Comprehensive enterprise risk management strategies, including climate risk disclosures, are key to business resilience and sustainability.

In brief

- Environmental, Social and Governance (ESG) issues arising from climate change are key concerns impacting business recovery, resilience and sustainability.

- Strong business resilience demands a comprehensive approach towards enterprise risk management (ERM), including adequate attention to climate risk disclosures.

- The time to identify climate-related risks and seize new opportunities is now.

The COVID-19 pandemic has reinforced and accelerated the need for governments and businesses to re-prioritize their management of the environmental, social and governance (ESG) issues that have the potential to inflict damage to economies and to drive a more balanced policy approach towards inclusive and long-term sustainable growth.

In fact, just before the COVID-19 outbreak, the World Economic Forum (WEF)’s Global Risks Report 2020 highlighted that the top five global risks are climate-related and most regional markets, including Malaysia, have not been spared climate-related disasters, such as floods, droughts and rising sea levels.

Climate change acknowledged but not addressed

According to the EY Climate Risk Barometer 2020 Malaysia , over three-fifths of the top 100 Malaysia public-listed companies (PLCs) surveyed reported their commitment to the United Nation’s Sustainable Development Goals (SDG) on climate action, SDG 13, which recommends corporates step up disclosures on climate-related risks in governance, strategy and risk management.

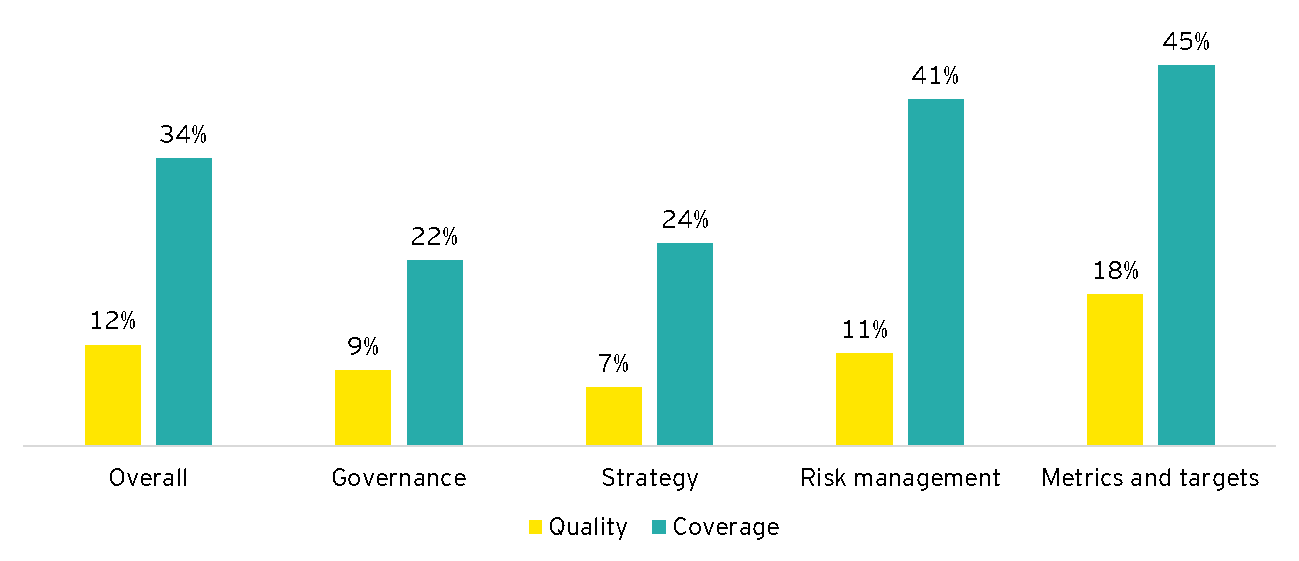

However, the analyses of the PLCs’ climate-risk disclosures indicate that most companies are at the nascent stage of climate risk reporting. Based on the Global Task Force on Climate-related Financial Disclosures (TCFD) recommendations, the PLCs surveyed scored highest in terms of coverage of metrics and targets at 45%, followed by risk management at 41%. Coverage of governance and strategy was lower at 22% and 24% respectively. Although over one-third or 34% of the 100 PLCs disclosed climate change-related risks, the quality of these disclosures scored just 12%.

