On 13 October, the 10th Prime Minister, Datuk Seri Anwar Ibrahim has tabled the largest budget that the country has ever seen with a whopping of RM 393.8 billion. With the theme of, ‘Budget 2024: Economic Reforms, Empowering the People’, the immense budget sets aside RM303.8 billion for operating expenditure (OpEx) while the remaining RM 90 billion has been allocated towards development expenditure (DevEx).

Below are the differences between the two MADANI budgets:

| Year | Total Allocation | Operating Expenditure (OpEx) |

Development Expenditure (DevEx) |

|---|---|---|---|

| 2023 | RM 393.8 billion | RM 303.8 billion | RM 90 billion |

| 2024 | RM 388.1 billion | RM 289.1 billion | RM 99 billion |

Budget 2024 has three key trusts, which are:

- Delivering reforms to enhance governance and public delivery system

- Transforming the economy and business

- Elevating the well-being of the Rakyat

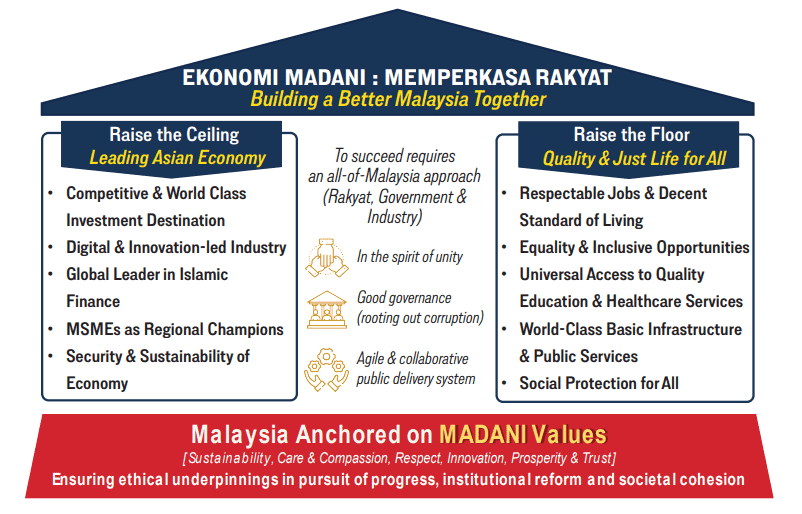

The Budget is the continuing effort towards achieving the Ekonomi Madani policy that was introduced back in 27 July 2023. In re-engineering the country to be in a better trajectory, generating growth, and enhancing the rakyat’s well-being, the policy proposed the country to be anchored on six (6) Madani values which are – (1) Sustainability, (2) Care & Compassion, (3) Respect, (4) Innovation, (5) Prosperity & (6) Trust.

The values are supported by two pillars that serves as a framework for the current and future actions:

- Raise the Ceiling – To be a leading Asian economy by restructuring the economy towards national competitiveness

- Raise the Floor – Quality & justice life for all by championing social justice to improve the quality of life of the rakyat.

The Madani economy policy has seven key targets that are to be achieved over the span of 10 years, which are to:

- Be the top 30 largest economy

- Be the top 12 in global competitiveness

- Be the top 25 on the Human Development Index

- Increase Labour share of income to 45%

- Improve Malaysia’s position in the Corruption Perception Index Top 25

- Move towards fiscal sustainability, targeting deficit of 3%, or better

- Increase Female Labour Force Participation Rate to 60%

Read more on Ekonomi Madani policy here.

Some of the highlights of Budget 2024 in supporting business continuity and resilience:

- Women Career Comeback Programme – An income tax exemption on employment income received for a max of 12 consecutive months for women that return from a career break.

Effective date: Application received by Talent Corp from 1 Jan 2024 – 31 Dec 2027

- Tax Relief for Lifestyle – The relief for lifestyle up to RM2,500 on the purchase of reading materials including books, printed/electronic daily newspapers, personal computers, smartphones or tablets, internet subscriptions, sports equipment, and gymnasium membership fees.Additional relief up to RM500 is allocated for:

- Purchasing sports equipment

- Payment of rental/entry fees to sport facilities

- Registration fees for participating in sports competitions

Effective date: From year of assessment of 2024

- Tax Deduction on ESG Related Expenditures – Tax deduction up to RM50,000 for each year of assessment be given on ESG related expenditures such as:

- Enhance Sustainability Reporting Framework

- Climate Risk Management & Scenario Analysis

- Tax Corporate Governance Framework (TCGF) of Inland Revenue Board of Malaysia

- E-Invoicing implementations

- Any reporting requirement related to ESG

Effective date: From year of assessment 2024 to 2027.

- Income Tax Exemption for Islamic Financial Activities under Labuan International Business and Financial Centre (IBFC) – A full income tax exemption for a period of 5 years be given to Labuan entities that undertake Islamic financial-related trading activities such as Islamic digital banking, Islamic digital bourses, ummah-related companies, and Islamic digital token issuers.

