Hoping for a soft landing in 2024 won’t mitigate current risks or raise business performance and living standards longer term. If companies pursue the three-sided productivity opportunity, however, they can do both.

At the outset of 2023, energy prices were off their peaks, inflation was no longer accelerating, economic growth appeared to be holding up, and geopolitical tensions were easing. We wondered at the time whether this might signal a break from the macroeconomic and geopolitical disruptions that had severely tested management teams the previous year, ushering in less challenging business conditions in the coming months.

That emphatically did not happen.

At the outset of 2024, uncertainty has, if anything, deepened. New geopolitical disruptions; ongoing shifts in the global economic order; and the advance of AI, new technology platforms, and the energy transition are just some of the trends that signal the potential onset of a new era and keep a wide range of medium- and long-term economic scenarios in play.

The sentiment is more positive in the short term, with rising hopes for a “soft landing” in many economies, but elevated inflation and interest rates, frustrated consumers, constrained labor markets, and domestic political volatility continue to complicate business and policy decisions. We cannot rule out a recession in the coming months, and the potential for a balance sheet reset continues to hang over the global economy.

In this context, it is understandable that business leaders are uncertain about the steps to take to help their companies prosper. Nevertheless, we believe that these converging forces have the potential to create the economic conditions for a much brighter future. From the first successful fusion experiment that produced more energy than was used to ignite the process1 to the vast promise of applied AI, mRNA therapeutics, gene editing, and other technology trends, we would argue that there is no better time than today to invest in a prosperous and sustainable future.

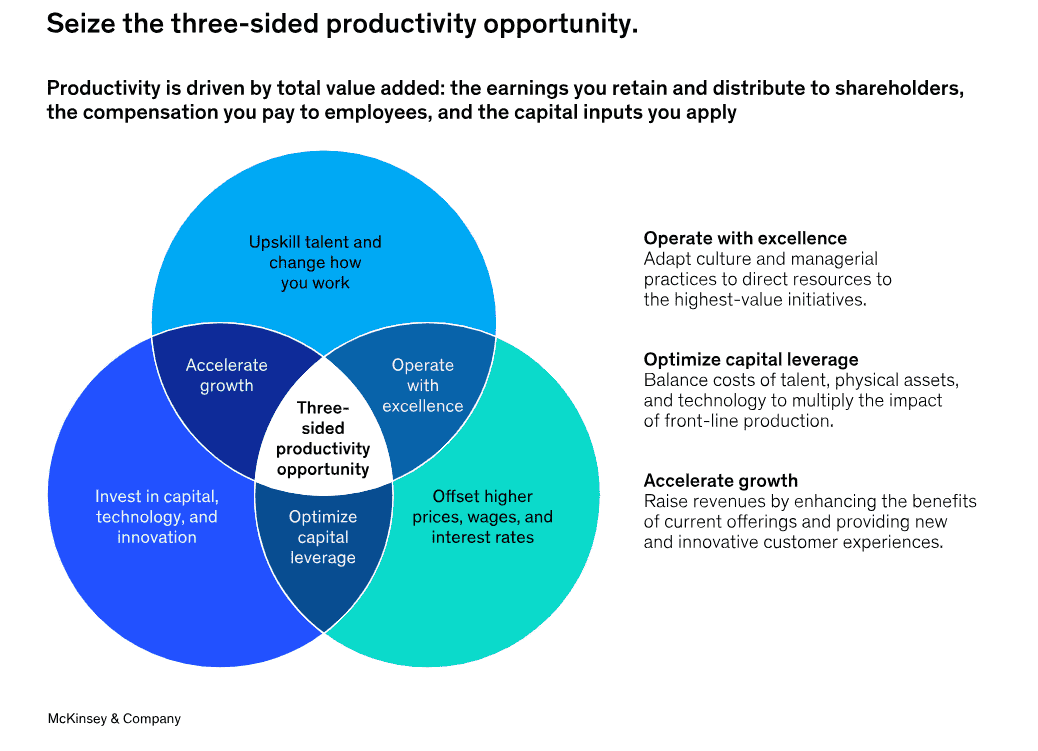

There is a way for business leaders to invest in that future while managing through the ongoing uncertainty and boosting their companies’ growth and profitability: pursuing and capturing the three-sided productivity opportunity (Exhibit 1). By upskilling workers and changing how their organizations operate; tirelessly striving to offset higher input prices and interest rates; and better targeting their investments in capital and technology, companies can operate more efficiently, empower workers with tools that multiply their impact, generate sustainably higher wages, and accelerate growth.

Business leaders who pursue this productivity imperative while navigating the mercurial conditions will not only position their organizations for outperformance but help make 2024 the advent of future abundance.

Why do we see abundance—of jobs, corporate value, technological advances, and economic growth—as the right aspiration for 2024 and beyond? The last great productivity acceleration in the United States, which occurred between 1995 and 2000, flourished on the foundation of the same three elements.2 When faced with intensifying international competition, companies that coupled capital and technology investments with capability building and changes in management practices saw their productivity soar, which in turn lifted the entire economy. Cost management was part of their productivity imperative, but the key ingredient was raising top-line output per worker.

Today the same three-sided productivity formula is an essential component of successful digital and AI transformations and underpins the performance of leading players across sectors. Productivity can transform entire companies, industries, and even economies if we can collectively accelerate progress in months and years rather than decades—something companies proved they could do during the pandemic. Productivity is the imperative that can deliver business outperformance and a future of abundance.

