The fifth EY Climate Risk Barometer shows an increase in companies reporting on climate but falling short of their carbon ambitions.

In brief

- There are incremental increases in the quality of climate-related disclosures, but the rate of improvement is not enough for measurable change

- Three new core areas will dictate the reporting landscape over the next few years

- Companies should use climate-related disclosures to drive corporate strategy rather than view it as a compliance burden

After a decade in which companies’ climate-related disclosures have become more tightly regulated, the focus is now on action, and on moving from commitments and target-setting to measurable results. The need for action is more urgent than ever. It is not enough to simply stay up to date with the latest iteration of climate-related standards. Neither is it possible to bring about much-needed change by simply offering vague, long-term ambitions without a clearly articulated plan of how to achieve them. The reality is that government regulators, stakeholders and the public are demanding far more from companies in the battle to arrest climate change.1

Now in its fifth year, the EY Climate Risk Disclosure Barometer (pdf) is designed to identify the trends, opportunities and key issues facing businesses in relation to climate change. An economy-wide transformation is needed to keep global warming to a below -2°C trajectory. As such, businesses need help to navigate the complex landscape of regulatory requirements and understand their benchmarking at a global level. The better the information that exists for stakeholders, regulators and investors, the better and more sustainable the decisions that could be made by businesses and governments in relation to climate risks.

2023 EY Climate Risk Disclosure Barometer

If they have not already done so, companies must shift their mindsets to understand that addressing and reflecting climate risk in reporting is not a mere tick-box exercise. Rather, it could present opportunities to thrive. A recent EY study found that when companies act on climate change, they realize above-expected returns across financial, customer, employee, societal and planetary value.

Encouragingly, the 2023 Barometer shows that companies are making progress with their climate disclosures. Overall, the quality score for the disclosures analyzed for the research rose from 44% to 50%. This confirms that companies are investing more time and energy into improving what they disclose to stakeholders. At the same time, positive signs of improved governance may be noticed across the world. Many companies are adopting International Sustainability Standards Board (ISSB) disclosure requirements and disclosing whether they have the necessary skills at board level to oversee climate-related strategies. Additionally, companies are considering Scope 3 greenhouse gas emissions across all material categories to better understand the climate risks and exposures within their value chains. These improvements are marginal, however. To put the findings into context, it is now eight years since the launch of the Taskforce on Climate-Related Financial Disclosures (TCFD). Therefore, a quality score of just 50% is a concern. Climate reporting is crucial in helping us understand whether the economy as a whole – and sectors and companies within it – are actually moving towards real transition.

