Survey respondents reporting increased ESG impact say their organisations focus on both protecting and creating value.

It is becoming increasingly essential for companies to understand and address the effects that externalities can have on their social license.[1] The latest McKinsey Global Survey on environmental, social, and governance (ESG) issues asked more than 1,100 respondents in more than 90 countries how their organisations are rising to this challenge.[2] More than nine in ten respondents say that ESG subjects are on their organisation’s agenda. While environmental topics are recently the ones making headlines, just one-third of respondents rank environmental issues as their organisation’s greatest ESG priority.

Survey respondents report that their organisations are not just paying lip service to ESG: many say their organisations are making meaningful ESG changes that have demonstrable benefits. More than two-thirds of respondents say their organisations have achieved broad impact from their ESG efforts in the past three years, and 43 percent report that their organisations have captured financial value from their ESG investments over that span—suggesting that the full effects of ESG are multivariable and may take time to fully capture. For example, one-third of respondents say their organisations’ work with ESG topics has a strong positive effect on their own commitment to the organisation and, in turn, to overall employee retention, consistent with the notion that ESG can underpin both value and values.[3]

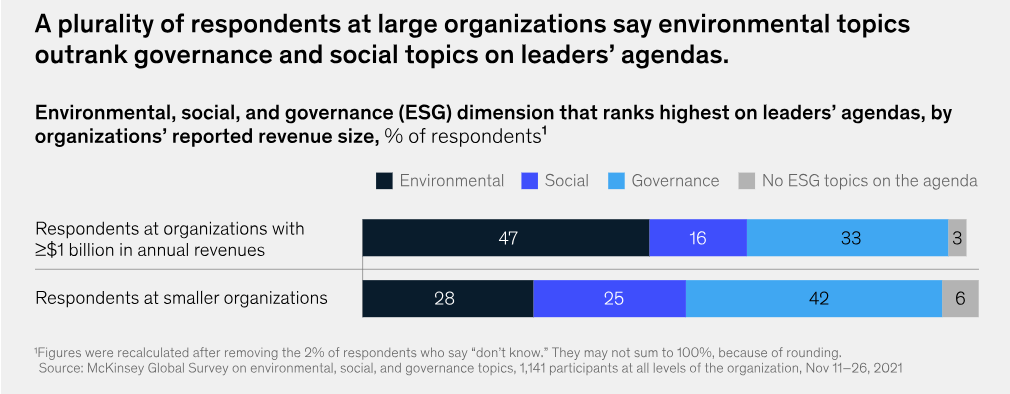

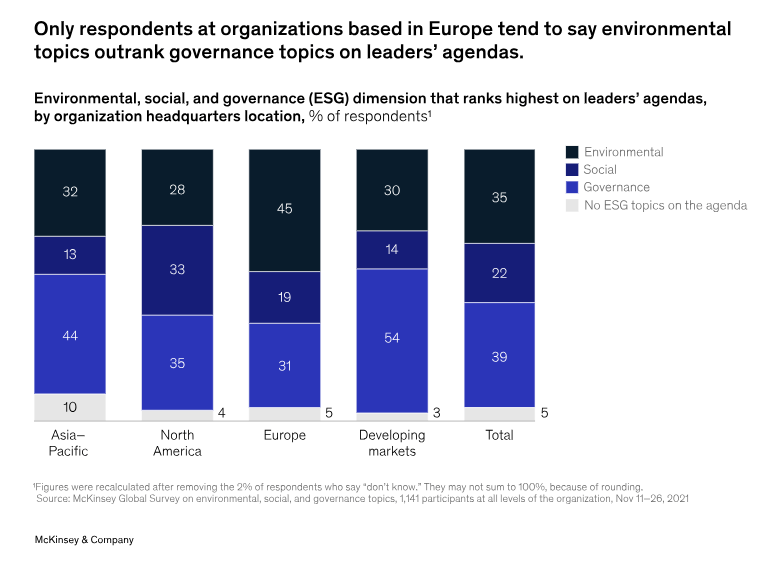

Other survey findings about how organisations are approaching environmental, social, and governance (ESG) efforts differ between respondents at large and smaller companies. Respondents who say they work for organisations with at least $1 billion in annual revenues are nearly 1.7 times more likely than those at smaller organisations to say environmental topics outrank social and governance topics on their leaders’ agendas (Exhibit 1). Those at larger companies in Europe and North America report higher prioritisation of environmental and social topics than governance topics, whereas the opposite is true in other regions.