The 2024 Productivity Imperative

As we enter 2024, business leaders face three key challenges that all point to the imperative to increase productivity. Macroeconomic headwinds will challenge economic growth, demographic shifts and changes in employee preferences will intensify the competition for talent, and high capital and labor costs are expected to continue unabated.

Lackluster growth expectations. Executives are almost equally split between optimism and pessimism about the economic outlook over the next six months, but our analysis of the three largest economies points to clouds on the horizon (see sidebar “Performance snapshot of the world’s largest economies”). The Bloomberg median real GDP growth estimate for China is 4.5 percent in 2024. Our own scenarios see a downside risk in China of 3 percent in 2024 and 1 percent in 2025. For the United States, the consensus real GDP growth estimate stands at approximately 1.0 percent, and we see a downside risk of a 1.7 percent contraction in the second half of 2024 and first half of 2025. The picture in Europe is even more challenging, with a consensus estimate of 0.8 percent real GDP growth and a downside scenario of a 2.4 percent contraction. Consequently, business leaders in all three geographies cannot count on macroeconomic support for their growth aspirations.3

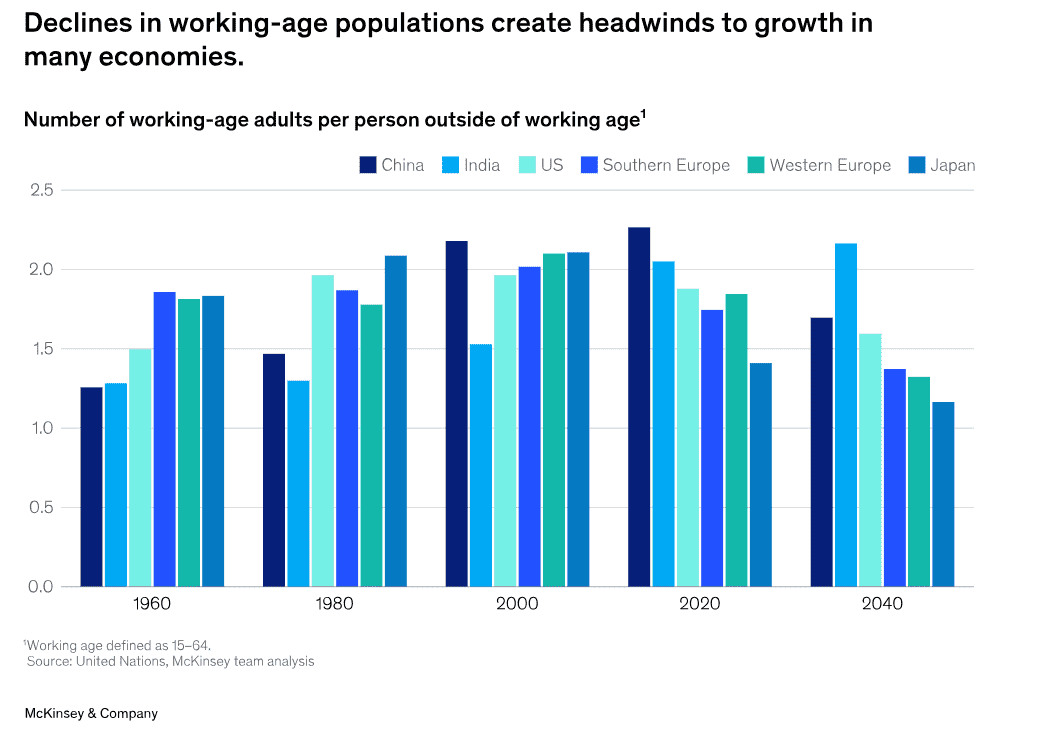

Intense competition for talent. China not only saw a decline in its total population for the first time last year, but its working-age population is expected to decrease by 39 million people by 2033, according to population statistics from the United Nations. The EU faces a similar challenge, with a projected working-age population drop of 10 million by 2033. Proportionally, the declines in the two regions represent 4 to 5 percent of their 2022 working-age populations (Exhibit 2). In the United States, meanwhile, companies are dealing with a historically tight labor market, with millions of excess job openings and a labor force participation rate still below pre-COVID-19 levels as fewer individuals 55 years of age and older returned to the workforce.4

Our analysis of the three largest economies shows that business leaders cannot count on macroeconomic tailwinds alone to deliver their growth aspirations in 2024. Planning exclusively on a return to pre-COVID-19 growth trends is not prudent.

United States: The surprising resilience of the American consumer has put the US economy on track for 2 to 3 percent real GDP growth in 2023. Despite that strong spending and persistently tight labor markets, broadly measured core inflation momentum has slowed to 3.2 percent in November 2023, down from its 5.5 percent peak in 2022.1 Against this backdrop, the country looks increasingly likely to avoid a recession in 2024. If inflation moves up again, however, further tightening in 2024 could tip the economy into a recession, as could a pull-back in consumer spending. Post-2025, a wide range of real GDP growth outcomes are possible, from a lackluster 1 percent to 3.5 percent if productivity and investment increases accelerate.

China: The country’s leaders have made clear their commitment to support the troubled construction sector and associated lenders and to do whatever it takes to minimize reverberations for the broader economy. Even so, geopolitical volatility and short-term headwinds are almost sure to continue, making 2024 a bumpy ride. Post-2025, the Chinese economy faces challenges from a declining working-age population, which makes even growth projections around 4.5 percent annually optimistic. If productivity growth also slows, China may see real GDP growth as low as 2.0 percent. Against this backdrop, companies will likely see slower growth in mainland markets, and continue to wrestle with their reliance on China-dependent supply chains.

