Investments in climate technology are still increasing, defying the headwinds that affected most capital markets. We identify eight factors for deploying capital in this resilient space.

Climate-related investment increased significantly in 2022, defying the considerable geopolitical and macroeconomic headwinds that roiled most global capital markets. Due in part to the policies of the United States and Europe aimed at zeroing out emissions by 2050, that growth seems on track to continue this year, even though the global economic context remains challenging. In this article, we outline a framework that could allow investors to succeed in this turbulent environment by ensuring that investment targets are not only well positioned to leverage a wide range of climate tailwinds but are also able to deliver on critical business fundamentals. We offer a review of climate-investing trends in the face of recent market volatility and identify eight factors that investors and leaders can consider when looking to deploy capital productively.

Last year, Russia’s invasion of Ukraine, the resulting energy crisis in Europe, turmoil in the global economy, and a slowdown in markets all generated concern that a three-year period of growth in climate technology investment was ending.1 That downturn hasn’t materialized, as measured by investment in the area. Instead, climate-related private-market investment far outpaced the broader market in 2022 as measured by deal activity, the amount of capital deployed, and capital flows into dedicated funds.

The momentum seems poised to continue in 2023 as governments, corporations, and investors increasingly accelerate the deployment of climate technologies, which offer the potential to promote energy security, affordability, and sustainability objectives. European nations, for example, are speeding up their long-term plans for local renewables, even as many seek to offset cuts in Russian energy imports by boosting supplies of gas, coal, and oil in the shorter term.2

Climate-related private-market investment far outpaced the broader market in 2022 as measured by deal activity, the amount of capital deployed, and capital flows into dedicated funds.

Climate technology is getting a further boost from unprecedented government programs in the United States and Europe that will unleash a flood of capital to meet the challenge of achieving net-zero emission commitments by 2050. The US Inflation Reduction Act (IRA), passed last year, allocates more than $370 billion in funding to mitigate climate change, while the EU Green Deal could potentially dedicate more than €1 trillion in public and private funds to the fight. Together, these measures may open up more opportunities for investors in a market that McKinsey estimates could reach $9 trillion to $12 trillion in annual investment by 2030.