When asked which specific ESG topics have the biggest effect on respondents’ organisations, respondents at larger organisations are more than twice as likely as others to point to climate change and greenhouse gases, while respondents at smaller organisations are much more likely to cite governance structure.

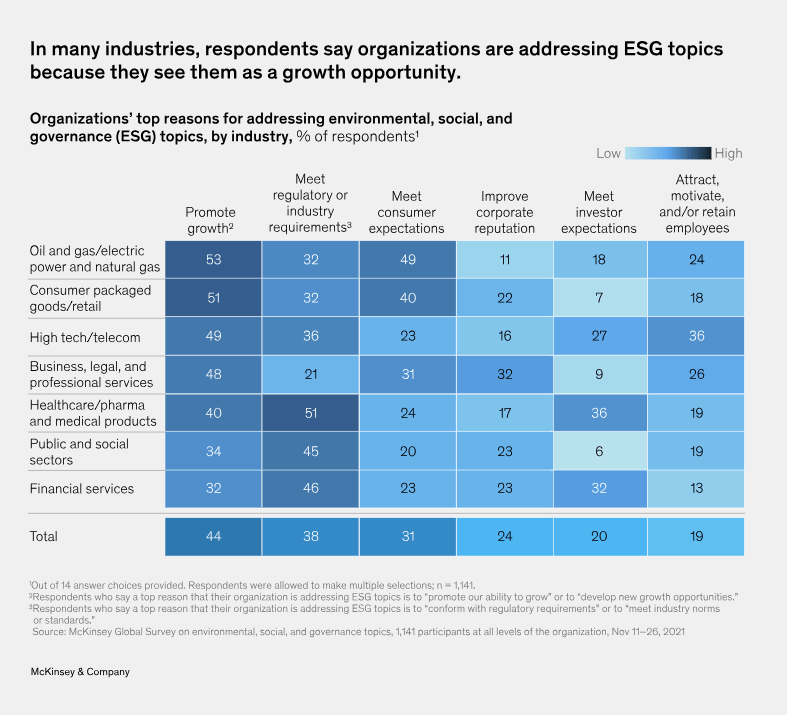

Exhibit 1

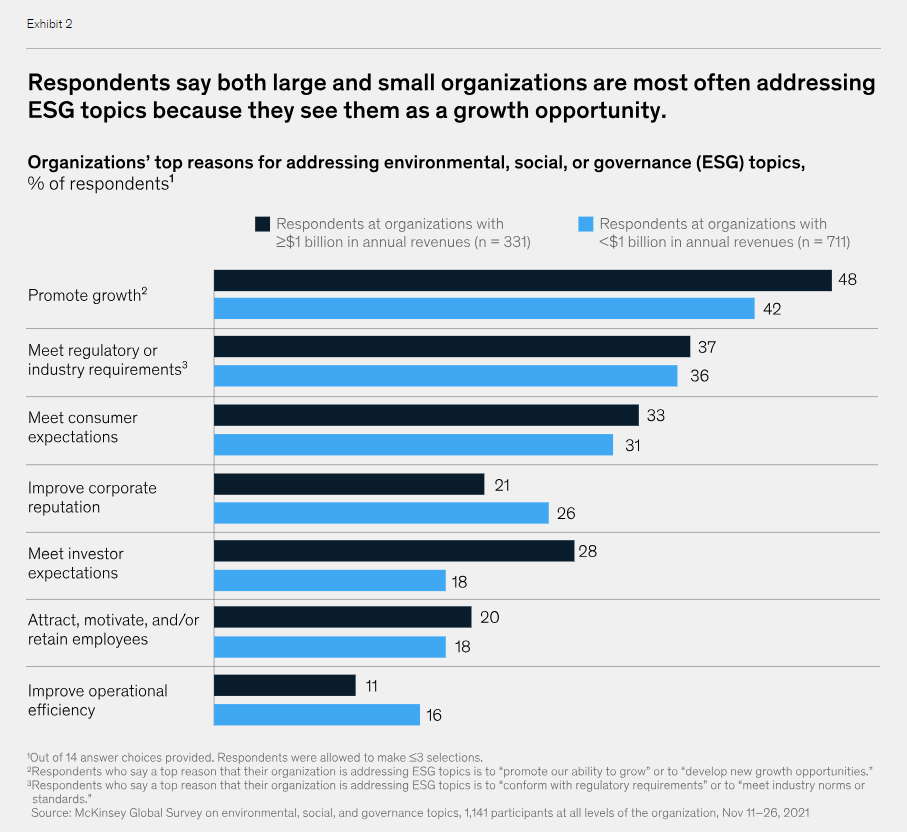

The survey results suggest that organisations’ motivations for pursuing ESG efforts also can differ by size. Respondents at both large and small organisations most often cite growth as a top reason for addressing ESG topics, followed by meeting regulatory or industry expectations. Yet that focus on growth—as well as on investor relations—is more commonly reported by respondents at larger organisations (Exhibit 2).

