Boards should consider reimagining how they govern in a world defined by rapid change, rising complexity and evolving stakeholder expectations.

In brief:

- Non-executive directors of some the world’s largest companies describe a governance model under strain.

- Organisational complexity, the volatile business environment and a status-quo orientation contribute to governance challenges.

- With timely action, boards can become agile, forward-looking strategic partners helping to create organisational strength and sustained value.

Today’s governance model is under strain, calling into question whether it can be sustained. At the same time, an actionable agenda for change has emerged. That’s what we learned through a series of in-depth interviews with non-executive board directors – independent members of the board who do not manage day-to-day operations – of some of the largest global listed enterprises as part of the EY Board of the Future study (pdf).

Most study interviewees report being overloaded and struggling to maintain comprehensive oversight across vast, multi-market operations while finding sufficient time for critical strategic foresight. Even those with a more positive viewpoint acknowledge the growing challenges of governance.

A business environment becoming increasingly nonlinear, accelerating, volatile and interconnected (NAVI) contributes to this challenge.

With the current model rooted in the status quo, boards frequently find it hard to match the strategic and operational tempo of global business. These factors threaten the efficacy and sustainability of governance oversight and stewardship.

The research presented in this report was sparked by the observation — gained through formal and informal EY board interactions — that many non-executive directors find aspects of governance increasingly difficult to sustain.

To explore the sustainability of the current governance model, the EY organisation conducted in-depth interviews with 21 non-executive directors who serve on the boards of some of the world’s largest companies, with aggregate revenues of US$1.9 trillion and a market capitalization of US$2.3 trillion. Most are part of the Fortune Global 500. This group of companies represents multiple sectors, including automotive, consumer products, retail, mining, financial services, energy, aerospace and telecommunications.

Our interviewees serve on a total of 90 boards. As a result, the report offers as a “voice of the director” account of the challenges faced by large, multi-market organizations.

In addition, interviews were held with senior EY subject matter specialists and non-EY thought leaders (and governance association leaders), with expertise across a broad swathe of domains, including AI/technology, sustainability, and new enterprise models.

Undertaken with Dr. Dean Blomson, an independent governance researcher and EY alumnus, our research focuses on the overall state of governance, rather than the specific boards and circumstances of the interviewees’ companies. Interviewee names and affiliations have been kept confidential to enable candor.

A two-part study

This report, Part I of our study, focuses on how we can practicably improve governance over a three-year time horizon, beginning today. Part II will lay out “what could be” the future of governance in light of megatrends in a business environment that is NAVI.

