Sustainability Trends 2023

Last year we had great hopes that 2022 would be the year to build back better in the aftermath of COVID-19.

Unfortunately, surging inflation, a global energy crisis and a constant threat of recession cut out a few of our expectations.

Despite the outlook Environment, Social and Governance topics have continued to be a key priority among investors, consumers and companies.

In this article, I’ll summarise key events defining 2022 and present four sustainability trends that will prepare you to create an impact in 2023.

2022 Sustainability Summary

In 2022, the voice against “greenwashing” practices was clear and loud.

Authorities raided the offices of several ESG funds (e.g. Goldman Sachs‘s and Deutsche Bank’s DWS) for exaggerating claims about their products’ sustainability credentials.

Besides, companies like Easyjet ditched its offsetting carbon program to focus on reducing direct emissions and avoid the critics that the program raised.

ESG discloser requirements moved one step further. The European Union passed the world’s most far-reaching mandatory ESG reporting regime, the CSRD. The ISSB and the SEC also made several announcements.

We had the Conference of the parties COP27, where we saw the creation of a loss and damage fund, increased push for private action, and the role of green hydrogen.

Finally, we had COP15 on Biological Diversity with the agreement to Protect and Conserve at least 30% of the World’s Land and Ocean by 2030 (30×30). The text was applauded among others by the WWF but also drew concerns about the level of ambition and source of funding.

The good news is that every recession eventually creates new opportunities, so continue reading about 2023 sustainability trends.

Sustainability Trends 2023: Mandatory Reporting

The rise in ESG investment has contributed to an increasing demand for quality and comprehensive non-financial information disclosures.

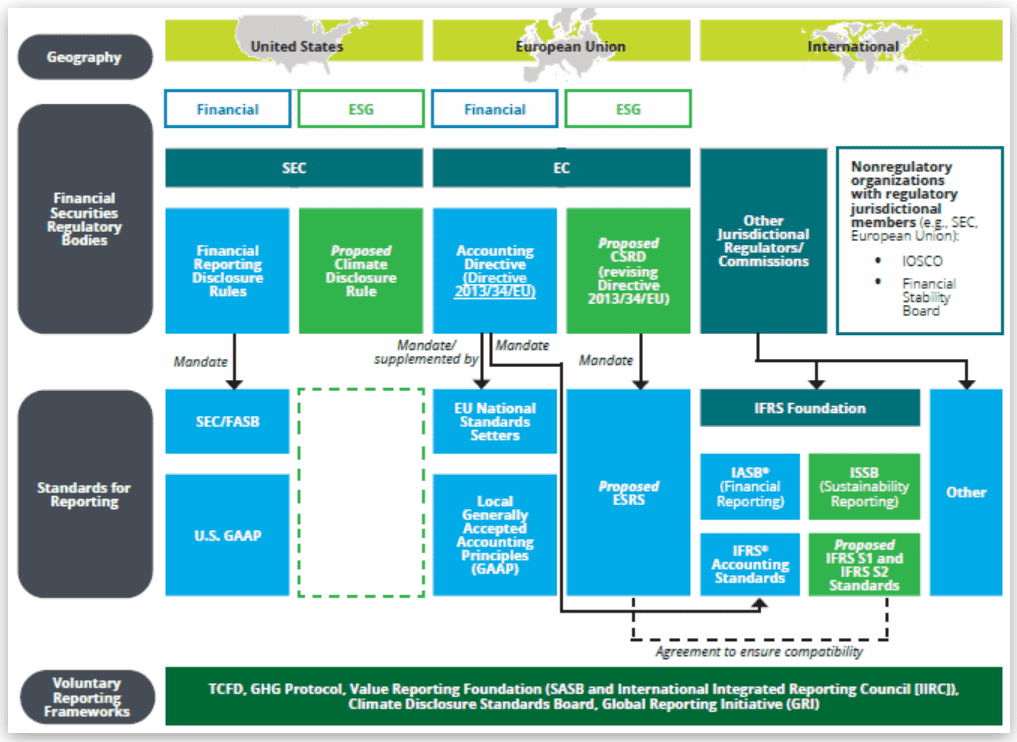

In 2022, we had a leapfrog in the crusade of regulators to protect investors and influence corporate behaviour against the current “alphabet soup” of voluntary standards and lack of abundant and reliable non-financial information.