What’s more, responses from larger companies suggest differences in the leadership and organisation of their ESG efforts. While 24 percent of these respondents say their organisations have a chief sustainability officer in place who oversees ESG topics, just 10 percent at smaller organisations report that role, and they are much more likely than their large-company peers to say no one oversees ESG topics at all. At large organisations, respondents say the leader of ESG topics also oversees a variety of ESG-related functions—the corporate affairs or government relations, legal, communications, and philanthropy functions—much more often than smaller-organisation respondents do.

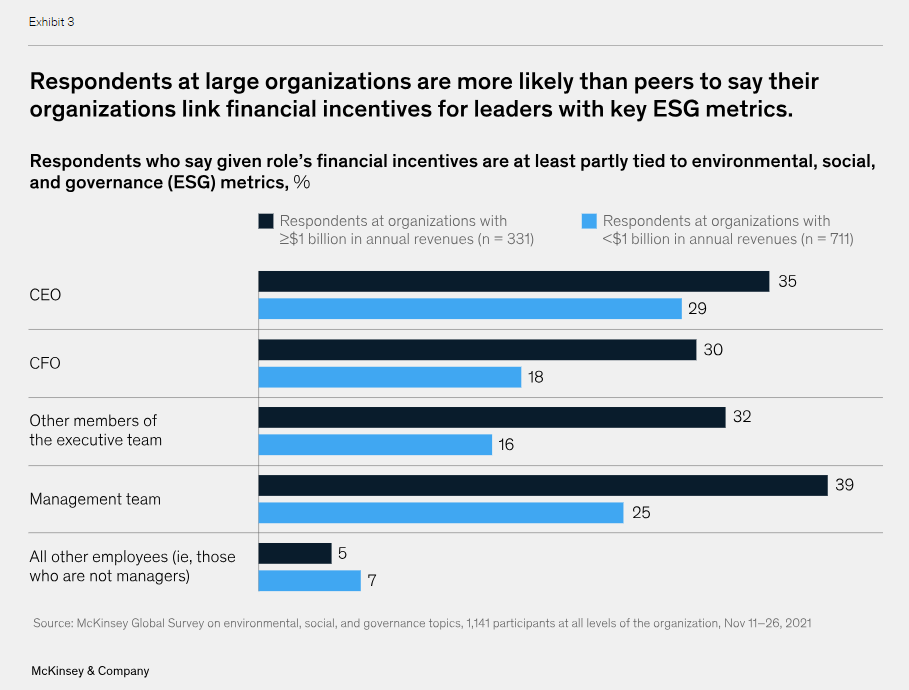

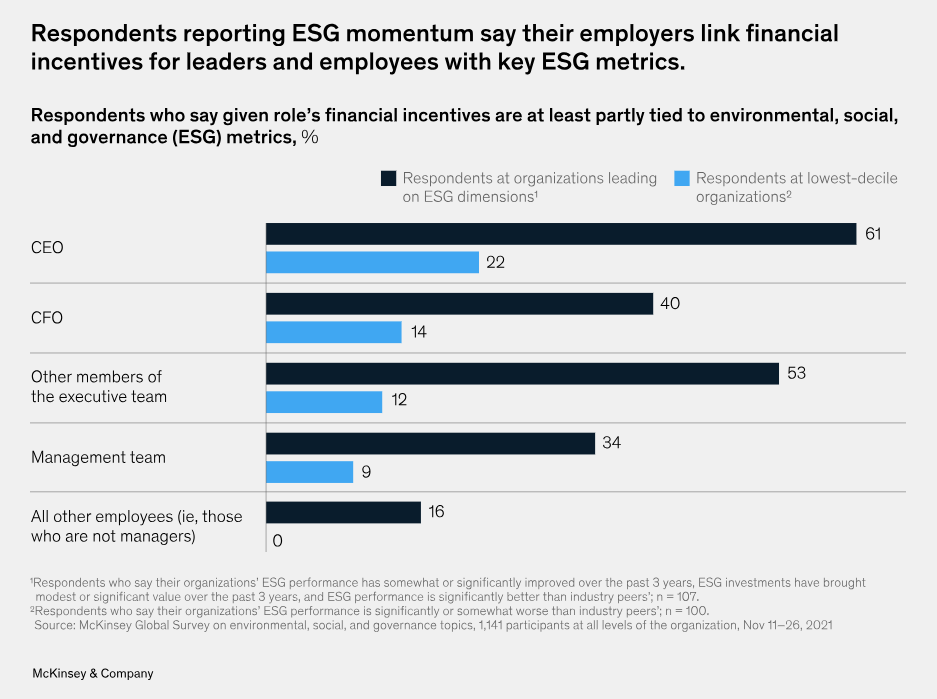

Those at larger organisations are also nearly twice as likely as others to say their organisations have an ESG team of more than five employees, with a median of eight employees.