Early results from our proprietary CEO Excellence Assessment Tool offer insights into the key issues facing more than 100 CEOs, mostly from Asia, and where they feel most confident—and most vulnerable.

The CEO role is one of the most challenging and demanding positions in any organization, particularly in the current economic climate. It is also one of the most important. Our research indicates that as much as 45 percent of a company’s performance can be attributed to the CEO’s influence.1

But how are CEOs actually performing? What issues are they struggling with, and what can be done to help them perform at their highest level? These are some of the questions that the McKinsey Center for CEO Excellence (MCCE) seeks to answer. A new addition to the tool kit is our proprietary CEO Excellence Assessment Tool (CEAT), a compact self-assessment centered on the six dimensions of leadership described in the book CEO Excellence, written by McKinsey senior partners Carolyn Dewar, Scott Keller, and Vikram Malhotra (see sidebar, “About CEO Excellence, MCCE, and the CEO Excellence Assessment Tool”).2 This initial article explores preliminary insights emerging from data gathered over the past year,3 which represent more than 100 CEOs across 17 major industries. The majority of participants represent companies headquartered in Asia,4 with subsequent waves expected from other global regions as the tool is scaled.

About CEO Excellence, the McKinsey Center for CEO Excellence, and the CEO Excellence Assessment Tool

The McKinsey Center for CEO Excellence (MCCE) is McKinsey’s dedicated offering focused on CEO development. The flagship MCCE journey involves a unique nine-month CEO Excellence program, tailored to help CEOs elevate their performance and reach their full potential. Each MCCE cohort brings together an exclusive group of CEO peers, carefully curated from diverse industries and regions, and offers an unparalleled opportunity for CEOs to learn from experienced senior CEOs, engage with like-minded CEO peers, and obtain feedback on their leadership style and behaviors.

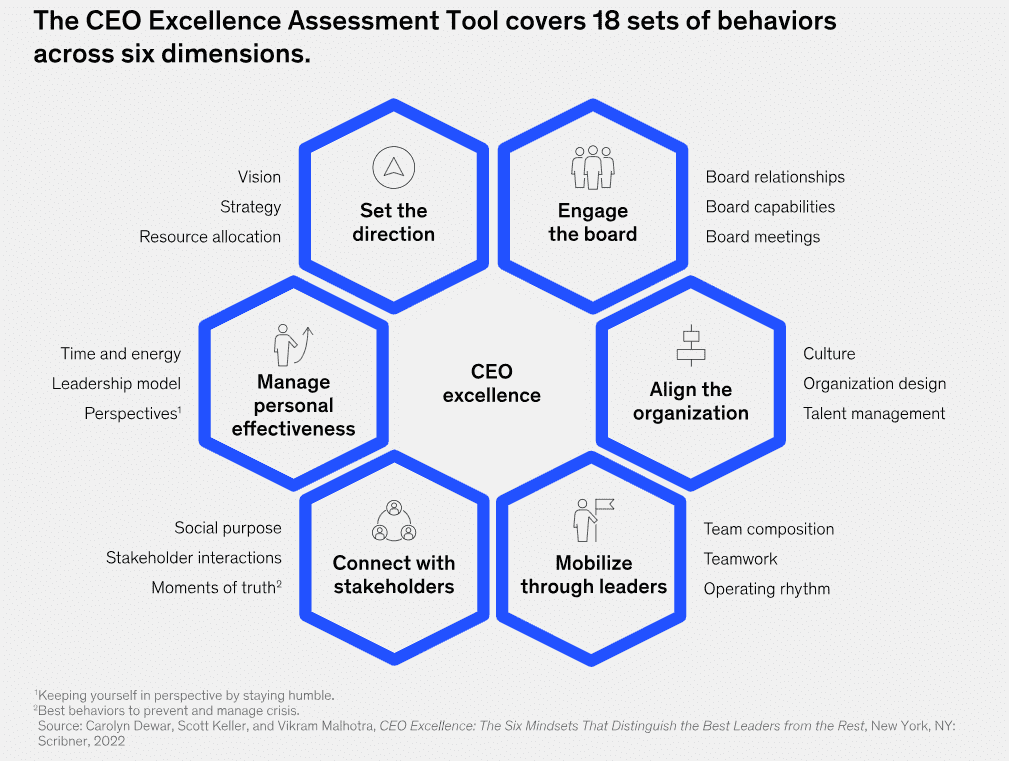

As part of the CEO Excellence program, we deploy our proprietary CEO Excellence Assessment Tool (CEAT), which is a self-assessment survey designed to capture a CEO’s aspirations and behaviors. The questions in the tool are based on the six dimensions described in the book CEO Excellence, written by McKinsey senior partners Carolyn Dewar, Scott Keller, and Vikram Malhotra. The research underpinning the book is based on more than 20 years’ worth of data on 7,800 CEOs from 3,500 public companies across 70 countries and 24 industries.1

