Board members and executives are increasingly focused on environmental, social and governance (ESG) issues due to pressures from a variety of stakeholders, including investors, employees, customers and suppliers. BlackRock, through its CEO’s annual letter to portfolio companies’ CEOs, has advocated a greater focus on purpose, stakeholders and, most recently, climate change. The Business Roundtable, an association of CEOs from leading U.S. companies, has shifted primacy from a commitment to shareholders to a commitment to all stakeholders. ESG has become a critical business consideration for everyone, impacting companies’ cost of, and access to, capital; however, companies with strong ESG practices have been found to deliver more sustainable returns, including higher levels of value creation and risk mitigation.

Human capital — a key part of the “S” in ESG — has become a key issue at the boardroom table. ESG compliance involves an increase in disclosure requirements relating to human capital, which is prompting boards to consider exercising better oversight and governance processes on such issues as inclusion and diversity (I&D), pay fairness and culture. The U.S. Securities and Exchange Commission, for example, recently adopted a rule that requires companies to disclose details on human capital where they are material to an understanding of its business. Beyond disclosure, as companies seek to attract and retain next-generation talent to stay competitive, sustainable human capital practices have become key to a high-performing employee experience.

Compensation committees are broadening their remit to human capital governance

From a business perspective, increased governance over human capital (i.e., human capital governance or HCG) is also about driving business results by holding management accountable for:

- Building and sustaining an inclusive and diverse workforce

- Planning for leadership succession beyond top executives to build a strong pipeline of future leaders

- Acquiring and retaining critical talent and skills to execute on business strategy