[1] They also report federated governance of ESG projects much more often than respondents from smaller organisations do, and they say their companies embed key ESG impact metrics into leaders’ incentives more often than their smaller-company peers do (Exhibit 3).

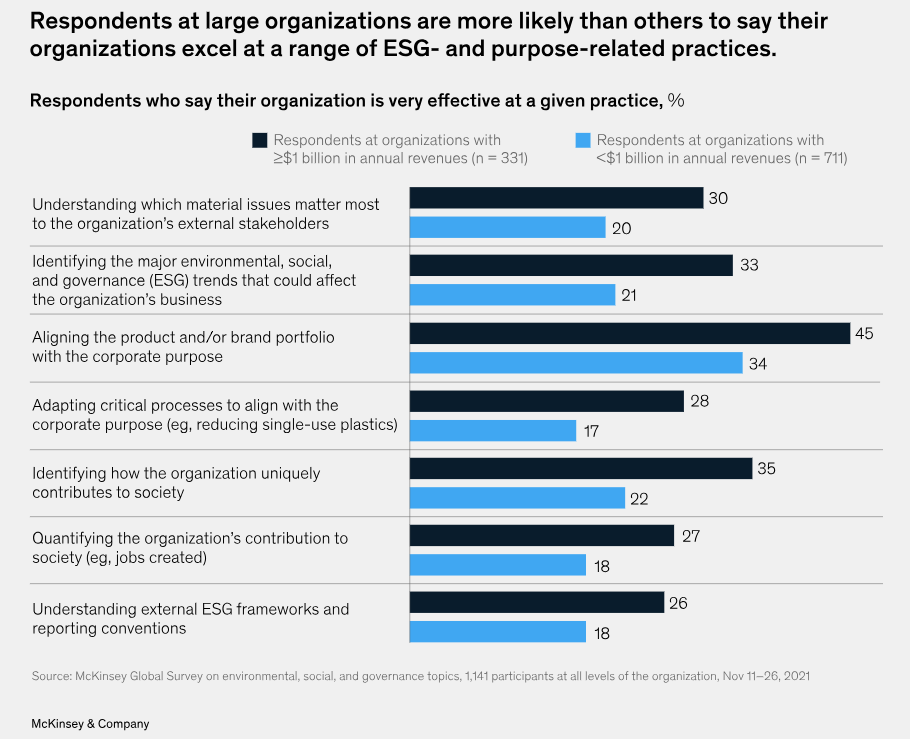

Finally, respondents from larger organisations rate their effectiveness at core ESG- and purpose-related practices more highly than others do (Exhibit 4). Furthermore, they report progress more often: they are 1.5 times more likely to say their organisations’ ESG impact has significantly improved in the past three years, compared with their smaller-company peers.

Survey respondents who report that their organisations have both created financial value and increased broader impact from ESG—the two conditions for what we call “ESG momentum”4—point to seven organisational traits.