These six dimensions—setting the direction, engaging with the board, aligning the organization, mobilizing through leaders, connecting with stakeholders, and managing personal effectiveness—are further broken down into 18 behaviors (exhibit).

The CEAT is an online survey that asks CEOs to assess their current performance against gold standard behaviors in each category. The tool offers a quick and simple way for CEOs to get a snapshot of their current strengths and challenges. By taking the survey at regular intervals, leaders can also gain insights into their personal CEO journeys, including areas in which they are making progress and those for which they may need to be more intentional in seeking support. The CEAT also enables McKinsey to build a rich global database of anonymized, self-reported CEO performance from which we will be able to develop industry- and country-specific insights, benchmarks, and solutions.

Even at this preliminary stage, the data set is already yielding rich—and often counterintuitive—insights into the challenges and uncertainties faced by Asian CEOs. We find, for example, that CEOs generally feel confident about their ability to manage their own personal effectiveness but can struggle to manage the board and engage with key stakeholders, although high-quality training opportunities can improve self-assessed performance significantly, especially for early-tenure CEOs. Interestingly, women CEOs appear to be more confident than their male peers in their performance across many key practices, though the number of women in our current sample is small.

The insights in this article are just the beginning. Over the next few years, our vision is that the CEAT will collect data from hundreds or even thousands of CEOs, enabling richer insights and further granularity across geographies and industries. We will complement the findings of the tool with insights on opportunities, challenges, and best practices gleaned from our interactions with CEOs as part of the McKinsey CEO Excellence Program. While the CEO role is undeniably tough, encouraging open conversations about why this is—and what can be done to address some of these issues—can help to ensure that the role is also one of the highlights of any leader’s career.

The most common CEO challenges are engaging the board, allocating resources, and connecting with stakeholders

Exhibit 1

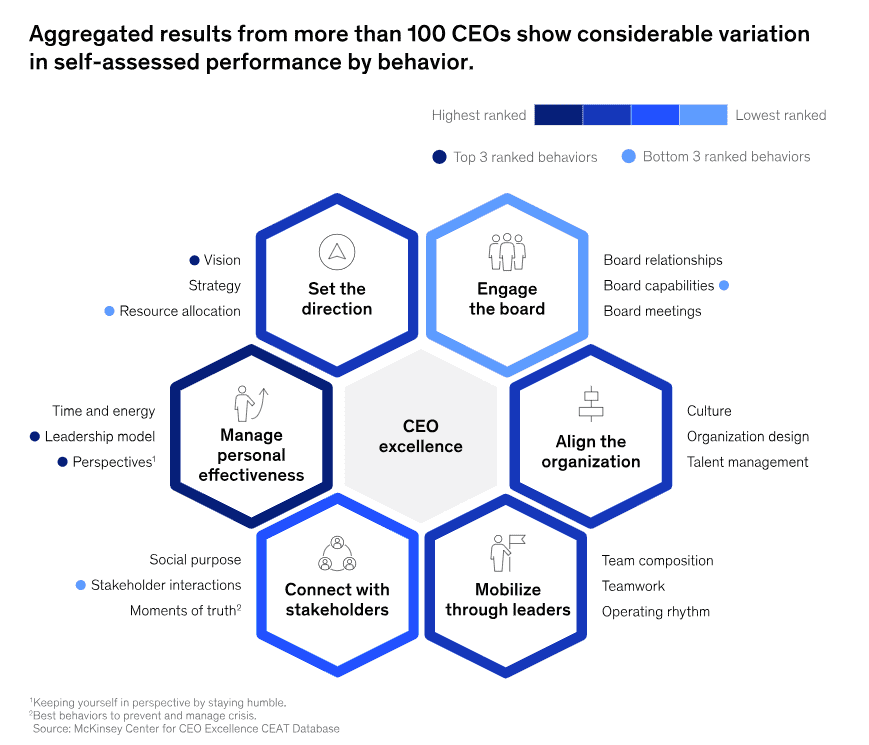

No two CEOs are alike, and each has a unique set of strengths and weaknesses. Among the 18 behaviors that denote CEO excellence across dimensions, however, provisional results from the CEAT indicate that some generally come more naturally to CEOs than others.