Eurozone: The region’s real GDP fell in the third quarter of 2023, dragged down by contractions in Germany and France and lackluster performance in Italy. Europe’s ongoing exposure to energy supply and commodity shocks caused by the invasion of Ukraine remains a significant risk. The European Central Bank faces a tougher challenge for 2024 than does the US Federal Reserve as the conditions in Europe clearly signal the need for interest rate cuts even as core inflation remains above 4 percent—more than double the bank’s target.2 After 2025, demographic and productivity headwinds may lead to growth rates as low as 1 percent, although, as in the United States, an acceleration of productivity alongside technological innovation and energy transition could see long-term growth rates approach 3 percent.

Additionally, the labor market disruptions caused by the pandemic have shifted workers’ priorities, creating hard-to-resolve supply-demand imbalances and challenging employers’ ability to find the right talent. The World Economic Forum’s 2023 Future of Jobs Report found that 60 percent of organizations around the world face skills gaps and struggle to attract talent.5

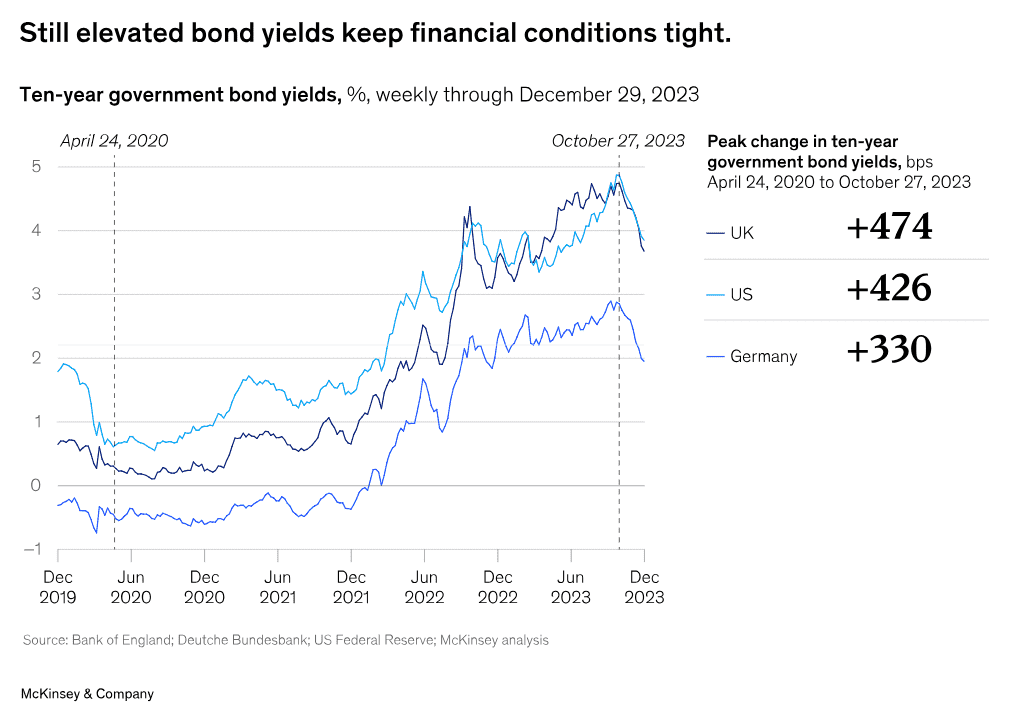

Expensive capital and labor. Interest rates have come off their fall 2022 peaks, but even if central banks start cutting rates in 2024, financing conditions will remain tight. The ten-year government bond yield in the United States peaked at approximately 5 percent in October 2023, up about 425 basis points since the low reached in April 2020. Similarly, in Germany, the ten-year Bund yield peaked at 3 percent. It was less than 75 basis points from 2015 to 2018 and negative from 2019 to 2021.6 We are highly unlikely to return to debt costs of essentially zero—and if we do, it would be amidst a profoundly weak, potentially stagnating economy.

In the wake of the pandemic, many countries have seen a significant acceleration in wage growth. In the United States and the United Kingdom, wages are up 20 to 25 percent since December 2019, a pace more than double pre-COVID-19 rates. Since nominal monetary wages have rarely, if ever, fallen in developed countries, business leaders should view this cost reset as permanent. In the eurozone, wages have experienced smaller increases as policy makers more directly ameliorated labor market disruption.7

In this environment, the only sure way for companies to boost profitable growth is to increase their productivity. And the potential for productivity growth is immense.

