Climate change is visibly disrupting business. It is driving unprecedented physical impacts, such as rising sea levels and increased frequency of extreme weather events. At the same time, policy and technology changes that seek to limit warming and reduce the associated physical impacts can also cause disruption to business. As with any form of disruption, climate change is creating and will continue to create risks and opportunities for business in a diverse number of ways.

This disruptive relationship between climate change and business is already receiving increased attention. This has been prompted by the Paris Agreement, the emergence of climate-related legislation, the recommendations of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD) and, most recently, the heightened awareness of physical impacts and risks detailed in the Special Report of the Intergovernmental Panel on Climate Change (IPCC) on Global Warming 1.5°C.

In light of this attention, investors, regulators and other stakeholders are challenging companies to demonstrate an integrated, strategic approach to addressing climate-change risks and opportunities.

An important element in ensuring that climate risks and opportunities are appropriately addressed is the important duty that boards of directors have for long-term stewardship of the companies they oversee. However, to govern climate risks and opportunities effectively, boards need to be equipped with the right tools to make the best possible decisions for the long-term resilience of their organizations.

This article was first published here.

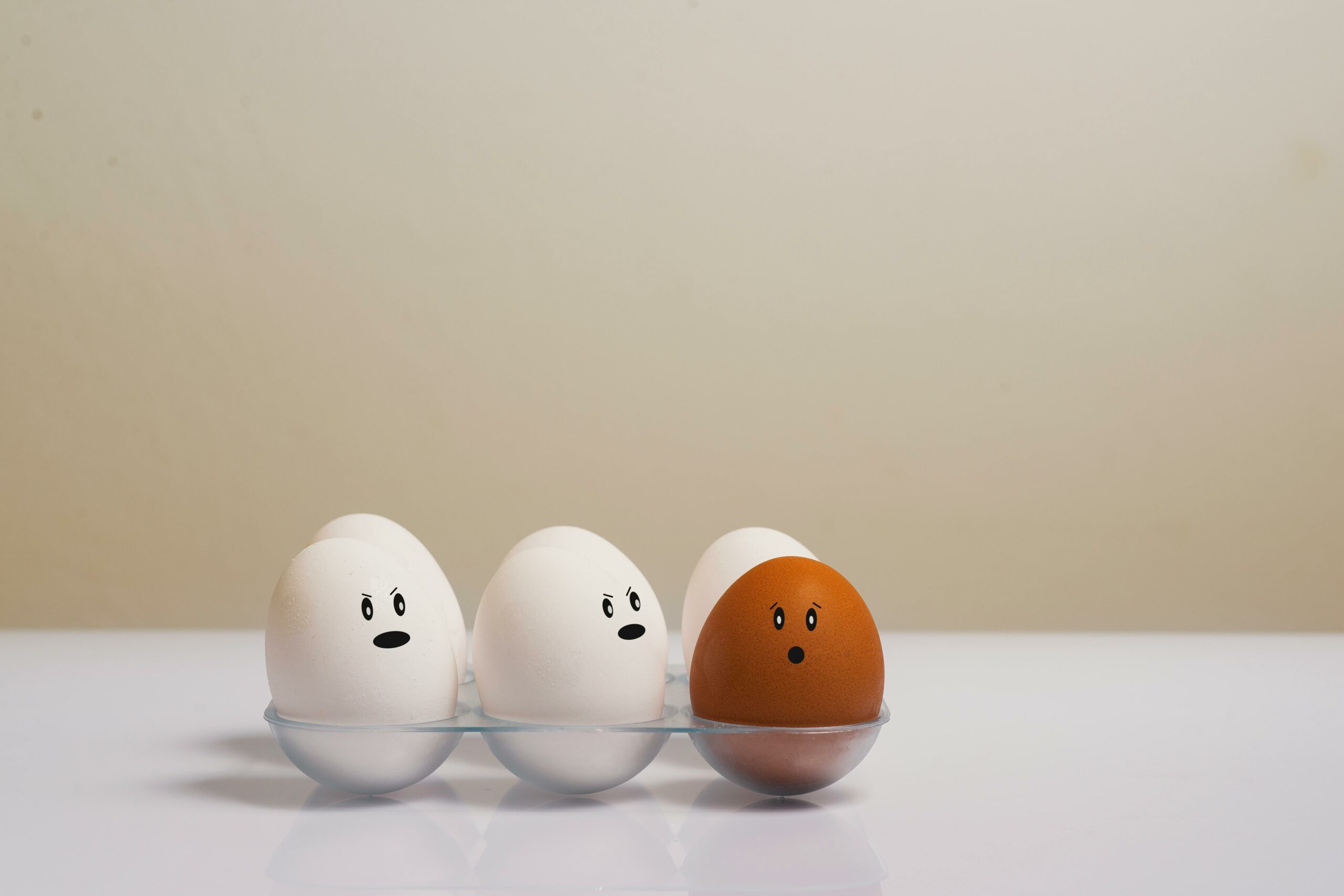

Photo by Daniel Leone on Unsplash.

5.0

5.0