Three major proposals will dominate the ESG reporting landscape in 2023:

- The International Sustainability Standards Board (ISSB),

- The European Union’s Corporate Sustainability Reporting Directive (“CSRD”) and the

- United States Securities and Exchange Commission (SEC) proposed rules.

Figure 1: Emerging Regulations and Standards on Sustainability and Climate Disclosure and organizations involved (Source Deloitte)

Besides, mandatory sustainability reporting is also progressing rapidly at the country level. Examples are the Swiss art 964 and the German supply chain act.

I think it’s fair to say that without their (GRI) work it would have not been possible to establish the ISSB and the EU Sustainability Reporting Board. Thank you GRI!

Robert Eccles, Visiting Professor of Management Practice, University of Oxford

These standards will impact almost all public companies.

With a few exceptions, they will all require the disclosure of greenhouse emissions, TCFD recommendations, double materiality and move towards reasonable assurance.

Besides, although private companies are not initially in scope, they will feel pressure from their impacted customers.

Moreover, companies will use voluntary frameworks and surveys such as GRI, SASB, CDP, UNGC, and Ecovadis to answer requests from customers, investors and other stakeholders.

Given the potential reputational and workload impact of these requirements, companies in 2023 will focus on assessing what to report. On top of that, they will be creating plans to comply as soon as by the 2024 reporting cycle (e.g. CSRD).

As I wrote in my article, the many sustainability frameworks suck companies’ resources and confuse stakeholders.

Takeaway – Companies in 2023 will focus on understanding which mandatory and voluntary standards to disclose and building roadmaps for limited and reasonable assurance of their data.

Sustainability Trends 2023: Impact Valuation

Companies’ purpose has shifted to reduce ‘negative externalities such as carbon emissions.

Moreover, companies’ intangible assets, such as human capital or brand value, account for 90% of S&P500 value and are very sensitive to ESG issues such as climate or social justice.

Consequently, investors have incorporated ESG metrics in their investment criteria, revealing an industry that has grown to US$35 trillion, a third of all professionally managed assets. (source GSIA)

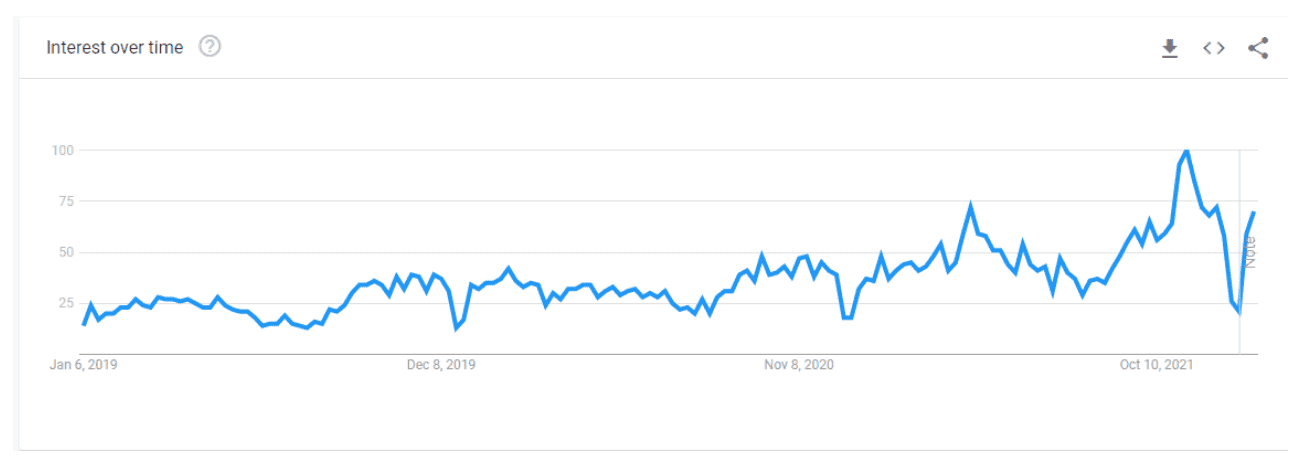

Unfortunately, ESG metrics and ratings used by investors to build their portfolios or by companies to explain their purpose have lately been questioned, and “greenwashing” as a concern has peaked in popularity, as shown by the popularity of the term in google.

