The EY Global Corporate Reporting and Institutional Investor Survey finds a significant reporting disconnect with investors on ESG disclosures.

- Companies and investors are not aligned on their perspectives on the best ways and means to weave sustainability into corporate reporting.

- Investor-grade ESG disclosures can be key to building mutual understanding, but stakeholders’ transparency expectations are not being met.

- Companies should clarify the expectations of long-term investors as it relates to sustainability.

Companies continue to invest more time, resources and leadership effort into sustainability. However, there is still a significant disconnect between the expectations and goals of companies and their investors when it comes to corporate and sustainability reporting — in particular, the ESG disclosures that (along with existing financial statements) can help companies and their stakeholders to communicate and assess performance against strategic risks and opportunities in multiple dimensions.

This disconnect could potentially undermine the smooth running of capital markets, the collective battle against threats such as climate change, and the trust that is necessary between a company and its stakeholders, including customers, employees and communities. The EY Global Corporate Reporting and Institutional Investor Survey (pdf) explores these issues, drawing on a methodology that canvassed 1,040 senior finance leaders at the companies issuing reporting and 320 institutional investors as users of those disclosures. Three important themes emerge for the future of corporate reporting:

- The disconnect between companies and investors: There is a significant disconnect between companies and investors when it comes to maintaining a focus on long-term value creation and sustainable growth, and avoiding short-term thinking.

- The importance of effective corporate reporting: Effective corporate reporting could be key to building alignment and understanding, but investors say that current ESG disclosures do not meet their requirements and expectations.

- Understanding expectations: To close this gap, the research suggests companies should build a better understanding of the sustainability expectations of long-term investors and earn their trust by defining the involvement of the finance function in ESG disclosures.

Chapter 1: The Sustainability and Long-Term Value Disconnect

Investors and corporates don’t see eye to eye on ESG reporting

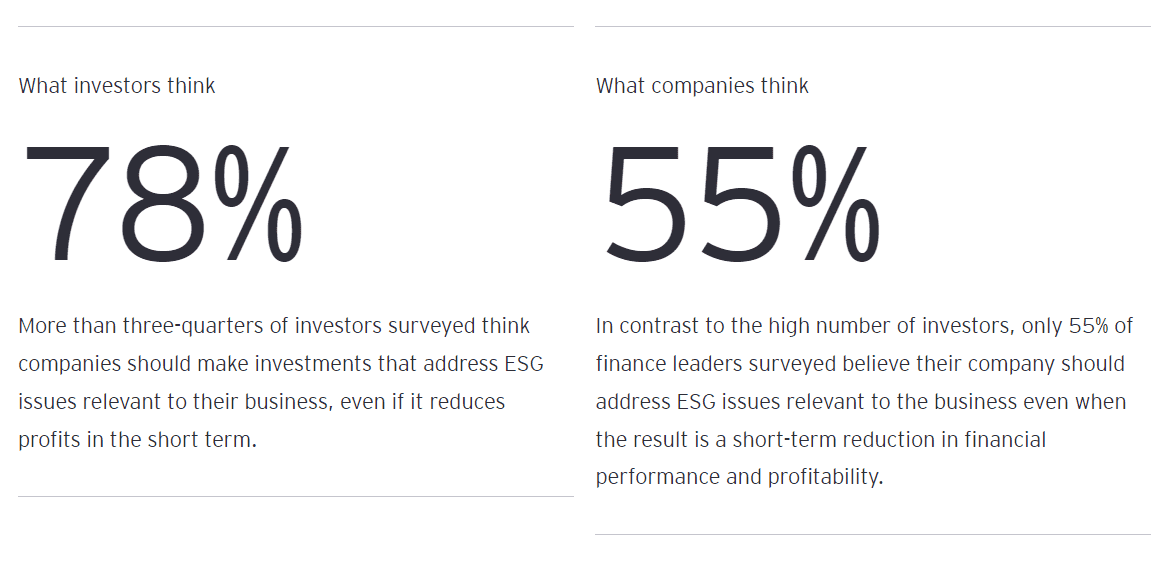

For both companies and investors, a long-term view is inseparable from sustainability considerations. However, when it comes to the trade-off between short-term earnings and long-term value creation, there is a disconnect between investors and finance leaders. Investors are much more likely to favor decisions that lead to sustainable, long-term value creation even at the expense of short-term earnings shortfalls, but finance leaders are much less inclined to make that trade-off. The research specifically found that over three-quarters of investors think companies should make this trade-off, but only around half of finance leaders are prepared to take this long-term stance:

