- Stakeholder capitalism – ensuring that business serves society at large – has been on the rise during the COVID-19 pandemic.

- A new World Economic Forum report outlines how to create governance frameworks for environmental, social and governance (ESG) standards.

- The recommendations cover purpose, strategy, board composition and more.

The gradual pace of social progress is occasionally punctuated by periods of rapid change. We are undoubtedly amid one of these shifts, as pandemic, climate risks, and economic and racial inequality test society’s resilience – and rapidly force new ways of operating.

These shifts are increasingly apparent in the business world, where businesses are adapting by integrating stakeholder outcomes into their business models. “Stakeholder capitalism” has made headlines over the past 18 months as the World Economic Forum, the Business Roundtable and others have called on corporate leaders to include the voice of stakeholders in their decision making.

The rise of stakeholder capitalism

In response, many corporate leaders are seeking to refocus the purpose of business. For example, the US Business Roundtable changed its statement on the purpose of a corporation in August 2019 to commit to promote “an Economy that serves all Americans”.

In addition, the world’s largest investors, including Blackrock, State Street and Vanguard, have begun publicly to endorse the importance of sustainability. Climate Action 100+, an investor-led initiative launched at the end of 2017 to ensure the world’s 167 largest corporate greenhouse gas emitters take necessary action on climate change.

Social movements to rethink capitalism have also grown. For example, Greta Thunberg and other young activists inspired global climate strikes. Similarly, the Black Lives Matter movement renewed focus on profound inequalities in society, adding to public demand for a fairer society.

Turning words into action

How can companies embrace the theories of stakeholder capitalism to drive long-term value creation and sustainable growth?

They must address two pressing challenges: measuring and reporting stakeholder practices on a consistent basis on the one hand and the imperative to embed stakeholder governance in corporate decision making on the other. Shareholders, investors, corporates and other stakeholders including NGOs and regulators have been vocal over the need for convergence of environmental, social, and governance (ESG) reporting standards and for practical guidance on embedding stakeholders in business strategy (or put more simply, how to “do” ESG).

A new Forum report, “The Future of the Corporation: Moving from Balance Sheet to Value Sheet,” provides practical guidance on steps boards, chairs and the executive can take as regards creating an effective stakeholder governance framework. These recommendations build on an earlier paper, “Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation” that proposed a set of stakeholder capitalism metrics using existing standards already followed by a number of companies.

Tangible solutions for corporate boards

The new report puts forward recommendations for companies to implement effective stakeholder governance. There is not a “one-size-fits-all” approach to stakeholder governance. Instead, each company must embark on its own stakeholder governance journey, guided by its purpose. The recommendations cover purpose, strategy, culture and values, fiduciary duties, board composition and effectiveness, stakeholder engagement, engagement with shareholders/investors, incentives, ESG KPIs and transparency and reporting.

We find that successful stakeholder-oriented companies are proactive in engaging their investor base. Their boards know which stakeholder issues investors consider financially material, and demonstrate a culture of transparency in how they supervise these issues. Forward-thinking boards are intentional about the skillsets, incentives, and reporting they use to engage with investors on stakeholder-relevant issues.