Effective date: From year assessment of 2024 to 2028

- Review of Capital Allowance on Information and Communication Technology (ICT) Equipment and Computer Software – The capital allowance rates have been revised as listed below:

- Purchase of ICT equipment and computer software packages – 40% of proposed initial allowance

- Consultation, licensing and incidental fees related to customised computer software development – 20% of proposed annual allowance

The caporal claim period is reduced from 4 years to 3 years.

Effective date: From year of assessment 2024

- Income Tax Exemption on Islamic Securities Selling and Buying (ISSB) Transactions – Income tax exemption will be given for income derived from ISSB transactions.Effective date: From year of assessment 2024

- Tax Deductions on Contributions for Environmental Preservation and Conservation Projects –

- Tax deduction under Section 34(6)(h) of the Income Tax Act 197 will be given on expenses incurred by the company for provision of services, public amenities, charity or community projects pertaining to education, health, housing, enhancement of income of the poor, infrastructure, information & communication technology, maintenance of heritage building including environmental preservation of conservation projects.

- Tax deductions will be given to entities contributing or sponsoring activities related to tree planting projects, or environmental preservation and conservation awareness projects verified by FRIM.

- Effective date: Application received by MoF from 1 Jan 2024 – 31 Dec 2026.

- Reinvestment Under the New Industrial Master Plan (NIMP) 2030 – To encourage companies that have exhausted their Reinvestment Allowance (RA) eligibility period and increase capacity and investment in high-value activities under the NIMP 2030, the incentives be given as follows:

- Qualifying Capital Expenditure:

Tier 1 – 100%

Tier 2 – 60% - Statutory Income to be Set Off:

Tier 1 – 100%

Tier 2 – 70%

- Qualifying Capital Expenditure:

Effective date: Application received by MIDA from 1 Jan 2024 to 31 Dec 2028.

- Tax Incentives for High-Growth and High Value (HGHV) Sector – A result based incentive that uses a tiered system in which the government plans to provide a tiered reinvestment tax incentive in the form of Investment Tax Allowance of either 70% or 100%.

Effective date: This has yet to be clarified.

- Review of Green Technology Tax Incentive –

- Green Investment Tax Allowance (GITA) project (business purposes) – 100% GITA to be set off against 70% or 100% of statutory income for 5 + 5 years (Tier 1) or 5 years (Tier 2 and Tier 3)Application date: Application received by MIDA from 1 Jan 2024 – 31 Dec 2026.

- GITA Asset (own consumption) – 100 % (Tier 1) or 60% (Tier 2) GITA to be set off against 70% of the statutory income. The qualifying assets need to be purchased from 1 Jan 2024 – 31 Dec 2026 and are verified by the Malaysian Green Technology and Climate Change Corporation (MGTC)

- Green Income Tax Exemption (GITE) Solar Leasing – 70% tax exemptions on statutory income for 5 years (>3MW – ≤ 10MW) or 10 years (>10MW – ≤30MW).

Effective date: Application received by MIDA from 1 Jan 2024 – 31 Dec 2026.

- Contribution to Support Educational Programmes Including Sports Education – Up to 10% tax incentives of aggregate income will be given to individuals or businesses that make contributions to institutions, organisations or funds that support education programmes including sport educations.

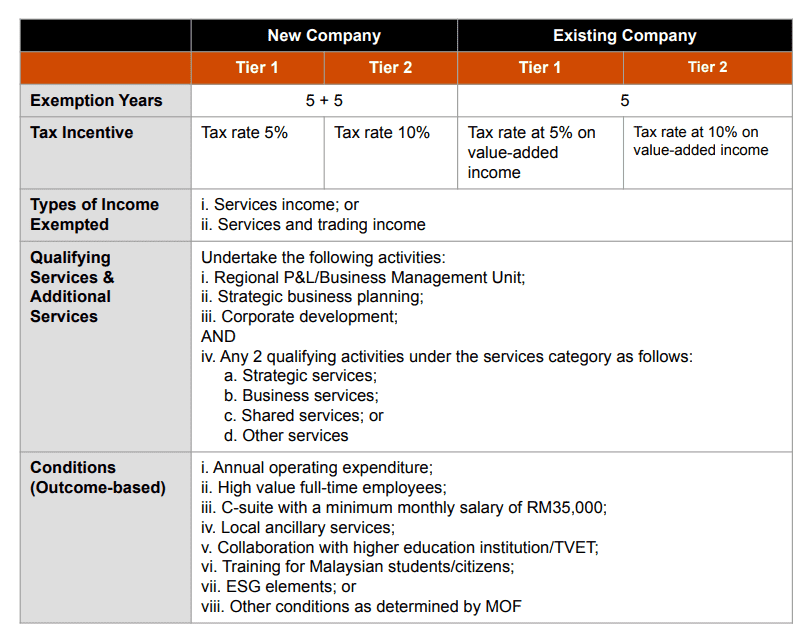

Tax Incentive for Global Services Hub – This incentive is based on an outcome-based approach introduced as follows:

It is also proposed that a 15% income tax rate is to be given to 3 non-citizen individuals that’s in the C-Suite/key positions of the new company approved with GSH incentive for 3 consecutive YAs with a monthly salary of at least RM35,000.

