Drawing from our experience in reviewing and assuring sustainability reports, we identify where gaps in sustainability reporting may lie, before diving deeper into the issues behind these challenges.

As sustainability and climate targets gain importance, there is a growing call for trust and assurance over these non-financial data.

As of May 2024, our analysis indicates that 38% of the Top 100 listed companies on Bursa Malaysia have subjected their recent sustainability reports or statements to independent assurance, a significant increase from 21% in the previous year.

With regulation over this information is continuously increasing, this publication aims to highlight common pitfalls in sustainability reporting and provide some insights on how to mitigate these gaps for better reporting.

Common Challenges

To fully capture the scope and impact of your sustainability initiatives, your organisation must tackle these common challenges:

People

- Lack of buy-in on the importance of sustainability data reporting

- Lack of clarity on roles and responsibilities in preparing sustainability reports

- Insufficient ownership and accountability at the business unit level

- Inconsistent data entry by different data owners

Process

- Absence of Standard Operating Procedures (SOPs) for data collection

- Lack of clear communication regarding timelines and expectations

- Supporting evidence is often unavailable because it is not typically compiled

- Data is only compiled annually, often lacking periodic audits and reviews

- Discovery of errors from previous years after reporting

Technology

- Data are not readily available to be examined

- Data are not readily available to be examined

- Absence of a centralised ‘source of truth’ for ESG data

Common Pitfalls in Sustainability Reporting

1) Organisations often lack clarity on methodology and data quality when reporting sustainability indicators

In September 2022, Bursa Malaysia issued its Sustainability Reporting Guide (3rd Edition) which mandates the reporting of 22 common sustainability indicators across 11 sustainability matters.

Reporting of the sustainability indicators has often been conducted under various frameworks, such as the Global Reporting Initiative (GRI) Standards; Sustainability Accounting Standards Board (SASB) Standards; and Taskforce on Climate-related Financial Disclosures (TCFD) recommendations.

The challenge: companies have had the flexibility to use the reporting framework of their choice ever since sustainability reporting was made compulsory for listed companies in 2016. Each of these frameworks come with its own practices and methodologies. This would make it difficult to compare one company’s sustainability indicators to another, if the two businesses did not specify the reporting framework used.

Hence, organisations should formalise how data will be collected and reported on sustainability indicators. This clarity of methodology is crucial to ensure reporting consistency across organisations.

Emissions management

- Scope 1 emissions in tonnes of CO2e

- Scope 2 emissions in tonnes of CO2e

- Scope 3 emissions in tonnes of CO2e (at least for the categories of business travel and employee commuting)

Health and safety

- Number of work-related fatalities

- Lost time incident rate

- Number of employees trained on health and safety standards

Anti-corruption

- Percentage of employees who have received training on anti-corruption by employee category

- Percentage of operations assessed for corruption-related risks

- Confirmed incidents of corruption and action taken

Input

- What is the source data required for reporting?

- Are the data sources readily available?

- Can the data be traced to supporting documents?

Process

- How should the information be computed?

- Is the basis of computation consistent across the organisation/group of companies?

- Is the basis of computation consistent with market practice?

Output

- How should these indicator be presented in the sustainability report?

- Are narrative explanations required to explain the sustainability performance?

- Could the presentation and disclosure potentially be misleading, contribute to greenwashing?

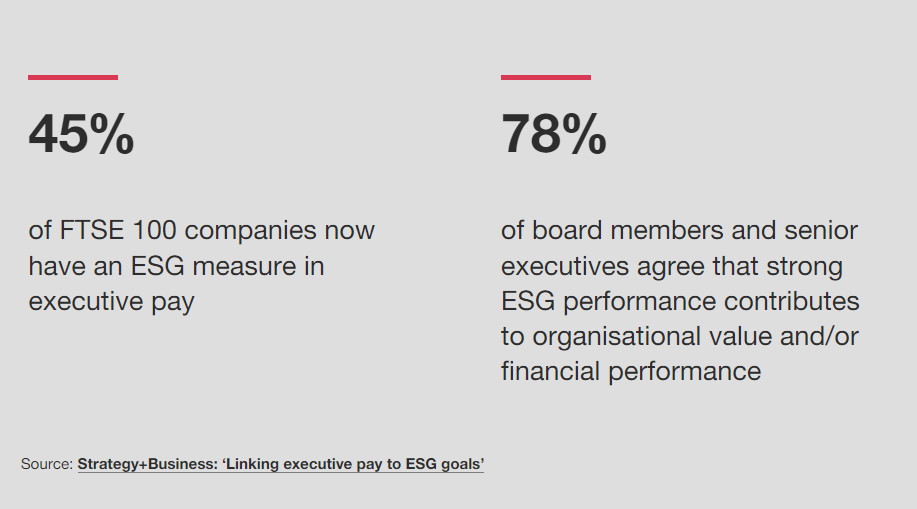

2) Insufficient accountability of the performance and the reporting of sustainability targets is a missed opportunity for value creation