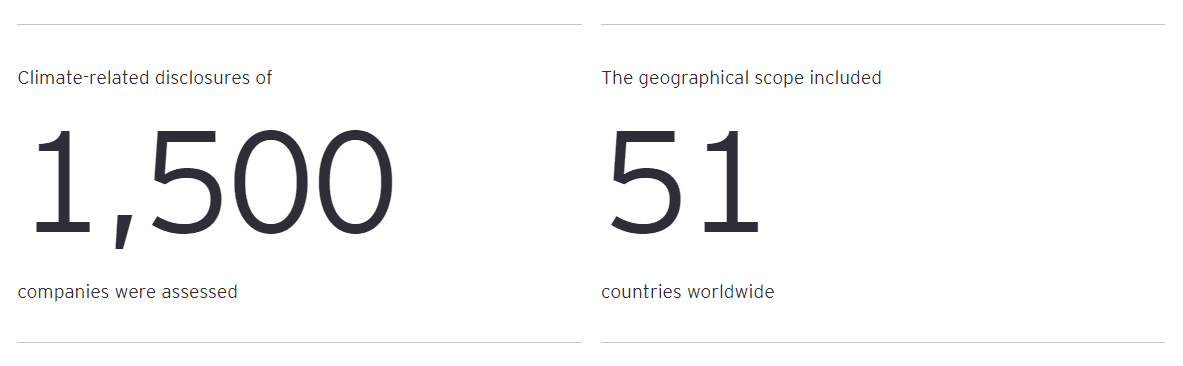

In 2023, EY conducted an overview analysis of the alignment of organizations’ climate-related risk disclosures. The research considered the disclosures of more than 1,500 companies (the largest by market capitalization) across 13 exposed sectors, in 51 jurisdictions. It draws on public disclosures produced during the 2022 calendar year by companies in both financial and non-financial sectors, including companies that are at high risk of climate-related impact. These disclosures were typically made in annual sustainability reports and Carbon Disclosure Project reports.

This assessment provides an understanding of the current state of global climate risk reporting, particularly in terms of how it aligns with the 11 recommendations of the TCFD.

Companies were scored on two different metrics: the coverage and quality of their disclosures.

Coverage: Companies were assigned a percentage score, based on the number of TCFD recommendations they addressed. A score of 100% indicated the company had disclosed some level of information compliant to each of the recommendations, regardless of the quality of information provided.

Quality: Companies were given a rating based on the quality of the disclosure expressed as a percentage of the maximum score, should the company implement all 11 recommendations.

Several new elements included an exploration of organizations’ readiness for the introduction of IFRS S2 Climate-related Disclosures.

To read more about the methodology, see the full report.

Part 1 – Leaders and Laggards: Benchmarking within Sectors and Markets

Certain markets and sectors are pushing ahead with climate reporting, while others are still lagging.