Breakout Growth

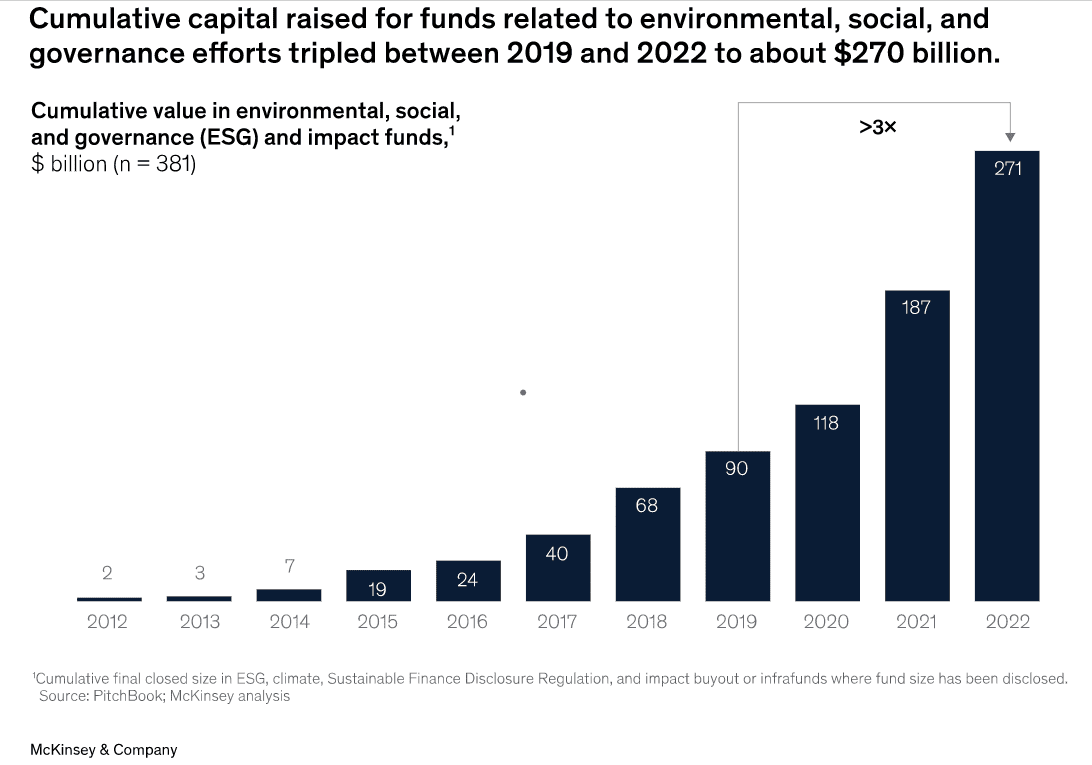

Climate investing experienced a period of breakout growth in capital formation over the past four years. From 2019 until the end of 2022, private-market equity investors launched more than 330 new sustainability; environmental, social, and governance (ESG); and impact funds. The cumulative assets under management in these funds grew threefold, from $90 billion to more than $270 billion (Exhibit 1). Furthermore, those figures do not include the significant amount of capital earmarked for climate opportunities in corporate capital budgets, public-equity investment vehicles, and credit funds.

