Questioning management is good. Dictating what it should do is not.

A company’s board and CEO work together toward a common end. But imagine a scenario in which the CEO devises a strategy, the board gives it the thumbs down—and the CEO executes the strategy anyway.

This topic has been in the news recently, including a highly publicised case where the board of directors ordered the CEO not to pursue any mergers, and then the CEO did it nonetheless.

It’s an unusual situation whenever it happens, says Joe Griesedieck, vice chairman and managing director of Korn Ferry’s Global Board & CEO Services practice, and it speaks to a level of disconnect between company management and the board itself. “In a general sense, the CEO wants to try to bring the board along,” Griesedieck says. “To do something in the face of opposition from the board, in this day and age, is very rare, and not productive in the long run.”

The highest-functioning boards that govern the best-performing companies have a strong, united culture. That doesn’t mean that everyone agrees unanimously on every issue, says Tierney Remick, vice chairman and co-leader of the Board & CEO Services practice at Korn Ferry. “It means they’re working in the same direction, with the best interest of shareholders as a key driving factor,” Remick says.

The role of the chairman is critically important in this culture. “This is the person who sets the tone for the rest of the boardroom. He or she is critical to helping bridge any conflicts as well as nurture the relationship with the CEO,” Remick says.

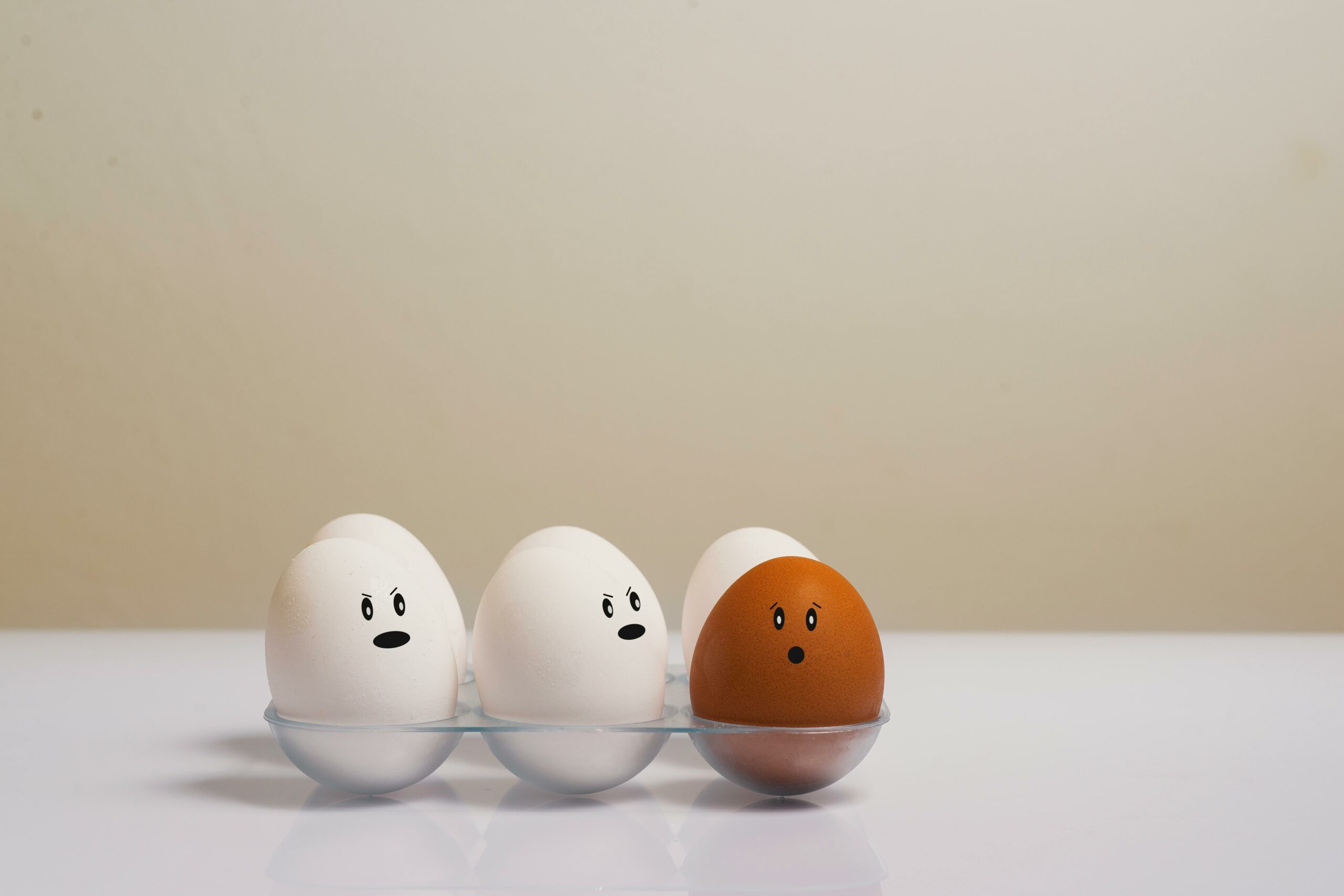

But board composition is vital. While historically boards were pulled together on the basis of their positions and the sizes of the companies they led, now there’s more opportunity to look for skills in other types of backgrounds, from digital security and cybersecurity to risk management to human resources. There must be sufficient expertise to understand the strategic issues the company may be facing. “The board of directors is fundamentally a team,” Remick says. “As such, it is imperative that the directors bring various types of relevant experience, expertise, diversity, and independence to the group. Moreover, it is imperative that the executives demonstrate great character and leadership abilities.”