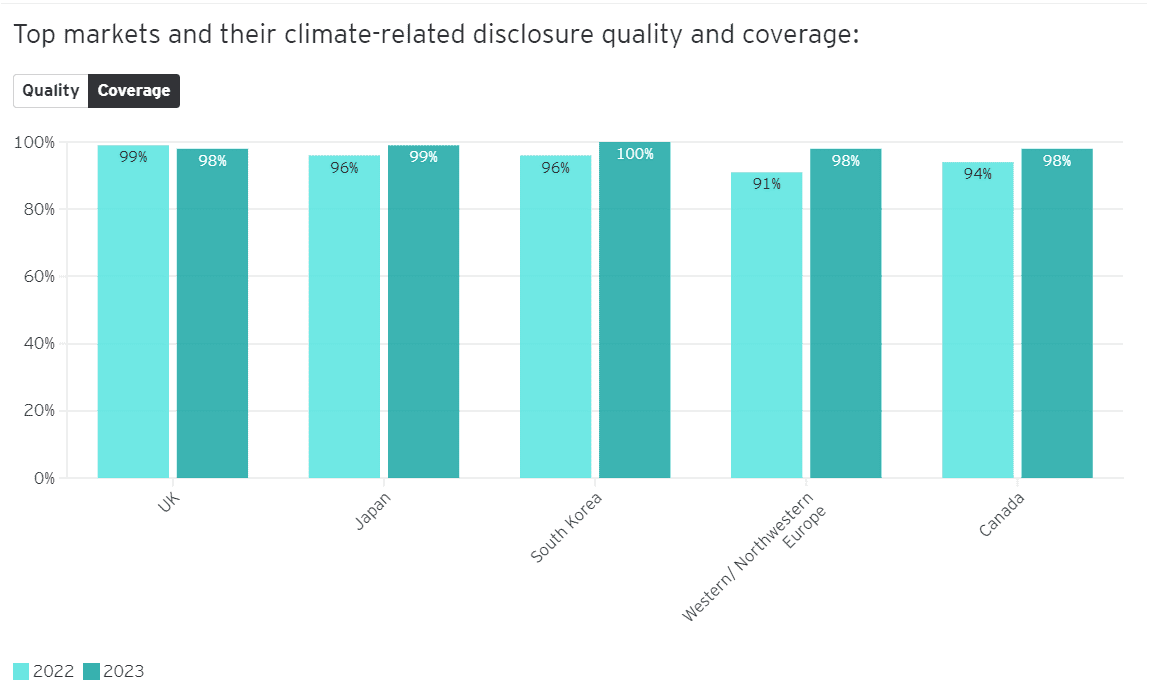

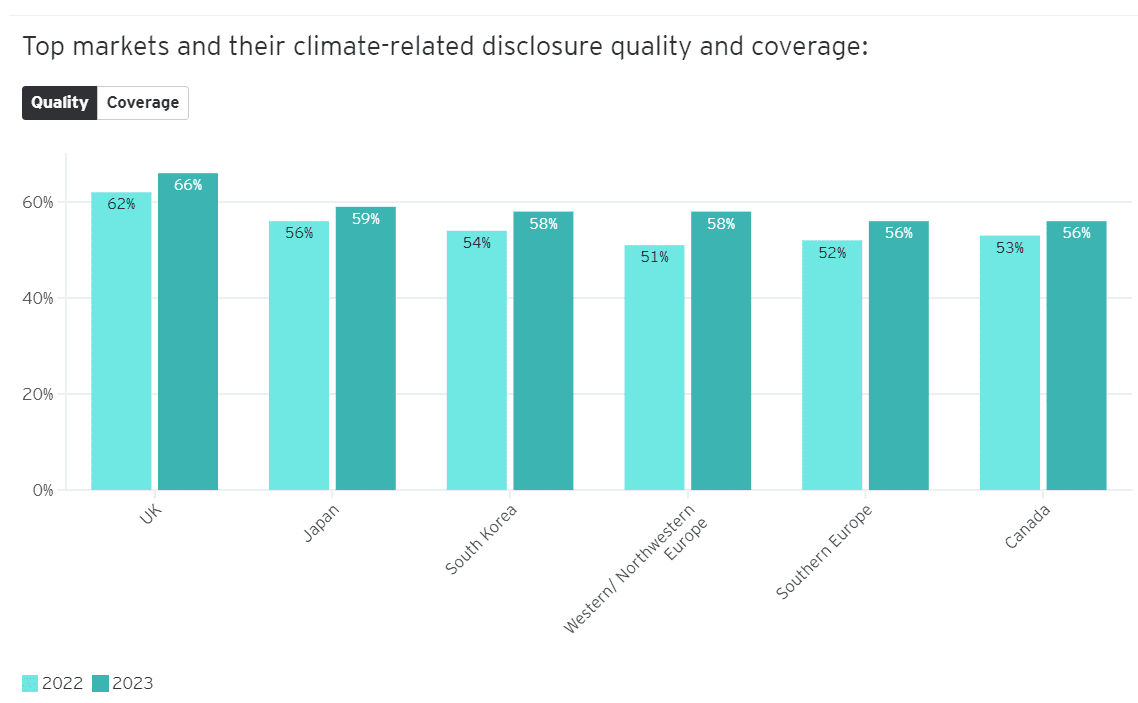

In a trend that reflects last year’s Barometer, certain markets and sectors continue to push ahead with their climate-related disclosures, while others work to catch up.

The first chart shows the top five best performing markets and their climate-related disclosure quality. The UK is at 66%, Japan is at 59%, South Korea is at 58%, Western/Northwestern Europe is at 58%, Southern Europe is at 56% and Canada is at 56%.

The second chart shows the top five best performing markets and their climate-related disclosure coverage. South Korea is at 100%, Japan is at 99%, UK is at 98%, Western/Northwestern Europe is at 98% and Canada is at 98%.

The third chart shows the top five best performing sectors and their climate-related disclosure quality. Both Energy and Insurance are at 55%, Materials and Buildings together with Other financial Institutions (e.g.: Exchanges, other financial services providers, rating agencies and credit bureaus) are at 54% and Telecommunications and technology is at 52%.