The Path to Productivity and Abundance

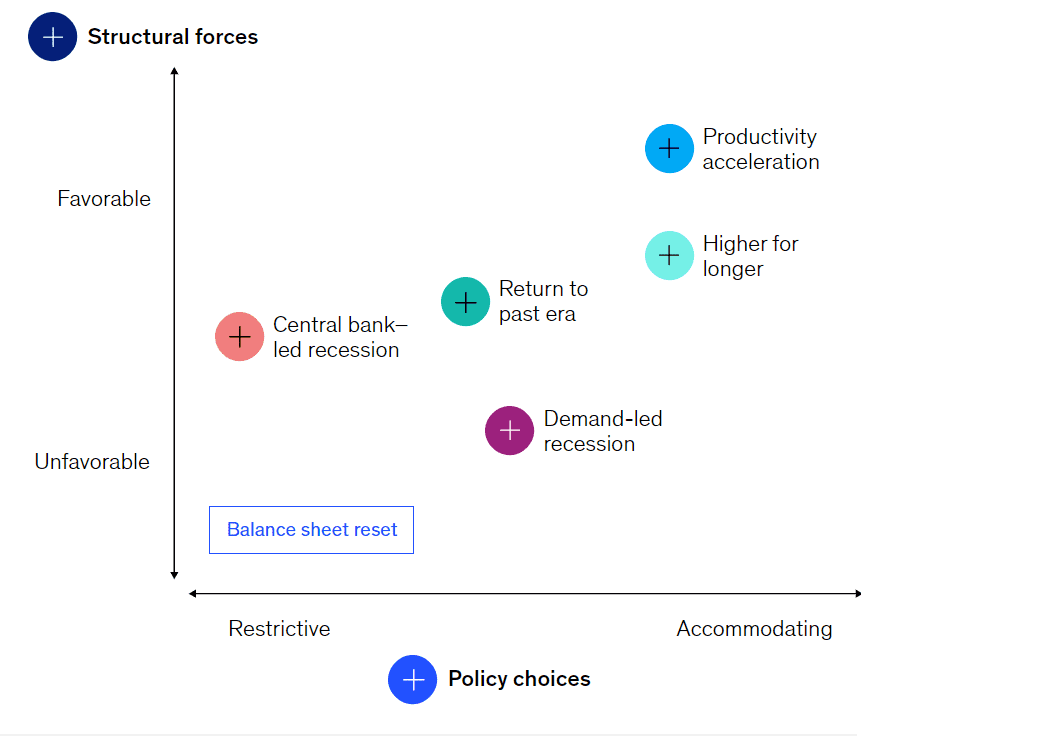

Looking beyond 2024, the range of possible economic scenarios would create widely different medium- and long-term market outcomes. The consensus expectation is for growth to revert to pre-COVID-19 trends, but this is by no means preordained. We see plausible scenarios in which growth is well above or well below historical levels. Furthermore, our research shows that soaring asset prices have raised global net worth relative to GDP by 170 percentage points above the pre-2000 average, creating the risk of a global balance sheet reset that would lead the economy into a protracted period of deleveraging and weak performance.

While many factors will combine to plot the ultimate course of the global economy, one element—largely determined by the actions of business leaders—could have the most significant impact on delivering a positive outlook: productivity growth. Our productivity acceleration scenario generates by far the largest growth upside and is the only outcome we see that would reduce the chances of a balance sheet reset to effectively zero.

Leaders must navigate persistent geopolitical and macroeconomic uncertainty to capture the three-sided productivity opportunity.

The mercurial global environment makes the outlook for 2024 uncertain, just as it was at this time last year. To track the ongoing turbulence that business leaders must contend with, we are updating the McKinsey Macro & Markets scenarios on a quarterly basis. This latest perspective includes reported GDP data through the third quarter of 2023.

The scenarios take two major sources of uncertainty as inputs: structural forces that determine the global economic environment, and policy choices that govern national economies. The combination produces the economic outcomes—including consumer spending, investment, trade, productivity, and GDP growth—that set the context for business activity.

These are the underlying factors that promote or constrain economic growth and shared prosperity. Individual countries can influence these factors but cannot directly control them. Examples include the extent of international cooperation, technological change, the scale and reach of global flows (in resources, goods, services, capital, people, and data), the advance of the energy transition, and macroeconomic volatility. When favorable, these forces can provide short-term boosts to growth and long-term stability.

These choices include government spending, tax, and regulatory policies that shape the functioning of labor markets, the attractiveness of business and household investment, the scale and pace of consumer spending, and the distribution of income and wealth. Monetary policy influences the tightness (or looseness) of financial conditions, the level of inflation, and the pace of economic growth. When policy choices are accommodating, they can raise economic activity, promote investment, support spending, and create jobs, producing the conditions for capital allocation and innovation that spur economic growth in the long term.

The world achieves multipolar stability that eases geopolitical tensions and allows global flows to broaden and deepen. Investment accelerates, driven by the transition to a net-zero-emission economy and the emergence of new technologies. Real GDP growth rises globally to 3.7 percent annually for the 2027–32 period. Strong investments and demand for capital support higher interest rates, and central bank policy rates settle at around 4.5 percent after 2025. In 2024, real GDP growth accelerates to 2.0 percent in the eurozone, 2.7 percent in the United States, and 5.8 percent in China. After 2027, US and European central banks keep interest rates stable and allow inflation to settle above current targets, at 3 percent.

Global tensions remain heightened but don’t escalate, global flows maintain current levels, and government industrial policies lead to continued growth in deficits. US and eurozone central banks lose support for bringing inflation back to 2 percent targets and lower policy rates to below 4 percent by the end of 2024. Real GDP grows at 1.3 percent in the eurozone and 2.3 percent in the United States in 2024. Post-2026, inflation stabilizes at a “new normal” of 3.5 percent; global real GDP grows at 3.0 percent annually, supporting an accelerated energy transition; and interest rates remain at 3.5 to 4.0 percent in developed economies.

Global tensions remain heightened. The productivity promises of new technologies prove to be exaggerated. Energy transition stays on the current trajectory. In 2024, central banks achieve a “soft landing,” and inflation continues to decelerate, sliding back to the 2 percent target in the United States and Europe by 2025. Growth drops to 1.2 percent in the United States, 0.8 percent in the eurozone, and 4.4 percent in China this year. US and eurozone central banks cut rates, which ultimately settle at around 2.5 percent after 2026. Global real GDP growth sits at 2.5 percent after 2027, returning to pre-COVID-19 trends.

