Authors

- Tensie Whelan, Distinguished Professor of Practice at NYU Stern and Founding Director of NYU Stern Center for Sustainable Business

- David Linich, Sustainability Principal, PwC US

Corporations and consumers are feeling squeezed by inflation, tariffs and volatile stock markets. Yet, despite this challenging economic environment, one consumer trend has held steady: demand for sustainable products. Products marketed as sustainable continue to grow in share alongside their counterparts. Notably, research shows sustainable products see an average price premium of 26.6% compared to conventional products.

Companies also increasingly find that sustainable strategies such as decarbonisation can generate meaningful financial value. Reducing emissions can lower operating costs, reduce risk and drive new revenue by identifying innovative products and services that those same consumers are demanding.

A growing number of corporate leaders and investors recognise this dynamic. PwC’s 28th Annual Global CEO Survey found one in three CEOs report climate-friendly investments made over the last five years have resulted in increased revenue.

But many organisations still fail to systematically identify and capture the full range of financial benefits. Why? Key stakeholders in sustainability and finance often lack clear methods for tracking these relatively new areas of focus and sources of value.

In this article, which is a joint effort between PwC and the Center for Sustainable Business (CSB) at NYU Stern, we highlight where and how companies can realise financial gains from decarbonisation, along with real world examples so you can be more equipped to identify and capture this value for your organisation.

