The 5 Board “Must-Haves” for Successful CEO Transitions

(Originally appeared in the December 18th, 2019 ‘Across the Board’ publication, a Board Director, Board Advisor, C-Level, and Business Newsletter reaching 26,000+ exceptional business leaders in over 65 countries with articles focused on leadership, strategy, and governance topics – sign up here)

Essentially, it is a main imperative for Boards of Directors to hire a competent CEO (or Executive Director – ED – for nonprofits), and guide, assess, and govern the overall direction and strategy of the organization – through the entrusted CEO. Along these same lines, CEO succession is one of the key responsibilities of the Board of Directors. At its core, CEO succession refers to the structured process by which Boards of Directors secure sustainable and effective organization performance through transitioning CEO leadership. Needless to say, this responsibility is an extremely important action for the Board to implement properly and will decide whether your organization thrives or survives.

Regulatory bodies globally vary in their requirements of CEO succession data disclosures, creating inconsistent depths of publicly accessible data, but there is, however, some interesting history in the United States behind CEO succession processes in public companies as it relates to the Securities and Exchange Commission (SEC). Up until October 2009, public companies in the US were not required, and were somewhat reluctant, to disclose any information on their CEO succession processes, plans, and status to shareholders. Public company Boards typically grouped this information within what is called the ‘ordinary business exclusion’ (Rule 14a-8(i)(7)), which essentially permits a company to exclude (ignore) a shareholder proposal (request for information) if it “deals with a matter relating to the company’s ordinary business operations.” Boards had historically classified information relating to CEO succession in this ‘excluded’ category. This changed in October 2009 when the SEC updated its position on the releasing of information pertaining to CEO succession (Staff Legal Bulletin No. 14E (CF)) – they announced that matters pertaining to CEO succession “raised a significant policy issue regarding the governance of the corporation that transcends the day-to-day business matter of managing the workforce. Going forward, we will take the view that a company generally may not rely on Rule 14a-8(i)(7) to exclude a proposal that focuses on CEO succession planning (…except in situations where such a proposal seeks to micro-manage the company by probing too deeply into matters of a complex nature upon which shareholders, as a group, would not be in a position to make an informed judgment.)” This change indicated that regulators, rightfully so, reclassified CEO succession as a risk management issue and business continuity concern, firmly reasserting the responsibility and newly required transparent disclosure with the Board.