The geopolitical landscape remains unsettled. Stubbornly high inflation causes the US Federal Reserve to raise rates above 6.0 percent and the European Central Bank to hold rates at 4.5 percent, causing a recession. Real GDP contracts in the United States by 1.7 percent and by 2.4 percent in the eurozone in the second half of 2024 and first half of 2025. As recessionary concerns dominate, investments in new technologies and the net-zero transition slow, lowering real GDP growth to 2 percent globally after 2026. Inflation settles at central banks’ 2 percent target across major economies, and lower investment demand brings policy rates to below 2 percent across the United States and Europe.

Geopolitical tensions escalate globally, raising uncertainty and suppressing consumer spending and business investment. Even without further monetary tightening, soft demand pushes economies around the world into recession, with real GDP contracting to 1.8 percent in the eurozone and 0.6 percent in the US by the fall of 2024. As a result, real GDP drops to 1.8 globally percent after 2027, inflation settles below 2 percent targets and interest rates retreat to around 1 percent in the US and the eurozone. Momentum in the energy transition fades as investments in new technologies and productivity stall, and secular stagnation sets in.

Our research shows that global net worth relative to GDP has grown by 170 percentage points above the pre-2000 average on the back of soaring asset prices. Tighter monetary policy, perceptions of rising risk, or stress and failures in financial systems around the world could lead to a sharp correction in asset values back to historical norms as well as a prolonged recession. As households, businesses, and financial institutions come under stress, the global economy could face a decade-long period of deleveraging, causing GDP growth through 2030 to slow by 0.6 percent globally and household wealth to decline by more than $30 trillion.

The MVI is a self-service platform providing quick and curated insights on company, industry, and macro performance:

- Explore McKinsey’s Macro & Markets scenarios to inform your strategy and investment decisions.

- Access industry-level insights beyond raw data, converting numbers into value-creation strategies.

- Benchmark companies via curated insights on financial, operational, and organizational performance.

Businesses as the Source of Productivity Growth

The value added in the products and services your company delivers to your customers naturally includes your profits—the total earnings you retain and distribute to shareholders. Less emphasized is the value you add during production, which includes the compensation you pay to employees and the capital inputs you apply. From a P&L perspective, these are costs. From an economic perspective, they are part of the income the economy generates. The more value added you create, the more income you generate, and the more you can invest in talent and technology, distribute in the form of profits and wages, or use to improve your competitive position by selectively sharing the surplus with customers.

When shareholders and households invest and spend the value added they receive as income, they can initiate a positive, self-reinforcing cycle that translates to expanding markets for products and services and more value added. Since GDP is the sum of all value added in the economy,8 increasing that value added leads to more GDP and economic growth and higher living standards. This is why advancing the productivity frontier is the path to creating a future of abundance.

Companies at this frontier are reimagining what it takes to deliver operational excellence; defining new ways to enhance the return on talent, physical capital, and software investments; and leading with innovation to accelerate growth (see sidebar, “Unleashing your productivity potential”). Navigating a world that’s rapidly being transformed by technology is not a new challenge for companies, but it is an increasingly pressing one as digital tools and AI reshape how we work and live. Business leaders who succeed in digital and AI transformations are completely rewiring their organizations. They are bringing business, technology, and operations more closely together, raising the skills of individual workers, and building a distributed technology and data environment that empowers hundreds of teams to digitally innovate. The capabilities required to deliver on the three-sided productivity opportunity turn out to be an essential input to the broader requirements of such successful transformations.

As in digital transformations, creating productivity growth across an organization requires management teams to execute a range of difficult actions simultaneously. Many of these activities will feel familiar to business leaders but now require new twists. Instead of focusing primarily on P&L line items to free up cash for productive investments, for example, turn equal energy to balance sheet discipline. Shift your attention from the war for talent to measuring the return on talent investment, emphasizing skills and capabilities rather than roles, and using analytics to turn talent acquisition into a science. Recognize that the next frontier of operational excellence is in discovering how culture and digital can change the fundamental assumptions about what operations can (and should) achieve. Finally, create direct productivity increases through revenue growth by efficiently raising the market value of current offerings and by innovating new offerings and customer experiences.

The executives we speak with unanimously agree that increasing productivity is a key to driving profitable, sustainable growth. Their primary focus is typically relentless cost control, but efficiency is only one aspect of productivity. Companies that focus on operating with excellence, optimizing capital allocation, and accelerating growth have the greatest chance of delivering transformative increases in productivity.

Modernize your operating model: Adapt management practices to direct resources to the highest-value initiatives and business systems

Companies that focus on channeling the resources required to achieve their operational goals, rather than thinking about their operational improvements as cost cutting, radically improve their ability to succeed. Achieving operational excellence requires instituting rigorous resource allocation processes and embedding new cultural and managerial practices.

Reset resource allocation. Many of the fastest growing and most profitable companies dynamically allocate financial capital, talent, and capabilities, nimbly reallocating these resources in the face of shifting opportunities and in times of heightened uncertainty. This should come as no surprise as our comprehensive research shows that companies that reallocate 60 percent of their capital expenditures across businesses units over ten years materially improve the odds of capturing the economic profit available in their industries.