The fourth chart shows the top five best performing sectors and their climate-related disclosure coverage. Energy is at 95%, Materials and Buildings is at 95%, Insurance is at 93%, Telecommunications and technology is at 91% and Other financial Institutions (e.g.: Exchanges, other financial services providers, rating agencies and credit bureaus) is at 84%.

From a market perspective, Japan, South Korea, the Americas and most of Europe are all performing strongly and leading the way in terms of the quality of their disclosures. This is unsurprising, since these countries and regions can draw on several years of mandatory TCFD disclosures, which have readied companies for the ISSB’s more detailed requirements.

On the other hand, the Middle East and Southeast Asia have improved their performance compared with last year and positioned themselves for further progress but are still trailing behind. Governments have an opportunity to strengthen their climate disclosure requirements to accelerate progress. By adopting mandatory climate disclosure requirements, they can potentially change the currently low scores to a significant extent.

As for sectors, this year’s report once again highlights that those companies with the most exposure to transition risk tended to post higher scores for their disclosures, in terms of both quality and coverage. Energy tops the league for quality and coverage, though its quality performance is largely matched by financial institutions such as exchanges, other financial services providers, ratings agencies and credit bureaus, whose score has risen notably year-on-year, from 46% to 54%. In fact, quality has improved across the board, with the biggest changes seen in real estate, mining, agriculture, and materials and building, as well as financial institutions. The shift in scores comes from stakeholders, such as regulators and investors including financial institutions, putting pressure on businesses in carbon intensive sectors to disclose their decarbonization plans and progress. From the point of view of financial institutions, funding drives the bulk of their businesses, and investors are putting pressure on them to reduce their brown lending.

The shift in scores comes from stakeholders, such as regulators and investors including financial institutions, putting pressure on businesses in carbon intensive sectors to disclose their decarbonization plans and progress.