For example, CEOs tend to be least confident in their ability to tap into the wisdom of their board members (average score of 3.2 out of 5.0). They are less comfortable to objectively allocate resources as an outsider would, especially when it comes to removing or shutting down initiatives (average score of 3.3 out of 5.0); and they are tentative in their judgment to prioritize and develop engagement strategies for their priority stakeholders (average score of 3.4 out of 5.0). CEOs are generally most confident in their ability to stay true to their convictions and values, practice gratitude and stay humble when reflecting on their growth, and to set or reframe the vision for their company.

These initial results support many of the findings in CEO Excellence and are consistent with the insights that we are hearing from our interactions with CEOs.

Setting the direction. CEOs generally assess that they set the vision and strategy well but struggle with resource allocation. This finding is in line with the research underpinning CEO Excellence, which found that a third of companies reallocate no more than 1 percent of their capital year to year.5 Companies that are not dynamically aligning their resources—including money, talent, and management—with evolving corporate strategies may be leaving value on the table. A company that actively reallocates delivers a 10 percent return to shareholders, on average, compared with 6 percent for a sluggish reallocator.6 This return on proactivity is not unique to the allocation of resources; in our experience, the best CEOs are also judiciously bold across the other two dimensions of direction setting: vision and strategy.

Engaging with the board. This is the dimension in which CEOs judge their own performance most harshly. On average, respondents say they are able to have good relationships with their board but are less confident in their ability to put good behaviors into practice when tapping into the board’s capabilities and focusing board meetings on the future. Board members often agree with this assessment: only 30 percent of respondents to a 2019 McKinsey survey of global boards reported that they serve on boards whose processes are effective.7 And board effectiveness is an important determinant of value creation: research shows that it’s strongly correlated with higher market valuation and better performance.8 The best CEOs don’t tolerate an indifferent relationship with their boards. In place of the traditional mindset that their role is to help the board fulfill its fiduciary duties, the best CEOs assess that their role is to help directors help the business.

Aligning the organization. CEOs are generally confident in their ability to create culture and design effective organizations, but they are less positive about behaviors related to talent management. Our research indicates that CEOs looking to improve their performance on talent management need to understand and manage the 40 to 50 roles that are most pivotal in increasing value—which may not necessarily be the most senior roles.9 Those roles should be occupied by top performers, with a robust bench on hand if required.

Mobilizing through leaders. This is one of the dimensions in which CEOs express the most confidence. They are comfortable with their performance related to team composition, teamwork, and operating rhythm. The best CEOs are constantly assessing how their team works together. They display an in-depth understanding of the team’s psychology and talk about the importance of getting their team to understand and make decisions based on what is best for the whole organization, rather than for their own smaller part.

Connecting with stakeholders. CEOs are generally confident about their performance on finding their social purpose, maintaining a long-term perspective, and showing personal resilience during difficult periods, but they struggle with stakeholder interactions. This is another area with significant implications for company performance: research shows that a company’s relationships with external stakeholders can influence as much as 30 percent of corporate earnings.10 Where there are misalignments with or between stakeholders, the best CEOs start by questioning the reason why. Developing a deep understanding of their stakeholders’ motivations, hopes, and fears can help CEOs create strong bonds and arrive at the best answer.

Managing personal effectiveness. CEOs are generally confident in their performance in this dimension, particularly when it comes to staying humble, modeling leadership, and staying true to one’s values. They are slightly less satisfied with their ability to manage their time and energy, and CEOs looking to improve their performance should be ruthless with their calendar—including by building in time to think and deal with the unexpected—to ensure that they are spending their finite energy on the right things. The best CEOs prioritize their personal time accordingly and have a strong awareness of when others in their team can or cannot undertake individual tasks.