Even so, most companies continue to operate on a traditional annual review and resource-allocation cycle. We are starting to see more organizations reallocate their resources in one-, three-, or six-month cycles, and work iteratively with investment committees and working groups to ensure that allocation decisions closely tie to the company’s overall strategic goals and shifting market and operational needs. Any consideration of operational excellence must start with resource allocation.

Change your culture to harness technology. The introduction of lean management and agile operating models transformed how companies operate by challenging the way leaders thought about waste, variability, and flexibility. Leaders at the next frontier of operational excellence recognize that shifts in culture and digital technology have changed the fundamental assumptions about what operations can (and should) achieve. They craft a purpose and strategy that the entire organization clearly understands and that links transparently to what functions do (and need to stop doing), how they are organized, and what resources they require for success. They then build management systems that reinforce these operating principles and the behaviors needed to support them, and they apply technology where it can uniquely add value-stream benefits while augmenting human capabilities.

By adopting these principles, a mining company changed its culture from one in which workers rarely felt encouraged to share their improvement ideas, to an environment where bottom-up innovations produced dozens of process changes. The result was a production improvement of at least 10 percent annually and significantly lower water usage that was critical to the company’s operations in a drought-prone region.

Multiply the impact of front-line production and delivery: Strike the right balance of talent, physical capital, and software investments

Companies that deliver sustained increases in productivity intentionally create a mix of capabilities and tools that support front-line production and customer delivery, where the battle for efficiency and value creation is won and lost. This requires an intentional and persistent focus on offsetting the impact of higher prices, wages, and interest rates to free up more funds to invest. While there are numerous ways that different sectors can optimize capital leverage, two approaches can have outsized impact across industries: embracing balance sheet discipline to free up cash and maximizing the return on talent to generate impact from new investments.

Scrutinize your balance sheet. The balance sheet is the product of thousands of decisions made by hundreds of your employees every day. To be cash efficient, business leaders and their teams need to shift away from the traditional focus on the P&L to a more comprehensive approach that also scrutinizes the balance sheet. This means improving their cash conversion cycle by optimizing working capital management, including payment terms, payment processes, and inventories. All of this needs to be supported by instilling a new cash culture in all employees that emphasizes the importance of cash discipline, and identifies and prioritizes metrics for capital efficiency, including incentives tied directly to delivery.

Companies that excel at cash management also strengthen the balance sheet in other areas, by divesting underperforming long-term assets, reviewing cash trapped in foreign jurisdictions, or determining the optimal instruments for credit support needs. By applying these principles, one global agriculture company released $1.5 billion in cash from its balance sheet, providing funding for capital investments, novel commercial offerings, and return of capital to shareholders.

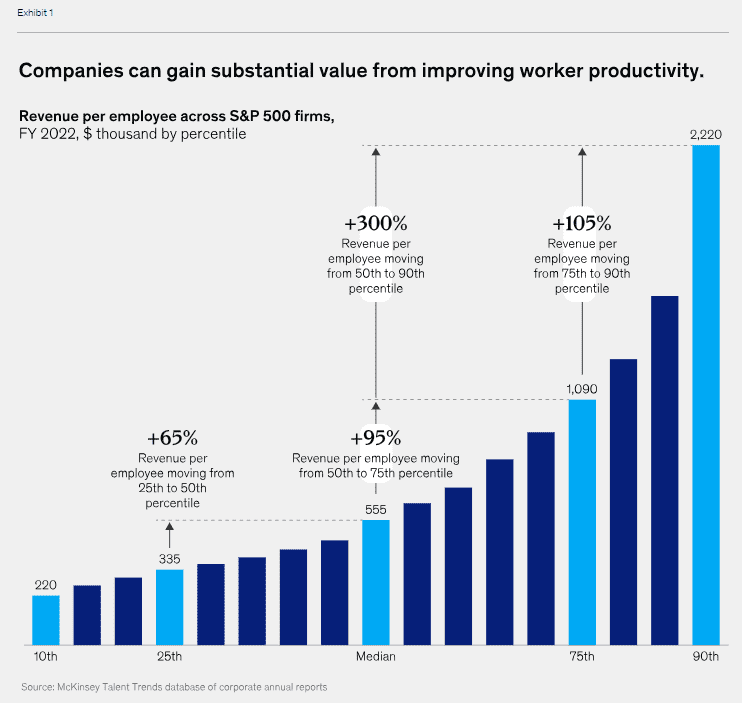

Reimagine how to maximize “return on talent.” Talent is scarce and expensive today, which makes maximizing the return on your talent investment critical. Our analysis of S&P 500 companies shows that a company at the median of revenue per employee is 65 percent higher on this rough proxy for productivity than one ranked in the 25th percentile. Companies ranked in the 75th percentile deliver 95 percent more revenue per employee than those at the median, and companies in the 90th percentile deliver 300 percent more (Exhibit 1). There are five critical actions to maximize the return on talent.

First, identify the most critical roles and skills and establish a hiring engine that focuses on delivering them. One global media company, for example, identified critical roles and talent pools, built a predictive model to zero in on future talent needs and gaps, and developed an action plan to close those gaps. With the right team in place, the company was able to raise its revenue growth targets by more than one-third.

Next, focus on the highest-return learning journeys for development, reskilling workers where you can, and manage your talent and culture to drive performance and experience in a way that allows talent to flourish. One multinational retail company struggling to ensure its growing workforce had the right capabilities designed an in-person and online academy covering on-the-job and leadership skills that trained 400,000 employees in one year.