The fact that investors and finance leaders are not aligned when it comes to long-term value trade-offs could create problems further down the line in sustainability performance and corporate reporting. For example:

- If finance leaders do not share investors’ appetite for prioritizing long-term, sustainable investments, will a company’s disclosures reflect what investors see as strategic priorities? Or will the reporting be seen by investors as lacking a clear narrative on the strategy for growing and protecting long-term, sustainable value? If reporting is seen as lacking clarity, could this explain why some companies feel they are not “rewarded” for the long-term sustainable plays they do make?

- In a similar vein, if companies are seen as less willing to make these difficult trade-offs, could investors become concerned that leaders will not make the investment commitments required to move from ESG promises to concrete progress?

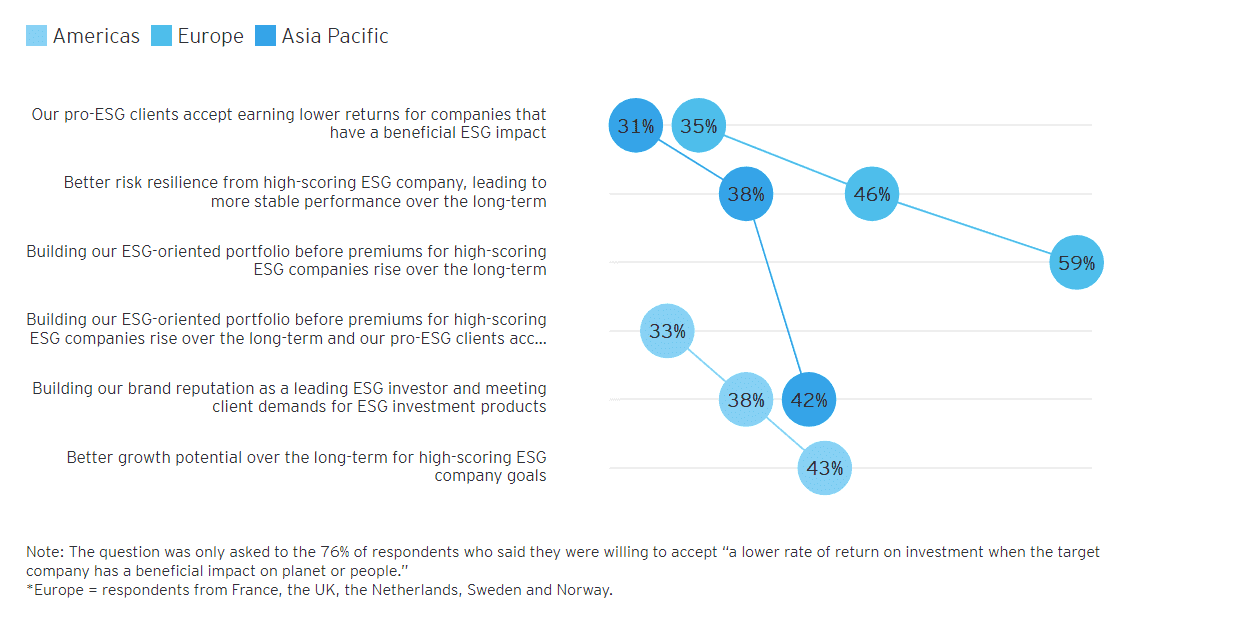

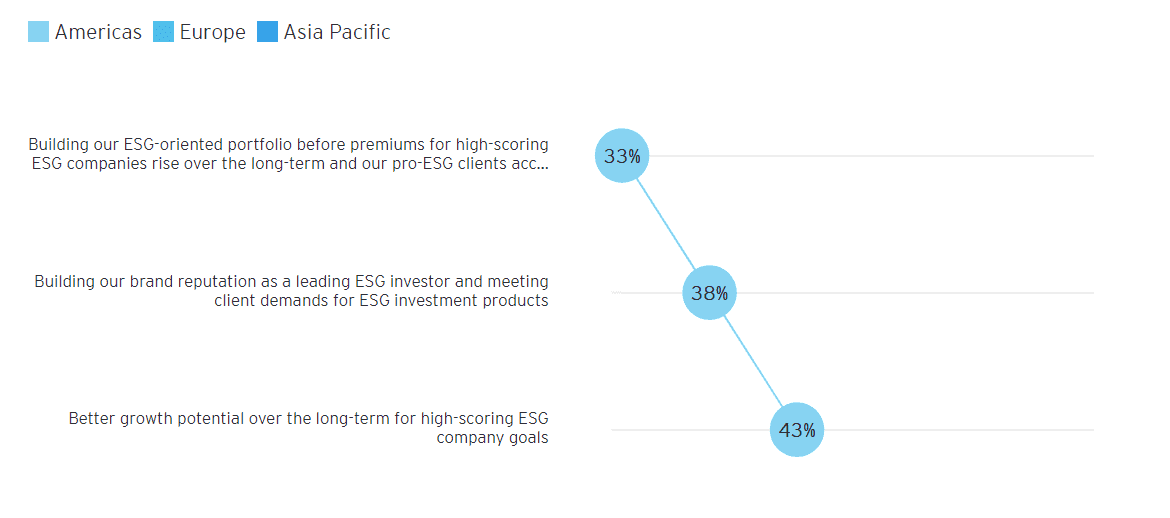

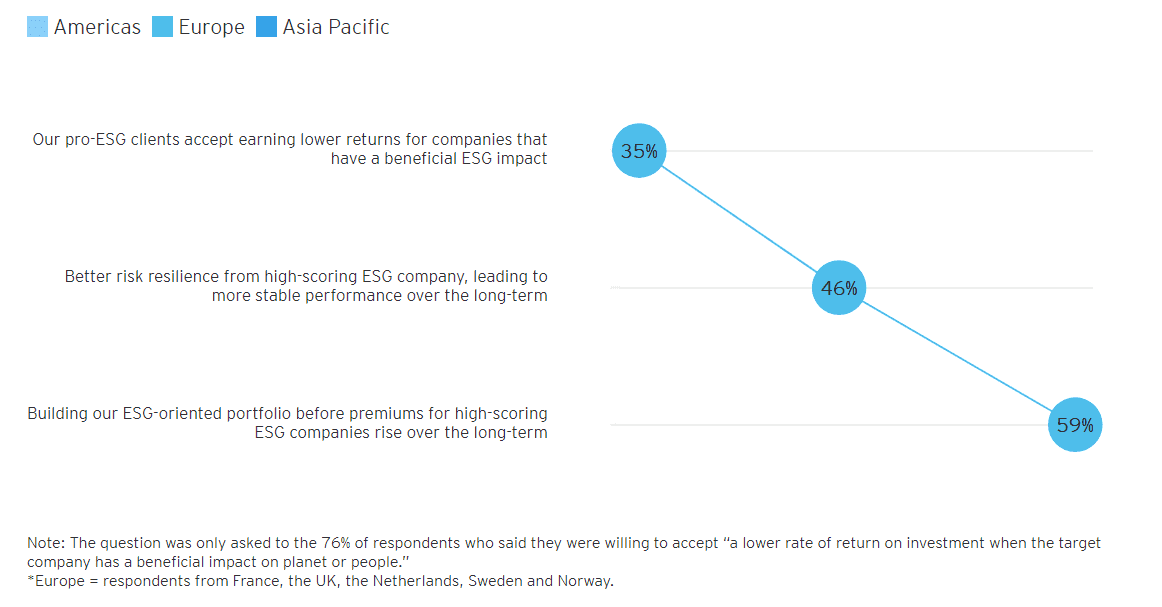

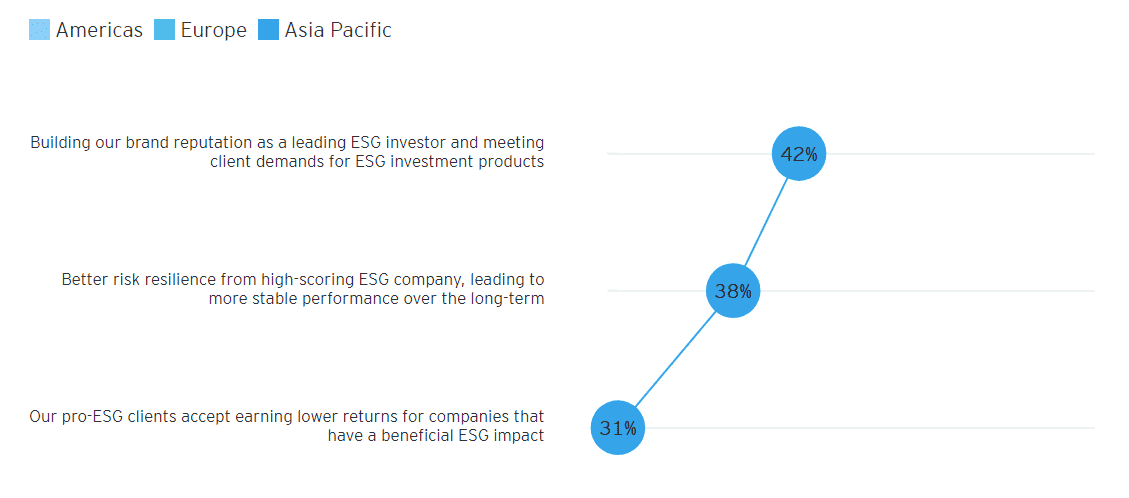

Reasons investors are willing to make long-term, sustainable investment plays over immediate returns

