It’s rare for corporate directors to receive candid feedback from their company’s management teams. The nature of the board of directors’ oversight role makes it an uncomfortable proposition. But the view of the boardroom from the C-suite can be illuminating—and surprising. That is why PwC and The Conference Board asked more than 550 public company C-suite executives to share their perspective on their boards’ overall effectiveness, their strengths, weaknesses and their readiness to tackle some of the biggest challenges facing companies today.

The results were clear: most executives say board performance is falling short of the mark.

Board Effectiveness: Directors Earn Mixed Grades

The COVID-19 pandemic and the economic and social disruption that it caused have been huge challenges for companies, and their leaders have been tested as never before. With supply chains snarled and many workplaces closed, executives and boards of directors have had to navigate unprecedented uncertainty.

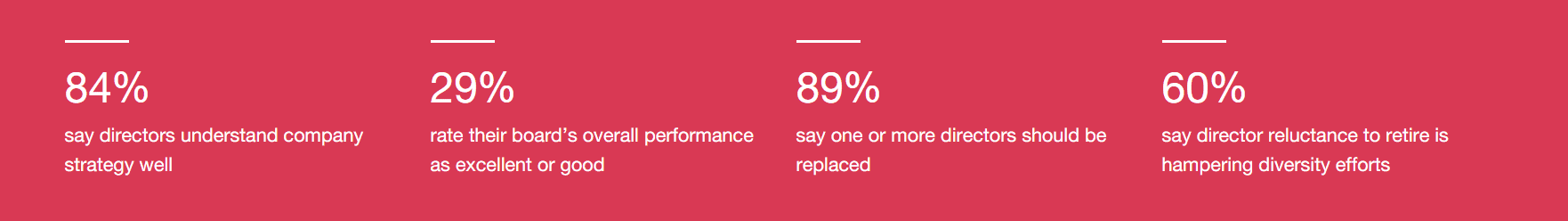

Against this backdrop, executives find reasons to both praise and fault their boards. Directors understand their company quite well in the eyes of the C-suite, with many saying they have a good grasp of areas like strategy and key risks and opportunities. Yet many executives also believe that directors aren’t investing enough time and effort into their jobs. The result: middling marks for overall effectiveness.

Boards Demonstrate Mastery of their Core Responsibilities

There’s no denying that corporate boards have overcome huge obstacles in the past year. Executives praise directors for their strong grasp of the fundamentals of oversight and give them high marks for their understanding of the company. More than eight out of 10 (84%) say board members understand company strategy somewhat or very well, and more than seven out of 10 say the same of its key risks and opportunities (79%) and shareholder base (76%).

Executives also say that directors bring the right mindset to their oversight responsibilities. Only 11% say board members lack true independence of judgment or are reluctant to challenge management, and just 13% say they’re too risk averse.

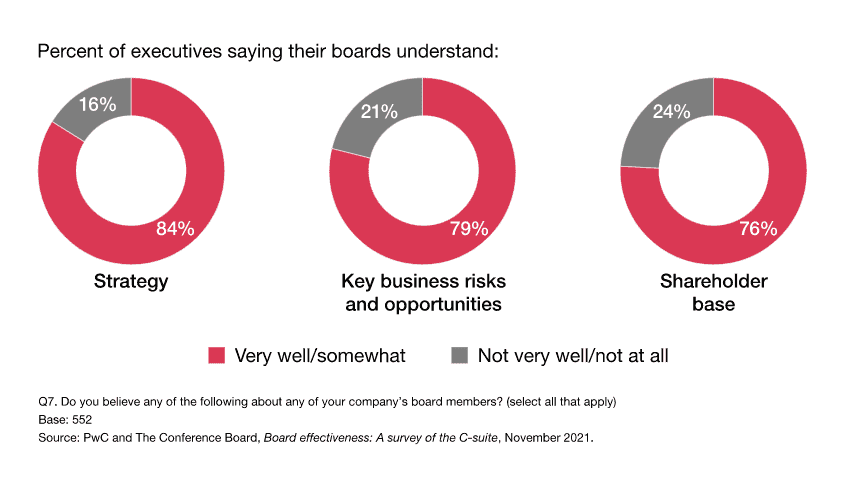

Executives Rate Overall Director Performance as Lackluster

When asked to take a step back and evaluate the overall effectiveness of their boards amid a still-unsettled environment in 2021, most executives say directors are doing fair job (55%). A surprisingly small share grade them as excellent (10%) or good (19%). These assessments vary across industries, with executives at banks and insurance companies giving the highest marks and media, entertainment and telecommunications executives giving lower grades.