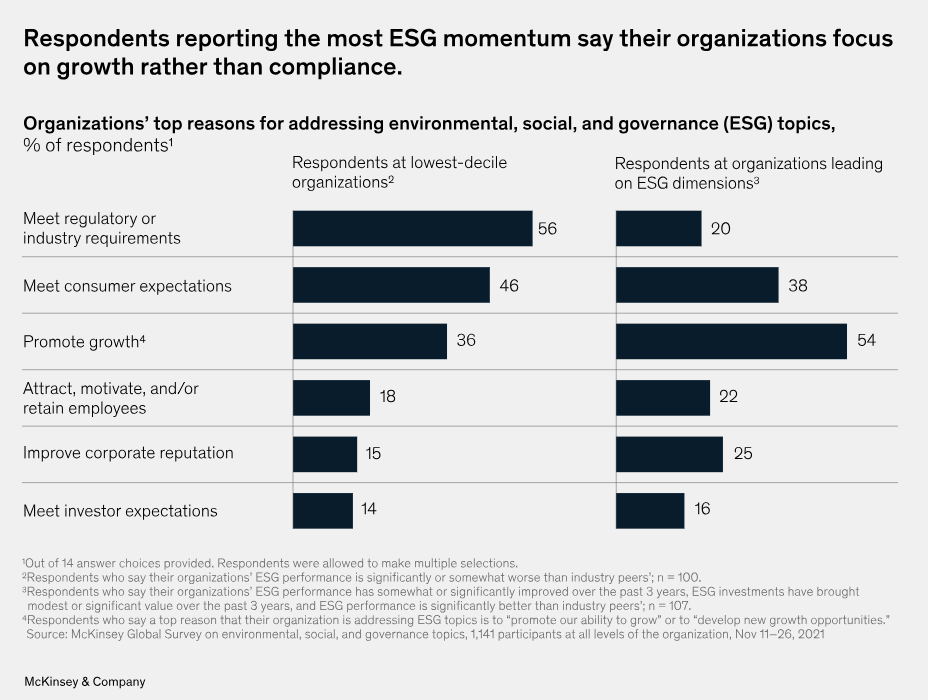

First, their organisations approach ESG from a growth perspective. The organisation’s priorities, respondents report, exceed merely conforming to industry standards or regulatory requirements and aim toward unlocking new opportunities.

Second, they report that their organisations strive to connect with external stakeholders and to be accountable to them.

Third, they identify specific stakeholder priorities for which their organisations are uniquely placed to excel; respondents say, further, that their organisations strive to make these priorities a core part of their business strategy.

Fourth, respondents say their organisations empower a specific executive in the C-suite to work with the CEO in defining and achieving ESG ambitions.

Fifth, their organisations build a central ESG team—which is not the same as building a large team. Respondents also say their organisations bring together talent from across the organisation to help meet ESG goals.

Sixth, their organisations make considered efforts to embed purpose into multiple aspects of their business.

Seventh, their organisations tie ESG metrics to compensation, using KPIs to gauge progress on ESG objectives.

All told, survey respondents who identify their organisations as leading in ESG see their efforts as a means of both protecting and creating value.[5]

In the survey, 93 percent of respondents say at least one ESG dimension—an environmental, social, or governance topic—is on their organisation’s agenda. While survey responses suggest that organisations broadly seem to recognise the importance of ESG overall, approaches and areas of focus vary by sector, industry, and region, consistent with differences in materiality.

Responses indicate that organisations in many industries are going beyond merely trying to meet regulatory requirements and view ESG as a growth opportunity. Promoting growth [1] is the reason that respondents most frequently cite for their organisations addressing ESG topics. This is a particularly common motivator for organisations within the energy sector, while compliance with regulations and industry norms are the most-cited motives by respondents in healthcare and pharmaceuticals, financial services, and the public and social sectors.

The ESG dimensions receiving business leaders’ focus vary by geography and company size. While environmental issues are increasingly being featured in headlines globally, responses suggest that Europe is the only region where environmental topics tend to outrank governance on leaders’ agendas. According to respondents, social topics are of outsize concern among organisations based in North America, where diversity, equity, and inclusion issues have come to the forefront in recent years. On the other hand, respondents working for organizations with headquarters in Asia–Pacific and developing markets tend to rank governance topics as their organisations’ most important ESG priorities.[1]

Looking by company size, respondents at organisations with annual revenues of $1 billion or more are much more likely than others to say environmental topics outrank social and governance dimensions on their leaders’ agendas (see accordian above, “What respondents say larger companies are doing differently”).

Seven Traits that Respondents Say Organisations lLeading on ESG Dimensions Have in Common

Our findings reveal seven traits of organisations that, respondents report, have developed clear ESG momentum. We compare responses from survey participants who say they work for leading, top-decile organisations against those who say they work for the lowest-decile organisations, as scored by self-reported ESG progress. [6]

1. Sights set on growth. Respondents who report working for an organisation leading on ESG dimensions are 1.5 times more likely than respondents from reported bottom-decile organisations to say their organisations approach ESG topics with the aim of promoting growth. Respondents from the lowest-decile organisations, on the other hand, are 2.8 times more likely to say ESG efforts are focused on conforming to industry standards or regulatory requirements.