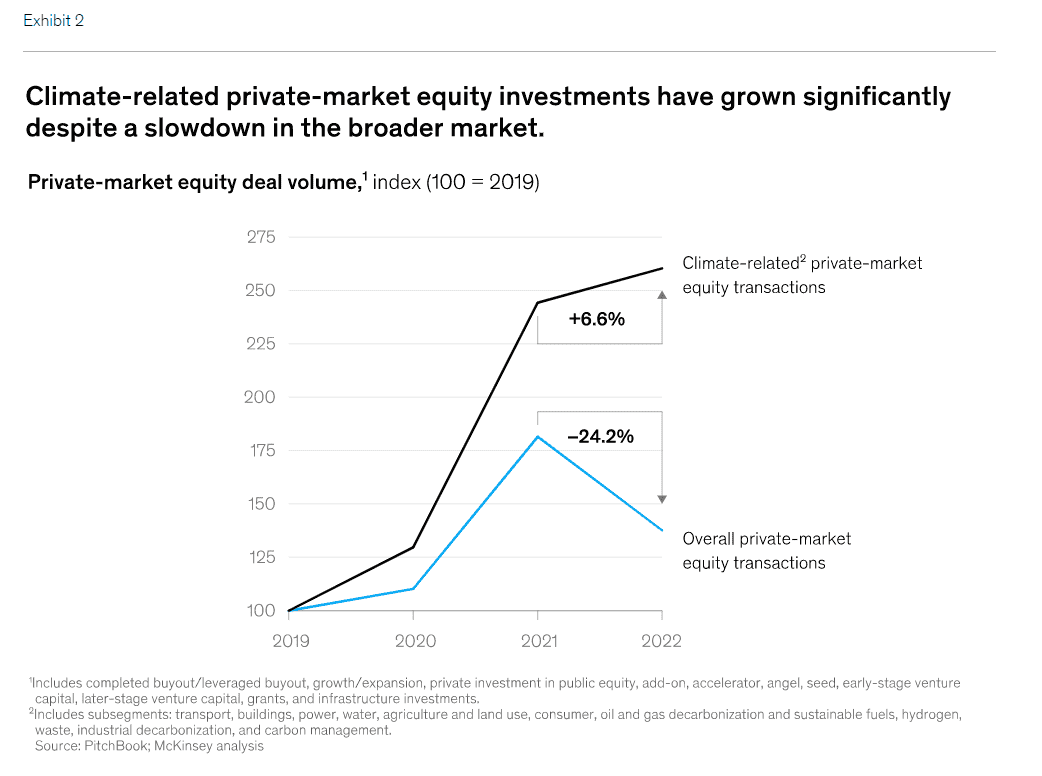

Climate-focused capital has been deployed rapidly. The global volume of climate-oriented equity transactions in private markets—equity investments, from pre-seed to buyout, in energy transition technologies and other climate solutions—increased more than 2.5 times, from about $75 billion in 2019 to about $196 billion in 2022, according to PitchBook, a database of private-market deals (Exhibit 2).3 That represents average annual growth of about 40 percent. In 2021, investment reached $183 billion, an increase of almost 90 percent from the previous year. From 2021 to 2022, the level of investments grew by nearly 7 percent. That kind of performance contrasts sharply with the overall private-market equity deal volume, which declined by roughly 24 percent from its 2021 levels.

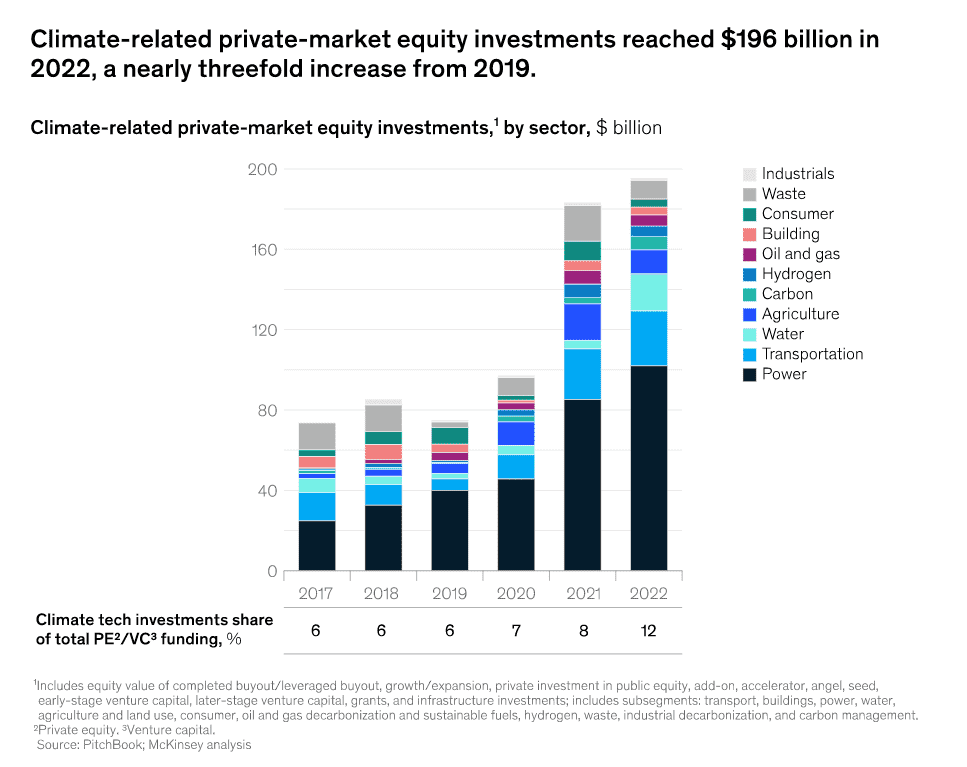

Climate-oriented equity investments in private markets have been spread across a range of subsectors (Exhibit 3). Power was the biggest recipient, taking in about 50 percent of the deployed capital from 2019 to 2022 as investment more than doubled, from $40 billion to $100 billion, benefiting from the continued momentum in large-scale renewables. Transportation came in second: investment increased by 370 percent during that period, from $6 billion to $30 billion, driven by the increasing adoption of electric vehicles (EVs). Hydrogen and carbon management—two prominent emerging fields—each represented only 3 percent of total climate-focused private-market equity investments in 2022. Nonetheless, they recorded the most significant growth in investment inflows since 2019: 460 percent for hydrogen (from less than $1 billion to $5 billion) and 1,400 percent for carbon (from less than $500 million to $7 billion) in addition to the significant corporate investments in these fields.