Board Refreshment: Executives Want to Reboot their Boards

Historically, board refreshment has not always been a priority. That can make it challenging for boards to add new members with needed skills, fresh perspectives, and diverse personal and professional backgrounds.

Executives want board refreshment. Almost nine in ten (89%) say at least one director should be replaced. But when PwC’s 2021 Annual Corporate Directors Survey asked directors the same question, more than half (53%) didn’t think any change was necessary at all.

The Challenge of Long-Tenured Directors

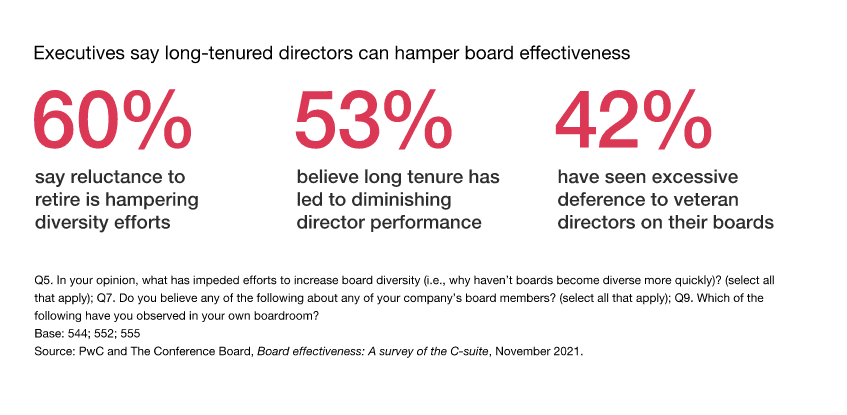

Experience can be an asset in the boardroom, but executives sometimes view over-committed and long-serving directors as an obstacle to needed changes. More than half (53%) of those surveyed say their board includes members whose long tenure has led to diminished performance. Likewise, 44% of executives see over-committed directors on their board.

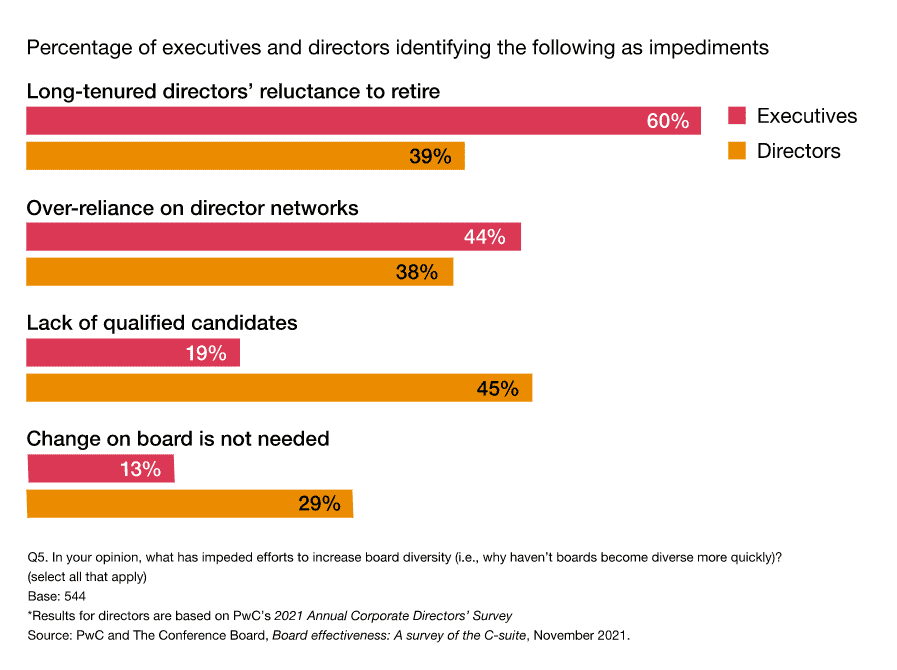

Executives also view long-serving directors’ unwillingness to retire as a significant hurdle to efforts to bring directors with different skills, experiences and identities into the boardroom. In fact, this was the most frequently cited impediment to increased board diversity, highlighted by 60% of executives we surveyed.