Figure 2: Word Greenwashing rated 100 in popularity in 2022 – source Google Trends

In this context, the case to demonstrate impact has gained in popularity.

Among investors, sustainable investing is evolving from negative screening toward engaging with companies. Consequently the information ESG investors are seeking is changing too.

Impact investing is getting traction and, in 2022, reached 1.2 trillion in AUM, according to a report by the Global Investing Network. Moreover, measuring impact is still in its early development, with most funds using SDGs or qualitative assessments to measure their impact.

Among companies, Impact Valuation as an approach to valuing a company’s impact on society has hit an inflexion point.

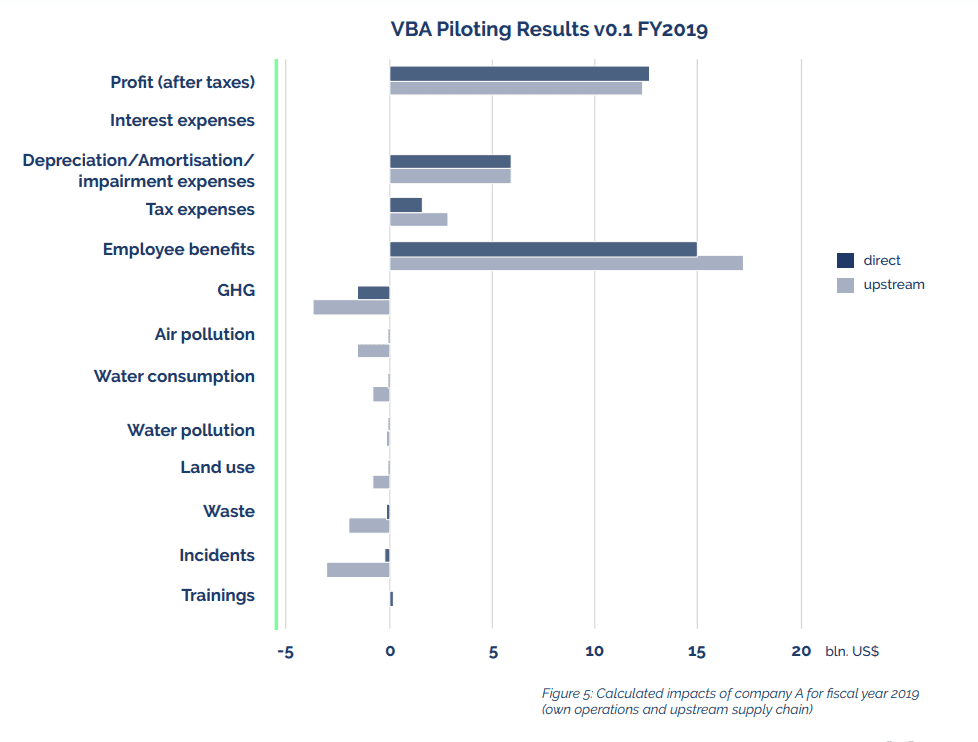

The work of the Value Balancing Alliance and Harvard’s newly formed International Foundation for Valuing Impacts (IFVI) aim at measuring companies’ value creation. Value creation is measured by translating environment and social externalities into monetary values.

Figure 3: Calculated impacts of company A for the fiscal year 2019 (own operations and upstream supply chain). Source VBA

By measuring impact, companies can identify the most significant impacts and material topics, improve internal decision-making and provide greater transparency to external stakeholders.

Above all, Impact Valuation will allow 2023 companies to move corporate sustainability roadmaps beyond reducing negative externalities and climate channel funnel vision to material areas of their businesses such as the just transition, diversity and inclusion or loss of biodiversity.

Do you want to know more? Read the “The case for impact” by Sonja Haut: A must-read practical book full of references and advices written by a corporate practitioner.

Takeaway – Companies will move from having a purpose to reducing externality to demonstrate impact. Impact investments and impact valuation, although still far from perfect, will play a key role in combatting greenwashing and contribute to the sustainable transition.

Sustainability Trends 2023: Net-Zero Roadmaps

Countries and companies have taken responsibility for climate change and raised their carbon emissions reduction ambition. As a result, 91% of the global economy and almost half of the 2,000 largest companies have net-zero pledges.