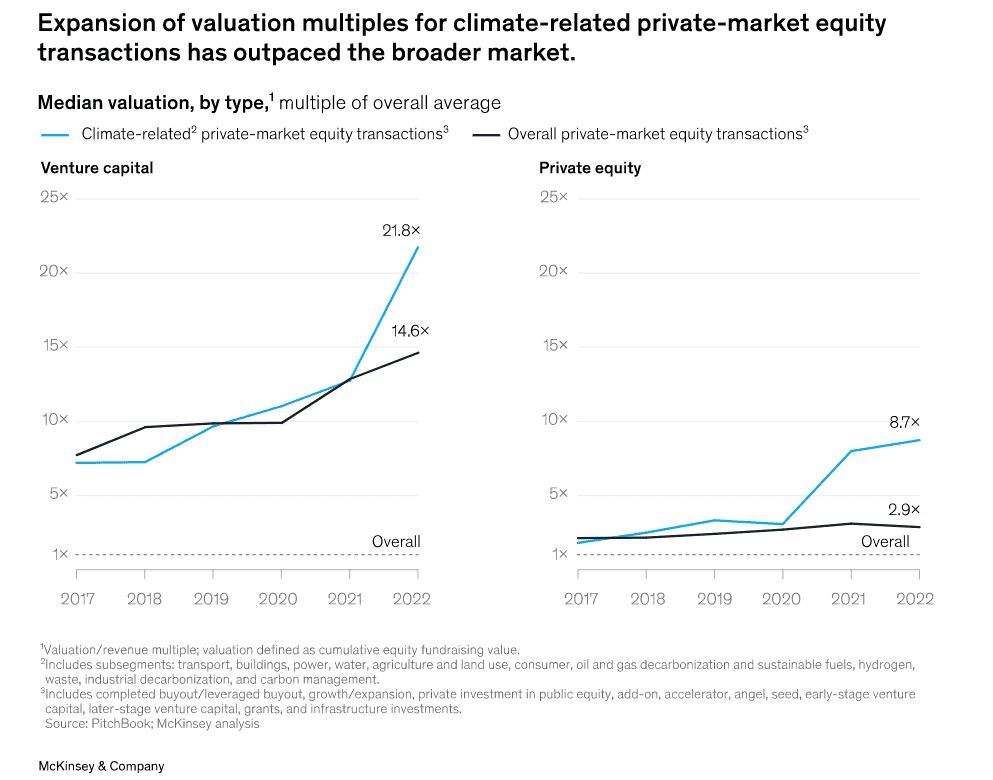

This inflow of capital has rapidly increased valuations (Exhibit 4). The median valuation-to-revenue multiple of climate-oriented equity transactions in private markets increased from about three in 2019 to about nine in 2022 for private equity deals and from about ten to about 22 for venture capital deals. Competition for climate-focused assets from corporate capital has put further upward pressure on valuations: some energy companies are tapping their vast cash reserves to acquire growth assets in the climate solution field—for example, BP America’s purchase of the renewable-natural-gas (RNG) provider Archaea Energy for about $4.1 billion and Chevron’s acquisition of the renewable-fuels player Renewable Energy Group for $3.2 billion.

Weathering the Downturn

The 2022 performance of private-market investments in climate technologies defied powerful macroeconomic and geopolitical headwinds that sent most global capital markets into considerable turmoil. In 2023, climate investing continues to face headwinds that have depressed both investor sentiment and the general economic outlook, slowing down capital markets across sectors and regions:

- High inflation—driven by a strong labor market, pent-up demand for services, and high government spending during the COVID-19 pandemic—has sparked a cost-of-living crisis around the world.

- Elevated interest rates to fight inflation have increased the cost of financing capital-intensive assets and projects while discounting the value of future cash flows for earlier-stage and growth companies. This is particularly salient for the lifetime economics of climate solutions, which often involve replacing ongoing operating expenses such as fuel with upfront capital expenditures—the deployment of solar- and wind-generation assets, for example.