Finally, transform HR into a true business leader, with visible CEO support and the resources to invest in programs required for success. An international telecom company that had siloed, reactive, and largely manual HR operating processes benchmarked its processes and budgets to best practices, then designed a new HR vision, including implementing an agile HR operating model.

Importantly, to raise productivity, corporate leaders have to understand that their workforces are not monolithic. From the highly dissatisfied and actively disengaged to the thriving stars and the vast middle in between, employees span a broad spectrum, requiring companies to apply segmented strategies to boost levels of satisfaction and commitment, performance, well-being, and, ultimately, retention and engagement.

Accelerate growth: Raise the top line by targeting the benefits of current offerings and creating innovative customer experiences

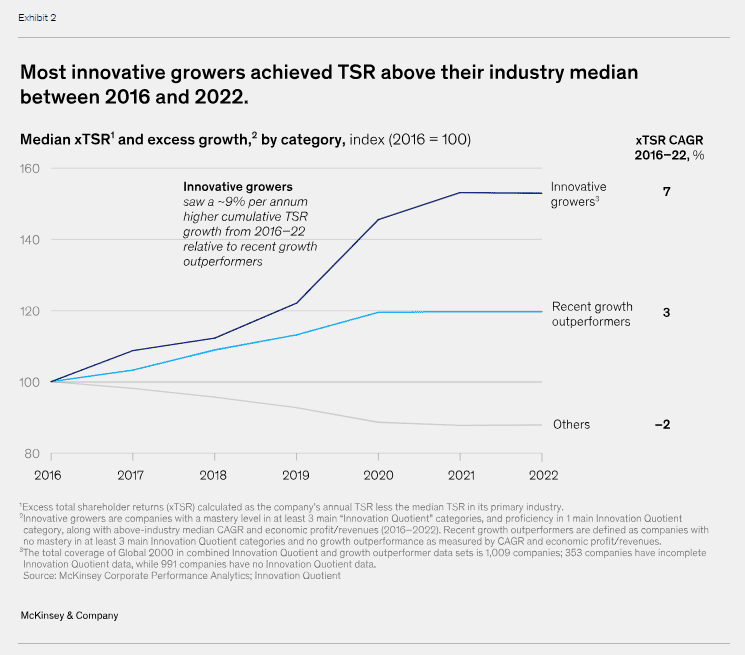

Growing revenues by efficiently raising the market value of current offerings and introducing new ones translates directly into productivity gains as these actions deliver new revenue that can be captured as surplus. Successful innovation is essential to driving both aspects of top-line growth. The benefits of getting this right are exemplified by a group of “innovative growers”—companies that achieved higher profitable growth than their industry peers between 2016 and 2021 while also excelling at the essential practices associated with innovation (Exhibit 2). To maximize net-new organic growth, three innovation practices stand out: linking innovation to an aspirational growth mindset, pursuing multiple pathways to growth, and investing in innovation and growth capabilities.

Choose growth. Innovative growers actively put growth and innovation at the center of strategic and financial discussions. One company, for example, sought to increase its online sales through faster mobile checkout and an augmented-reality app. After a concerted effort to reinforce the importance of “transformation through innovation” in employee town hall meetings, during earnings calls, in public interviews, and in press releases, it saw online sales grow by 80 percent, with digital sales accounting for 60 percent of overall revenue.

Be the rightful owner. Growth leaders enter adjacent business areas where they have a clear right to win and well-defined growth pathways. In 2018, Nintendo launched its first subscription gaming service, giving fans access to a growing library of beloved titles. Three years later, it opened Super Nintendo World at Universal Studios Japan, expanding into “in-person” entertainment. The Super Mario Bros. Movie in 2023—the first film release of the year to pull in $1 billion in box office sales1—then moved the company into non-software entertainment.

Raise your financial commitment to innovation tenfold. The average innovative grower generated 100-plus more patents than its peers. These innovation leaders also were awarded three times as many “stronger patents”—those with broad applicability and many citations to other patents—as peers. An R&D team at one medical technology company, for example, generated a flood of new patents during the development of a new line of surgical robots, averaging about 750 more patents than its competitors. The organization ended up delivering one and a half times the total shareholder returns that its peers generated.

Companies that seek to drive productivity through top-line growth should consider how the innovative growers have delivered this unrivaled record of accomplishment.

Companies at this frontier are reimagining what it takes to deliver operational excellence; defining new ways to enhance the return on talent, physical capital, and software investments; and leading with innovation to accelerate growth (see sidebar, “Unleashing your productivity potential”). Navigating a world that’s rapidly being transformed by technology is not a new challenge for companies, but it is an increasingly pressing one as digital tools and AI reshape how we work and live. Business leaders who succeed in digital and AI transformations are completely rewiring their organizations. They are bringing business, technology, and operations more closely together, raising the skills of individual workers, and building a distributed technology and data environment that empowers hundreds of teams to digitally innovate. The capabilities required to deliver on the three-sided productivity opportunity turn out to be an essential input to the broader requirements of such successful transformations.

As in digital transformations, creating productivity growth across an organization requires management teams to execute a range of difficult actions simultaneously. Many of these activities will feel familiar to business leaders but now require new twists. Instead of focusing primarily on P&L line items to free up cash for productive investments, for example, turn equal energy to balance sheet discipline. Shift your attention from the war for talent to measuring the return on talent investment, emphasizing skills and capabilities rather than roles, and using analytics to turn talent acquisition into a science. Recognize that the next frontier of operational excellence is in discovering how culture and digital can change the fundamental assumptions about what operations can (and should) achieve. Finally, create direct productivity increases through revenue growth by efficiently raising the market value of current offerings and by innovating new offerings and customer experiences.