Today, stakeholders have higher expectations of sustainability practices – they want to see measurable outcomes and constant improvements. This sets a higher bar for organisations to reach towards when disclosing net zero and sustainability targets.

However, having supported many Malaysian organisations with their sustainability reporting efforts, we have observed that clear accountability on sustainability performance remains a common challenge. This is because monitoring and reporting sustainability performance is often done sporadically and informally.

Incorporating sustainability key performance indicators (KPIs) into performance management presents significant opportunities for value creation. By integrating these KPIs into organisational frameworks, companies can better align their operations with sustainability objectives, enhance accountability and cultivate a culture of continuous improvement.

Similar to financial reporting, tracking and reporting on these non-financial metrics should be aligned with the Committee of Sponsoring Organisations of the Treadway Commission (COSO) Internal Control Integrated Framework, as outlined below.

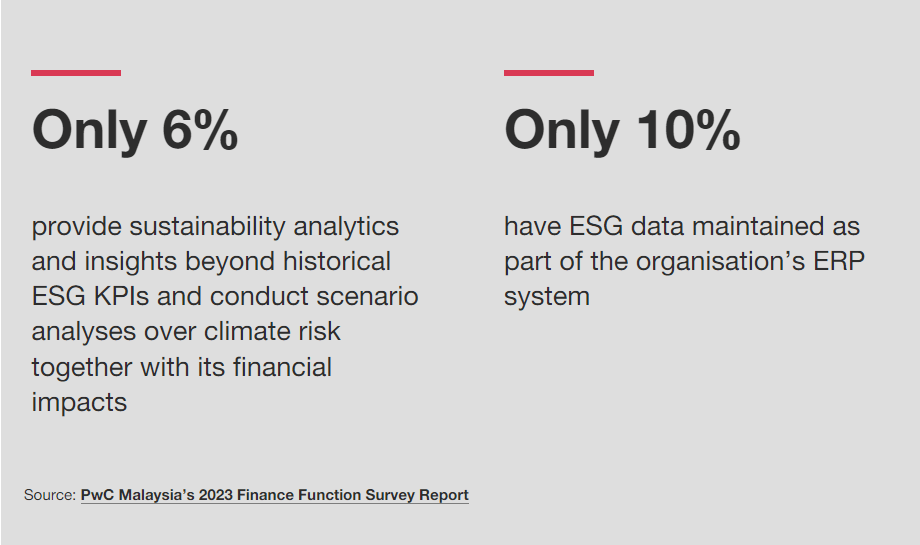

3) Manual reporting processes highlight the urgent need for technology investment

Findings from our 2023 Finance Function Survey Report show that only 10% of respondents indicated that their existing ESG data is integrated within the organisation’s Enterprise Resource Planning (ERP). This highlights a notable technology gap in managing ESG data.

The prevalence of manual reporting processes for sustainability data, which often relies on spreadsheets, poses risks of data manipulation and inaccuracies. This emphasises the urgent need to invest in technology.

Digital tools would not only improve the speed and accuracy of the reporting process; they could also help leadership incorporate ESG data into strategic decision-making across the organisation.

Taking the Lead on Sustainability Reporting

-

Set a clear reporting methodology

A clear reporting methodology should be adopted within an organisation, which will form the basis of how the data should be collected and reported.

-

Establish a clear line of responsibility and accountability

A clear SOP will ensure that there is accountability over ownership, with designated roles for collecting, analysing and reporting sustainability data.

-

Unlock value with human-led, tech-enabled sustainability reporting

Robotic Process Automation (RPA) and analytics are key to realising the full value of investor-grade ESG data.

The article was first publish by PwC.

Photo by Austin Distel on Unsplash.

5.0

5.0