ONE of the biggest phenomena we have observed not only in Malaysia but perhaps the world over is the level of participation by retail investors in the market during the Covid-19 pandemic and very well into the current recovery phase.

Statistics from Bursa Malaysia shows that retail participation in the market has increased by leaps and bounds and the earlier fear that this was only temporary seems have now been debunked.

According to Bursa Malaysia’s statistics, some RM1 trillion in value was traded in 2020, more than double the RM471bil worth of stocks traded in 2019, and retail investors were the biggest driving force as their market participation leapfrogged from 25% in 2019 to 38% last year at the expense of the domestic institution, as foreign participation was relatively flat at 46%.

Since the start of the year, statistics still shows that retail participation remained strong with year-to-date market share of about 39% in terms of value.

From strong market themes that drives retail investors, which of course includes the glove and tech sectors, retail interest tend to be concentrated on penny stocks as local retail market share in terms of market volume traded is close to 50%.

Nevertheless, it is the retail investors that are the biggest net buyers of the market over the past 3¼ years, i.e. between the period from 2018 and end-March 2021, with cumulative net buying of almost RM26bil, followed by local institutions at RM23.2bil, while foreign institutions have been net sellers during the same period to the tune of RM49.2bil.

In fact, the foreign boys’ net selling during this period has resulted in the foreign shareholding of the market declining from 23.2% as at end-2017 to the current level of about 20.4% – almost matching the previous low of 20.3% in 2009 and 2010.

Are retail investors buying to trade or investing for the long term?

There are statistics that seems to suggest that retail investors, who by and large trade penny stocks, tend to be traders or short-term investors, while those who are managing a portfolio of stocks for investment purposes are at least medium to long-term investors.

The latter group tends to be more fundamentalist, with capital appreciation and dividends as their main reasons for investments, while the traders tend to be more momentum players or driven by chart patterns and market rumours and are purely looking for short-term capital gains.

The end game is, of course, similar for both groups, which is to make money from the stock market.

Despite the greater participation among retail investors in the local stock market, statistics from Bank Negara in the form of total deposits placed in the banking system seems to suggest a lot of monies are placed in the traditional asset classes, like fixed deposits and savings.

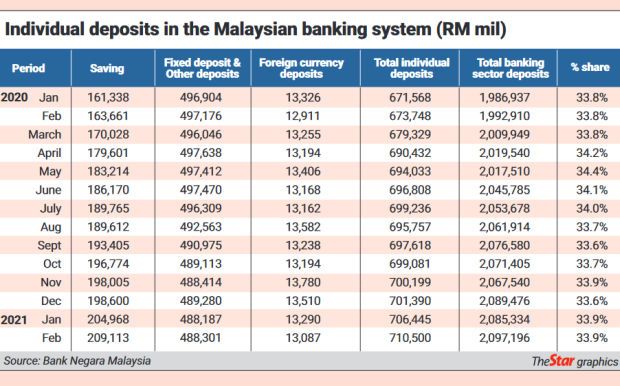

Table 1 summarises the deposits placed by individuals in various type of deposits that generally attract interest income. The table excludes demand deposits, which are seen as mainly floating deposits, as they are used to pay monthly obligations and expenses.

An interesting observation from this table is that, overall, both individual and banking deposits have been on a steady uptrend even before the pandemic, and in general, while we have seen some reduction in fixed deposits and even foreign currency deposits among individuals, the level of savings have actually been rising rather strongly.

A near 30% increase over a space of 14 months in savings by individuals in the banking system suggests that individuals may have shifted some deposits away from fixed deposits to savings, perhaps to meet the immediate needs for certain expenses but at the same time, individuals may have also increased their level of savings due to the perceived tough times during the Covid-19 pandemic.

This was also the time when the loan moratorium was extended to borrowers and perhaps, instead of channelling the monies towards consumption or other investments, individuals by and large saved it for the rainy days ahead.

As a percentage of total deposits, individual deposits has held a steady market share of about 34%.

However, these phenomena continued into 2021 and well after the end of the moratorium period in September 2020, with individual savings rising by another RM15.7bil to RM209.1bil, from RM193.4bil as at end-September 2020, an increase of 8.1%.

This could also be due to savings made by individuals from government handouts as well as payments received from the Employees Provident Fund’s (EPF) i-Lestari scheme. Last month, EPF was reported to have approved RM52.48bil under the i-Sinar withdrawal scheme, and out of this amount, some RM32.74bil has been credited to members. This will definitely see some increase in money velocity in the economy as members will likely channel these funds into either consumption or investments.

By logical sense, these monies will first go into members’ accounts, likely savings or the chequing account but it should not be long before it is deployed by members for consumption or investments. If it is meant for investments, members should strive to invest into assets that give better returns than what EPF provides, that is a return of more than 5%, which is the opportunity cost of withdrawing the monies in the first place.

Having said that, other than the very low current savings rate of 0.47% or fixed-deposit rates that range between 1.49% for one-month and 1.75% for 12-month deposits, what are the alternative investments available for individual investors?

Most EPF members are using the i-Sinar withdrawals to meet short-term obligations that they are facing due to the Covid-19 pandemic, as their regular income may have been impacted. However, we have also seen, based on anecdotal evidence, goldsmith shops being swamped by consumers, driven by about 15% drop in gold prices. Some are turning to the property market to put in their hard-earned savings into a form of deposit to purchase a home while others are also seen investing in the stock market.

As long as these monies from i-Sinar are being “sweat out” to earn income or to provide a roof over one’s head, the withdrawal of i-Sinar would at least not seen as a waste and deployed with care and responsibly.

Hence, what about the huge RM710.5bil that is sitting in the banking system in the form of various individual deposits, earning meagre returns? Should these depositors start to look for alternative investments as the returns are simply too small to make a difference having them as deposits? Should they embark on investment journey that provides them slightly better returns?

With the recent sell-off in the bond market due to the rise in US treasuries as well as rising inflation expectations, would it not make more sense to invest in bond funds that provide reasonable returns that is much higher than bank deposit rates? In a portfolio of securities in a bond fund, while there could be mark-to-market losses due to the recent sell-off, the current yield to maturity generally would justify investors to earn a decent income, which is much higher than deposit rates.

How about the equity market? The market may be volatile but it does provide reasonable dividends for investors who have the patience to hold their investments for the long term. This include some great consumer names, the larger capitalised REITs and, of course, utility companies.

In fact, some of the banking stocks too are attractive for investors looking for income as they in actual fact provide much better dividend yields than the deposit rates the banks are offering. It is almost a no-brainer. In this case, depositors turned investors will earn more in dividends than interest on deposits.

At the end, managing a portfolio of individual stocks comprising eight to 10 stocks is not too difficult. If the objective is to collect dividends, a portfolio of stocks comprising good dividend-yielding stocks can be rewarding, especially if the rate of dividends paid out is on a rising trend, and certainly much better than deposit rates.

While an investor may experience a capital loss if the market was to undergo a correction, investing for the long term suggests that capital losses can be recouped in time and in actual fact, investors can actually enjoy capital gains in the longer term. This is what most investors strive to achieve, which is the holy grail of investments – capital gain and income.

Pankaj C. Kumar is a long-time investment analyst. Views expressed here are the writer’s own.

The article was first published here.

Photo by Jamie Street on Unsplash.

5.0

5.0