- Supply chain constraints and labor shortages as economies emerge from the pandemic are increasing the cost of building and operating assets.

- An acute focus on energy security has overshadowed the push for sustainability as governments and companies, particularly in Europe, seek supplies of gas, coal, and, to a lesser extent, oil to ensure sufficient reserves for this winter and next.

The Difference this Time

Still, climate investing is well positioned to continue along its growth trajectory in this turbulent environment. The reason is a number of persistent, sector-specific tailwinds that have supported the recent rally and provide a stable, resilient foundation.

1. Clear Demand Signals, Particularly in the Context of the Energy Crisis

In reaction to the ongoing energy crisis, many countries have maintained—and in some cases increased—their short-term reliance on fossil fuels.4 Yet public and private entities alike have made comprehensive commitments to reduce greenhouse-gas emissions across industries and technologies. The number of companies pledging to set science-based targets, for instance, has increased more than fourfold over the past two years alone, reaching almost 2,000 in 2022. As of November 2022, around 140 countries had proposed or set net-zero targets that cover almost 90 percent of global emissions. In addition, 111 nations have made commitments to reduce methane emissions as part of the pledge launched by the United States and the European Union at COP26 in November 2021.5 The signatories, which account for 45 percent of global human-caused methane emissions, have committed to collectively reduce the emissions by at least 30 percent below 2020 levels by 2030.

Today’s pledges build on and go beyond the demand commitments that have supported early adoption of renewables—for example, the feed in tariffs (FITs) that supported solar and wind in the late 2000s and early 2010s. Multiyear offtake agreements for renewable fuels, low-carbon materials, and key input materials serve as indicators of sustained demand for climate and decarbonization technologies in the future. Furthermore, the energy crisis has highlighted the imperative of diversifying the energy supply base. Consequently, climate solutions—particularly in the power sector—have been rolled out in an accelerated fashion. In the United States alone, the demand for clean energy through corporate power purchase agreements has increased eightfold since 2015, to almost 20 gigawatts.6

2. Policy Support and Regulation

Governments, including in major economies, have taken significant legislative and regulatory action to support their climate and energy transition priorities. Since 2019, for example, the European Union’s Green Deal (2019), Fit for 55 (2021), and RePowerEU (2022) programs have progressively raised the target for emission reductions by member states. As part of these initiatives, the European Union has also expanded the coverage of its Emission Trading System (ETS) to incorporate new sectors, such as maritime and aviation. Most recently, the European Commission released in 2023 the Green Deal Industrial Plan, which includes incentives for domestic production and clean tech.7

In the United States, the Inflation Reduction Act (IRA) will deploy $370 billion in tax credits and other subsidies toward new energy solutions. In 2021, China introduced an emissions-trading system that covers carbon emissions from power plants. Since then, its carbon market has become the world’s largest: three times the size of the European Union’s.8 Government actions—whether in the form of mandates (such as emissions reductions), subsidies (such as investment or production tax credits), or market design (such as carbon pricing)—continue to be major catalysts for climate solutions.

3. A Decline in Green Premiums for Climate Solutions

Several mature climate solutions, such as utility-scale solar or wind, have already achieved cost parity—or discounts—compared with fossil-based alternatives. Consequently, they can access large value pools. Solutions in earlier stages of development, such as grid-scale storage or hydrogen, still command green premiums. However, these have declined over the past several years, a trend that is set to continue with accelerating deployment. As an example, while the cost of clean hydrogen has increased recently—largely spurred by construction costs—McKinsey analysis suggests significant cost reductions through the 2030s that will eventually result in cost parity between green hydrogen (produced using renewable power) and gray hydrogen (produced using natural gas), especially in countries with abundant low-cost renewables, such as Australia, Chile, and China.9 Similarly, our modeling shows that the total cost of ownership (TCO) for medium- and heavy-duty battery EVs will be lower than the TCOs for their internal-combustion-engine (ICE) counterparts as soon as 2025.10