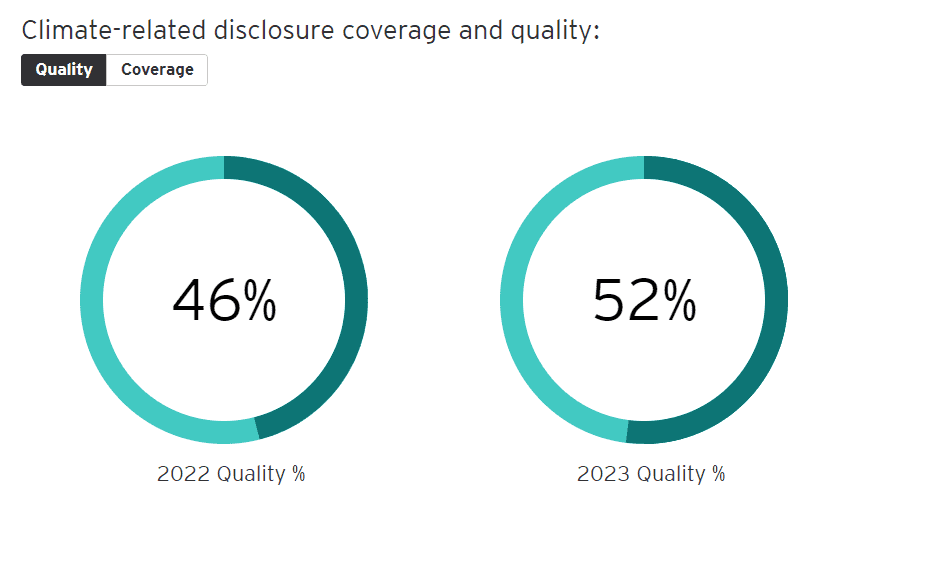

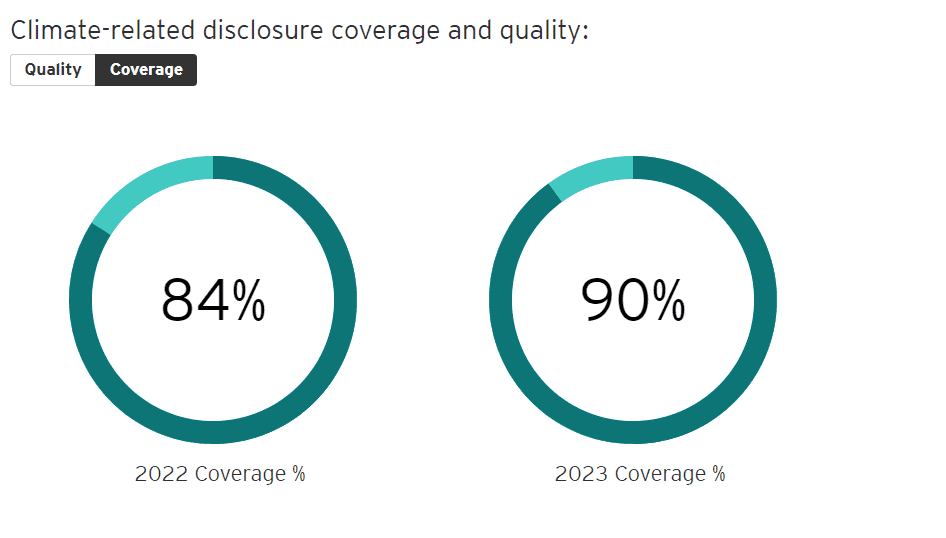

The first two circular graphic images show that the average score for the quality of governance disclosures since last year has increased from 46% to 52%. The second two circular graphic images show the increase in Coverage has climbed from 84% in 2022 to 90% in 2023.

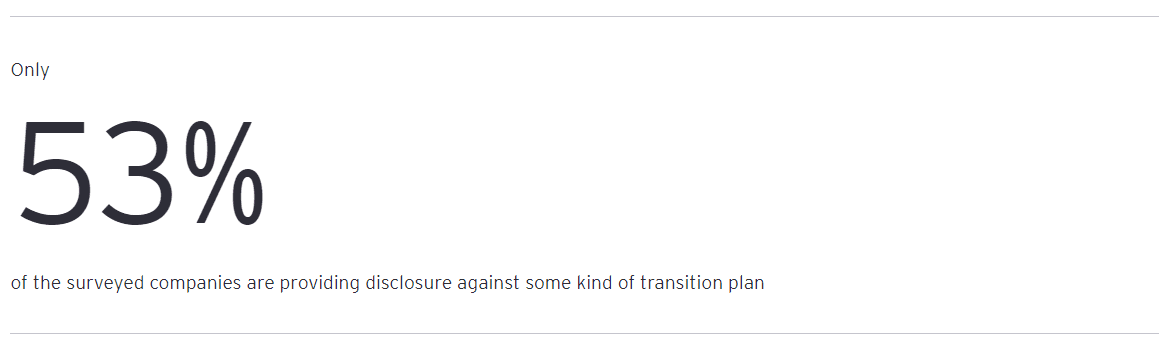

The average score for the quality of governance disclosures has increased from 46% to 52% since 2022 – partly due to regulatory pressure – but that figure is still too low. Transition planning also remains patchy, with only just over half (53%) of companies providing some kind of coherent plan. The research found that companies are still more focused on risks than opportunities when it comes to climate disclosures. While 77% of those assessed have conducted analyses on risk, just 68% have done so on opportunities, a slight improvement on 2022.

Part 2 – Shaping the Reporting Landscape of Tomorrow

What key elements will impact climate-related disclosures the next few years?

In addition to companies’ disclosure performance against TCFD recommendations, this year’s research also included three core elements that will shape the reporting landscape for the next few years.

The core elements that will shape the reporting landscape for the next few years:

ISSB Preparedness

Companies’ levels of preparedness for the introduction of the ISSB’s first two IFRS Sustainability Disclosure Standards, which are applicable from 1 January 2024.*

Transition Planning

Companies’ activities to design and implement effective transition plans.