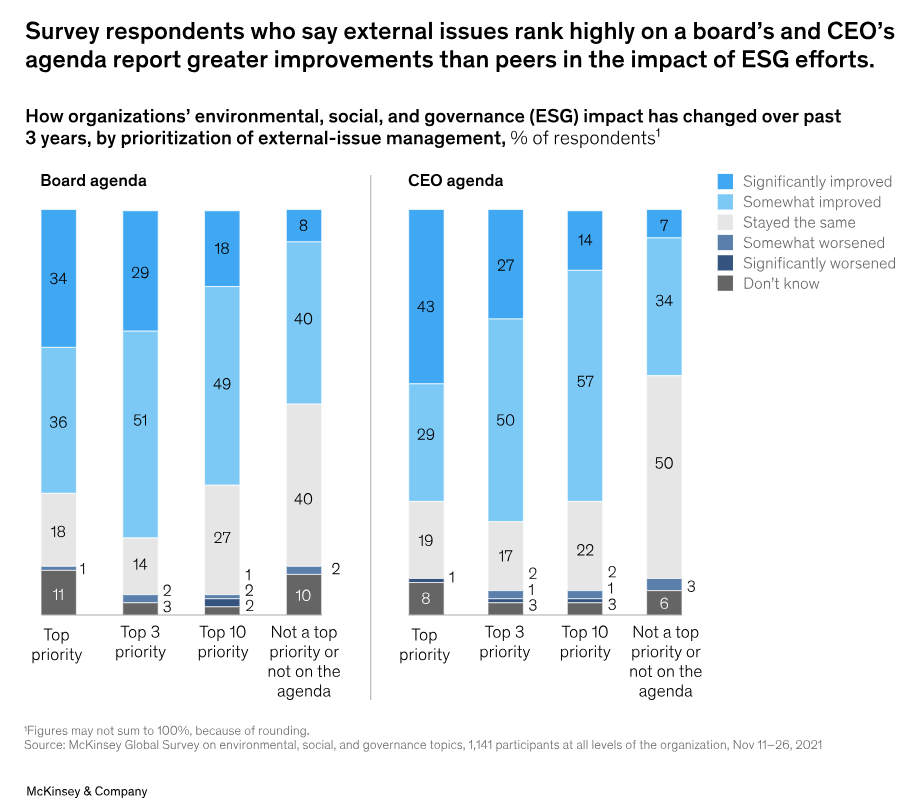

2. Board directors and senior leaders who connect with external stakeholders. Respondents who report that their organisations have built ESG momentum are more likely than those at reported lowest-decile organisations to say their organisation’s board members, CEOs, and CFOs connect with external stakeholders and feel accountable to them.

Also, the higher that respondents say external engagement is on their board’s and CEO’s agenda, the more progress they report that the organisation has made with its ESG impact over the past three years. For example, respondents who say their organisation’s CEO makes external engagement their top priority are three times as likely as those reporting it as a top ten priority to say their organisation has seen significant improvement in its ESG impact. Moreover, the higher that respondents say ESG is on the CEO’s agenda, the more likely they are to report that their organisation has captured significant value from ESG investments.