4. Alignment in the Capital Markets and the Financial System

Despite recent market upheavals, the financial system broadly—and asset owners in particular—remain aligned around financing the energy transition. Most prominently, more than 450 financial institutions belonging to the Glasgow Financial Alliance for Net Zero have pledged about $130 trillion toward net-zero goals. The largest and most sophisticated investors in energy, industrials, and infrastructure are all turning their attention to investment opportunities across a range of climate technologies, and in many cases they are launching dedicated vehicles to pursue these investment opportunities. Investors and lenders have shown the ability to decrease the cost of capital for climate technologies as they mature, such as in utility-scale wind and solar projects, and now will need to work through similar journeys on the next horizon of technologies.

The largest and most sophisticated investors in energy, industrials, and infrastructure are all turning their attention to investment opportunities across a range of climate technologies.

5. Coalition Building and the Emergence of Ecosystems

The deployment of climate technologies at scale often requires systemic change across entire value chains. The World Economic Forum’s Clean Skies of Tomorrow initiative, for instance, aims to enable airlines to make and fulfill commitments to sustainable aviation fuel. Cross-sector collaboration and standard setting are also required: for example, the Voluntary Carbon Markets Integrity Initiative aims to create a common code to inform the purchases of corporations and guide their claims for carbon credits. Such initiatives create transparency and promote the pooling of risk and investments, thereby helping to achieve step changes in decarbonization within and across sectors.

Doing Good Deals Well

Although these climate-focused tailwinds are set to persist, our analysis shows that the landscape for investors in the sector is likely to remain as complex as it was in 2022, given the more challenging macroeconomic outlook. To succeed in this environment, investors will need to exercise great caution to ensure that acquisition targets are not only well positioned to capture the tailwinds but also insulated from macro headwinds.

We offer a framework for identifying such investment opportunities below. Specifically, we’ve developed eight factors, across two categories, that investors can apply to assess climate-focused deals. The first four factors are fundamental dealmakers or deal breakers, and the last four are emerging priorities that we expect to become table stakes for sophisticated investors.

Dealmakers or Deal Breakers

The first four factors are demonstrated technology and operational performance, a clear path to cost competitiveness, the ability to secure captive demand, and a leadership track record and the ability to attract talent.

Demonstrated technology and operational performance. Emerging technologies need a credible fact base to support any claims that the market needs the solution they offer (increased energy density for battery technology, for example, or decreased thermal and water requirements for direct-air carbon capture). Investors will want to seek as much proximity to real-world conditions as possible (for example, the ability to replicate yield performance via continuous manufacturing rather than one-off production in the lab). Investors will also prefer objective third-party verified results over in-house tests. To attract later-stage private equity capital, the path to commercial-scale production and adoption should be clear, if not yet proven.

These technologies should also demonstrate a practical path toward hitting performance and cost thresholds, as well as a foundation for appropriately calculating risks in their go-forward road map, leveraging insights from the deployment of earlier projects and from analogous journeys of other technologies: for example, 99 green-hydrogen projects have been launched and are now operational in the United States, the European Union, the United Kingdom, and China. The projects have helped to demonstrate the technical and economic feasibility of at-scale electrolysis. The technology is now set to scale up rapidly: according to the Hydrogen Council, the industry had announced 680 large-scale clean-hydrogen project proposals as of the end of May 2022, an increase of more than 160 since November 2021.11 Of these projects, 61 are gigascale (more than 1 gigawatt of electrolysis for renewable or more than 200,000 metric tons a year of low-carbon hydrogen supply).