Climate Risk Reflection

The level to which climate-related risk and opportunities are being reflected in companies’ financial statements.

The text above shows the three core elements that will shape the reporting landscape for the next few years:

- These are, firstly, ISSB preparedness. This covers a company’s levels of preparedness for the introduction of the ISSB’s first two IFRS Sustainability Disclosure Standards, which are applicable from 1 January 2024 (dependent on jurisdictional adoption).

- Secondly, Transition planning. This covers a company’s activities to design and implement effective transition plans.

- Thirdly, Climate risk reflection in financial statements. This covers the level to which climate-related risk and opportunities are being reflected in companies’ financial statements.

ISSB Preparedness

For the first time, this year’s research looked at companies’ readiness for meeting the requirements for IFRS S2 Climate-related Disclosures. These findings stood out:

- In relation to governance, companies are adopting the increased ISSB disclosure requirement and disclosing which skills and competencies are required at board level to oversee climate-related strategies.

- Looking at strategy, companies are moving toward additional disclosure around scenarios that include detailed analysis and its inputs. In addition, companies have started to include value chain emission reduction targets within their overall reduction targets.

- From a metrics and targets perspective, companies are moving toward disclosing their Scope 3 emissions for the most material categories.

Leading companies are typically looking at how climate could impact their business strategy, rather than using reporting frameworks solely for disclosure. Climate issues are becoming core to top-line business strategy, and companies that have understood the links between climate risk and their business growth strategy are well positioned to address the new requirements of IFRS S2. Examples of pacesetter companies that are using climate disclosures to drive strategy can be found in the full report (pdf).

Transition Planning

While greater engagement with sustainability disclosures is still needed, companies are now faced with a stark challenge: to design and implement an effective transition plan that takes into account real-world scenarios and commits real resource to the effort.

Yet the Barometer shows that only 53% of the surveyed companies are providing disclosure against some kind of transition plan. This figure should be significantly higher since a well-structured transition strategy helps companies to stay in line with, or ahead of relevant, policy goals for the organization.

Climate Risk Reflection in Financial Statements

Companies face heightened demand for greater scope and detail in their climate-related disclosures. Therefore, the most pressing question for them in the coming years will inevitably center on how their risks and strategic responses are reflected in their financial statements. The 2023 Barometer (pdf) shows that just over a quarter of companies (26%) are including the quantitative impacts of climate-related risks in their financial statements – which reflects the general trend for climate strategy and risk management to remain largely separate from corporate reporting. This is set to become a tension point since reflecting climate risk in reporting should not be a mere form-filling task, but a comprehensive, forward-looking effort to understand the anticipated financial impact. As such, it should be assessed in the context of the company’s value chain and wider market dynamics.

Part 3 – The Way Ahead: Picking Up the Pace

While the level of reporting is moving in the right direction, the pace and intensity are lacking.

The overall picture painted by the EY Global Climate Risk Barometer should ring alarm bells. Big year-on-year increases in certain statistics are rightly a cause for celebration, but for many sectors and geographies the improvement is from a low baseline, and progress is too slow.

The report identifies three actions that companies should take urgently:

- Shift the mindset from burden to action: The “pacesetter” companies use disclosure to drive behavior rather than see it as a compliance burden. Detailed, coherent and measurable data in disclosures is typically matched by the rigor and energy around strategy and action.

- Master the data to serve your carbon agenda: Use data to drive action and reduce emissions. Put in place governance structures to harness and manage data in such a way that it is always integrated into strategic and operational risk management.

- Elevate the discussion to drive impact: To truly inform the overall business strategy, address climate data and related impacts at board level. This, in turn, allows leaders to take a holistic approach that encompasses operations, people, supply chain and technology.

2023 EY Global Climate Risk Disclosure Barometer

To better understand why businesses need to shift from a commitment to an action mindset, take a look at the full report.

The article was first published here.

Photo by Jonas Jacobsson on Unsplash.

1.0

1.0