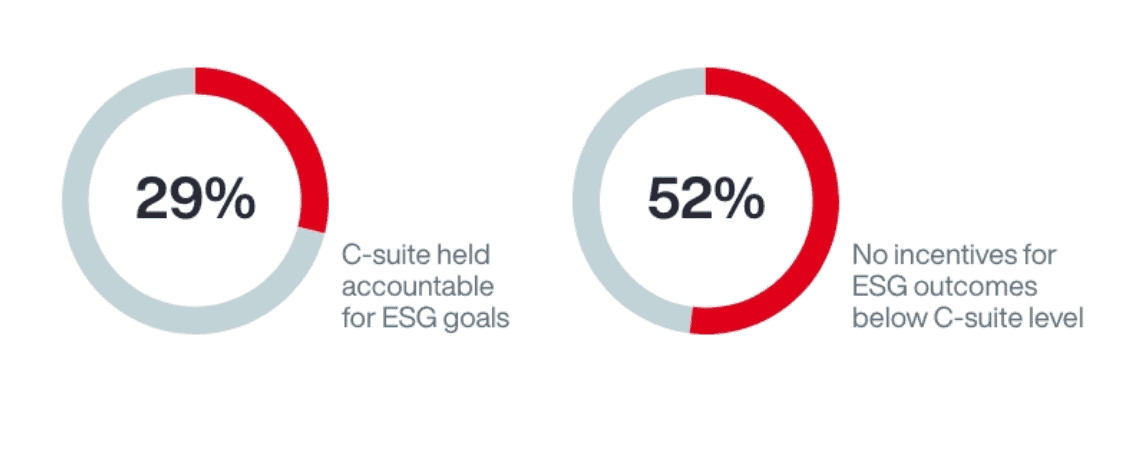

The survey also found that relatively few companies hold the C-suite accountable for setting and achieving ESG-related goals, and few incentivise below the C-suite for ESG-related outcomes. Download the report to learn about the Top 6 most common education topics shared with boards.

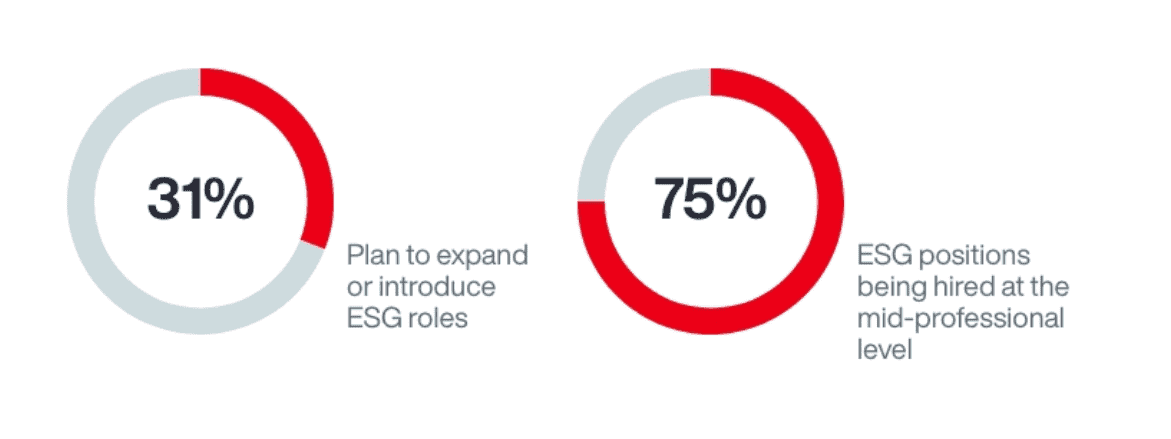

As industries move to lower-carbon, resource-efficient practices, there is a surge in demand for green skills, but a lack of talent to meet it. Companies will need to embark on job redesign and skill-upgrading initiatives and invest in developing the necessary talent to meet this growing demand.

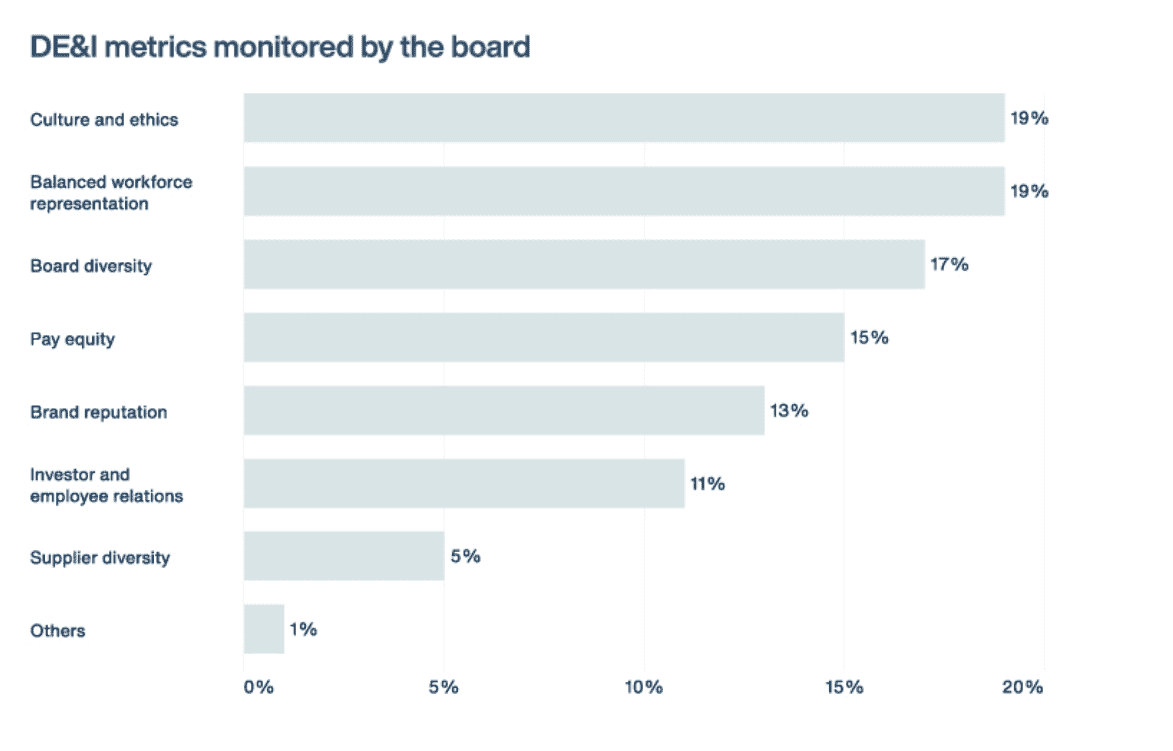

When it comes to diversity, equity and inclusion (DE&I), companies are more likely to discuss internal diversity metrics, including culture and ethics, balanced workforce representation, board diversity and pay equity versus external facing metrics like brand reputation, investor and employee relations, or supplier diversity.

61% of boards are actively monitoring DE&I, making it a high priority in Asia Pacific.

Diverse and inclusive workplaces tend to be more resilient and innovative, which can lead to better talent attraction and retention outcomes [The Rising Resilient, 2020]. However, it is common for individual leaders to have different ideas about what DE&I means. Companies should take time to evaluate why DE&I matters and articulate their vision before devising a strategy.

Download the report to learn more about the latest ESG approaches or contact us for a confidential discussion.

5.0

5.0