- Enhancing overall workforce engagement and productivity

- Developing a strong and healthy corporate culture

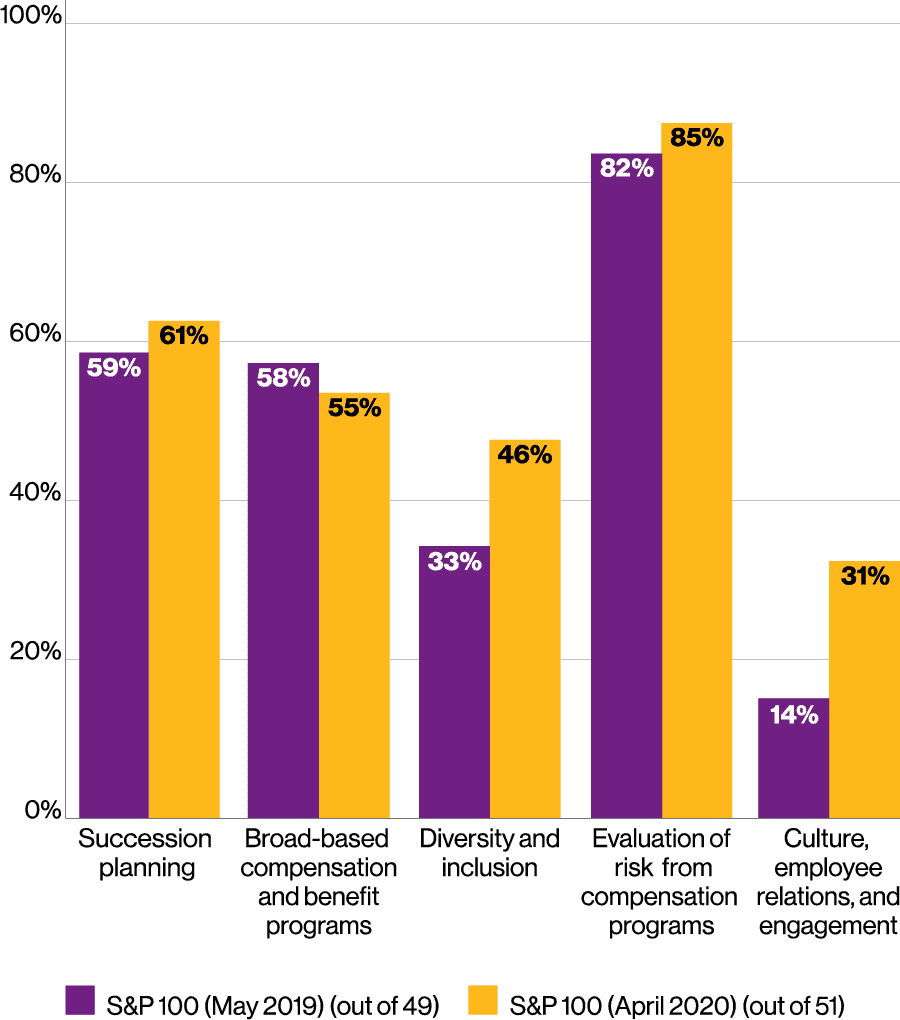

Data from our research on S&P 500 companies corroborate these anecdotal observations and provide further insights into the implications on corporate governance. In 2019, almost 40% of S&P 500 companies expected their compensation committees1 to provide oversight on such issues as leadership development, succession planning, I&D, culture and employee engagement. In a study updated in 2020, we found that one-third of the largest 100 S&P 500 companies now formally include culture, as well as employee relations and engagement, in their compensation committee’s charter (Figure 1).

Source: Willis Towers Watson Global Executive Compensation Analysis Team’s 2020 S&P 100 compensation committee charter review

Similar trends are observed in other parts of the world, such as remuneration committees in the U.K., human resource committees in Canada, executive resources and compensation committees in Singapore, and the combined nomination and remuneration committees in Japan.

As we look through data and existing literature on ESG and HCG, we find two material gaps that we look to address in terms of global scope and from the view of a board member. First, corporate governance practices vary quite significantly by jurisdiction, and the ESG/HCG discussions have largely focused on major developed economies in Europe and North America. Second, and perhaps more important, publications on ESG and HCG have generally reflected perspectives from activists, institutional investors and consulting firms. We believe that it is important to understand how board members are addressing these issues around the boardroom table and how these discussions may evolve in different jurisdictions.

Hearing directly from board directors

It is against this backdrop that Willis Towers Watson is launching two key research initiatives in 2020 to hear directly from board members around the world about their perspectives on a variety of ESG and HCG topics. The first is a survey specifically targeted at corporate non-employee directors, which was launched in mid-September. We expect results to be ready sometime in November. Second, we interviewed 170 non-executive directors and compensation committee chairs and members on three core themes:

Shareholder primacy and trade-off between profitability and organizational purpose

- Do directors continue to believe in shareholder primacy? To what extend do they represent non-shareholder stakeholders of the company (e.g., the community, employees, customers, creditors)?

- Do directors see organizational purpose and profitability as a trade-off? Do they agree that purpose drives long-term, sustainable value creation? To what extent do they see a business advantage in having a well-articulated organizational purpose?

The majority opinion is that purpose and profitability are not at odds: Purpose defines why a business exists in a competitive market. Most board members believe that they ultimately represent shareholders and that taking an interest in other stakeholders’ opinions is imperative to long-term, sustainable value creation for shareholders.

ESG priorities and agenda

- What should the board’s and the compensation committee’s role be in shaping and driving a company’s ESG priorities and agenda?

- Do directors favor the inclusion of ESG metrics in executive incentive plans? What are their main considerations when making this decision? What are the criteria for selecting the right ESG metrics?

The majority of directors agree that the board should have oversight over a company’s ESG priorities and agenda. The compensation committee’s role is to align management’s interests with the achievement of relevant ESG priorities via appropriate performance management, incentive plans and leadership/talent development.

Human capital governance and organizational culture

- What do compensation committees expect of management on human capital reporting and strategy? What is the right scope for human capital governance?

- What is the board’s and the compensation committee’s role in shaping a company’s organizational culture?