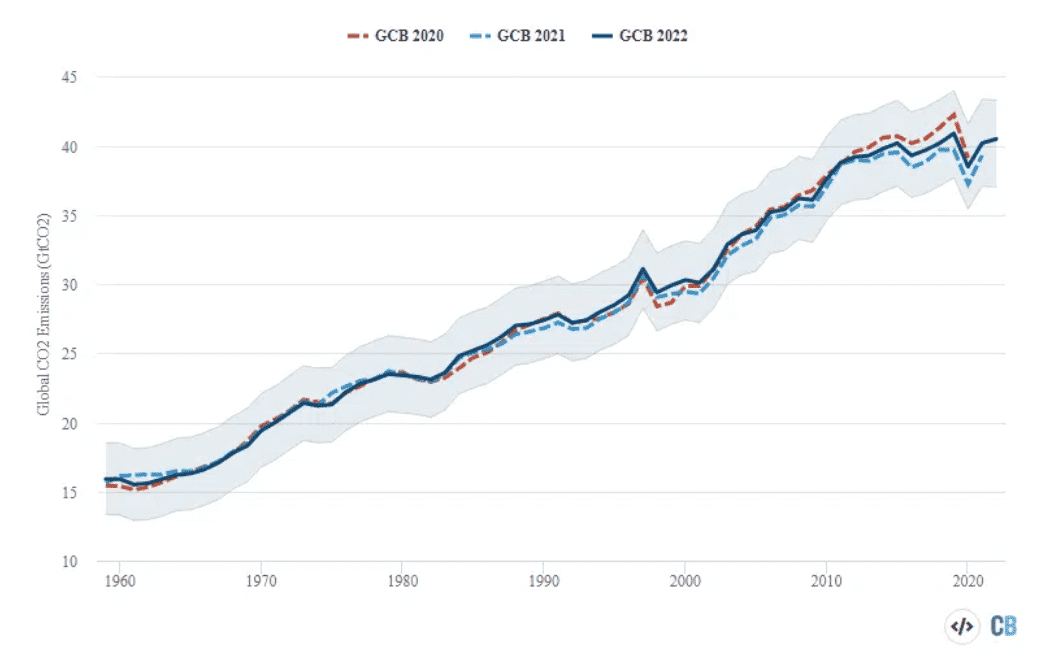

Still, history repeats, and after the COVID-19 pandemic, CO2 emissions from fossil fuels are almost at the levels of 2019. We had one of the hottest summers in history, accompanied by dozens of climate extremes such as record-shattering summer heatwaves (e.g. UK) and devastating floods (e.g. Pakistan).

Figure 4: Global CO2 emissions (fossil and land use) from the past three Global Carbon Budgets

At COP26 last year, we left with the feeling that businesses were committed to net zero. This year in COP27, UN experts told companies that their net zero pledges lacked scientific rigour and no real progress was achieved. As part of the report, for example, companies were criticised for building or financing new supplies of fossil fuels or for the use of carbon offsets (read my article about carbon offset markets).

Research conducted by Accenture over 2,000 companies shows that only 7% of companies will reach their net-zero commitments.

Pressure is mounting, and brands fear accusations of greenwashing, avoiding sometimes talking about their sustainability targets or progress, a growing trend known as ‘greenhushing’.