Executives Seek Faster Action on Board Diversity

Executives see the value in having a board made up of directors with diverse backgrounds and a variety of areas of expertise. By significant majorities, they also say that their boards currently fall short. Perhaps unsurprisingly, given their overall bearish view on their board’s subject matter knowledge, just 29% of executives say their board has the right mix of skills and expertise. In addition, only 21% say the board has enough gender, racial and ethnic diversity.

Directors and executives agree that board diversity is a priority, but they don’t always see eye to eye on what’s getting in the way of achieving it. In PwC’s 2021 Annual Corporate Directors Survey almost half (45%) of board members say a lack of qualified candidates from underrepresented groups is hampering these efforts. That’s a much less commonly held view in the C-suite, with only 19% of executives citing it as a cause.

Risk Oversight: Boards Need to Lean into Big Challenges

The challenges that companies face are evolving rapidly. Not only do issues like climate change, for example, pose strategic risks to companies of all sizes and in every industry, but stakeholder expectations around how businesses plan to mitigate those risks are also in flux. The result: an uncertain landscape that must be navigated with care.

At the same time, our survey shows that the C-suite don’t always feel confident that their directors have the skills and knowledge to fully engage in this work. They want their boards to further their expertise in these key issues and deepen their commitment to addressing them.

Executives see ESG Deficiencies

Public companies’ most influential stakeholders are intensely focused on ESG matters. It therefore follows that ESG should be a priority for boards as well.

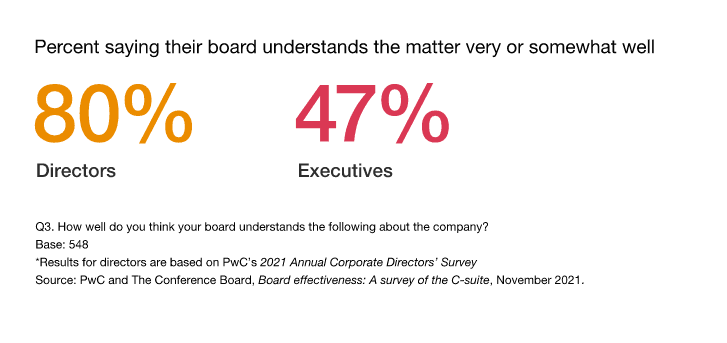

Fewer than half of executives say boards are spending enough time on ESG issues like climate change, diversity and inclusion and corporate political activity. What’s more, executives feel directors don’t truly understand ESG. They give directors poor marks when it comes to grasping the ESG risks facing their companies—just 47% say board members understand somewhat or very well. That’s a stark contrast with directors’ self-assessment. Four in five (80%) said they have a handle on such matters.