A clear path to cost competitiveness. Any solution should have a viable path to achieving a cost advantage (or a durable premium position in the market) compared with incumbent offerings and alternative disruptors. The key factors for achieving a cost advantage include an accelerated learning rate, economies of scale, and design improvements. New mass-market EVs, for example, have a TCO advantage over ICE vehicles in several markets. Our research estimates that in China, heavy-duty fuel cell EVs will achieve cost parity with incumbent ICE vehicles—or even discounts—by 2025 to 2030 because of low-cost renewable power and cheap hydrogen electrolyzers.12

The ability to secure captive demand. A solution should meet a near-term need for customers to make them willing to buy it or to make offtake commitments. RNG developers, for example, are securing purchase agreements for over five (and often ten to 15) years for fuel production and the issuance of associated credits. That strong demand signal has catalyzed a growing number of partnerships in RNG. These include oil and gas companies willing to co-invest in assets and infrastructure alongside private capital to support the scaling of local waste- and agriculture-based producers and to secure preferential access to future supplies of fuel and credits. In the voluntary carbon markets—carbon removal, in particular—Frontier Climate has secured advanced purchase commitments from a number of corporations to accelerate project development and improve access to capital for innovators. A similar trend is manifesting itself in the liquid-clean-fuel sector: project developers for power-to-liquid fuels (for instance, e-methanol to decarbonize the shipping industry) identify and lock in offtake well before they design the first project. Understanding and leveraging downstream decarbonization needs and commitments are often crucial to secure this demand.

A leadership track record and the ability to attract talent. The leadership team ought to have the experience and skills to navigate the next chapter of rapid growth. There should, for example, be a compelling plan to attract and develop talent. Early-stage, high-growth companies must look beyond the skill sets that initially made them attractive to investors and quickly build the capabilities to deploy the next round of capital effectively. For capital-intensive climate solutions, this requirement involves capabilities such as capital project execution, project financing, offtake negotiations, and workforce management—not typical focus areas for early-stage technology disruptors. To support the rapid buildout of first-of-a-kind facilities, advanced battery manufacturers, for example, have hired experienced operations leaders from the automotive, semiconductor, and solar sectors.

Soon-to-be Table Stakes

Soon, the ability to access and capture policy support and incentives, the readiness to hyperscale, a financing road map and a path to lower-cost capital, and the ability to create and leverage ecosystems will become table stakes as well.

The ability to access and capture policy support and incentives. The policies designed to catalyze energy transitions across economies are central considerations in assessing climate-focused investment opportunities today. So too is the impact of those policies on the economic viability of individual solutions. While previous policies have been instrumental in the historical adoption of climate technologies, an expanding set of technologies will struggle to create value for investors without incentives or policies, which can affect the market at the macro level (supporting adoption across an entire sector) and the micro level (product or asset-level unit economics).

Technologies that benefit from macrolevel policy tailwinds include sustainable aviation fuel—a way airlines plan to meet their government-imposed decarbonization mandates. More broadly, in the European Union, a range of green technologies is benefitting from higher ETS prices (which reached €100 per metric ton in February 2023). That impact will likely soon be apparent in additional sectors (such as shipping and buildings) as a result of the extension of the ETS as part of the Fit for 55 initiative.

The US Inflation Reduction Act, by contrast, includes many unit-economic incentives that could make a wide range of climate technologies significantly more attractive: the act’s 45Z provision, for instance, provides up to $3 per kilogram in production tax credits to clean-hydrogen producers. Similarly, a sizable increase in 45Q tax credits for CO2 storage creates a tailwind for US carbon capture ventures: up to $180 per metric ton of stored CO2 in the case of direct-air capture.13 To maximize the value of these incentives, investors can consider strategic control points along value chains, and sound analysis will help them avoid credit “leakage.” Examples could include onshore battery manufacturers with integrated lithium-sourcing operations.14

The readiness to hyperscale. Disruptive climate technology companies are often celebrated for their technology innovation, yet many executives (and their investors) would cite the ability to rapidly scale their execution capabilities as even more critical to their success. The demand for climate technologies can often surpass a growth-stage company’s ability to deliver—bringing forward the need to scale up manufacturing capacity, build efficient yet resilient supply chains, streamline operational processes, recruit and onboard talent at scale, and forge external partnerships.