You mentioned that your organization has accepted a lower investment return when targeting a company that has a beneficial impact on environmental or societal issues – what are the primary reasons for accepting a lower yield?

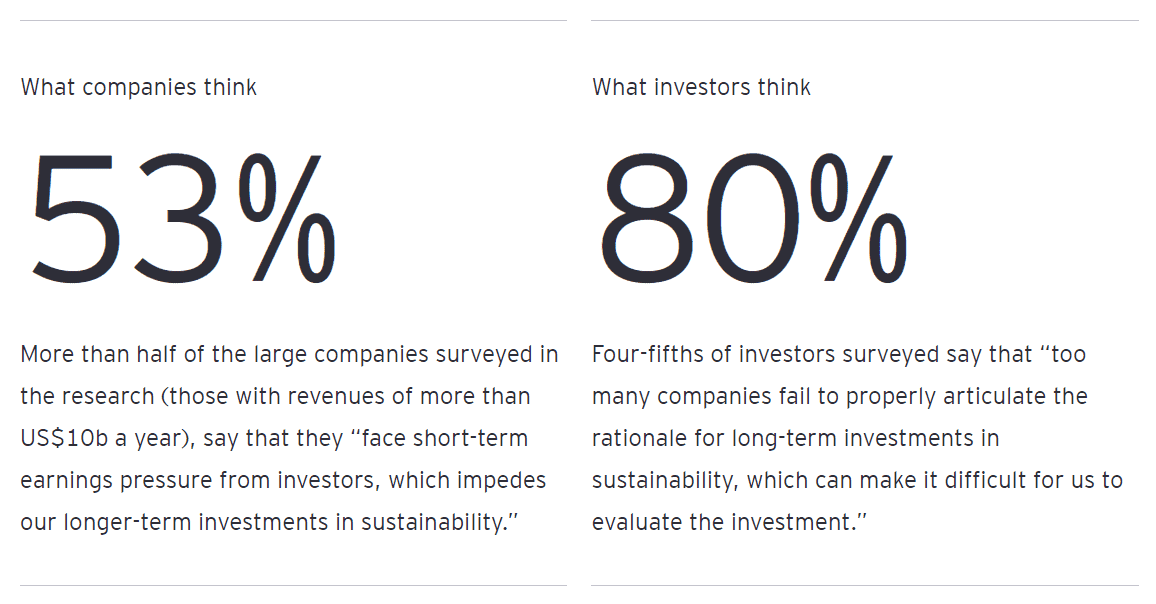

In fact, the research shows a fundamental gap between companies and stakeholders when it comes to sustainability performance and corporate reporting. Companies are still very focused on what they see as short-term pressure from certain investors, while investors say they do not receive robust insight on a company’s strategy for long-term growth:

Given the disconnect between the perceived trade-offs of short-term profitability and long-term sustainable performance, how should finance leaders go about regaining the trust of their stakeholders and transforming reporting so that investors and companies are on the same long-term value page?

Chapter 2: The Key to Building Trust

More transparent corporate reporting could build trust with shareholders and stakeholders.

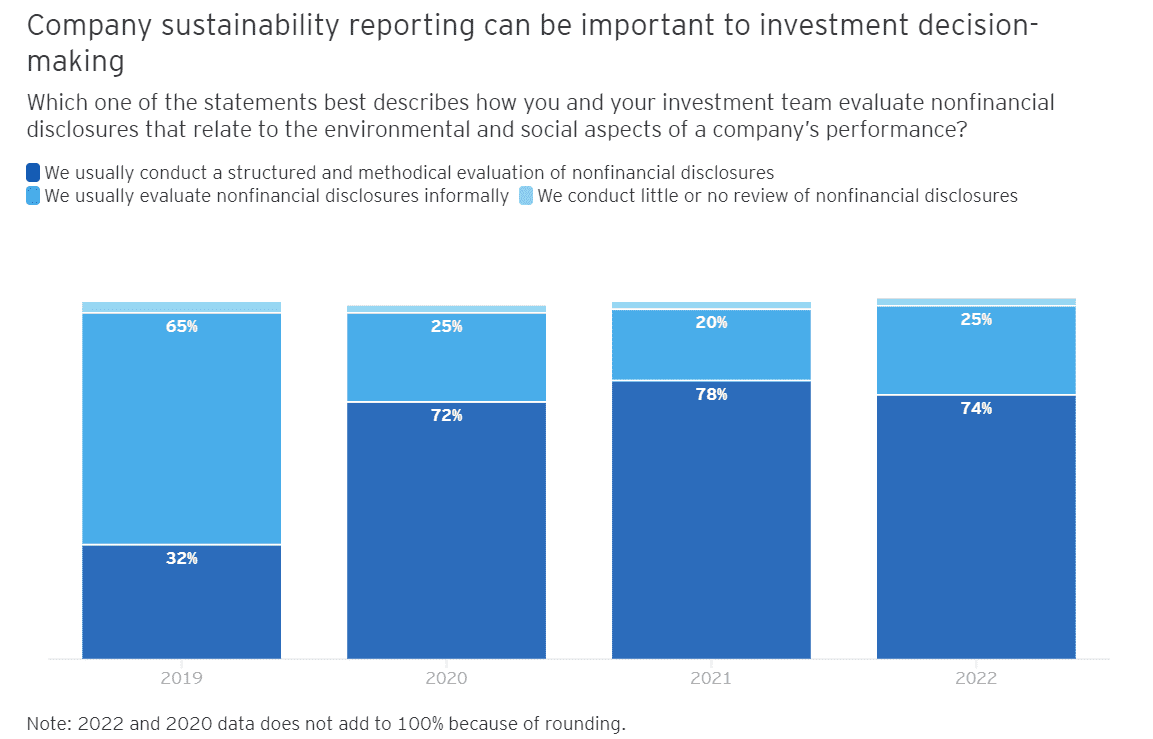

A company’s sustainability disclosures are one of the important insights investors use to understand the impact of sustainability issues on a business’s performance, risks and long-term growth prospects. Today, 99% of investors surveyed utilize companies’ ESG disclosures as a part of their investment decision-making, including 74% who use a rigorous and structured approach. By comparison, in the 2018 EY Global Institutional Investor Survey, only 32% of investors surveyed were using a rigorous approach.