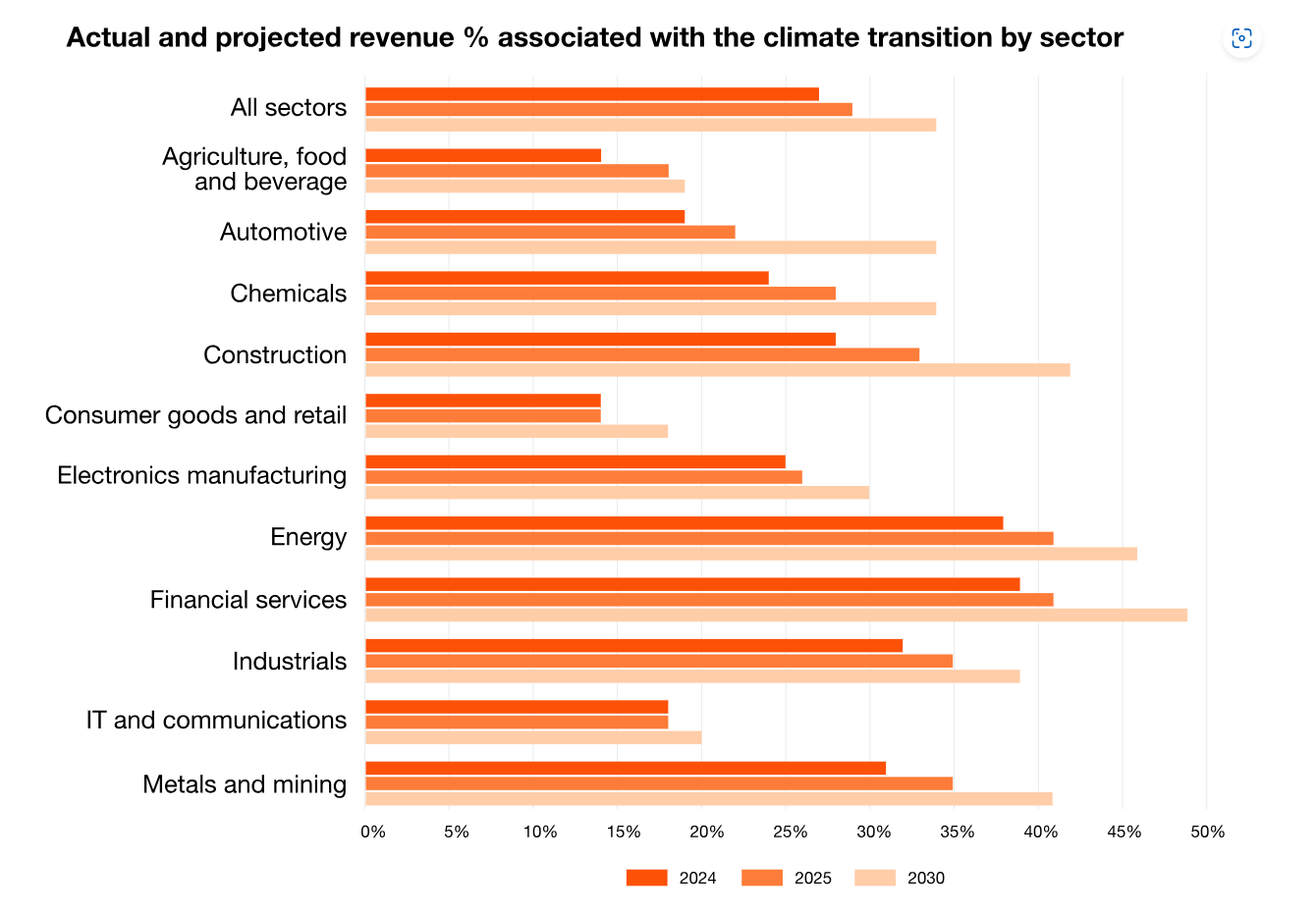

First, some data from PwC’s Second Annual State of Decarbonisation Report. We analysed practices across 4,163 companies and found they are anticipating one-third of their revenue will be associated with the climate transition in 2030. That revenue may come from net new revenue streams based on new offerings such as refurbished products or sustainability services, or it may come from higher sales volume and premium pricing.

NYU Stern CSB’s consumer purchasing research supports that thesis: sales of sustainability-marketed consumer packaged goods (CPG) in the US are growing 2.3 times faster than conventional products and at the average price premium we mentioned. As of 2024, products marketed as sustainable held a 23.8% market share of branded players, up 9.2 percentage points since 2013 and up 2.6 percentage points from the prior year despite continued inflation.

1/3

Companies project that 1/3 of their revenue will be associated with the climate transition in 2030.

PwC’s Second Annual State of Decarbonisation Report

26.6%

The average price premium sustainable products enjoy over their conventional counterparts.

NYU’s Center for Sustainable Business – Sustainable Market Share Index

2.3x

The sales growth rate for sustainable products versus conventionally marketed products.

NYU’s Center for Sustainable Business – Sustainable Market Share Index

83%

Of companies report R&D investment in low-carbon products and services.

PwC’s Second Annual State of Decarbonisation Report

Despite headlines about corporate and investor pullbacks from net zero alliances and commitments, PwC’s recent analysis from more than 4,000 companies found that 37% are increasing their climate ambitions, while only 16% are getting less aggressive. Smaller companies — often key suppliers to major brands — are also stepping up, with a sharp increase in climate commitments in 2024. This momentum enables large organisations to begin to address the Scope 3 emissions in their supply chains. (On average, these Scope 3 emissions are 11 times greater than Scope 1 and 2 combined.)1 Our analysis also found that 83% of companies report R&D investment in low carbon products and services that can sell for premium prices.

While the decarbonisation value drivers listed below are consistent across industries, they show up differently in practice. Most corporate finance teams track energy savings associated with decarbonisation efforts, but few account for costs tied to embedded carbon and natural resource use. NYU Stern CSB worked with a pharmaceutical company that reformulated a product using green chemistry, reducing water, energy, chemicals and waste — saving $1.5 million per 100 metric tons of product. Electricity represented $177,000, and carbon fees represented $240,000 of that cost reduction — but that was at a price of just $5 a metric ton in a few jurisdictions. By contrast, as of May 2025, the EU carbon price per metric ton was more than $80.

Before examining categories of financial benefits, it’s important to note their interrelated nature — valuable insights emerge when the full range is tracked. For capital-intensive investments, returns may appear insufficient without considering the benefits.

For example, a company that decarbonises its factories and warehouses by installing LED lighting can reduce costs and increase worker productivity through better lighting. That’s potentially reducing accidents and thus insurance costs, as well as decreasing maintenance costs because the lights do not need to be changed as often. A company that decarbonises its fleet by moving to electric vehicles can also potentially reduce energy costs, reduce maintenance costs and improve worker health and productivity. And finally, if the company powers its factories through renewables with storage on site, it reduces its downtime caused by power outages and/or costs associated with backup generators. These “secondary” and sometimes deferred or non-immediate benefits are seldom tracked but are real and can be sizable.

