It’s sometimes taken for granted that corporate directors are seasoned professionals serving on boards in the final decade or two of their careers. But as shareholders and other engaged parties call attention to a lack of gender and racial diversity in the boardroom, the issue of age diversity within boards is also moving to the forefront.

In terms of directors’ ages, boardrooms don’t look like the general population. Is that a problem?

Younger Generations Are Underrepresented

An April 2018 report on age and board composition from PricewaterhouseCoopers (PwC) shows that younger people are underrepresented on corporate boards. The average age of independent directors serving on S&P 500 boards was 61 in 2007, though by 2017 it had risen to 63. Just 6% of S&P 500 board seats are held by directors age 50 or below. And more than half (57%) of S&P 500 companies have no directors who are 50 or younger on their board.

This pattern is more pronounced in the US than in other countries, with 21% of directors of public companies 70 or older, compared to just 10% in other countries around the world.

Age Diversity Is Valued

In PwC’s 2017 Annual Corporate Directors Survey, age was the highest rated element of board diversity, with 90% of respondents assessing age diversity as “somewhat” or “very” important. While the long experience of older directors may represent a unique asset, younger directors are valued for a range of critical skill areas, too.

According to the 2018 report, the most cited area of expertise among directors under 50 was finance and investing, with 44% of younger directors noted for their expertise in these areas and 34% coming from financial services backgrounds, more than from any other background. A board including younger directors with experience in finance might be better equipped to take millennial investing preferences or expectations for corporate behavior into consideration. According to Morgan Stanley, millennials are more likely than previous generations to support impact investing and to care about sustainable products. As this cohort grows in importance as investors and consumers, having someone closer to the millennial generation on a board could help the board stay attuned to values across all generations and anticipate consumer needs and trends.

The second most cited area of expertise among directors under 50 was technology (30%), with just under a quarter of younger directors coming from information technology backgrounds. In the internet era, where tech trends can seem to appear almost overnight, uniformly older boards may struggle to keep up with shifting technological frameworks. According to PwC’s 2017 annual survey, 86% of directors consider emerging technologies a challenge to oversee, with additional uncertainty lingering around cybersecurity.

Drawing strict lines separating director skills and interests according to age or generation is likely to be a mistake.

All that said, drawing strict lines separating director skills and interests according to age or generation is likely to be a mistake. In the PwC report, one younger director noted that her board often assumes they should seek her guidance around environmental and sustainability issues, though she has no expertise on those topics. And likewise, of course, directors of any age can bring a variety of valuable viewpoints and knowledge to their position. It’s possible for a 70-year-old director to be as technologically savvy or supportive of enivornmental, social, or corporate governance (ESG) principles as a 30-year-old.

But the general idea stands: if most directors on a board have similar characteristics to each other—whether in terms of age or by any other measure—the board could be missing out on a wider range of expertise and perspectives, and it might benefit from being more diverse.

Age Diversity Complements Other Forms of Diversity

Age diversity within boards, like diversity in gender, race, or socioeconomic background, can enable a board to understand the needs of diverse customers, employees, and investors. Age diversity doesn’t negate the importance of other forms of diversity; instead, it complements them. A board that’s diverse according to many intersecting criteria, including age, is likely to be stronger than a board that is mostly homogenous.

Appointing younger board members can also give companies a chance to boost diversity by multiple measures. For example, PwC found that 31% of younger directors are women, higher than the 22% share of women among all S&P 500 directors. Thus, companies that gain younger board members may also be introducing more gender diversity to their boards.

Although it may take a concerted effort to achieve greater age diversity on corporate boards, there’s reason to be optimistic. As Bloomberg Businessweek reports, more S&P 500 boards are bringing in first-time directors. And in 2017, more than half of new directors joining Fortune 100 companies’ boards were under age 60. If these trends continue, corporate boardrooms could become truly age-diverse, potentially benefitting companies and investors alike.

This article was first published by Impactivate.

