Boards will need to reframe current governance practices to drive governance for good and deliver long-term value for stakeholders.

- Corporate ESG initiatives can help catalyze revenue growth, enhance investor appeal, improve operations and reduce idiosyncratic risks.

- Challenges include investor pressure to prioritize short-term earnings and a lack of metrics to assess nonfinancial drivers of long-term value.

- Boards must take key steps, such as fostering deeper stakeholder engagement and linking executive compensation to sustainability.

The COVID-19 pandemic raised stakeholder expectations for corporations to take a more proactive role in addressing societal issues like climate change and inequality. It also prompted business leaders to reassess and reframe their organizations’ roles in terms of who they serve, the contributions they can make to society and how value is defined.

With the dynamic marketplace changes, there is a growing recognition that an organization’s success requires a multi-stakeholder, long-term orientation.

A Compelling Proposition

Gone are the days when governance for good was dismissed as a mere feel-good philosophy. In recent years, various studies have unveiled a correlation between environmental, social and governance (ESG) initiatives and improved business and financial performance. From a valuation standpoint, robust corporate ESG practices could increase a company’s value. By embracing these practices, forward-thinking organizations position themselves to reap a multitude of benefits.

First, integrating ESG considerations can help catalyze revenue growth. The Business and Sustainable Development Commission estimated in 2017 that achieving the UN Sustainable Development Goals could unlock annual market opportunities worth at least US$12 trillion for the private sector by 2030. As environmental and social considerations increasingly shape consumers’ purchasing decisions, companies with sustainability at their core stand to command higher price premiums for their products and services and capture a larger share of customers’ wallets.

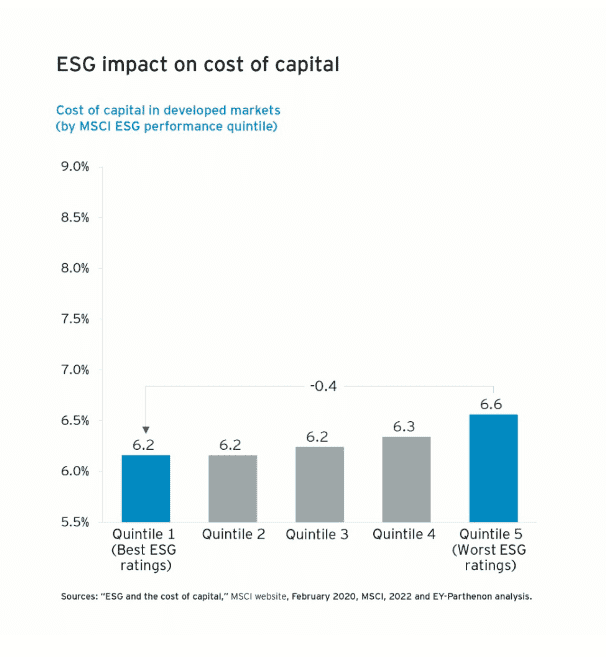

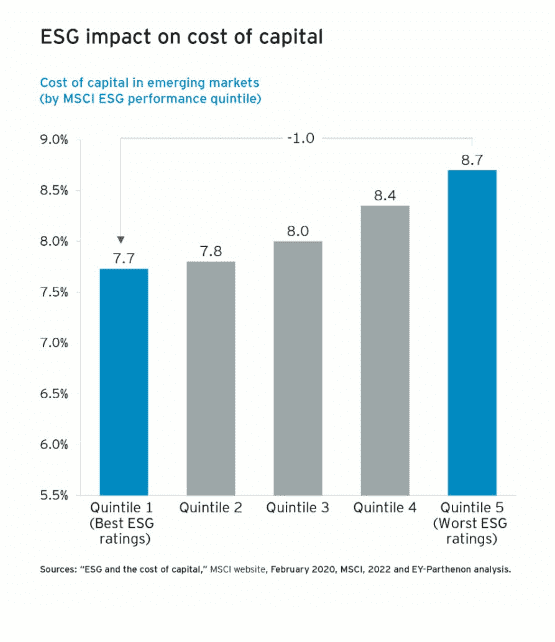

Second, adopting ESG principles can enhance investor appeal for companies and lead to a reduced cost of capital. Today, there is a disparity between the surging influx of investment capital seeking authentic ESG leaders and the scarcity of such companies. Companies that can demonstrate tangible ESG achievements may hence benefit from a reduced cost of capital (see charts below).