Women CEOs tend to prioritize the ‘software’ of organizations more and rank themselves higher than their male peers on most behaviors

Exhibit 2

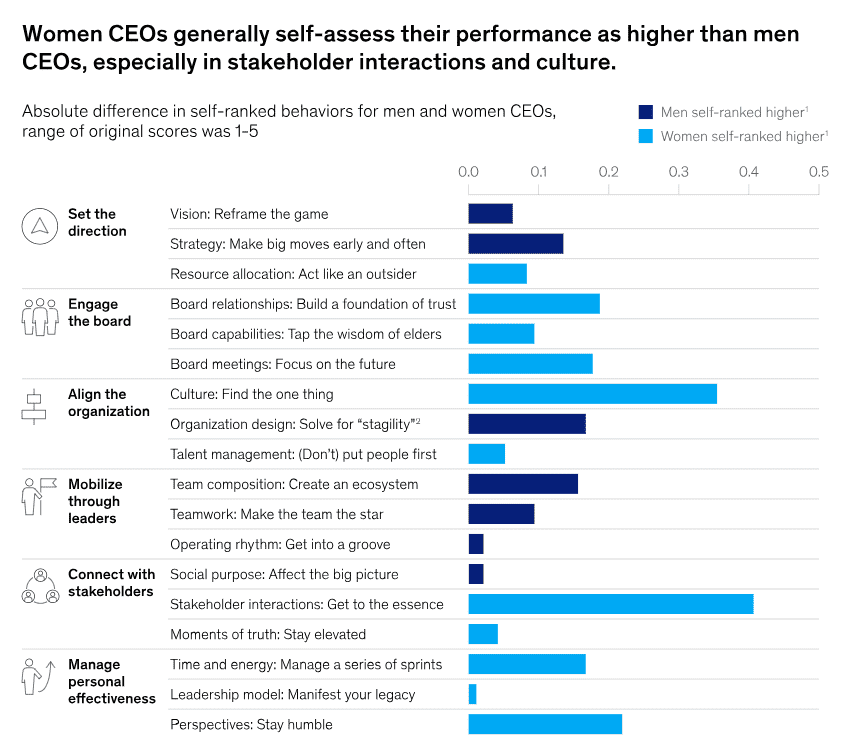

There has long been a stereotype that women are less confident and more self-critical. However, provisional results from the CEAT join a growing body of evidence that suggests that this “confidence gap” may be a myth, at least among CEOs.11 On average, the self-assessed performance of women CEOs tends to be higher than that of men CEOs for most behaviors. The sample size for women CEOs is relatively small (15), but the women in this sample cover a broad range of industries, countries, and tenures.

Looking at the behaviors in which men and women tend to rank themselves more highly, a pattern starts to emerge. Women CEOs generally ranked themselves more highly than their male peers in skills related to engaging with others, including connecting with the board and stakeholders and driving the right culture.12 This finding is supported by previous McKinsey research, which indicates that women in the workplace tend to be more proactive in people management.13 Men, on the other hand, tend to rank themselves higher on vision, strategy, and mobilizing the team.