While most directors share the opinion that managing human capital and shaping organizational culture are management’s responsibilities, they acknowledge the critical role the compensation committee and the board play in encouraging desired behaviors. Progressive boards take active interest in stewarding an organizational culture that brings long-term sustainable value to the company in terms of risk management and competitive advantage.

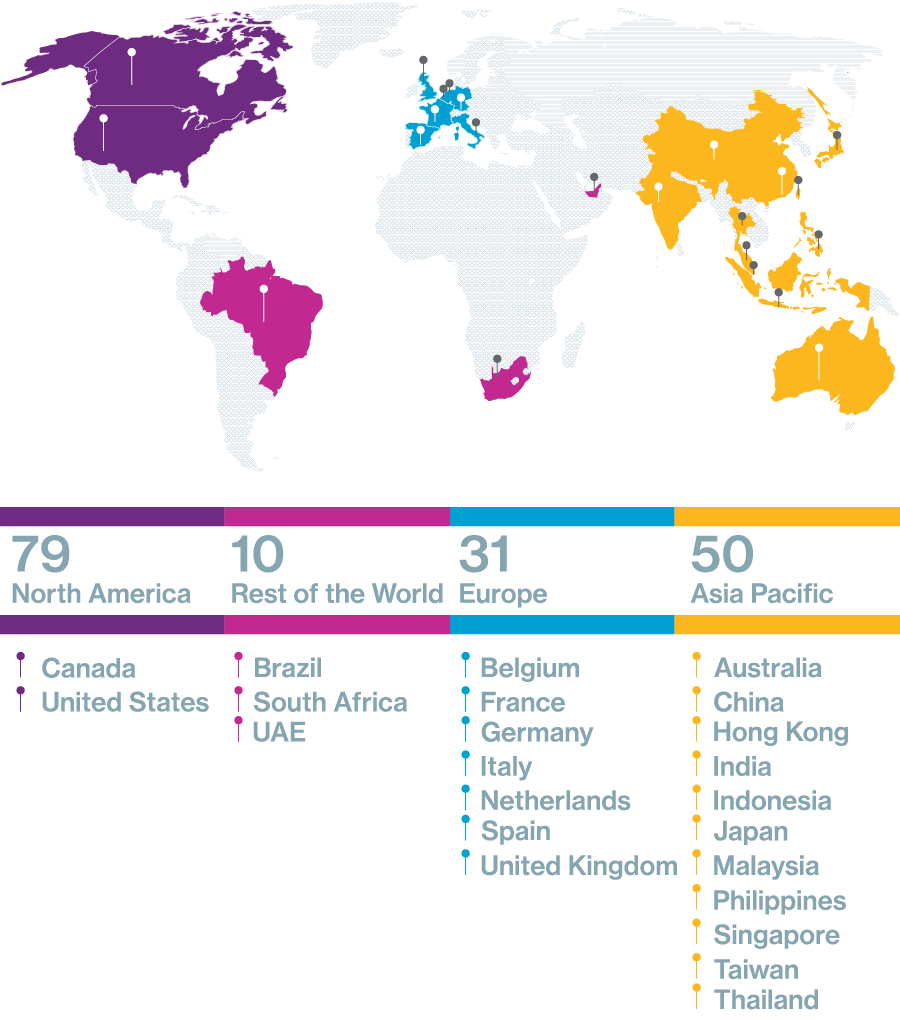

We are incredibly thankful for and humbled by the collective voice behind the directors we spoke with, most of whom serve as compensation committee or board chairs for at least one company. The 170 non-employee directors2 we interviewed represent all continents except Antarctica, providing a truly global perspective on these important issues.

Beyond geographic diversity, we were looking to include perspectives from a diverse and representative sample of directors. Approximately one-third of the directors we spoke with are female3. And while the vast majority of the directors we interviewed sit on boards of publicly traded companies, we also heard from directors who serve on the boards of other types of ownership structures, such as family owned, private equity and mutuals.

This article was first published here.

Photo by Michal Matlon on Unsplash.

5.0

5.0