The Challenge of Raising Productivity

The success stories—and failures—of the 1995-to-2000 productivity acceleration show why companies need a comprehensive approach to productivity.9 Walmart prioritized lowering costs to offer higher-value-added goods, invested in a hub-and-spoke distribution model to decrease logistics costs, and deployed IT systems specifically designed to improve in-store employee efficiency. Intel prioritized ongoing development of next-generation chips, standardized training, and overhauled production processes to enable quicker shifts to new higher-value-added products that would sustain growth. Both companies delivered significant productivity gains.

On the other hand, retail banking companies created a more convenient customer experience with online banking but failed to shift customers from legacy products to higher-value-added services. They made significant investments in technology but not in employee training, ending up with unused computing power that went beyond the capabilities of the organization to leverage. Hotels made significant investments in CRM systems but continued to operate in silos, with poor data sharing across properties, limiting the potential benefits from creating better customer experiences. They missed an opportunity to extract more value from revenue management systems because of a lack of employee training and capability building.

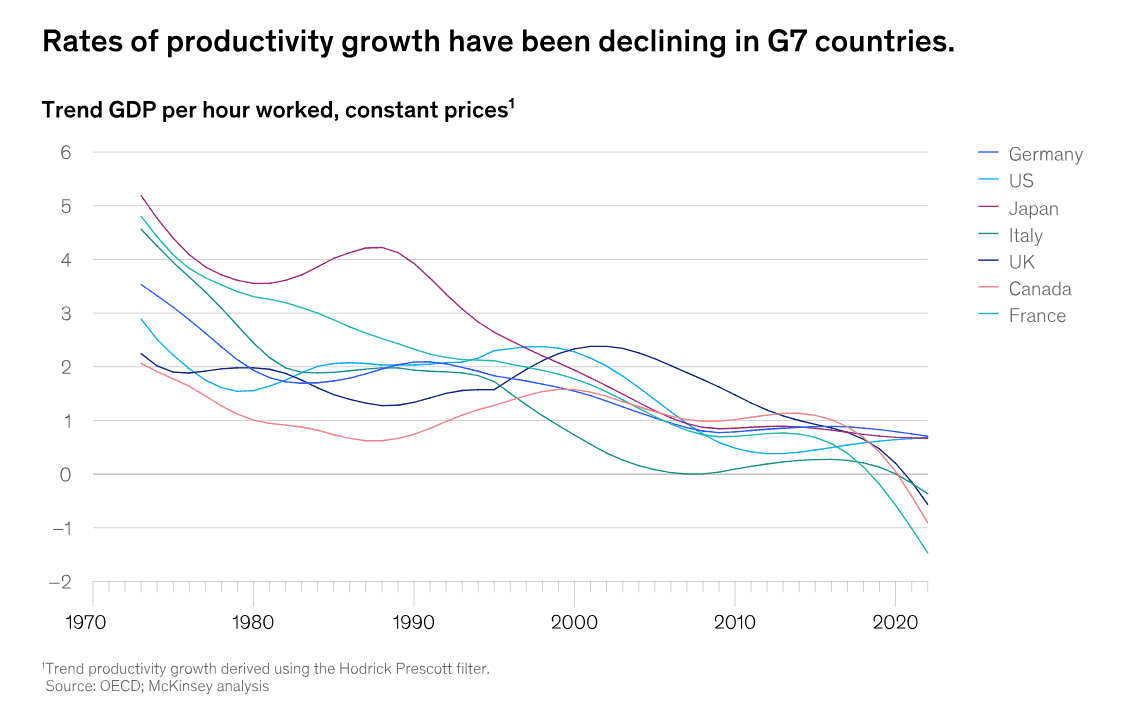

The challenge of creating productivity growth at the economy level is likewise high, as the record of G7 countries makes clear. In the 1995–2005 decade, growth in GDP per hour worked across the G7 countries averaged just above 2 percent annually (higher at the beginning of this period and lower at the end). From 2010 to 2019, productivity growth was just below 1 percent. In 2022, productivity was negative in four G7 countries, creating a roughly 0.5 percent decline for the seven countries combined (Exhibit 4).10

Even productivity success can create unintended consequences as the “creative destruction” critical to productivity growth displaces existing jobs, businesses, and industries.11 The last wave of globalization lifted millions out of poverty but entailed many consequences that were either ignored, minimized, or simply missed along the way. For example, the repercussions of labor market polarization in the United States and Europe (where high-education, high-wage and low-education, low-wage jobs grew but middle-paying jobs stagnated) are still being felt today.12

Governments, international institutions, and businesses can choose to intentionally create an environment conducive to productivity growth and spend the resources to actively manage the transition to new jobs, business opportunities, and entire industries. Collectively this would lead to prosperity that can be shared by all.

Business productivity gains not only improve company performance but translate into GDP growth and higher living standards. Business leaders who make decisions with this broader view in mind have a higher chance of raising shareholder returns while delivering on the corporate purpose they had set out to achieve. While delivering sustained productivity growth is not easy, management teams have repeatedly surmounted seemingly impossible challenges over the past four years by taking unprecedented actions, with exceptional speed, in the face of enormous uncertainty. Leaders who internalize these hard-won lessons and incentivize the behaviors that have helped them weather the recent period can significantly raise their odds of outperformance and help make 2024 the advent of future abundance.

The article was first published here.

Photo by Marga Santoso on Unsplash.

5.0

5.0