How has the coronavirus crisis accelerated treasury transformation? In this quick-take article, Matthew Giannotti, transaction services specialist, puts some key innovations under the microscope and outlines how corporate treasurers and finance teams can take advantage of them.

The coronavirus crisis and related volatility throughout 2020 has raised important questions about how corporate treasurers and finance teams can better use technology to future-proof their businesses and more easily move money through financial systems.

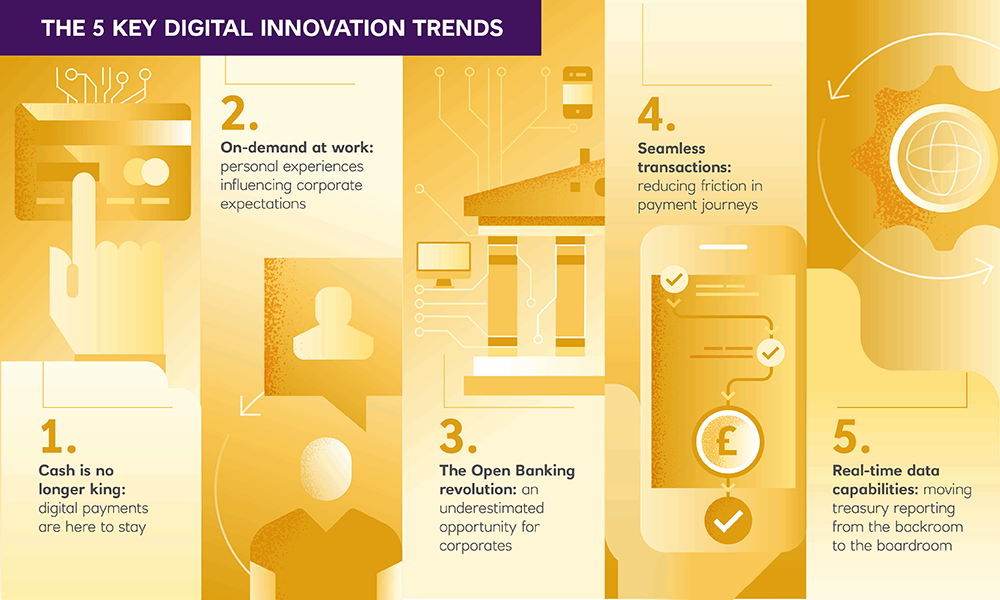

If ever there was a time for corporate finance decision-makers to consider ways of accurately monitoring their financial positions and keeping supplier payments flowing – it’s now. Here are 5 key digital innovation trends empowering corporate finance teams and driving treasury transformation in 2021.

The pandemic has fast-tracked the shift away from cash. While stuck at home, consumers turned to online shopping and food delivery services. In fact, habits have changed at an unprecedented pace during the lockdown: total online spending in May hit $82.5 billion, up 77% year-over-year – something that would normally take between 4-6 years to see*.

The pace and scale of change has forced businesses to quickly position themselves to accept payments online. Ultimately, digital payments ensure businesses can offer their customers the speed and ease needed in the current environment.

*Source: Forbes & Adobe, June 2020: https://www.forbes.com/sites/johnkoetsier/2020/06/12/covid-19-accelerated-e-commerce-growth-4-to-6-years/#191ab822600f

Whether ordering food deliveries or streaming digital content, we have become an on-demand society. This behavioural expectation has found its way into our business lives, where we increasingly expect real-time responses to our needs. Corporate treasurers expect payments to arrive at destination as soon as they have instructed them, and to know live positions of their bank accounts or financial instruments at the click of a button.

The application programming interface (API) revolution we are seeing in banking means that many of these things are a reality today. By easily integrating with cloud-based applications, organisations can explore a range of transformation opportunities. API-driven near real-time payments can deliver efficiencies, cost-savings, and improved customer service.

This is a fast-moving space – APIs in the global financial services industry are continuously developing in tandem with Open Banking: the use of APIs to create a rich fabric of interconnected apps and services. Corporate treasurers should stay close to these developments and reach out to their bank for insight into them.

Until recently, most of Open Banking’s focus has been on regulation, innovation and competition among banks and fintechs, with most early use cases centred on personal and small business customers. But we think Open Banking gives corporates the opportunity to take a big step into the emerging world of digital ecosystems – enabling them to better serve customers, deal with suppliers, and work with financial providers.

Corporate treasurers and finance teams will find Open Banking particularly useful for:

- Real-time accounts to support faster payments, reduce costs, and improve liquidity: At the heart of Open Banking sit APIs– technology giving customers a real-time connection with their banks, providing an immediate and accurate picture of all their accounts and movements within them. Corporate treasurers should be demanding their treasury platform providers link with banks for real-time connectivity – enabling them to see their transactions, do reconciliations, view payment channels and process payments and receipts. This can help finance teams make faster payments and reduce costs while improving liquidity.

- Faster, more efficient payment initiation systems to maintain the pace of trade: Payment applications enabled by Open Banking can help grease the wheels of trade by passing information through systems as quickly and easily as possible. For example: if a customer is waiting for a shipment of goods from a supplier, the supplier might hold back further shipments until the customer has cleared their account to below their credit limit. An API can provide a much faster notification of payment to the supplier’s credit control department, enabling credit to be granted and helping maintain the speed of trade.

- Greater cross-bank connectivity and transparency to empower decision-making: Open Banking has fundamentally changed the way data can be shared between financial institutions, giving corporate treasurers the ability to see consolidated views of their bank accounts from a range of counterparties in much more cost-efficient ways. This greater transparency across multiple institutions empowers treasurers to make more informed (better) choices with regards to pricing, cut off times, and liquidity management.

Regulation is introducing friction into payment journeys. The increased use of One Time Passcodes (OTP) under Payment Services Directive 2 (PSD2) will make online payments more cumbersome and diminish the customer experience. Banks are having to find ways of improving customer journeys to mitigate this.

In fact, we have seen customers taking advantage of Open Banking infrastructure for payments by making use of fingerprint sensors and facial recognition technology on mobile devices, making the process more organic and user-friendly whilst maintaining high levels of security. We expect this trend to continue apace.

When businesses harness the technologies that make their finance systems fully responsive, real-time data on cash flows and liquidity positions becomes an incredibly powerful tool. It takes payment processing from the backroom to the boardroom by providing the intelligence that management teams need to quickly make strategic decisions in a rapidly evolving and increasingly competitive business environment.

No one knows exactly what will have changed forever and what will return to the way it was before the coronavirus crisis. The good news for businesses that want to implement a fully digital treasury infrastructure, to improve processes and be able to better weather future large-scale disruptions, is that the technology exists. Real-time payments are already a reality for many organisations that are making digital transformations and they are fundamentally changing how those organisations manage themselves.

This article was first published here.

Photo by Luca Bravo on Unsplash.

5.0

5.0