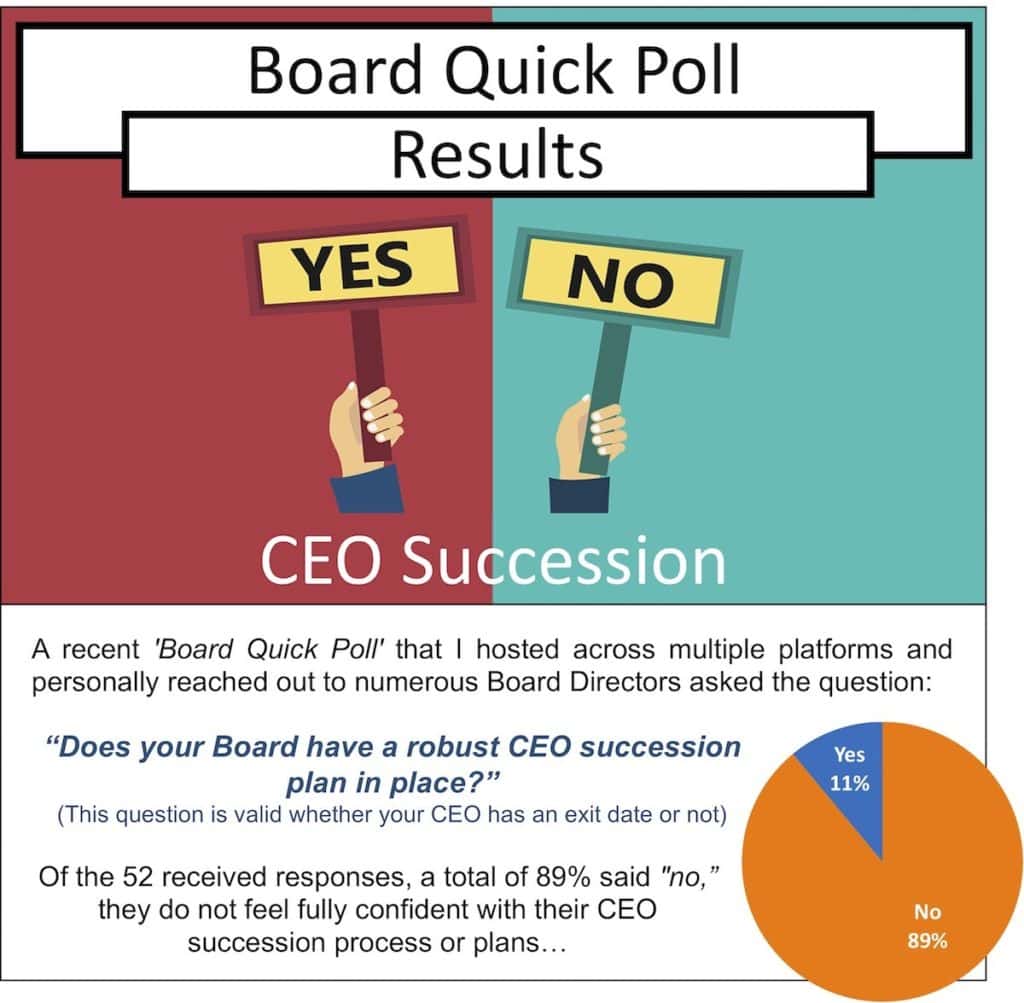

Even with the ever-increasing scrutiny on corporate governance, many Boards are still feeling out the acceptable line between includable and excludable information under this ruling. Interestingly, much of this has to do with a large percentage of Boards lacking a robust CEO succession plan to begin with – hence, the inability to assess and ascertain what information to release. A large percentage of the public Boards I work with are aware of their CEO’s intention to exit within a 3-year timeframe, but rely on wholly inadequate CEO succession plans (or a total lack thereof). An even riskier proposition includes scenarios of a CEO’s unplanned and unscheduled exit – something that every Board should be preparing for. A fact supporting this belief was seen in the first half of 2018 when nearly one in three CEO transitions at large companies involved a CEO resigning under pressure.

Regardless of the decision of what to disclose or not, it doesn’t hide the fact that most Boards are sorely unprepared for a CEO’s exit, whether planned or unplanned. Additionally, the total effort needed for proper CEO succession efforts is greatly underestimated by most Boards, in both time and duration. So, how can a Board ensure their CEO succession plans are indeed successful? Let’s look at a few areas of major importance in CEO succession initiatives that I systematically address and have come to trust over many years of implementation.

Over a dozen of my current Board consulting clients are at some stage in the process of CEO succession. Countless others have recently completed a transition. To ensure success in the CEO succession process, there are 5 main questions I initially assess and solution to lay the proper foundation:

Who owns the process?

Make no mistake – every Board Member owns the process as well as the outcome of a CEO succession initiative (Want an easy way to evaluate a Board candidate for an open Board seat? Research the success of an instated CEO from a previous Board the candidate served on). Treat CEO succession efforts as a major project and prime directive. Whether the Board creates a special project, ad-hoc committee, or houses the efforts within a standing committee, governance ownership of the process is important and should be directly integrated into the Board’s goals and strategy, not to mention reported on frequently. To be clear, CEO succession should always remain a Board priority, even when a current CEO is in-place and seemingly operating successfully. Unplanned CEO exits and forced resignations are a continual and existential threat to all Boards and organizations. I have seen quite a few Boards go from ‘stellar’ to ‘bottom of the barrel’ in short order when an unplanned CEO exit was experienced.

What is the timeline?

It is generally accepted that to ensure a seamless CEO leadership transfer, comprehensive preparation should begin 5 years in advance of a planned succession. This incorporates the full timeline from current CEO’s ‘inkling’ of an exit (or Board’s plan to make a change) to new CEO instatement. There is definitely some nuance here due to the average CEO tenure hovering around 5 years, but this is supportive of the premise that Boards should continuously be in the mode of CEO succession. Although succession planned in a shorter timeframe may not allow for needed contingency, many Boards leave considerably less time for this important transition, thus putting increased pressure on a Board and diverting efforts from core duties such as strategy and governance. Aligning Board makeup and time dedication is an important step in ensuring proper action is taken. It is worth mentioning that all CEO succession efforts should be achieved in full partnership with the current CEO when possible, which puts additional demands and time commitment on the current CEO.

Is it built into the Board’s strategy?

Let’s first start with the important concept that a Board should always have it’s own strategy in addition to the organization’s strategy. Yes, both strategies should be aligned, but the Board consistently has additional initiatives and goals to focus on that are separate and Board-specific (i.e. CEO succession). Without defined goals (the ‘what’) and an aligned strategy (the ‘how’), most Board initiatives will not be successful …and a failed CEO succession is no doubt a direct failure of the Board. Boards that have multi-layered strategies, one focused on CEO succession (proactive plan) and the other focused on emergency CEO succession (reactive plan), are most prepared to effectively tackle the challenge while simultaneously maintaining shareholder and employee confidence. Don’t underestimate the potential devastating effects of employee morale and stress during high profile transitions – protection of the employee lifecycle (hire, inspire, admire, retire – HIAR) should be continually measured and assessed. Additionally, ensure that specific succession goals, Board strategy, and progress milestones are fully defined and enforced. For more on the Board strategy topic, see my article, ‘Why Do Boards Continue To Struggle With Strategy?’