Effective date: Application received by MIDA from 14 Oct 2023 – 31 December 2027.

- Pengerang Integrated Petroleum Complex (PIPC) – PIPC will be transformed into a development hub for chemical and petrochemical sectors, with a tax incentive package in the form of a special income tax rate or an investment tax allowance.

Effective date: This has yet to be clarified.

- Tax Deduction for Voluntary Carbon Market – To encourage more participation in Voluntary Carbon Market (VCM) initiatives under the Bursa Carbon Exchange (BCX), a tax deduction of up to RM300,000 will be given to companies for costs incurred on the Development and Measurement, Reporting and Verification related to the development of carbon projects. The further tax deduction is deductible from the carbon credit income traded on BCX.

Effective date: Application received by MGTC from 1 Jan 2024 to 31 Dec 2026.

- Import Duty and Sales Tax Exemption on Manufacturing Aids – It is for the goods used in the manufacturing process to accelerate, improve, complement, and complete the manufacturing process of the finished goods, but is not part of the finished goods. Proposed import duty and sales tax exemption be given to eligible manufacturers on the importation and locally purchased manufacturing aids, subject to the type of industry and category of goods is to be determined.

Effective date: From 1 January 2024

- Excise Duty Rate of Sugar-Sweetened Beverages – Exercise duty for sweetened beverages is to be increased to RM0.50 per litre.

Effective date: From 1 January 2024

- Increase of Service Tax Rate – Service tax rate to increase from 6% to 8%. This increased rate does not apply to food and beverage as well as telecommunications services.

Effective date: This has yet to be clarified.

- Stamp Duty for Property Ownership by Foreigners – A flat stamp duty rate of 4% be imposed on the instrument of transfer of property executed by foreign-owned companies and non-citizen individuals (except Malaysian permanent residents).

Effective date: Instrument of transfer of property will be executed from 1 January 2024.

- High Value Goods Tax – A rate of 5% to 10% on certain high-value goods such as jewellery and watches. The rate will be determined based on the threshold value of the goods.

Effective date: This has yet to be clarified.

- E-Invoice Implementation Timeline

Implementation timeline:

| 1 June 2014 | Mandatory Implementation for taxpayers with an annual turnover or revenue in excess of RM100 million. | Taxpayers can voluntarily participate in the e-invoice initiative earlier than the implementation timeline regardless of their annual turnover and revenue. |

| 1 January 2025 | Mandatory Implementation for taxpayers with an annual turnover or revenue of more than RM50 million and up to RM100 million | |

| 1 January 2026 | Mandatory Implementation for taxpayers with an annual turnover or revenue of more than RM25 million and up to RM50 million | |

| 1 January 2027 | Mandatory Implementation for taxpayers and certain non-business transactions |

Effective date: 1 August 2024

- Review of Conditions for Institutions/Organisations/Funds Approved Under Section 44(6) of the Income Tax Act 1967 – Limit of accumulated funds utilisation for participation in business activities to be increased from 25% up to 35%. The threshold of charitable activity expenditure is increased from at least 50% to 60% depending on the limit of utilisation of fund for business activities.

Non-compliance with subsection 44(6) conditions:

-

- Donors remain eligible for tax deductions on the contributions made.

- The institutions/organisations/funds will not be eligible for tax exemption in the YA the breach of conditions occurred.

- Capital Gains Tax (CGT) on Disposal of Unlisted Shares –

| Share Acquisition Date | CGT Rate |

|---|---|

| Before 1 March 2024 | The taxpayer may choose:

|

| From 1 March 2024 | 10% on the net gain of the disposal of shares |

Effective date: 1 March 2024

- Global Minimum Tax (GMT) – It is expected that Global Minimum Tax (GMT) will be implemented in the year 2025 and apply to all Constituent Entities (CE) of qualified multinational enterprises with annual consolidated revenues of EUR 750 million or more in at least two of the four fiscal years immediately preceding the tested fiscal year.

The summaries below provide a good overview of the National 2024 Budget:

- KPMG | 2024 Budget Snapshots: Economic Reforms, Empowering the People

- PwC TaXavvy | Budget 2024 Edition

- Deloitte | Malaysia Budget 2024 Snapshot: Economic Reform, Empowering the People

- EY Take 5 for Business | Malaysia Budget 2024

- Grant Thornton | Budget 2024

- EY | Malaysia Budget 2024: Tax Snapshots

- TGS Advisory | Malaysia 2024: Budget Highlights – Economic Reform, Empowering the People

- TraTax Tax e-Alert | 2024 Budget: Tax Implications on Business

- Thanees Tax Consulting | Budget 2024 – Proposed Tax Measures and its Implications

Full speech of the National 2024 Budget is available here.

Photo by Kostiantyn Li on Unsplash.

1.0

1.0