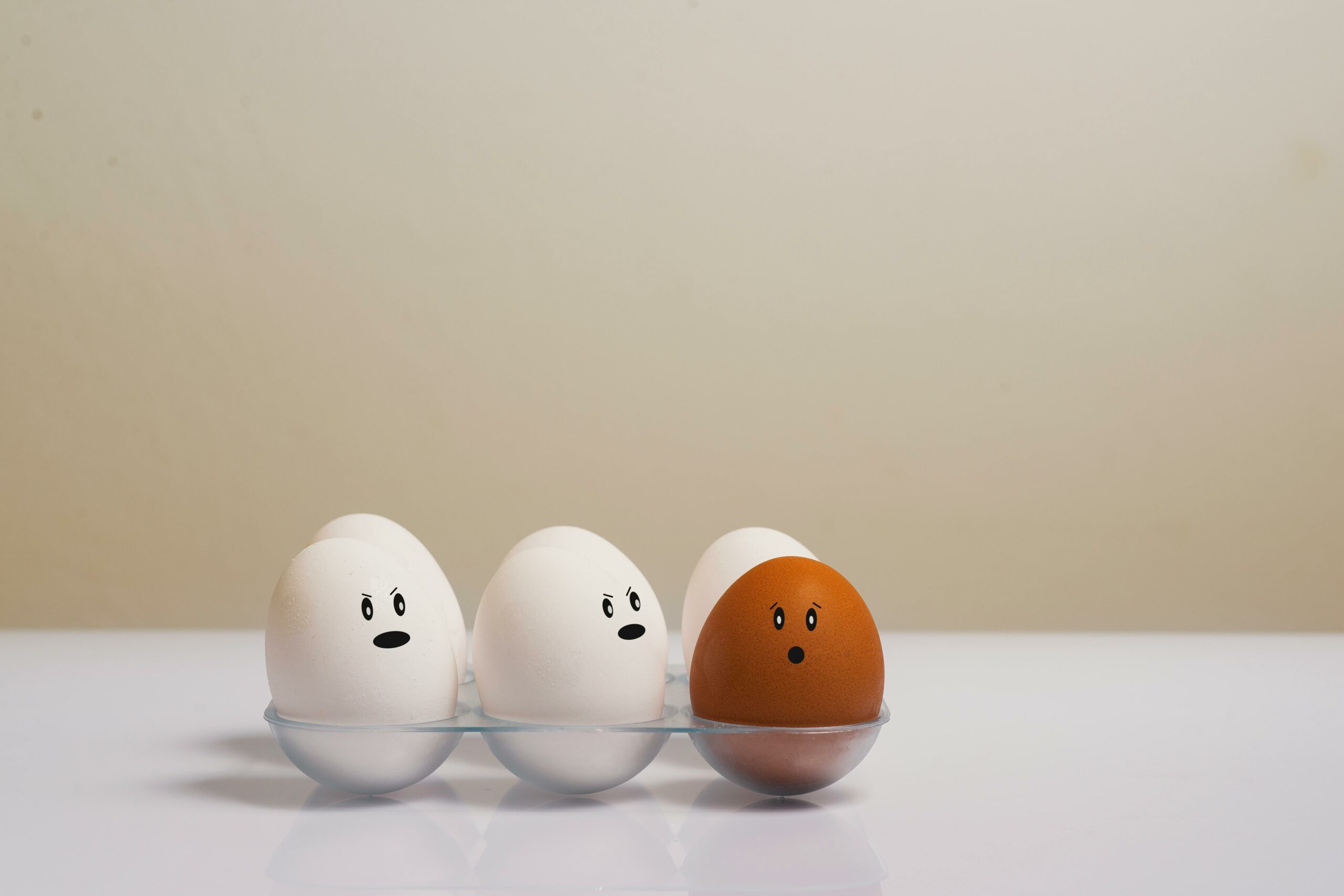

Board composition, and the incentives they put in place, continue to be critical success factors for effective stakeholder-oriented governance. Many companies have embraced the need for diversity of skill set, gender, race, age and physical ability. A board that reflects a company’s stakeholders can implement KPIs and incentives to track stakeholder impact and hold management accountable for it.

The use of ESG KPIs measured across the organisation year-on-year can be the beginning of a more holistic approach to valuing the board’s, management’s and workforce’s contribution to the success or otherwise of the business. Focus on climate, including science-based targets and decarbonization of supply chains, is also increasing.

The pandemic, climate, and inequality challenges of the past 18 month are unprecedented. But by building on decades of stakeholder theory, and utilizing emerging governance and ESG tools, corporate leaders can provide solutions to these challenges.

This article was first published here.

Photo by Jon Cartagena on Unsplash.

5.0

5.0