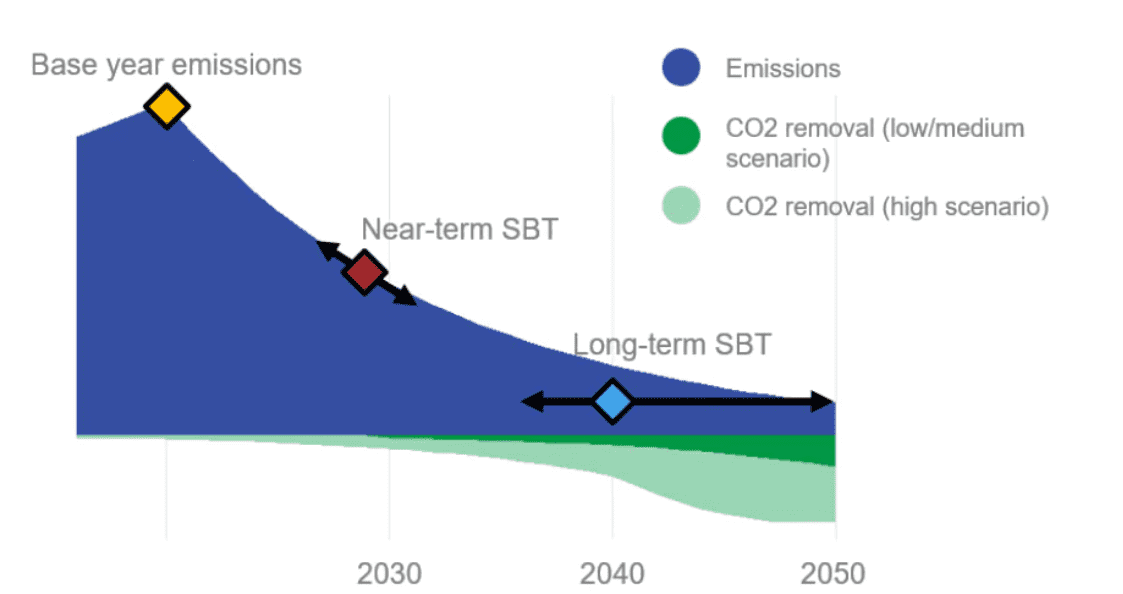

Companies in 2023 will be focussing on creating ambitious and credible Net-zero roadmaps.

In this sense, companies will need to put extra effort into understanding their baseline (their carbon emissions and those of their supply chain), continue setting targets, develop strategies for carbon reduction (e.g. renewable energy, supplier engagement, eco-design) and develop policies for offsetting unavoidable emissions.

In this sense, the most credible way of setting targets are the SBTi’s Net-Zero standard for corporates and the new foundations for Science-Based Net-Zero Target Setting for the Financial Sector.

Figure 5: Credible company Net-zero roadmaps require setting SBTi targets and explaining how they will be achieved (Picture source Science Based Target initiative)

Despite Carbon Offsets Markets growth (read here about carbon offset markets) which are crucial for achieving net zero emissions, they will be deprioritized after company and value chain emissions reductions.

Takeaway – After two years of strong growth on net-zero commitments, companies will be putting effort into demonstrating real impact by focusing on carbon footprint and prioritizing carbon reductions vs carbon offsetting.

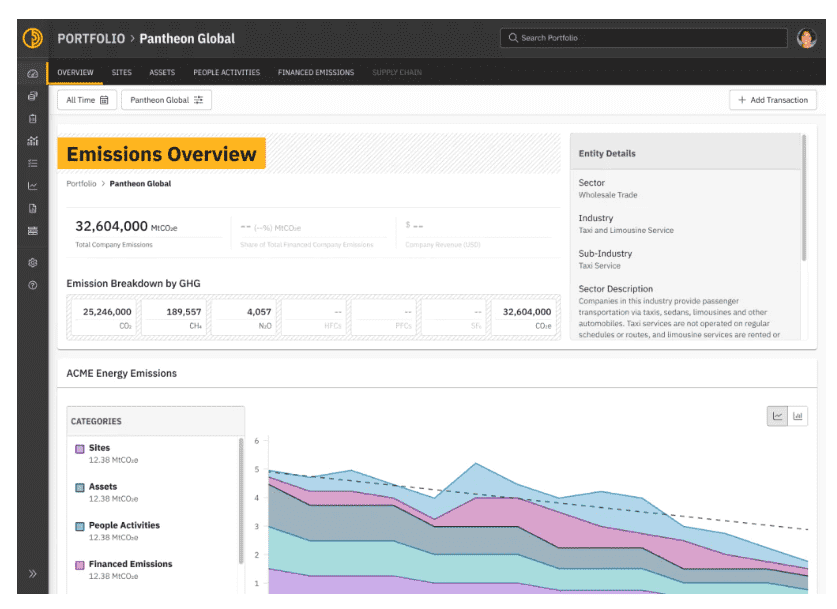

Sustainability Trends 2023: ESG Technology

Despite all the good intentions for harmonizing and reducing reporting burden, the reality is that every year the amount of sustainability data reported externally and internally keeps growing exponentially.

Moreover, most companies still use a manual process for collecting data and reporting, which stresses and sucks the time of the departments dedicated to reporting.

Luckily there is emerging smart ESG technology that can make a difference in reducing workload, fostering collaboration and reducing the risk of misreporting. I’ll focus on two examples: last-mile reporting and carbon footprinting software.