Energy costs are embedded in facilities, transportation, manufacturing and product use. Energy efficiency and a shift to renewables drive lower costs. A World Economic Forum study done in collaboration with PwC found up to $2 trillion in annual savings (at current energy prices) is possible using existing technology and if measures to reduce demand were taken by the end of this decade. NYU Stern CSB’s analysis of the financial benefits for sustainable building design for Gundersen Health System, for example, found that energy retrofitting would yield $1 per square foot in energy savings and avoided carbon fees, and net zero building design would yield net $2 per square foot annually. Optimising last mile delivery can also lead to energy savings and carbon fee reductions: Working with Cardinal Health on one supply chain route, NYU Stern CSB found optimisation would yield $254,000 in average annual savings. A circular approach can reduce greenhouse gas emissions and costs considerably: an automotive company reusing 2.5% of used car parts in Europe, recycling 10%, and paying to dispose of the rest, was netting $100 million annually in reduced costs and increased revenues, according to a CSB study.

Fossil fuel energy prices are volatile — and likely to become even more so. Companies that reduce their dependency on fossil fuels through energy efficiency and/or on-site renewable power reduce their exposure to price swings. For example, NYU Stern CSB found that a shift away from air transport to more ocean and road modes of transport, saved the apparel company Eileen Fisher an estimated $1.6 million annually in transportation costs by the fourth year of transitioning, and also insulated them against pricing volatility during COVID when air freight costs increased by 25-50%, especially between Asia and the US.

Global regulations, including in the European Union and California, require companies to report on their carbon emissions. While some countries have yet to enact similar regulations, and others, like the US, are delaying implementation at the federal level, the magnitude of climate-related risk is significant and growing, likely meaning more regulation in the future. In addition, companies risk losing customers. Brands and retailers are asking their suppliers to decarbonise to meet their own commitments and are increasingly including carbon specifications in their RFPs. For example, Apple is facilitating the transition of its direct manufacturing suppliers to 100% renewable electricity as part of its goal of being carbon neutral by 2030. Consumers are purchasing sustainable products in large numbers, and they and regulators are looking to make sure claims are authentic. Various jurisdictions such as the EU, US, UK, Australia and India, have active or proposed legislation that addresses false or misleading claims about environmental benefits. In the EU, penalties can amount to a minimum of 4% of annual revenue in the region per breach.

Government-imposed carbon fees can be as much as $159 per metric ton, according to the World Bank. Nearly 28% of global emissions are subject to some type of carbon pricing, and that percentage is growing annually. Governments generated $102 billion in revenue from carbon pricing fees in 2024. The EU has a carbon border adjustment tax, which will tax the embedded carbon of goods exported to the EU from elsewhere. Energy companies clearly have significant exposure, but agricultural and manufactured products, including packaging, generally have high levels of embedded carbon, often unmapped by the company selling the products. The emissions associated with AI computing needs are also significant and growing. PwC found that companies are emitting an average of 132 tons of CO2e per $100,000 in revenue, which would amount to 6.6% of revenue for a carbon fee of $50 per metric ton.

Companies investing in climate action are increasingly able to access lower-cost financing through green, social, transition or sustainability-linked bonds and loans. These instruments fall into two categories.

- Use of Proceeds (UoP) instruments: These green, social and transition bonds require that funds be directed toward specific environmental or social projects, with most supporting decarbonisation investments. Transition bonds are a relatively new mechanism designed to finance climate transition plans. These UoP instruments often benefit from a pricing advantage while also offering issuers access to a broader pool of investors and reputational benefits.

- Sustainability-linked bonds and loans: These instruments are not tied to specific uses of proceeds but are linked to achieving company-wide sustainability performance targets, such as reductions in greenhouse gas emissions. If targets are met, issuers typically receive a discount of around 25 basis points on interest rates. Some financial institutions are also beginning to charge a premium to companies — such as utilities — with high exposure to climate transition risk.

NYU Stern CSB worked with Capital Power, a Canadian-based utility, to assess the financial benefits of phasing out coal earlier than required by federal regulations. The analysis found that the company could realize cumulative net benefits of $189 million over nine years, driven in part by a reduced cost of capital.