Cybersecurity Acumen is Perceived as a Weakness

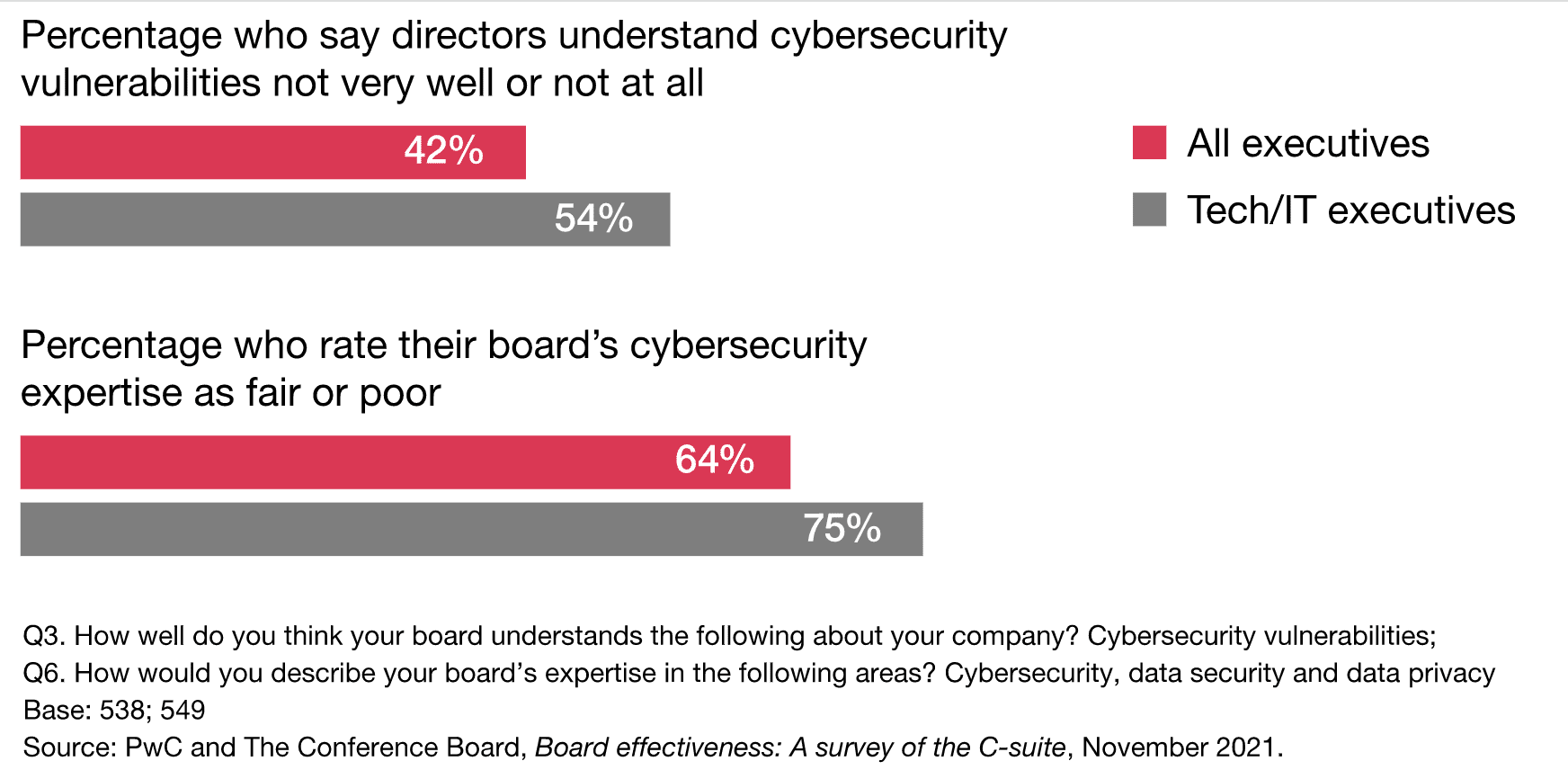

An increase in cyberattacks amid the abrupt shift to remote working due to the COVID-19 pandemic has thrust cybersecurity into the headlines and to the top of C-suite and boardroom agendas.

Yet executives give their boards mediocre grades for their readiness to tackle the issue. A significant portion of executives (42%) say directors don’t understand their company’s cybersecurity vulnerabilities very well or at all. And 64% describe their boards’ cyber expertise as fair or poor.

Bridging the Gap: Working Together to Strengthen Oversight

Effective corporate governance requires collaboration between boards and management teams. Though the duty of oversight belongs to directors, they cannot fulfill it alone. Building a stronger partnership between the C-suite and the boardroom can only benefit companies in the long run.

Here are some steps that can help both directors and executives strengthen their working relationship.

- Take full advantage of annual board and committee self-assessments, along with adopting a robust process for individual director self-assessments.

- Commit to having difficult conversations with underperforming peers.

- Don’t shy away from director succession planning. Do the work now to build a pipeline of qualified, diverse board candidates.

- Embrace continuous learning and don’t hesitate to call upon outside experts and advisors to get a fresh perspective.

- Get serious about increasing boardroom diversity and leverage direct search firms and other consultants to bring the board diverse candidates.

- Help your board stay prepared by taking a fresh look at the materials you provide and ensuring directors have enough lead time to digest them.

- Take stock of the relationships between members of the management team and directors, and commit to a plan for improving those connections.

- Devote time to bringing directors up to speed on rapidly evolving areas that are priorities for the firm and its stakeholders, such as data security and privacy, carbon emissions and supply chain sustainability.

- Play an active role in director onboarding by developing a coordinated strategy that gives new directors facetime with relevant management functions.

About the Survey

PwC and The Conference Board’s study, Board Effectiveness: A survey of the C-suite, gauges the perception that C-suite executives at public companies across the US have related to the performance of their boards of directors. In 2021, 556 executives participated in our survey. The respondents represent a cross-section of senior executives from over a dozen industries, the majority of whom help to lead companies with revenues of more than $1 billion.

The article was first published here.

Photo by Nastuh Abootalebi on Unsplash.

1.0

1.0