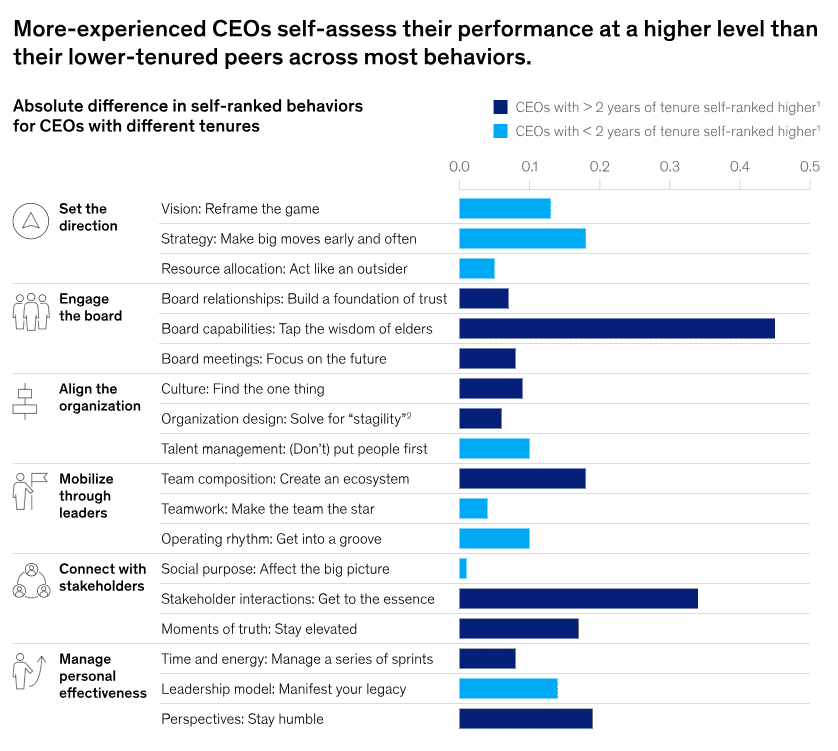

Tenure counts; more-experienced CEOs gain confidence by prioritizing different things than early CEOs

Exhibit 3

Unsurprisingly, CEOs with longer tenures tend to be more confident in their performance, ranking themselves higher on most behaviors. As CEOs gain experience and build their track record, they become more confident in their behaviors relating to engaging the board and connecting with stakeholders. While our CEAT data does not enable us to provide definitive answers for why this difference emerges, it may be, for example, that longer-tenured CEOs start to focus less on themselves and how they are performing and instead begin to prioritize their impact on others—including stakeholders and the board—which enables them to develop a better understanding of their broader ecosystem.

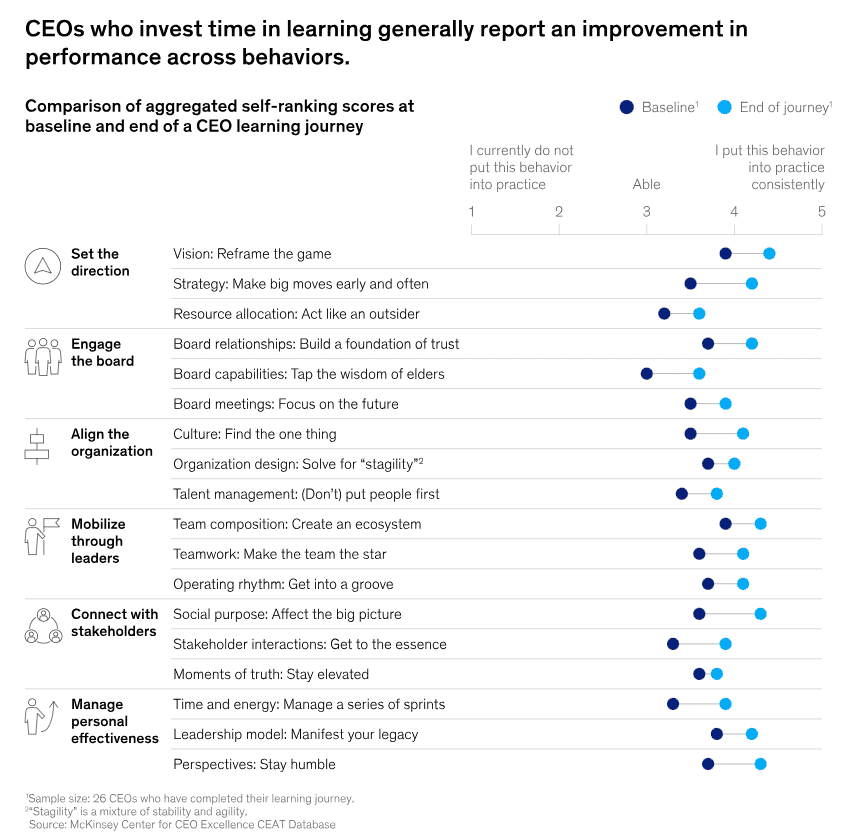

Self-care matters for CEOs; investment in targeted learning and mentorship interventions drives improvements across all behaviors

We know from our interactions with CEOs how consumed they can be by the demands of their role, which can make it difficult to take time off. Our provisional results indicate, however, that taking time to pause, reflect, and invest in their own learning can pay significant dividends. When CEOs invest time and energy in their own learning and growth—including with targeted training and mentorship—they become, on average, more confident across all 18 behaviors.14 The biggest self-reported improvements seem to be related to their ability to make bold strategic moves early and often and deliver social purpose with impact.

Broadly, however, the magnitude of self-reported improvement appears relatively consistent across behaviors, which means that the overall pattern of relative self-reported strengths and weaknesses remains the same. Setting a vision and building an ecosystem for the team remain the behaviors in which CEOs are most confident, while managing resource allocation and tapping into board members’ wisdom remain more challenging.