The culture of the board is something to consider. “It should be a culture that inspires rich conversation and appreciates having different points of view expressed to find the best solutions,” Remick says. On the other hand, a lack of chemistry can be a major issue that affects performance. If one director is domineering or another doesn’t listen well, the whole ecosystem becomes imbalanced and potentially toxic. “A board that’s experiencing power struggles is going to be a less-effective board,” Remick says.

When a board is working well together, they’re asking the tough questions, actively involved in developing company strategy, and acting on behalf of shareholders. The directors must be informed, and they need to understand the business and the marketplace around that business. “Debate in the boardroom is now very common,” Griesedieck says. “The CEO and his or her team have to be prepared to respond to that.

That said, the board is not management. Directors should offer support and guidance to the CEO and other senior executives—but ultimately the CEO must be empowered and be held accountable for decisions. “If the board starts delving into operational issues in a micromanaging way, that’s not a good thing,” Griesedieck says. “When you get to how you’re going to execute the strategy, that’s not the board’s purview, that’s management’s.”

Because the board and the CEO are both meant to be working toward the best interests of the company, a breakdown between the two can be complicated. Tension can arise due to a variety of external forces. “In recent years, there has been a rise in different forms of activism,” Remick says. “If board members are not aligned on how to respond, the situation can become quite uncomfortable and imbalanced pretty quickly.”

But there’s always the possibility that the company is evolving and the board is not. Are the people on the board still strategically appropriate? “They may be very capable and very nice, but are they really relevant in terms of the strategy of the company?” Griesedieck says.

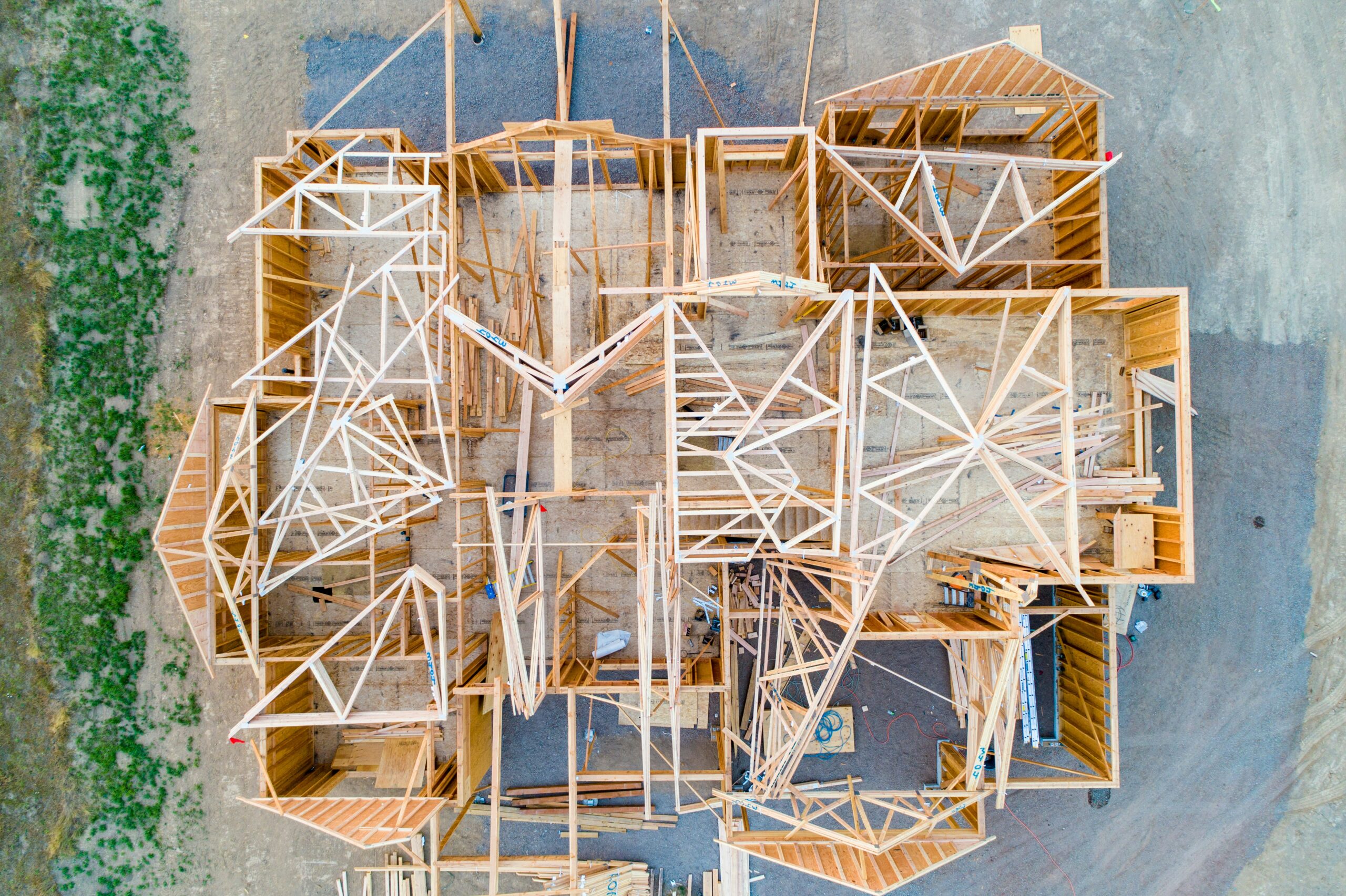

Today, an effective board should reflect the strategy of the company going forward. “Not everyone has to be an expert in every component of the strategy, but it’s much like a tapestry,” Griesedieck says. “When it’s all finished, it should all come together as the sum of its individual parts.”

The article was first published by Korn Ferry.

Photo by Daniel Reche.

4.5

4.5