WTW research found that 81% of global companies include ESG metrics in their executive incentive plans, and the use of climate metrics has expanded significantly.

For the fourth consecutive year, WTW has conducted a study on the global use of environmental, social, and governance (ESG) metrics in executive incentive plans. Through a review of public disclosures from more than 1,000 companies, including S&P 500, FTSE 100, TSX 60, and major European and Asia Pacific indices, this study provides not only insights into the prevalence of ESG metrics in executive incentive plans but also an in-depth analysis of industry trends and measurement methodology.

Our analysis found that ESG metrics are now used in 81% of executive incentive plans globally, an increase from 75% in 2022, ranging from 76% in the U.S. to 93% in Europe. While most companies incorporate ESG metrics into their short-term incentive (STI) plans, measurement of ESG in long-term incentive (LTI) plans has increased steadily over time, especially in Europe (56% of companies). In the U.S. and Canada, while the adoption of ESG metrics in LTI plans remains low, prevalence has more than tripled since 2019.

While more than three-quarters of companies in Asia Pacific disclosed the use of at least one ESG metric in their executive incentive plans, practices vary significantly by market. On the one hand, there is robust executive compensation disclosure and high prevalence of ESG metrics in such markets as Australia, Japan and Singapore, comparable to their counterparts in Europe and North America. In other parts of Asia Pacific, however, executive compensation practices are still maturing, and the use of ESG metrics remains uncommon.

Human capital metrics remain the most prevalent ESG category used in executive incentive plans. Across Europe and North America, prevalence of human capital metrics ranges from 70% to 83%. Some of the popular sub-categories in human capital metrics include employee engagement, employee safety, succession/talent management, and management and workforce representation.

Meanwhile, the market has seen significant expansion in the use of environmental and climate metrics. In Europe, 80% of companies now include environmental and climate metrics in their executive incentive plans. In Canada, the number of companies including at least one environmental and climate metric has doubled from 27% in 2020 to 50% in 2023. The expansion of environmental and climate metrics is even more remarkable in the U.S., where prevalence has nearly quadrupled from 12% to 44% during the same period. The use of environmental and climate metrics in Asia Pacific continues to grow, increasing from 28% to 39% year over year.

ESG metrics continue to be measured both quantitatively and qualitatively. Relative to the global norm, U.S. companies are more likely to use qualitative metrics in evaluating ESG performance, while three-quarters of European companies measure ESG performance quantitatively. In general, there is a greater tendency to measure ESG performance quantitatively in LTI plans than in STI plans.

Another notable observation in this latest study is the convergence of industry practices. Significant growth in the use of ESG metrics in industries such as information technology and healthcare means that they are catching up to the utilities, materials and industrials industries in terms of prevalence levels. The incorporation of ESG metrics in executive incentive plans has become a universal practice, while each industry emphasizes ESG factors with the greatest impact to the long-term value creation of their businesses.

Access our complimentary report to learn more about our detailed global findings.

This article was first published at wtwco.com.

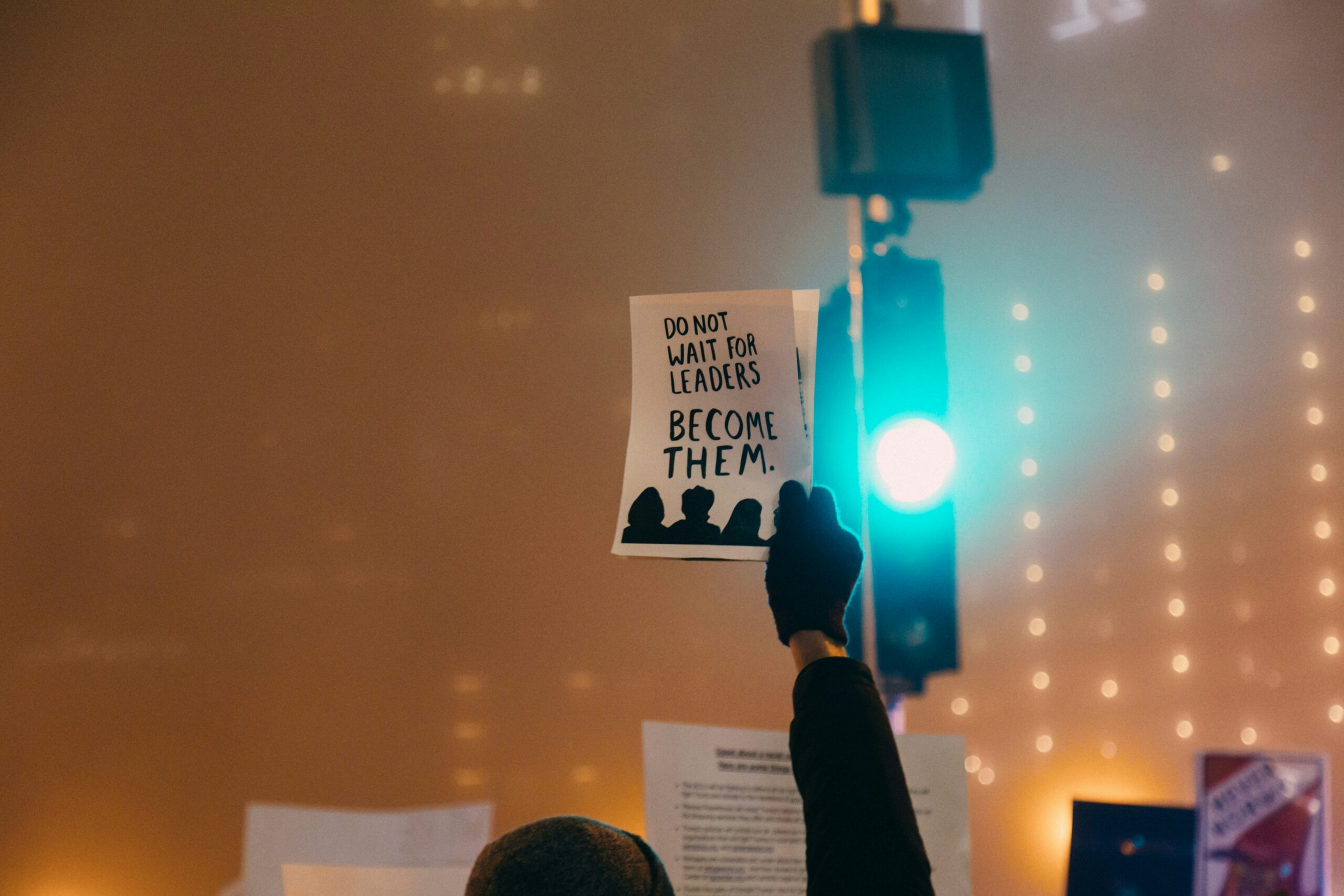

Photo by Nubelson Fernandes on Unsplash.

5.0

5.0