Innovation that produces new products, processes or services can open up access to new markets and revenue streams. Reselling platforms such as eBay Pre-Loved and ThredUp upcycle and resell apparel. They have been successful at not only creating value for themselves, but also for brands by enabling access to new customers and revenue from reselling garments multiple times. B2B companies are developing decarbonisation solutions for their customers and suppliers. IKEA, which strives to use 100% renewable energy across its value chain, announced earlier this year that the share of renewable electricity in production of its products increased from 71% to 74% in its 2024 fiscal year. It has a program that helps its suppliers purchase renewable electricity via bundled frame agreements or power purchase agreements. It also uses logistics modeling and other technologies to help suppliers understand and reduce transport-related emissions by improving routing, load efficiency and mode shifts (air, rail, sea).23

Consumer-facing products and packaging that reduce carbon footprints are also popular. To reduce its emissions, coffee brand Nespresso, has assessed the carbon footprint of its entire value chain, from the farmer to the cup. It works directly with farmers to reduce the impact of coffee cultivation and the Nespresso system uses a precise amount of ground coffee, water and energy to make one cup, which minimises food, water and energy waste. Aluminum from capsules and coffee grounds are recycled, helping compensate for the additional packaging used for portioned coffee.45

The Canadian utility mentioned earlier was also projected to benefit from $41 million in increased competitiveness with customers over nine years due to customers making decarbonisation commitments and looking to reduce their scope 2 emissions through their utilities.

Measuring emissions according to the Greenhouse Gas Protocol has become a table-stakes expectation for many organisations. It’s important to know where your emissions are today as well as where they will be in the future if no further action is taken to reduce them. This view will help the organisation understand the full magnitude of emissions reductions needed to achieve the targets they set.

There are many actions companies can take to reduce their emissions, and PwC has compiled an inventory of over 2,600 different levers in its Carbon Intelligence Hub.

A good starting point is to identify actions to reduce energy and fuel use through process and equipment optimisation and building energy efficiency actions.

In addition to reducing energy use, organisations should look to convert remaining energy needs to cleaner energy sources by converting fossil-based energy sources to electric and tapping into renewable energy sources such as onsite solar or geothermal or by entering into a power purchase agreement for renewable energy.

For Scope 3 emissions upstream and downstream, organisations should explore how product or service design can reduce emissions through less carbon-intensive materials or less energy required to source, manufacture and transport them. Work with suppliers and customers to reimagine the design and to get these solutions adopted.

The finance and sustainability teams can work together to finalize the ROI for a range of conservative to more aggressive scenarios.

The team should estimate how much carbon each lever will remove, along with the capital and operating expenditures required, available tax credits and incentives and other financing options, and the potential upside and risk avoidance of each lever. They should also project the tangible and intangible benefits of the investment (e.g. energy cost savings, maintenance savings and improved productivity related to LED lighting).

The levers can be grouped into different scenarios to understand the breadth of actions needed to achieve different targets. The finance team should put in place the metrics to track the financial benefits (intangible and tangible) of the investment once made in order to improve future decision-making.

Equipped with a clear understanding of the full costs and benefits of different ambition levels, the team can seek leadership buy-in on the desired targets. This buy-in should include support from finance for the CapEx and OpEx needed, from tax to capture incentives, and from operations, R&D, and supply chain to commit to the actions needed to reduce Scope 1, 2 and 3 emissions to achieve the targets.

Once the ambition level is agreed upon, the team may need to develop a more detailed plan that outlines the governance, processes, KPIs and detailed near term actions needed.

Investors, regulators, customers and employees increasingly expect transparency and accountability. CEOs and CFOs who actively report on climate goals can signal strategic foresight, reduce reputational risk and strengthen stakeholder trust. Demonstrating tangible progress can also unlock competitive advantage in a market where climate performance is fast becoming a differentiator.

About the research

The NYU Stern Center for Sustainable Business has investigated and mapped the value-drivers linked to decarbonisation for industries ranging from health care to agriculture and PwC has also analysed CDP data and client-facing work. We have come together to help provide a corporate roadmap to driving financial value through decarbonisation strategies.

- PwC and World Business Council for Sustainable Development. Reaching net zero: Incentives for supply chain decarbonisation. November 4, 2021. https://www.wbcsd.org/resources/incentives-for-supply-chain-decarbonization/

- IKEA accelerates the shift to renewable electricity in product. IKEA press release. January 30, 2025.

- Co-creating a decarbonised goods flow. IKEA.

- The Positive Cup: 2024 Progress Status. Nespresso.

- What’s the environmental impact of your cup of coffee? Nepresso. September 2023.

The article was first published by PwC.

Photo by Shrian Den on Unsplash.

5.0

5.0