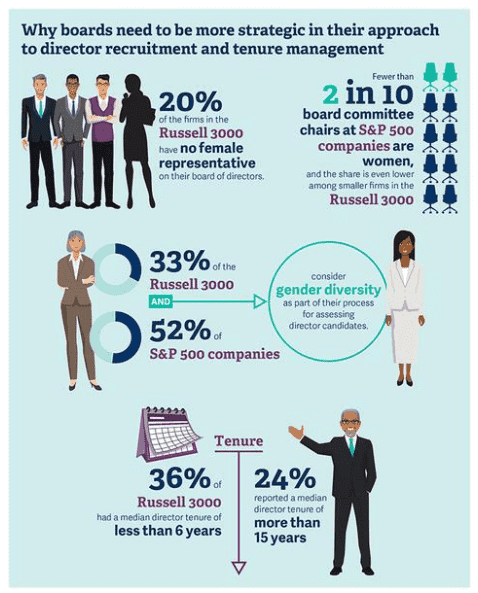

Despite the recent push for diversity, boards of directors tend to gravitate toward standard profiles when it is time to replace a member or add a new one. We look at how taking a more strategic, long-term approach to sourcing new directors can overcome default behaviors and create increasingly robust and capable boards.

The Long View of Director Succession

When it comes time to fill an open spot on the board of directors, it’s far too easy—and far too common—for directors to fall into the trap of short-term planning and “who do we know” candidate identification.

In recent years, companies have improved with regard to thoughtfully identifying and recruiting senior leaders who are best positioned for long-term success in the organization. Now, the same transition is taking place in the boardroom. Director searches now often involve a candid analysis of the board’s current composition, identifying future needs and developing a long-term strategy for board recruitment.

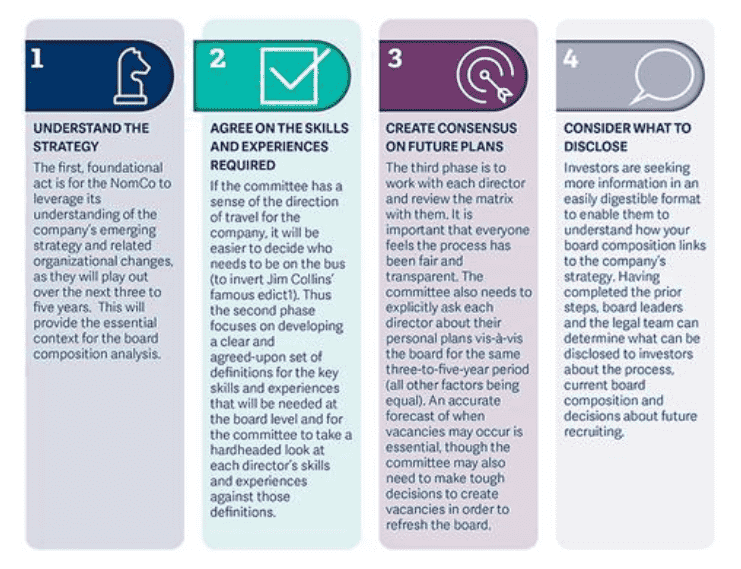

Boards that have successfully managed the refreshment process typically start with a board composition analysis, a strategic planning process that is comprised of four primary activities led by the Nominating and Governance Committee (NomCo):

The Wrong Way to Do the Right Thing

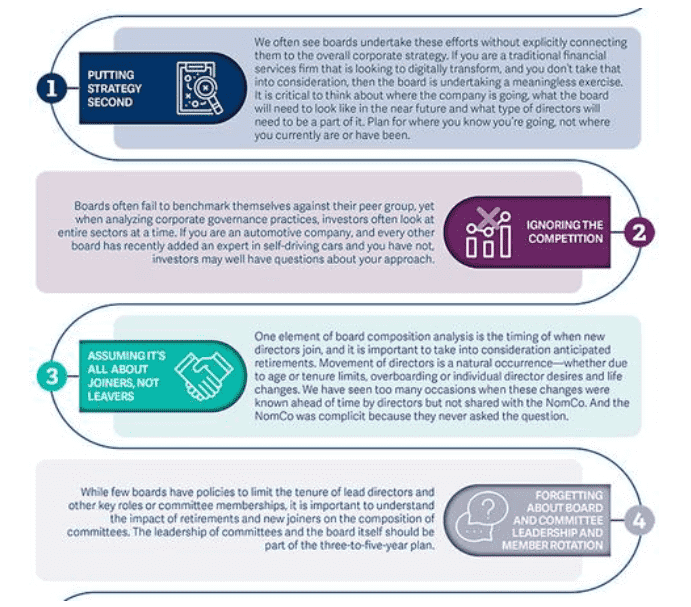

As beneficial as long-term board succession planning can be, there are numerous ways that it can be done badly to the ultimate detriment of the board, the company and its shareholders. We have seen four common errors that derail the work:

Once the board begins the process of undertaking a composition analysis, it is important that it is an open, inclusive process involving every single director. This can’t simply be managed by the general counsel or another executive from afar. Everyone has to have buy-in to the process and analysis.

At the same time, it’s important not to allow directors to over-inflate their qualifications. Directors will often believe that they are more current on a topic than they really are or that CFO experiences twenty years ago put them on the same level as someone who is an active CFO today. To avoid this, there needs to be a clear set of criteria for every measure, and the NomCo needs to be the ultimate arbitrator on ratings and qualifications.

Lastly, and perhaps most importantly, boards can’t avoid hard conversations during this process. Some of today’s directors won’t have an obvious role on tomorrow’s board, and others may believe they have qualifications or relevance that they don’t truly hold. The board leader (non-executive chair or lead director) or NomCo chair needs to be willing to sit down and have an open, honest and direct conversation with each board member during this process, including a willingness to help some directors find their way off the board.

While the board has to own the process and the results, using a third-party advisor can help deal with some of the challenges involved. One benefit is that they can help ensure there is the required objectivity and rigor in the process.

The Benefits of Action

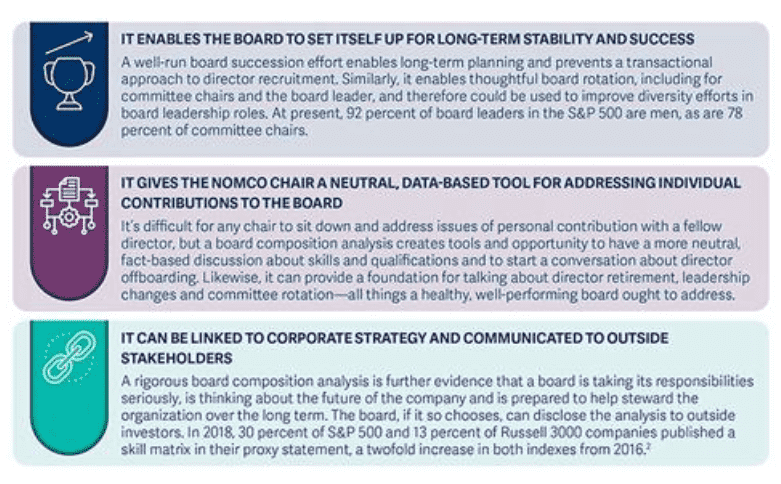

A rigorous board composition analysis creates value in numerous ways:

Thoughtful succession planning is critical to a healthy board. Although it must be championed by the independent board leadership, outside advisors can help or even lead the effort. But it is ultimately up to the entire board to thoughtfully engage in the process and be open to the conversations that follow.

This article was first published here.

Photo by Anoushka P on Unsplash.

5.0

5.0