Being a board director is a very interesting but arduous job, because with great power comes great responsibility (to quote Spiderman). It is ideal to have a board of directors armed with a range of expertise and abilities to fulfil the board’s fiduciary duties. In this regard, one area that is often overlooked is the understanding of market perceptions of corporate exercises taken by the board.

If a company is listed on Bursa Malaysia, surely it would be ideal to have the share price reflect the fundamentals of the company, especially when the going is good. True, but not always practised. In my decades of being in investment banking, analysing corporate manoeuvres across various sectors and companies, I find that many a time, the board and management completely misinterpret or misunderstand the impact of the transaction and are confused thereafter as to why the market did not react positively. Don’t get me wrong — management and boards should not be fixated by short-term share price movements but must take a longer-term view on corporate exercises.

As food for thought for boards and management, here are some common pitfalls or mistakes in Malaysian corporate practice.

Big is Not Always Beautiful

Being big is not attractive in itself. Some Malaysian firms brag about “being the largest company in the industry” or “having a land bank the size of Singapore”. Having a large asset base without extracting the full benefits of the economies of scale from the size of the operations suggests, however, that one has a lazy balance sheet, which is yielding poor returns.

Investors are more focused on returns, which is the ability to optimise the profits of an asset in hand, akin to squeezing blood out of stone. Investors will make a marked distinction between size and returns when valuing a company. For example, Top Glove Corp Bhd is the largest glove manufacturer in the world, but Hartalega Holdings Bhd’s returns are the most attractive among the large Bursa-listed glove companies in Malaysia. Although not the largest, Public Bank Bhd is seen as the most cost-efficient and has the highest return on equity (ROE), and therefore commands the highest valuations among Bursa-listed banks.