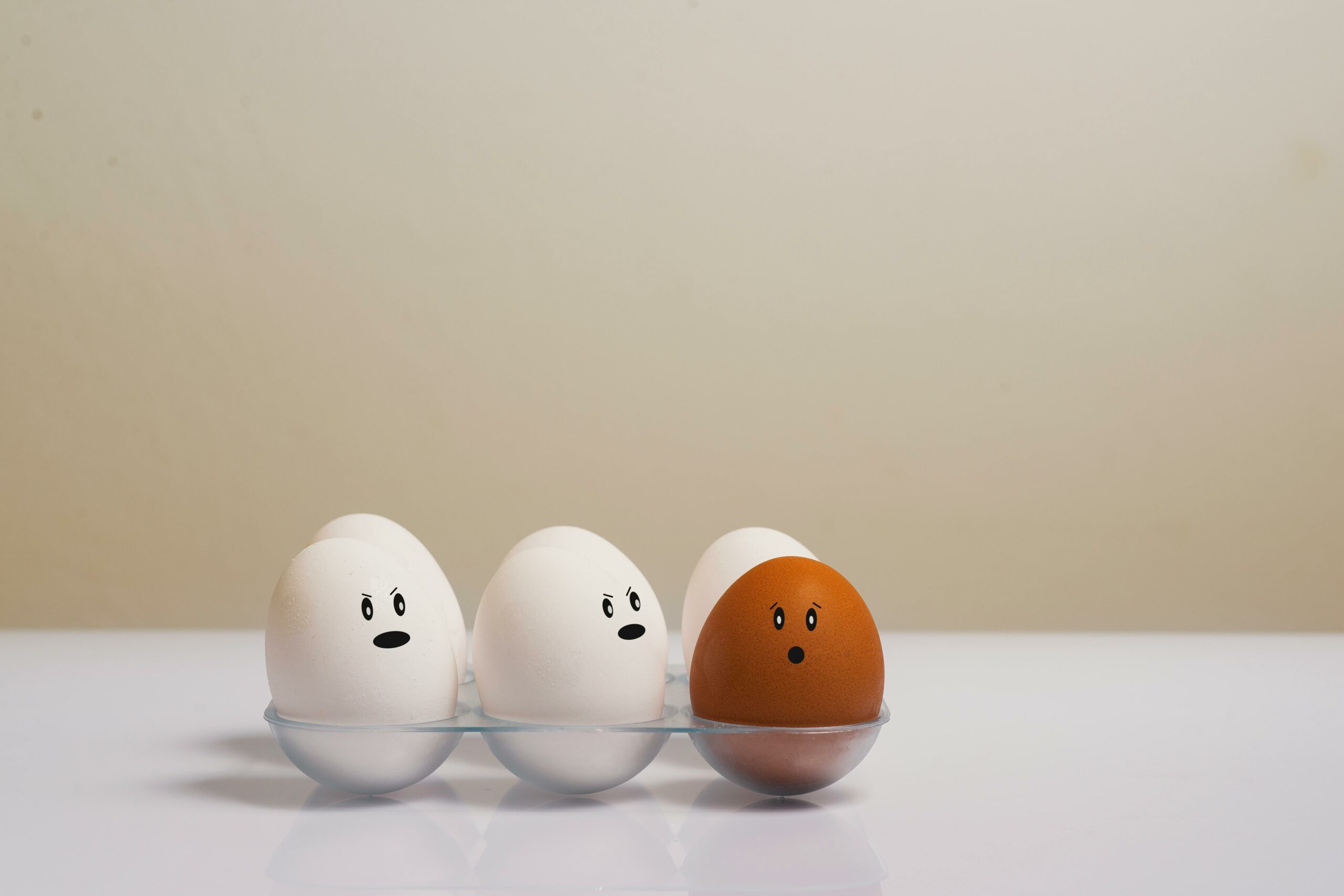

Photo by Stephanie Harvey on Unsplash.

5.0

5.0