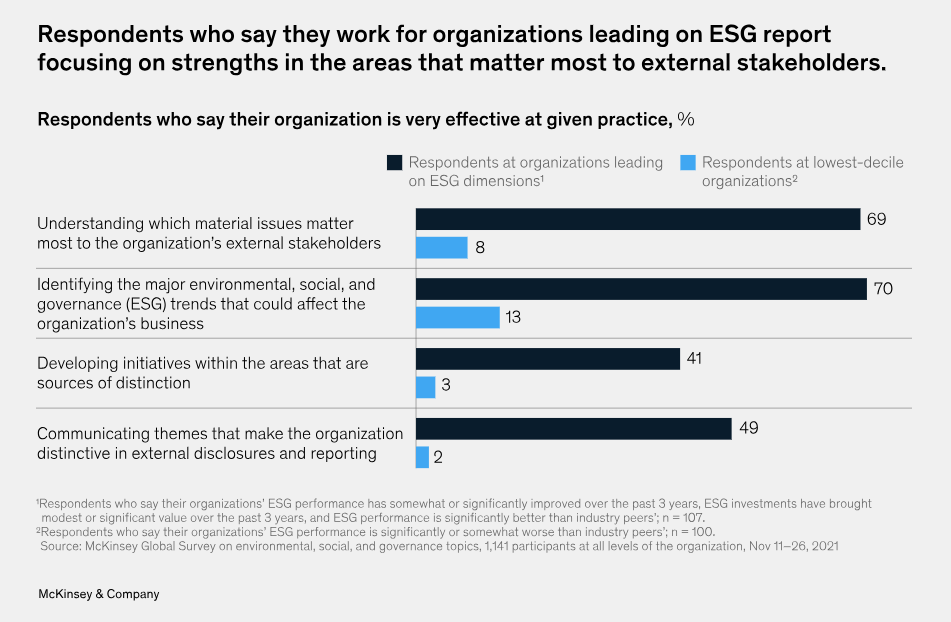

3. Prioritisation of strengths that matter to stakeholders. Respondents who report their organisations as leading on ESG dimensions are much more likely than respondents at reported lowest-decile organisations to find that their organisations have identified business-model-specific ESG issues, particularly those issues that, respondents say, matter most to their external stakeholders. These organisations, respondents further report, identify and concentrate on the specific stakeholder priorities for which their organisations are uniquely placed to excel rather than diffuse ESG efforts across many avenues.[1]

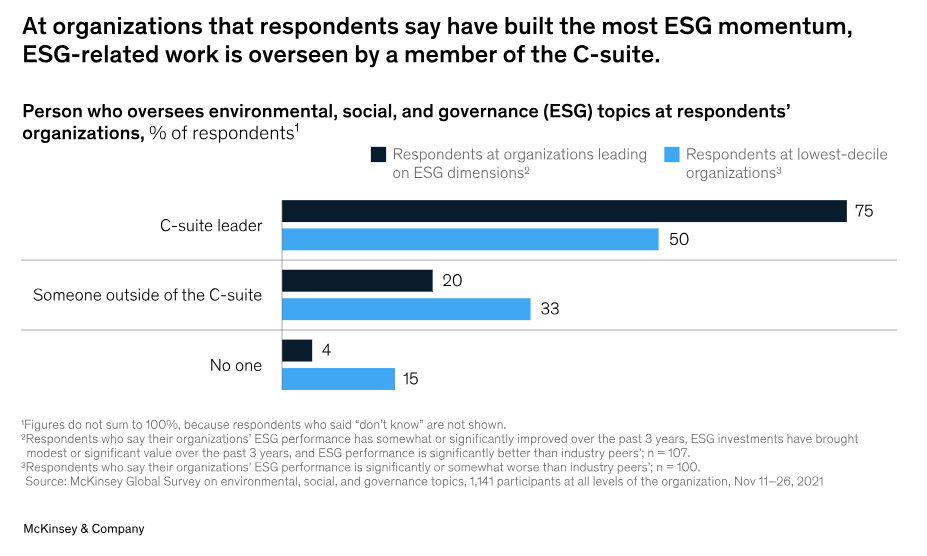

4. An ESG leader in the C-suite. Most respondents at organisations that, according to survey results, have built significant ESG momentum report their organisation’s ESG teams are led by a member of the C-suite. This executive is empowered to define ESG ambitions and strategy with the CEO, ensure collaboration among the other members of the executive team, and orchestrate initiatives across the organisation.

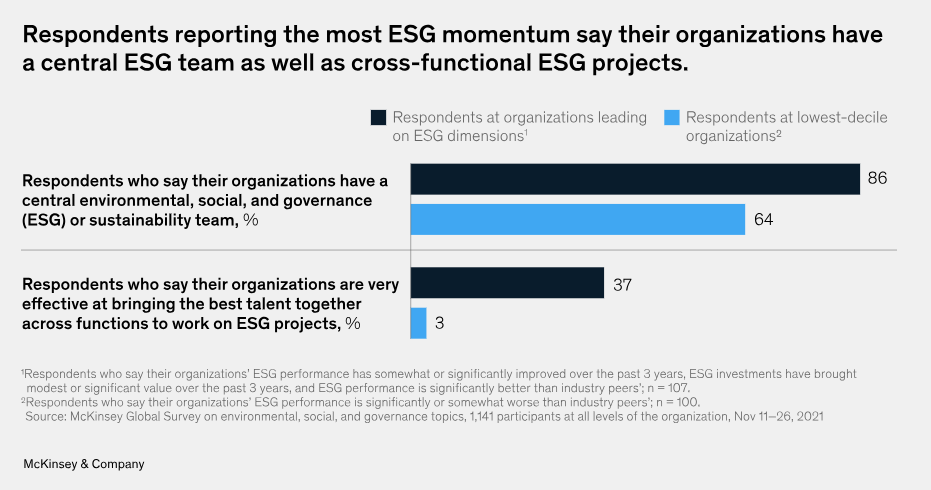

5. A central team. Survey results suggest that having a central ESG team or function can enable ESG momentum: respondents who say their organisations are furthest ahead on ESG dimensions are much more likely than those at reported lowest-decile organisations to report that their organisations have such a team, even if the team includes five or fewer people. These teams can manage ESG-strategy- and target-setting processes, coordinate delivery of initiatives and ESG reporting across the organisation, and ensure that ESG considerations are embedded into employees’ day-to-day behaviors. They also coordinate across functions so that efforts are not siloed within one department.