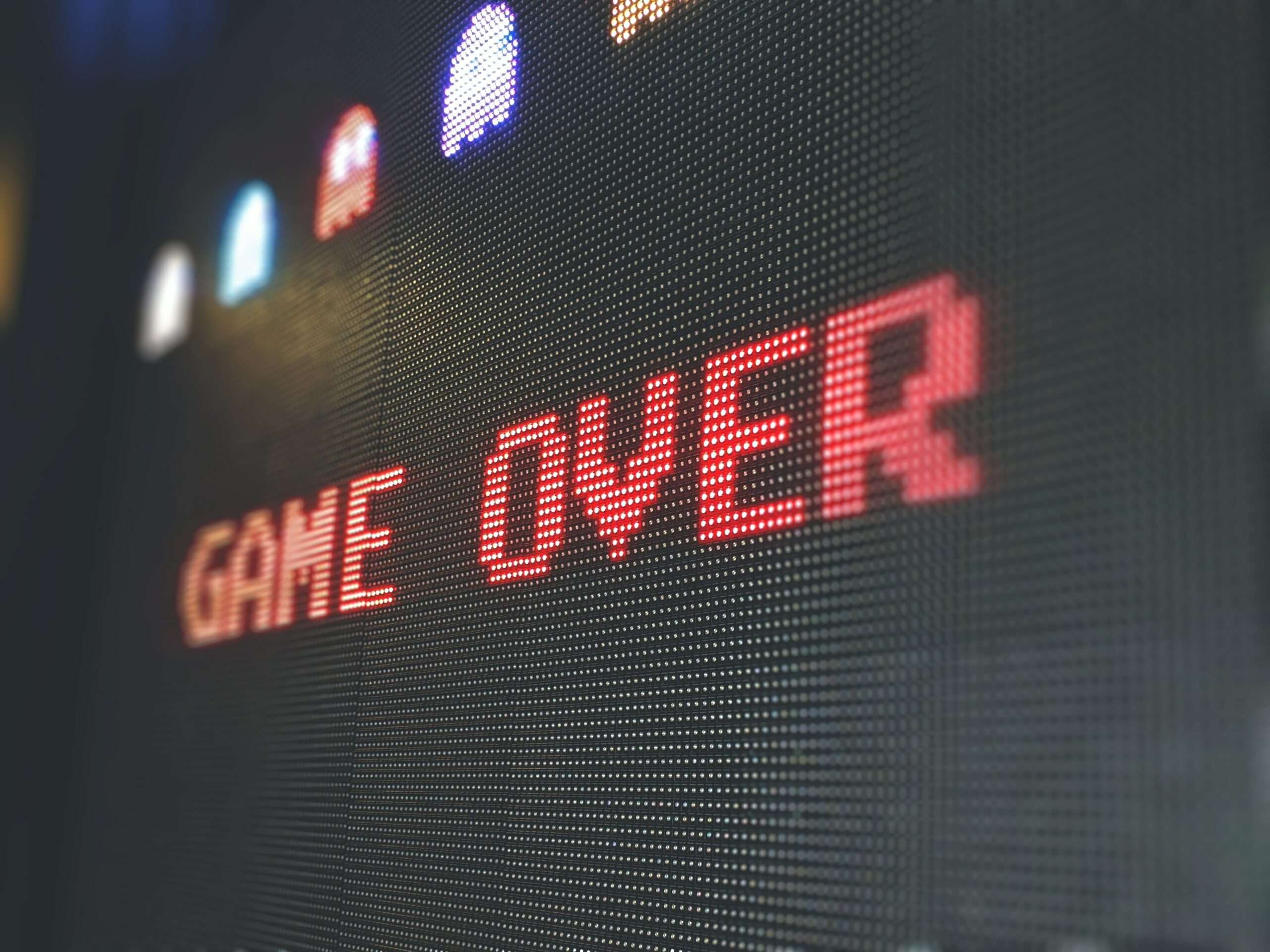

Herd Mentality in Business Decisions

Just because others are rushing into a new business or industry does not mean that your company should get carried away too. I have witnessed many occasions where companies rush into businesses that are “in vogue” but have done very little homework on the risks of venturing into a new business.

Sometimes, it is prudent to stick to what you know best. The many examples in Malaysia include entrepreneurs investing in standalone biodiesel plants with no supply contract of raw materials. Another example is property companies diversifying into the oil and gas business when oil prices surpassed US$100 per barrel in the last rally, just to get their fingers burnt very badly when oil prices crashed, following the global financial crisis. What about a property company venturing into the glove business during the pandemic?

These “out-of-tangent” transactions do not usually end well — many more will fail compared with the few that succeed.

What’s in vogue today? Glove manufacturing and start-ups; watch this space. By extension, if herd mentality is not good practice, then should one do the opposite? If evaluated properly, striking when there is blood in the streets or when distressed assets are plentiful will allow for M&A at undervalued prices, and upside surprises rather than downside shocks. One example is YTL Corp Bhd’s acquisition of Wessex Water, a regulated asset in the UK, when Enron sunk into a cash-flow crunch, as well as its acquisition of Taiping Consolidated Bhd below book value during the Asian financial crisis.

Buying a Poorly Managed Company Can be Your Best Investment

Buying a poorly managed company is not a bad thing if the price is cheap enough, as there must be lots of low-lying fruits and ample room for improvement. Buying a well-managed company at full price is not a good idea at all, as there is no longer any upside. The fully priced company can head in only one direction — down — if it has reached its operational peak. I have heard of boards taking the “we must get the asset at any price” approach — this is not the right attitude. Bidding too high a price will result in the “winner’s curse”, where one is so caught up in winning the tender that one loses sight of the intrinsic value or true worth of the asset.

Related-Party Transaction is a Big No-No

Regardless of the synergistic benefits or the price, related-party transactions are red flags for investors. The investment community’s natural reaction is pure scepticism towards related-party transactions, owing to the obvious conflict of interest. There are countless related-party transactions that have not ended well. In 1998, the major shareholder of a plantation-cum-property company decided to inject his private property development into the listed company. Investors voted with their feet and, within a month of the announcement, the company had lost more than 30% of its market capitalisation. The transaction was eventually pulled by the company. Four decades ago, a family wanted to inject its private island into the listed entity — a huge hue and cry ensued and the deal was called off, but it took decades to convince investors it had learnt its lesson. A serial proponent of related-party transactions is a cash-rich international gaming company. Each time the major shareholder is under some cash-flow duress, a related party transaction is almost sure to happen, and the pattern has been repeated throughout the decades. Owing to doubts over corporate governance, this company continues to trade below its intrinsic value, seemingly perpetually undervalued.

Venturing Overseas is Sexy but …

Some companies that succeed in Malaysia forget that they are on home turf, where one understands the nuances of doing business in one’s own backyard. Being successful in Malaysia does not mean that one has a winning strategy to venture overseas. Doing business in a foreign country is akin to walking through a landmine. While some dream of being a multinational company, stop and think whether the “copy and paste” strategy works in a foreign country. It usually does not.

There are, of course, success stories, such as Genting Bhd’s casino in Singapore; Malaysian plantation companies — Kuala Lumpur Kepong Bhd, Sime Darby Plantation Bhd and Genting Plantations Bhd — in Indonesia; property companies such as S P Setia Bhd, IJM Land Bhd and EcoWorld Development Group Bhd in the UK; and Malaysian banks such as CIMB Group Holdings Bhd and Malayan Banking Bhd, which have spread their wings in Southeast Asia. But more so than ever, companies will find that the learning curve is very steep and the high “tuition fee” is painful to bear. There are more horror stories than champagne celebrations when venturing overseas.

The Refusal to Recognise Failures and Put a Stop to it

Boards and management should not be emotional about assets. After numerous futile attempts to turn a failing project around, it is time to bid it farewell. When management has no bandwidth to make the asset succeed, do the next best thing — dispose of the asset! It is best to undertake damage control, reduce the bleeding by admitting defeat and move on. There are many examples in this category where the disposal should have been done earlier — a property company that could not turn around a British retail chain, a telco company that held on to loss-making foreign ventures and a construction company with no reason to own a battery technology firm.

Tan Ting Min is a former head of equity research at Credit Suisse (M) Securities. She is currently an independent non-executive director of Sime Darby Plantation Bhd, Sime Darby Oils Ltd, New Britain Palm Oil Ltd and IJM Corp Bhd.

5.0

5.0