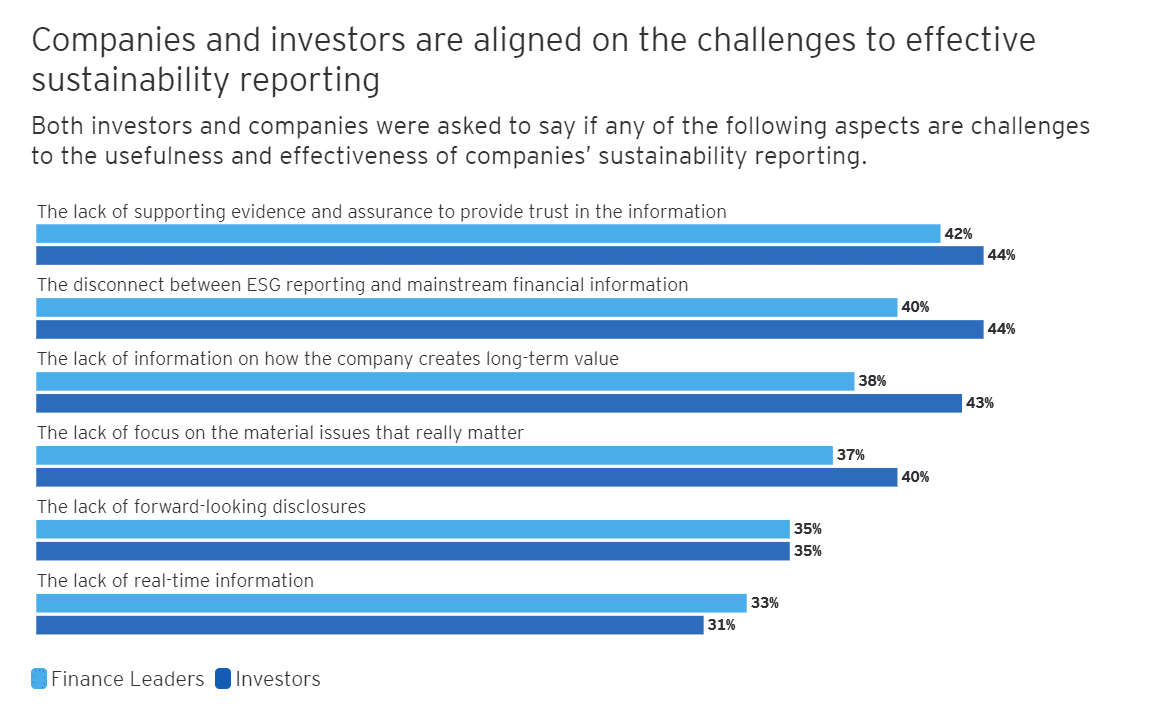

However, there is a marked disconnect between investors and companies when it comes to the sustainability disclosures in today’s corporate reporting. Investors feel strongly that they do not get the reporting and data-driven insight they require to inform their investment decision-making and how they evaluate a company’s growth and risk profile. The research found that 73% of investors surveyed say “organizations have largely failed to create more enhanced reporting, encompassing both financial and ESG disclosures, which is critical in our decision-making.”

This finding could reflect, for example, investor appetite for enhanced climate disclosures. The EY 2022 Global Climate Risk Barometer, a comprehensive analysis of disclosures made by more than 1,500 companies across 47 countries, found that while more companies are reporting on climate risk, they are not providing meaningful commentary about the challenges they face. For example, more than half of companies surveyed (51%) are still either not conducting scenario analysis, or not disclosing the results.