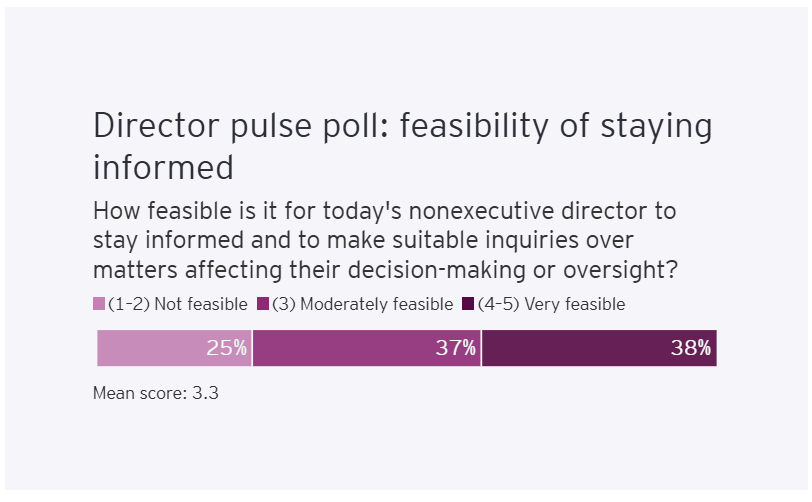

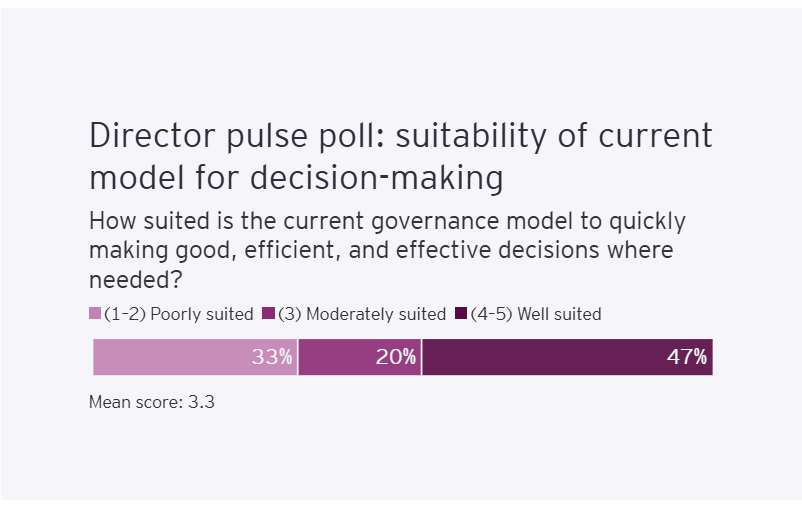

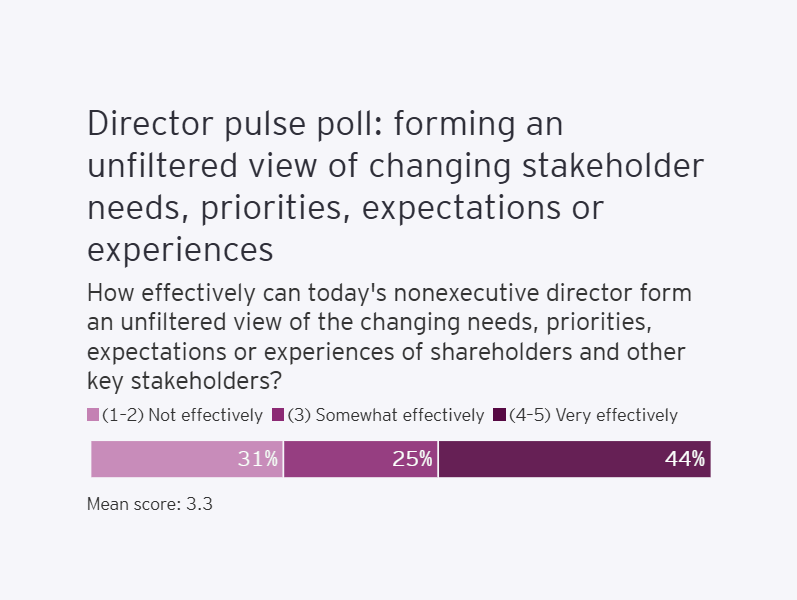

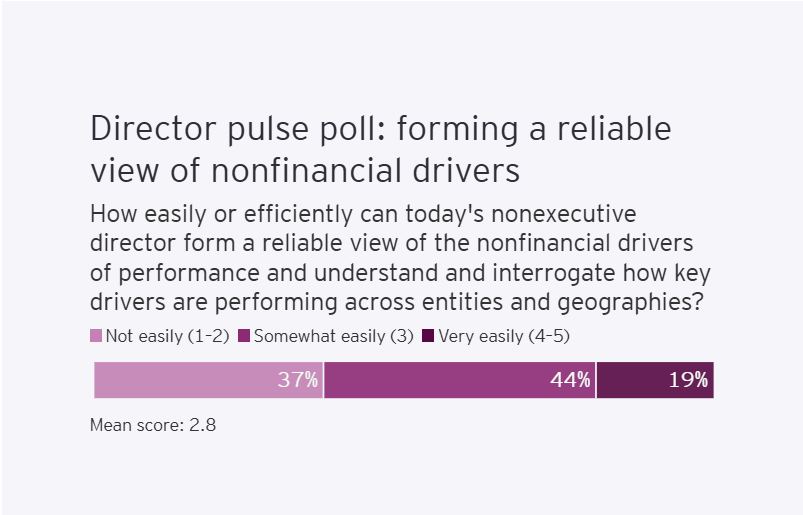

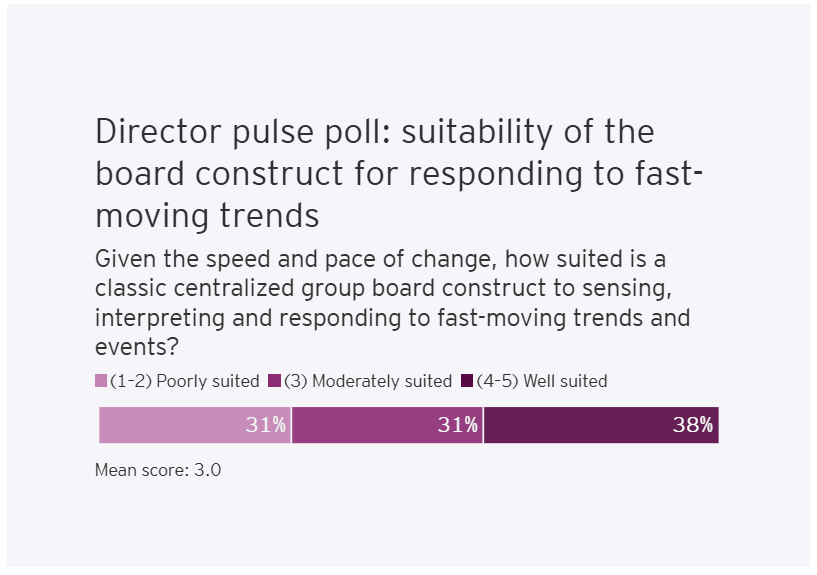

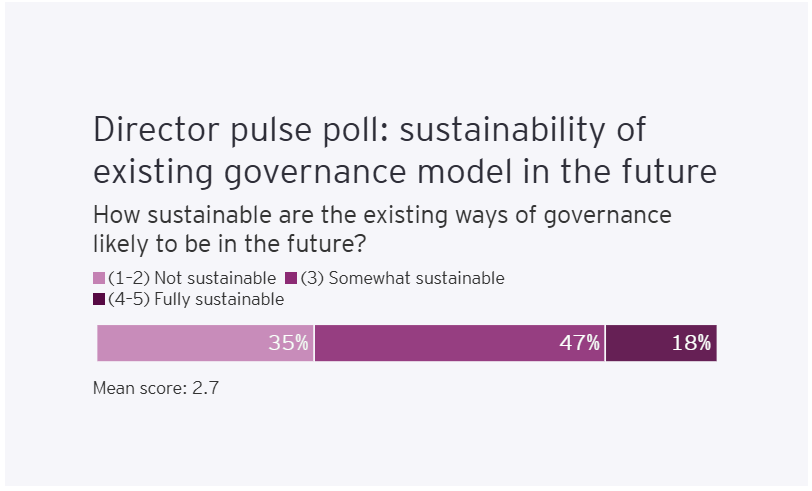

We conducted a short verbal poll as part of our 21 board director interviews to provide directly comparable insights into the director’s feelings about the challenges of governing in the current model. Responses were on a scale from one to five and are featured in this article.

The “6E” Change Agenda for Board Governance

The directors in our study offered important insights on how to address today’s governance risks and challenges with timely actions in the boardroom in collaboration with management. These insights yielded a set of six priority areas for change. We call this the “6E” agenda for reimagining governance.

Each step in the 6E agenda supports the next one, as a virtuous cycle. Just as the challenges are multifaceted and interconnected, so are the actions.

E1 | Elevate Efficiency

Reduce burdens on directors and free up time to focus on the topics that matters most.

E2| Enhance Effectiveness

Change ways of working to allow the board to deliver full value.

E3| Exercise Foresight

Engage the ecosystem to improve foresight and sensing.

E4| Encourage Independence

Prevent governance failures with curiosity and critical challenge.

E5| Engineer Simplicity

Give directors greater confidence in their governance of the global enterprise.

E6| Employ AI

Augment board capabilities as part of a broader enterprise AI strategy.

“How do we be intentional about looking at the [Board meeting] agenda and saying we’re going to spend 20% of the time on what happened last quarter and 80% on what’s going to happen in the next five years?”

Board Director

E1. Elevate Efficiency: Reduce the Burdens of Directores and Free Up Time to Focus on the Topics that Matter Most

Directors report being overwhelmed by the volume of information and time commitments. Increasing workload and regulatory demands faced by public company boards drive the need for more efficiency to free up bandwidth and spend more time on a strategic focus.