Third, a focus on sustainability has a positive impact on operations. EY-Parthenon teams analyzed the profitability of the top sustainable corporations globally based on Corporate Knights’ 2020 Global 100 ranking and found that sustainable companies outperformed their industry peers on gross profit, EBITDA, EBIT and net profit metrics. Companies with a strong sustainability focus tend to pursue operational and process efficiencies, thereby bolstering profitability. They do so through initiatives, such as reducing waste, streamlining supply chains and fostering an innovative culture that advocates circularity.

Fourth, companies with higher ESG ratings have been shown to be associated with reduced idiosyncratic risks (inherent risks associated with the company). Such companies experienced a lower occurrence of large, adverse idiosyncratic stock price moves between 2009 and 2019 compared with companies with lower ESG ratings.1

This can be attributed to better risk management practices and stringent compliance standards across their operations and supply chains. Consequently, these organizations tend to be more resilient and less vulnerable to unforeseen events, such as compliance breaches and supply disruptions, thereby delivering higher risk-adjusted returns for investors.

Corporate ESG practices can help catalyze revenue growth, reduce the cost of capital, impact operations positively and lower idiosyncratic risks.

Challenges in the Way

Despite the multiple benefits associated with sustainable corporate governance, various internal and external challenges may stand in the way of implementation.

One of the key issues is investor pressure to prioritize short-term earnings. This may compel companies to redirect resources and capital from long-term strategic initiatives to meet immediate financial goals. To address this, the board should challenge the management to implement a decision-making framework that balances short-term and long-term value generation. It should also seek to engage with investors proactively to build trust, communicate the corporate purpose and secure support for strategic, long-term value-creation approaches.

Internal challenges may include reframing how the organization ties CEO and executive compensation to short-term versus long-term performance. The lack of internal processes or metrics to assess nonfinancial drivers of long-term value, such as human capital, poses another challenge.

Putting Governance for Good into Action

Boards can take five approaches to implement an ESG strategy based on good governance.

Emphasize critical board attributes

It is crucial to have directors dedicated to long-term value creation and who recognize the importance of ESG. This helps set the right tone at the top and provides role models for the management and employees. Furthermore, certain attributes place the board in a stronger position to make decisions that deliver long-term value. These include the ability for directors to speak their minds and debate openly as well as a willingness to consider the interests of all stakeholders.

Diversity is another essential board attribute as it brings a wide range of perspectives and solutions to tackle complex issues. Diverse boards can challenge established thinking and biases in a way that homogenous boards cannot. Moreover, they are better equipped to ensure that decision-making considers the impacts on different stakeholders.

Crucially, the board must possess sound sustainability knowledge to be able to challenge the management on sustainability plans, oversee execution and progress toward fulfilling pledges. Engagement with investors on sustainability initiatives is also important. As companies forge ahead in their long-term value strategy execution, they may need to actively refresh and diversify the skill sets of their board members. Internal and external board evaluations should encompass an assessment of these desired attributes.

Deepen stakeholder engagement

Effective engagement entails bringing stakeholder voices to the boardroom table and genuinely considering their feedback in decision-making. Many companies, however, struggle to do this well.

As a starting point, boards must clearly define their key stakeholders and be clear on who are the most important. The engagement strategy should concentrate on understanding stakeholder needs and how they factor into boardroom decision-making vis-à-vis long-term value creation as well as getting stakeholders on board to drive buy-in.