Is there a valid Talent Pipeline?

The reason for a wishful 5-year transition timeframe has much to do with finding and properly assimilating the incoming CEO, actions that can take up a large portion of the transition timeframe. Concerns above and beyond skill set, experience, and leadership acumen includes the ability to maintain, protect, and elevate the values and culture of the organization – all areas that have a direct impact on the bottom line (also known as ‘The ESG Challenge’). Many Boards fail to oversee a proper talent pipeline within their organizations, and even when a CEO’s exit intentions are made clear years in advance, Boards frequently find themselves behind the best-practices curve. The evaporating pool of officer-ready talent only exacerbates the dilemma. The premise that full reliance on an external search firm is adequate when a CEO-replacement need arises is a risky proposition and rarely satisfies a Board’s insatiable appetite when the CEO position becomes unexpectedly vacant. In addition to preferred search firm relationships, I am a staunch believer that there should always be at least one internal candidate capable of assuming the CEO position (or at the very least, extremely close in their ability to do so), as this forces ongoing Board focus on training and cultivation of viable future leaders within the organization. When in a pinch, some Boards are forced to lean towards the appointment of an existing Board Member to the CEO position. More often than not, this is due to inadequate CEO succession actions by a Board over an extended period of time. This type of CEO appointment, although typically shortening the succession process, can create interesting and somewhat unexpected behavioral dynamics, and the Board should be prepared to incorporate specific topics into their succession procedures to counteract any ‘familiarity’ or ‘hierarchical’ entitlements. Other Boards lean towards appointing an interim CEO, allowing additional time for a proper longer-term candidate to be found.

Although this may seem to have an effect of alleviating pressure from the Board, in many cases it is quite the opposite, as it can create duplicate work and additional internal upheaval. If appointing an interim leader, remember that a good interim CEO knows how to make progress towards the company’s existing goals in support of the future vision, but not at the expense of the organization by means of interim mandates and strategies that a future more permanent CEO may most likely change or eliminate when appointed. When building or guiding Board processes for assessing and ultimately appointing a CEO, I press for an interim CEO candidate’s understanding of fixing areas that need immediate attention, but not necessarily rolling out all-new processes, procedures, goals, or strategies that the organization will be expected to immediately rally behind, only to have a potentially entirely new direction in the very near future. If an interim CEO is performing their role properly, I view it as a ‘leveling of the environment,’ essentially fully preparing the organization for its future leader.

How will you manage the transition and measure performance?

Measuring the progress and effectiveness of an in-place CEO is a given, but many Boards either skimp or lessen the importance of measuring an incoming CEO’s transition process. Know that it is the process that is the key to a successful transition, so measuring progress and accomplishments along the succession journey is paramount. Viewing the transition process as an implementable special project for the Board with goals defined (the ‘what’), strategic priorities (the ‘how’) vetted as well as agreed, and the supportive Board tasks defined (the ‘when & who’) sets the proper environment and expectations for all parties. Be mindful to not just include the ‘hard’ and tangible areas of measurement, but also the ‘soft’ areas that directly affect company culture, loyalty, and values. The most robust CEO transition strategies and plans I have created always include an infusion of hard and soft components – and I am especially thankful when a Board is open to considering this proposed approach after hearing me out on the importance of the balance. In a nutshell, the role of the CEO in this new era of social responsibility demands not just the technical leadership components, but also the increasingly relevant mindfulness components. Savvy Boards are keenly aware that nearly 50% of new officer-level appointments fail in the first 18 months, many due to what is chalked up as a cultural mismatch. Through the incorporation of a formal ‘ executive assimilation’ component to the transition, the chance of long-term success for an incoming CEO greatly increases. “Misaligned culture, low trust, and mismatched leadership approaches, especially with legacy team members, are major threats to a newly appointed CEO’s success,” states Emily Bermes, CEO of Emily Bermes + Associates and an expert in executive assimilation. “It is imperative for new or newly-promoted CEOs to start in-role fully understanding stakeholder expectations, empowered to navigate the corporate culture, and armed with the context they need to quickly align their teams. This combination allows CEOs to execute on expectations more quickly, with less hesitation, all while making fewer costly mistakes.”

The costs of a failed CEO succession initiative can be colossal, with added negative exposure risk considering the lessening patience of today’s shareholders and stakeholders. The effort and expense involved in creating and implementing a robust CEO succession plan is not only the Board’s imperative, but an investment that will pay dividends for many years into the future.

This article was first published here.

Photo by Chelsea Scott on Unsplash.

5.0

5.0