• Major business organizations are now aligning behind boardroom diversity.

• The pressure to refresh the C-suite can force older members out, leading to accusations of ageism.

• A long-term board strategy can avoid such problems, ensuring a balance of youth and experience.

It is the era of diversity and inclusion (D&I). Goldman Sachs announced in 2020 that it will only help companies go public if they have at least one board member who qualifies as diverse. State Street is insisting that FTSE 100 and S&P 500 companies release their diversity data or lose their support. JP Morgan has a board advisory service heavily focused on diversity and inclusion. And as of January 2021, companies that don’t have at least two diverse members including one woman, risk being delisted from the NASDAQ, one of the largest stock exchanges in the US. When companies like these, with trillions in assets under management, start to make D&I a strategic priority, the rest of the business world sits up and listens.

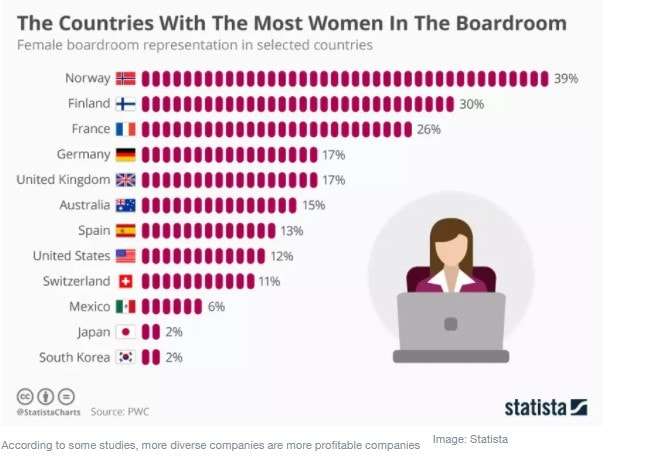

There is a growing consensus that more diverse boards lead to more growth, innovation and ultimately, profit. Some studies claim more diverse boards lead to better market performance, while others have found no relationship between the two matters; the level of impact is not clearly proven yet, though evidence is beginning to mount. While that question might be up for debate, most companies strongly believe that what State Street calls “the responsibility factor” means that addressing equality issues by introducing D&I initiatives at board level is imperative.

The route to board refreshment

There is much enthusiasm around making space for new voices in the boardroom, but there are also concerns. Among women, there is a strong desire to join boards where their industry experience and insights are valued, as opposed to tokenistic efforts where they are appointed purely based on their gender. There are also concerns around diversity of ideas, where boards may take a progressive approach to hiring women, people of colour and members of the LGBT+ community, but hire only from Ivy League universities, resulting in elitism and the potential for groupthink.

Globally, different factors come into play when it comes to board diversity. In Norway, Spain, France and Iceland, the law requires that women comprise 40% of board members at publicly listed companies. Meanwhile, board members must step down after nine years in the UK or 12 years in France unless they can demonstrate that their independence has not been compromised by their tenure on the board.

Self-defeating diversity

Quotas and term limits can be controversial. Diverse candidates tend to be younger, since the traditional pipeline of candidates to boards was accessible only to those who were older, white and male. However, a parallel challenge appears when board members who fit that description are asked to step aside – leading to allegations of ageism. In the world of tech, where youthful vibrancy has always been a valued commodity, IBM and Hewlett Packard are both facing lawsuits based on alleged ageism. A board that becomes outwardly diverse but fails to remain inclusive to its older members has undermined its own goals.

In the rush to right the wrongs of the past, organizations may unwittingly create new problems for themselves and barriers to true diversity. The desire to make space for newer, more diverse voices can become problematic if current board members feel sidelined or dismissed based on the fact that they are older. Research suggests gendered ageism in particular is a rising problem as older women are targeted.

The wisdom of age

Successful boards will seek to take advantage of their older board members’ experience, while seeking new voices to bring to the table. Management models like Edward de Bono’s Six Thinking Hats can ensure all voices and every point of view are well aired in an environment that is collaborative, rather than competitive.

Most boards will continue to need and value the input of long-established members. The experience of having gone through multiple economic cycles is of particular importance; a board member who went through restructuring after the 2008 crash is likely to have extensive input if their board is looking at restructuring as the result of the pandemic. Meanwhile, other areas like digital transformation and cybersecurity are likely to be dominated by their younger counterparts who have come up in these areas.

Creating this balance can only happen as part of a defined long-term board strategy. Whether quotes and term-limits are in place or not, this can involve proactive succession planning where board members are invited to be part of the process of mentoring someone to take their place in years to come. A formalized biannual conversation with board members on whether they wish to step down can remove any awkwardness at such a suggestion.

Bringing on new members need not always mean culling someone else’s seat; when a board is going in a new direction, expansion may be warranted.

The future-proof board

Boards should hold regular discussions on what expertise they should be looking for to support the organization. Finding diverse candidates means looking beyond traditional pools. At board level in particular, there is always the risk that hiring will happen informally on a golf course, omitting any candidates who are not already part of such circles. Subcommittees may be a good approach to ensure a rigorous process is in place, while the use of external consultants with broader networks can also help.

Boards should consider the skill sets the organization needs to fulfill its goals for the coming years. If expansion plans are on the horizon into new geographies or sectors, ensuring the board has some expertise in these areas is wise. Cultural “fit” can be a pretext for hiring more board members who think in the same way, so it’s less important to have that than it is to hire for good listening and communication skills.

Most of all, it’s vital to have a strong sense of purpose and take the time to find new board members who are aligned with it.

The article was first published here.

Photo by Clay Banks on Unsplash.

5.0

5.0