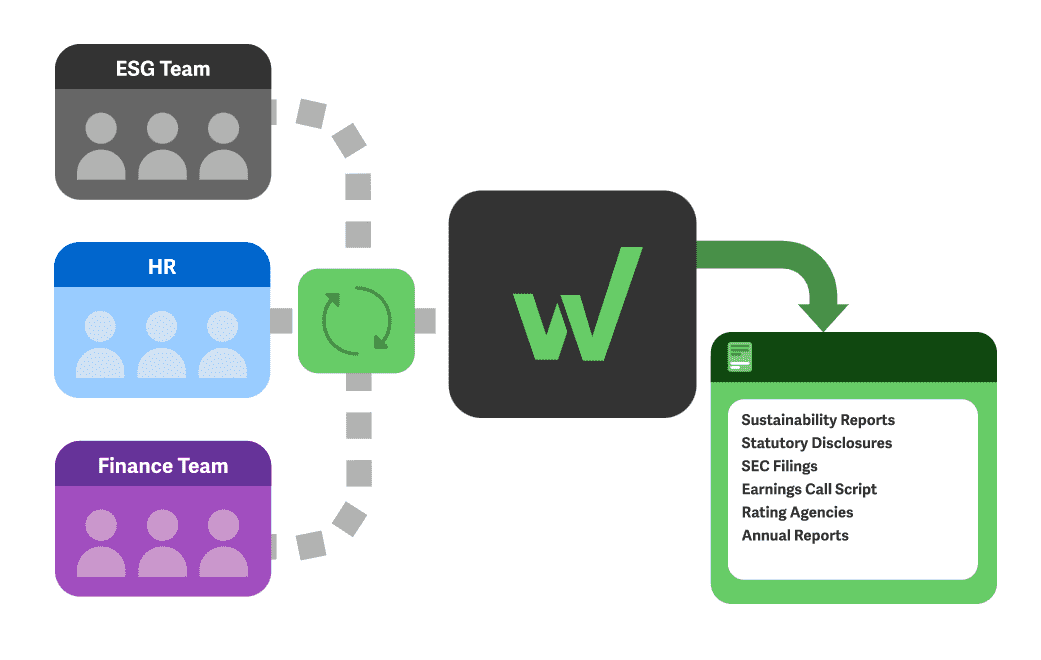

In the first type, companies prepare their ESG reports, capture data from different areas (Environment, HR, Supply Chain, Finance), and use emails or spreadsheets to gather and consolidate information.

There is a new wave of ESG technology solutions that allows extracting data from source systems, incorporates ESG frameworks (SASB, GRI, TCFD) and fosters collaboration among different departments.

Figure 6: ESG Technology to streamline external/internal sustainability reports. (Picture from Workiva ESG)

Using ESG technology to streamline the reporting process, reduce the risk of misreporting and allow better collaboration in creating external and internal management sustainability reports.

Regarding carbon footprint, estimating emissions is the first step to setting ambitious and credible net-zero roadmaps (read my net-zero article here).

In this context, sustainability teams at large companies have used spreadsheets for years to track corporate carbon emissions.

It is shocking to see in a world where cars almost drive themselves, most companies still use spreadsheets for calculating their carbon footprint.

The limitations of spreadsheets are lack of documentation, missing audit trail, propensity for errors, difficulties reconciling year-to-year data sets, and inability to generate real-time or emission forecasting reports.

Especially measuring emissions from the supply chain has its challenges, such as deciding how much you estimate based on data, life cycle data or from your key suppliers (read my article about carbon footprinting here)

Figure 7: Estimating carbon emission with ESG technology. (Source Persefoni)

The scene is dominated by cloud services offered by consolidated software developers (e.g. Salesforce Net-Zero cloud and SAP Product Footprint Management ) and fast-growing startups (e.g. Watershed, Persefoni, or Econometrica).

Takeaway – Sustainability reporting and estimating carbon emissions workload will get simplified in 2023 by the use of ESG technology.

Conclusions

To summarize, Mandatory reporting, Impact Valuation, Net-zero credible roadmaps, and ESG technology are key sustainability trends to watch in 2023.

They will create sufficient risks and opportunities to shake the way companies operate, not in 2050 but in 2023.

Whether these Sustainability trends will create an impact in 2023 will be down to governments, businesses, civil society, you and me.

Thank you for following my articles and giving me great feedback this year.

Enjoy this holiday season, and prepare to create an impact in 2023!

5.0

5.0