In fact, bringing together talent from across the organisation to help meet ESG goals is also a reported hallmark of leading organisations. Respondents reporting that their organisations have developed ESG momentum are more likely than those in the lowest decile to report that their employers are very effective at bringing the best talent together from across functions to work on ESG projects.

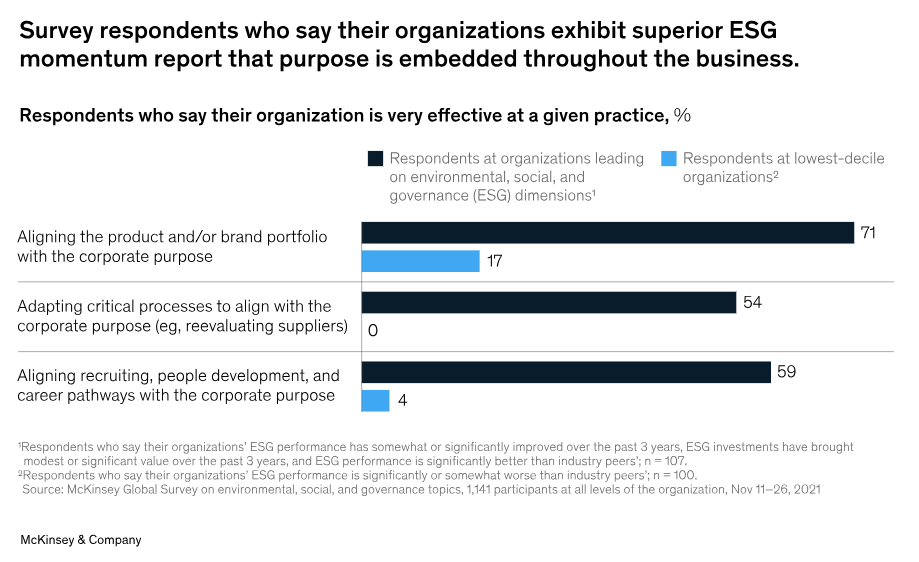

6. Purpose embedded throughout the organisation. Respondents who report that their organisations are leading on ESG dimensions say their organisations are very effective at embedding purpose into various aspects of their business, such as their product or brand portfolio and their talent-management efforts. By embedding purpose into organisational culture, the survey suggests, organisations can build an appetite for change that can bolster ESG initiatives.

7. Incentives tied to ESG metrics. Respondents from organisations reported to have the most ESG momentum are nearly three times as likely as respondents from reported bottom-decile organisations to observe that their organisations tie CEOs’ and CFOs’ financial incentives to ESG metrics. Embedding key ESG impact metrics into leaders’ and employees’ incentives can demonstrate, both internally and externally, that ESG is a priority for the organisation. It also helps ensure accountability for initiatives. An effective ESG incentive structure uses clear metrics, based on meaningful KPIs that gauge progress on key ESG objectives.[1]

Not all organisations identified by respondents as ESG leaders have all seven of these components in place. But survey responses suggest how consistently these traits are celebrated by those reporting more momentum and value realisation and how critical it is for organisations to go beyond mere declarations of intent. Embedding ESG in an organisation manifests in well-considered, focused ESG initiatives that are core to the business model. While embedding ESG is complex, the value that ESG efforts can protect—and create—can be compelling.[7]

ABOUT THE AUTHOR(S)

The survey content and analysis were developed by Bengi Korkmaz, a partner in McKinsey’s Istanbul office; Robin Nuttall, a partner in the London office; Lucy Pérez, a senior partner in the Boston office; and Jérémie Sneessens, a senior partner in the Brussels office.

They wish to thank Mercan Bakirezen, Leo Geddes, Pablo Illanes, and Alexandre Lichy for their contributions to this work.

The article was first published by McKinsey & Co.

Photo by Ralph Katieb on Unsplash.

1.0

1.0