Interestingly the survey that involved 4,000 male and female directors across 60 countries around the world revealed directors are more qualified than ever but they are facing even higher expectations from stakeholders.

The demands of multiple stakeholders such as investors, consumers, regulatory bodies and media for more transparency and accountability are making board roles in public listed companies more onerous.

Unless boards have the right composition of directors, who are fit and proper in discharging their responsibility for the preparation of accurate annual audited accounts and quarterly financial results, adhering towards strong corporate governance statement and fulfilling requirements in the statement on internal control and risk management, this could be an uphill task.

Realistically, frequent and sudden boardroom changes and re-designation of directors in companies could disrupt any planned boardroom succession, training to up-skill directors and efforts to stay ahead on corporate governance obligations.

Unless board and directors’ evaluations are objective and have a foothold in assessing board’s performance, director’s suitability and independence, it could be a wasted exercise. Instead, boards should invest in strong board processes that will keep them relevant and on top of stakeholders’ expectations.

Several key findings were identified under the 2016 Global Survey around board skills, processes and priorities such as:

- Boards are seeking out apt skills for new directors that include industry knowledge and financial/ audit skills

- Strategy experience is the highest of all skills named for directors and the most important area of expertise for directors today

- Other skills in demand on boards are risk management and international/global expertise which are important for board services today

- Networking is a priority for both men and women directors as it increases opportunities for both gaining knowledge and recruiting new board candidates

- Diversity in boards should be driven by board leadership, and

- Sales and marketing, compensation and succession planning expertise were rated as least important

Unless check and balances advocated in the best corporate governance practices are extended to government-linked agencies, and oversight authorities such as Public Accounts Committee and Auditor General are mandated to act independently, the Institute for Democracy and Economic Affairs reckons mismanagement, non-compliance to laws and appointment of unfit and improper public officials to GLC boards cannot be curbed.

In order to uphold public governance at the highest esteem, it is highly recommended that the rules and laws for the appointment of directors to boards of public listed companies should be applied to those in the government-linked agencies as well. Regulators should publicly name and shame directors who flout fiduciary rules in all sectors.

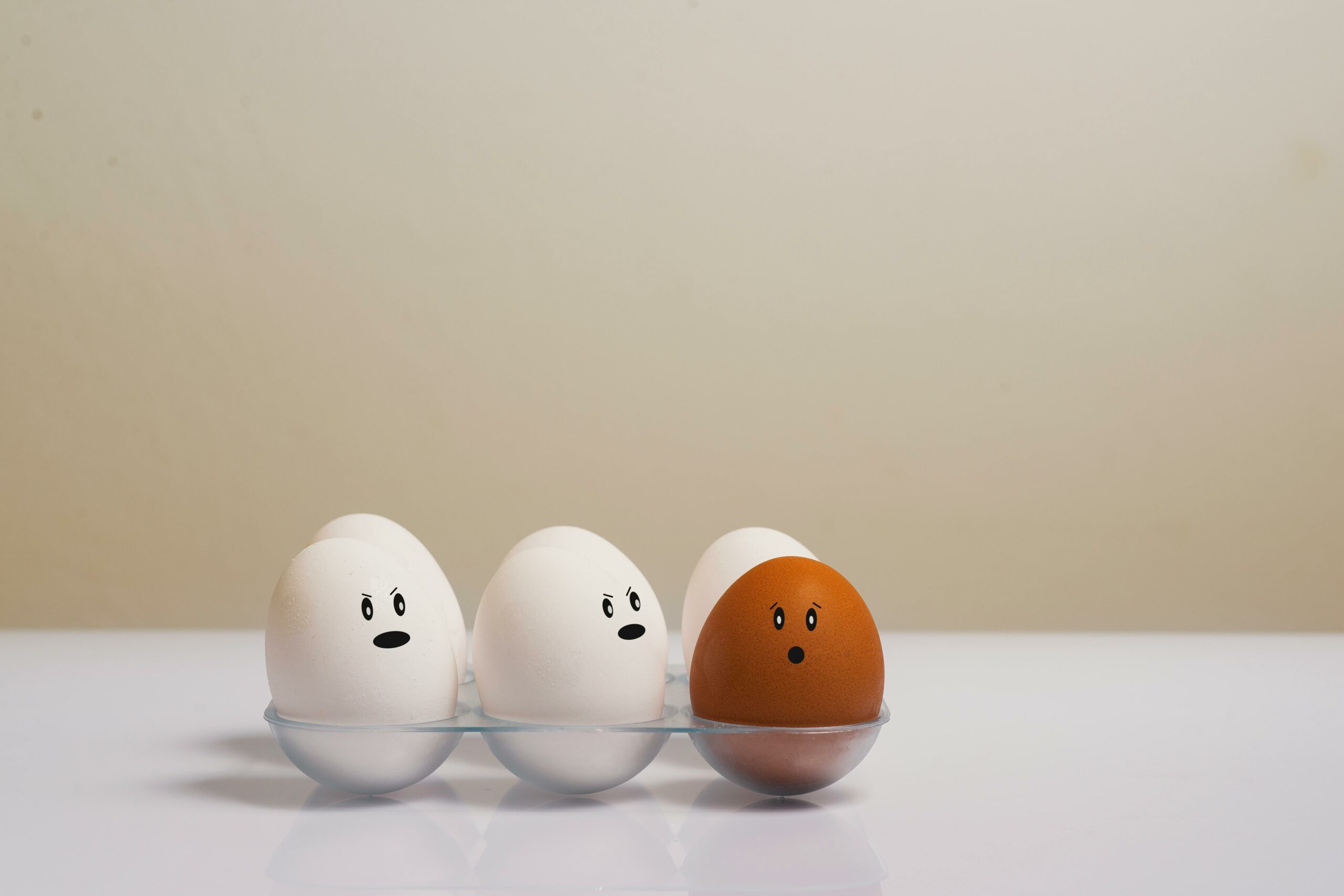

Photo by Garrhet Sampson on Unsplash

4.4

4.4