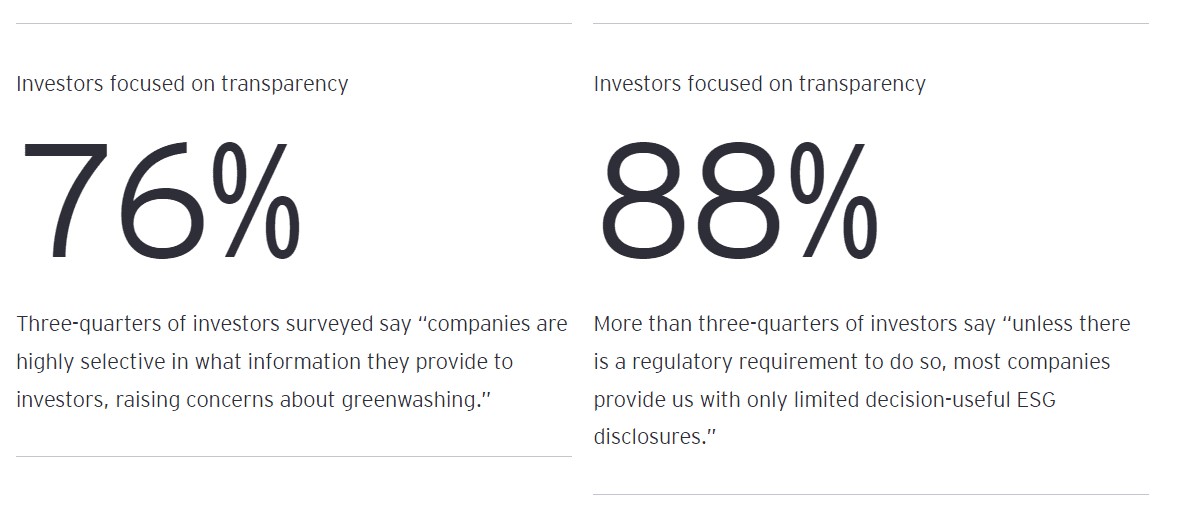

These ongoing challenges with sustainability disclosures could potentially create a trust deficit. Some companies feel the complex trade-offs they can be asked to make are not always recognized, and the research shows that investors in turn are skeptical about companies’ intentions:

Chapter 3: The Way Forward

Prioritising two actions items can help transform the future of reporting and close the stakeholder disconnect.

The first priority for companies is to align with investors and stakeholders on ESG disclosures within corporate reporting. In terms of investor expectations, the research shows the main elements can be characterized as the requirement for greater focus, accountability and transparency:

- Focus: Companies should respond to investors aligning their portfolios to net zero, with robust insight into the important opportunities and risks, including transition risk, physical climate risk, and climate scenario analysis.

- Accountability: Companies should meet investor requirements for robust governance and board oversight around sustainability. This could be seen as important for companies moving from ESG pledges to progress and results. Governance could also play a key role in responding to investor focus on ESG stewardship and the importance investors place on continued engagement with company leaders on sustainability goals and progress.

- Transparency: Companies should respond to investors’ calls for more consistent, comparable and reliable ESG disclosures. Companies should get ahead of emerging global reporting standards and drive up ESG data quality, to help meet high investor appetite for global reporting standards and assurance scrutiny of sustainability disclosures.

The second priority is to define the involvement of finance leaders to build confidence in corporate reporting and ESG disclosures. The report shows this confidence is lacking on both the investor and company side. Investors are skeptical about certain aspects of reporting on ESG issues, while not all companies feel able to give their current reporting a complete vote of confidence.

If it is decided to involve the finance leader and their team, then the function should be ready. However, the research shows that only a minority of finance leaders surveyed feel they have a mature capability when it comes to sustainability reporting. To address this, finance leaders should more closely connect the ESG agenda and broader initiatives currently underway, to help transform the modern finance function.

There are three qualities that could be important, with the future finance function defined as a team that is smart, connected and talent-led:

- Smart: Companies should craft a data strategy based on a clear understanding of the data challenges and important use cases. Companies should also build a data analytics capability that can provide access to relevant sources of data internally and externally, and provide analytical insight, leveraging tools such as artificial intelligence (AI).

- Connected: Companies should build a next-generation finance operating model. This model should support finance people to collaborate across organizational boundaries to address wider enterprise goals, with an agile operating model that extends beyond the walls of the enterprise so tasks can be completed more dynamically and the organization can flex more quickly to volatility and disruption.

- Talent-led: Companies should disrupt the finance function’s traditional skills mix to find the capabilities required to meet changing demands, while also disrupting traditional behaviors and attitudes to create a more innovative and value-driven culture.

The article was first published here.

Photo by micheile henderson on Unsplash.

5.0

5.0