Although capital-intensive companies have often taken a linear approach to building and scaling in the past (for instance, by proceeding one plant at a time), companies in the climate tech space are applying approaches that significantly shorten time to market and allow for the kind of exponential growth that was mostly known only to digital companies. Key concepts include parallel scaling, rapid standardization, and modularization. EV manufacturers, for example, are developing standard, modularized production lines to allow for easy upgrades and add-ons as products develop and to allow rapidly scaling facilities.

A financing road map and a path to lower-cost capital. Climate technology companies should have a clear path to reach derisking and growth milestones that help them build a balance sheet that expands to include lower-cost equity, project finance, and debt at scale. This factor will be particularly critical for capital-intensive climate solutions (such as hydrogen, carbon capture, and battery manufacturing) that require raising significant capital, building many first-of-a-kind facilities and projects, and educating investors and lenders to realize their scale aspirations.

A particular challenge will be the journey across the “valley of death” from venture capital (financing technology development and first demonstration) to project financing and debt capital (financing first-of-a-kind projects and future growth). There are several markers of success for companies that navigate through this journey: clear and committed demand from credit-worthy customers; secured access to feedstocks or input materials; a strong track record of meeting production, cost, and growth targets; and the ability to structure projects or financing vehicles with clear, stable cash flows.

The ability to create and leverage ecosystems. Decarbonizing complex industrial sectors entails transforming entire value chains. That will require cross-industry coalitions and collaborations beyond the typical boundaries of companies. To overcome supply chain uncertainties, for example, automotive and battery producers have established direct agreements with mines to secure lithium and other raw materials critical for the manufacture of EVs. Wind developers have engaged with their tier-two suppliers of processed materials to lock in supplies of critical resources for their tier-one turbine OEMs.15 Partnerships among competitors (such as carbon capture hub coalitions in the United States) are also emerging as a model to share capital burdens and deliver scaled solutions.

Staying Disciplined in the Next Chapter

The current momentum in climate-focused investing suggests that the space is breaking out—not breaking down—in the face of market complexity. Concerns about another cleantech hype cycle like the one that unfolded from 2009 to 2011 are fading in the minds of investors. Today’s climate investors continue to forge ahead and are actively pursuing deals, supported by the fact that among the 104 funds that have disclosed their dry powder, more than 35 percent of the capital is still available to deploy. In addition, new funds are being launched each month, and a growing range of investors now focus on climate solutions. In this context, it’s not clear if the investable universe of climate technology companies is growing at the necessary pace. These factors, combined with continued macroconomic and geopolitical uncertainty, mean that investors in the sector will need to be disciplined in the years ahead.

It will also be critical to gain perspective on the scale of the recent deployment of capital into climate solutions: the $196 billion of climate-focused private-market transactions by venture capital, private equity, and infrastructure investors is merely a fraction of what’s needed to achieve a net-zero pathway. (However, $196 billion is only a portion of the overall capital deployed for climate solutions.) Achieving net-zero emissions by 2050 will mean a transformation of the global economy and how we deploy capital: McKinsey estimates that, on average, it will require $9.2 trillion in annual capital spending on physical assets for energy and land use systems—about $3.5 trillion more than is spent today.16

The field of climate investing has now built a more solid foundation. Yet a new quantum of capital deployment will be required in the next chapter to meet the commitments of private- and public-sector leaders around the globe. Much more remains to be done to scale up climate investing. Identifying the most promising and resilient technologies today will affect the long-term prospects of the entire climate solution space. By extension, these investments will also determine our ability to accelerate the energy transition and achieve at-scale decarbonization in the years and decades ahead.

ABOUT THE AUTHOR(S)

Fredrik Dahlqvist is a senior partner in McKinsey’s Stockholm office, Sean Kane is a partner in the Southern California office, Lisa Leinert is an associate partner in the Zurich office, Maximilian Moosburger is a consultant in the Stamford office, and Anders Rasmussen is a senior partner in the London office.

The authors wish to thank Sara Bernow, Will Glazener, Jess He, Filippo Lodesani, Mark Patel, and Harshvardhan Sanghi for their contributions to this article.

The article was first published here.

Photo by Markus Spiske on Unsplash.

5.0

5.0