The engagement strategy should also be pragmatic. It is not feasible for the board to engage directly with every key stakeholder from suppliers to communities, so it must decide who to engage with directly and who to engage with indirectly through the management. Boards should also strive to close the feedback loop by communicating with stakeholders on how their inputs were considered. Failing to do so risks eroding the relationships over time.

Provide material and credible disclosures

Long-term value orientation has profound implications on how corporates communicate their performance. Organizations would need to shift from backward-looking financial reporting to forward-looking insights based on financial and nonfinancial (including ESG) disclosures.

Embracing this broader view of value and performance may require changes not only to frameworks and practices but also mindsets and cultures. Authenticity and accountability are paramount. This means being willing to share both positive and negative news openly.

Audit committees have an instrumental role in this transformation. They can help ensure that the company establishes and maintains effective controls supporting the quality of financial and nonfinancial information and reporting, including long-term value metrics. They can also oversee the robustness of risk information. Delivering reliable and consistent enhanced corporate reporting is crucial to help boards make confident decisions and for stakeholders to assess the company’s future prospects and cash flow.

Cultivate an appetite for long-term risk-taking

Companies may have a desire to pursue initiatives to enhance long-term value but may be held back by the uncertainty of success. Also, their traditional risk framework and focus on short-term shareholder returns might hinder them from acting boldly.

Boards should, therefore, seek to strengthen their risk assessment and management capabilities, including for atypical risks. Doing so will make them more confident in long-term risk-taking and understand the potential upsides of initiatives with a longer time horizon. The current uncertain environment presents an opportune time to embed cultural and operational changes to help businesses navigate emerging risks better as well as put in safeguards to mitigate future crises.

Link executive compensation to sustainability

Establishing “remuneration-grade” KPIs for sustainability objectives is challenging. But there is a compelling case to do so. Effective variable remuneration schemes can hold the management accountable to sustainability goals and support the achievement of desired outcomes.

To this end, compensation schemes should include a combination of near- and long-term incentives to reward executives for generating sustainable growth. These may include short-term compensation plans like annual bonuses alongside long-term incentive plans that encompass multiyear measurement periods.

To be effective, compensation schemes need to be aligned with the right ESG metrics. These can be challenging to define and assess. Not all ESG metrics are relevant for all companies, so organizations need to identify reliable metrics that are most material to them. Robust processes, data and controls as well as keen board committee oversight will be required.

Unsurprisingly, grappling with these intricate issues can lead to inertia. The EY Europe Long-Term Value and Corporate Governance Survey 2023 found that less than half of organizations currently incorporate sustainability into their remuneration practices. The study surveyed 200 directors and senior leaders and split respondents into two groups: “experts” and “beginners”, depending on their score on sustainability governance. Interestingly, 61% of the experts include ESG metrics as a significant element when setting the compensation of senior executives, compared with 29% among the beginners. This highlights the value of investing efforts in this area.

The Rubber Hits the Road

Ultimately, board leadership is integral to driving sustainability from ambition to action and from targets to concrete outcomes. Society is looking to businesses to take the lead in addressing the most pressing sustainability issues, and leaders need to pivot their governance approach to deliver real-world outcomes. Now is the time to establish strong multistakeholder engagement and implement the corporate governance elements that can help deliver sustainable value for all and the long term.

Boards should consider the following questions:

- Are we considering the interests of all stakeholders in decision-making and not just shareholders?

- Do we have an approach to strategy formulation and decision-making that effectively balances near-term and long-term value creation?

- Do we have an established approach to measure and communicate the long-term value generated by the company?

- Do we communicate to all stakeholders with authenticity, including being transparent about the positive and negative impacts of business decisions?

- Are we implementing remuneration schemes for executives and the management tied to long-term value creation?

The article was first published here.

Photo by Dane Deaner on Unsplash.

1.0

1.0