TCFD performance – disclosure results

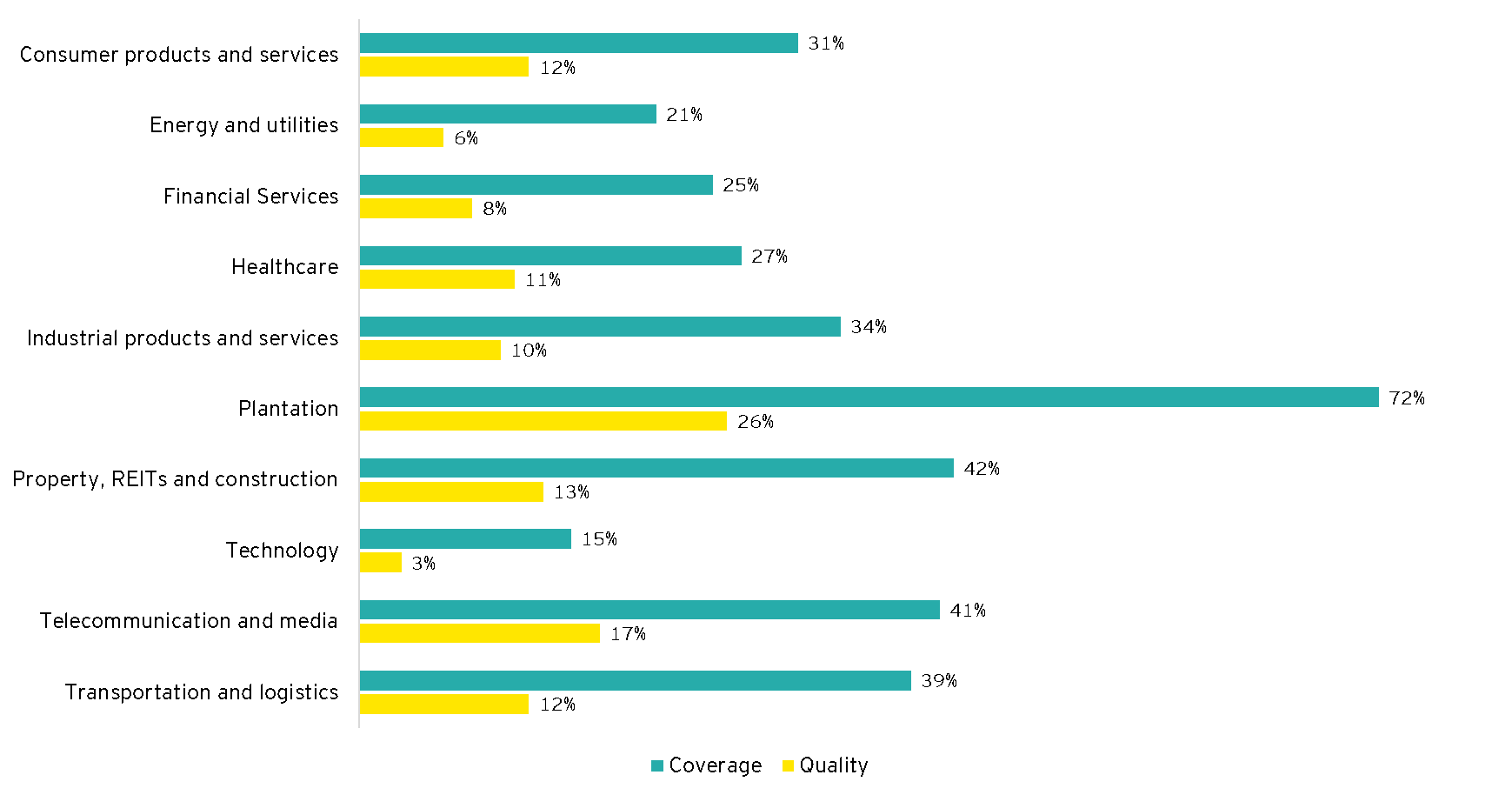

Sectors: climate-risk disclosures benchmarked against TCFD recommendations

“Inaction is no longer an option. Companies need to consider the broader value chain resilience and build preparedness in facing systemic shocks.”

Arina Kok

Director, Climate Change and Sustainability Services, Ernst & Young Advisory Services Sdn Bhd

Although companies are including climate change risks in their annual or sustainability reports, they are grappling to disclose how climate change may impact their business and how they are responding to these issues.

The majority of Malaysia’s PLCs generally adopt a “check-box approach” to climate risk reporting and do not consider climate-related risks in their ERM processes. Disclosures on the monitoring and review of climate-related issues are generally limited to current issues and performance metrics. In addition, many companies have not factored in climate risks and opportunities in their current business strategies.

Four action points moving forward

A recent EY Global Investor Survey found that investors are increasingly using non-financial disclosures from companies to support investment decisions. Disclosing climate-related risks requires changes to the governance and risk assessment processes (as per the TCFD recommendations). It also needs effective collaboration across the sustainability, risk, finance, operations, investor relations and business functions.

Moving forward, companies should focus on four action points in managing climate-related risks:

- Prioritize the impact of climate risk to business resilience

The ERM agenda of Boards needs to prioritize the impact of climate risk to business resilience and long-term sustainability. In their oversight role, Boards are integral in driving strategic discussions with management on climate risks. The assessment of climate risks and opportunities can strengthen current and future business strategies and build business resilience. - Step up ERM to include the likelihood and impact of climate risk

The ERM of companies can evolve to a more structured process including:- Ensuring climate-related risk is evaluated according to ERM considerations, specifically on its likelihood and impact

- Conducting periodic assessments of emerging climate-related risks and opportunities in the near, medium and longer-term future

- Integrate scenario analysis into ERM processes

Integrate scenario analysis into strategic planning and ERM processes and assign oversight to relevant committees or sub-committees. ERM assessments can consider the transition to a lower carbon economy consistent with a 2°C or lower scenario and, where relevant, scenarios consistent with increased physical climate-related risks in the following areas:- Products and services

- Supply chain or value chain

- Adaptation and mitigation activities

- Investment in research and development

- Set clear climate-related metrics and targets

With the urgency to mitigate climate risks, companies can set clear climate-related metrics and targets to improve the quality of disclosures. Stronger stakeholder engagement across the value chain and more collaborative enterprise-wide efforts can spur the innovation of solutions in mitigating and addressing emerging issues on climate risks.

“Mapping out potential future climate scenarios and their implications on a company’s risk management and strategy will be critical to steer the design of a “green” roadmap in building enterprise resilience.”

Summary

With the rampant occurrence of climate change disasters and rising global temperature, inaction is no longer an option. Companies need to consider the broader value chain resilience and build preparedness in facing systemic shocks such as the COVID-19 pandemic and climate change.

Mapping out potential future climate scenarios and their implications on a company’s risk management and strategy will be critical to steer the design of a “green” roadmap in building enterprise resilience.

This article was first published here.

Photo by Guy Bowden on Unsplash.

5.0

5.0