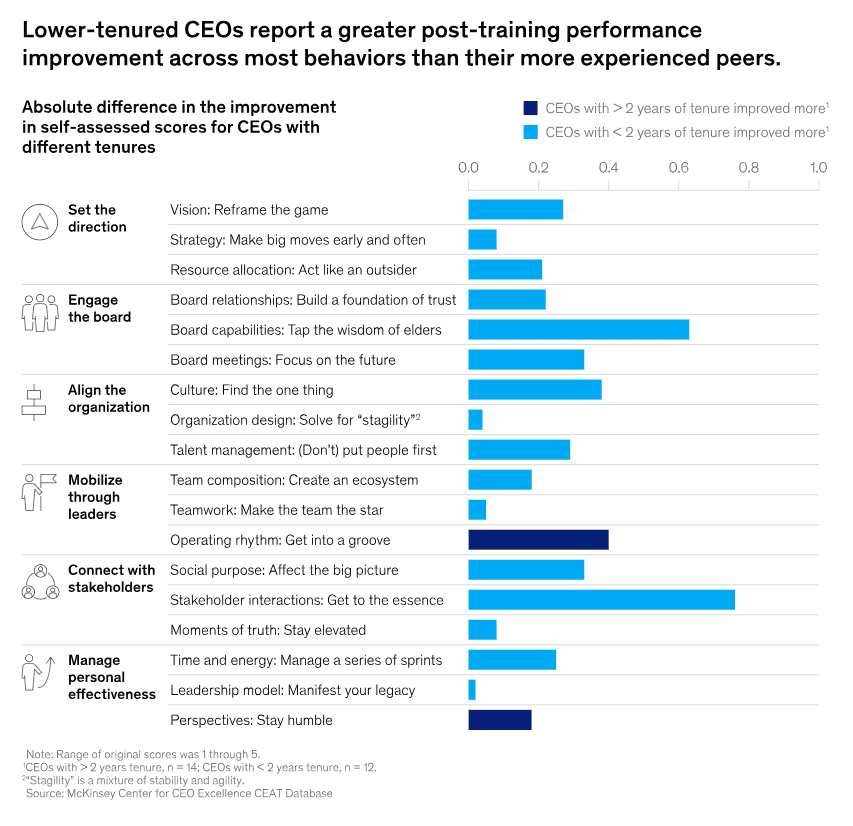

Early interventions matter; training and mentorship can accelerate growth for early-tenured CEOs

Exhibit 5

We’ve heard often that being a CEO is a role you can never prepare for. Our provisional results indicate that early-tenure CEOs may be in a learning “sweet spot,” which means that focused investment in their own learning can significantly accelerate performance improvement across many critical CEO behaviors for the remainder of their CEO trajectory. Encouragingly, early-tenure CEOs improve their self-reported performance more than their more-experienced peers do for some of the behaviors that newer CEOs struggled with at the baseline. Newer CEOs that undergo training seem to gain particular benefit in engaging with the board and connecting with stakeholders, for example, which are behaviors that represent a weak spot for many.15

Developing a better understanding of the challenges facing CEOs and opportunities for progress

While the CEAT is already generating important insights about CEOs’ perceptions and performance, these results also prompt several important questions. To what extent are the patterns observed here rooted in objective measures of individual performance as opposed to factors specific to a particular industry or demographic group? Why do CEOs generally seem to struggle with some of the behaviors discussed in this article, and what can be done to resolve these issues?

While this article has begun to explore some of those issues, more work is needed. As part of the McKinsey CEO Excellence Program, we work closely with a wide range of CEOs. Going forward, we will marry the insights gained from our CEO interviews and interactions with the growing body of data coming from the CEAT, which will also enable us to provide more best practices and tips for improvement along the six dimensions of leadership. Our aim with this work—as with everything we do at the MCCE—will be to continue to shed light on the opportunities and challenges of the vital, demanding role of the CEO and how individuals can best position themselves to lead in today’s uncertain and evolving world.

If you would like to learn more about the McKinsey CEO Excellence Program and the additional data and insights from the CEAT, please email the McKinsey Center for CEO Excellence at McKinsey_Center_for_CEO_Excellence@McKinsey.com.

The article was first published here.

Photo by Towfiqu barbhuiya on Unsplash.

1.0

1.0