One director described the volume of information as “extremely difficult to process and really overwhelming. I would say the amount of additional work and expectations placed on regulatory boards is enormous and very, very difficult to achieve.”

As non-executive directors spend more time on regulatory adherence, their capacity for strategic foresight and suitably deep operational understanding across the enterprise diminishes. The risk of unforeseen failures rises as a result, amplifying liability concerns.

The liability and constant demand for more granular oversight in the director role raises a significant concern regarding the future ability to attract and retain top-tier talent for board positions. “The golden age of being a non-executive director has passed. The joy has gone out of it,” said one of our study participants.

To adjust to the current environment, the emphasis must shift from merely adding hours to fundamentally redesigning how governance work is performed, where and by whom.

- Redefine board-management collaboration, moving boards from passive information reception to active pre-meeting engagement. Discuss issues in meetings rather than re-reviewing pre-reads.

- Demand and develop the discipline of board packs that “cut through” with concise presentation and effective distillation of data into actionable insights.

- Focus meeting agendas on fewer, higher-value topics and consider dividing board time into administrative meetings and more exploratory ones.

- Use artificial intelligence (AI) to free board bandwidth, remove procedural noise and focus on highest-value activities. Streamline board processes, reduce manual effort and augment directors’ ability to assimilate insights from lengthy board packs.

“Management teams view boards as a necessary evil and boards don’t feel that they necessarily have the opportunity to influence the operations and strategy of the company in a very meaningful way.”

Board Director

E2. Enhance Effectiveness: Change Ways of Working to Follow the Board to Deliver Full Value

Suboptimal dynamics and lack of trust can mean that executive teams miss opportunities to benefit from the wise counsel and strategic direction of their boards.

“Management teams view boards as a necessary evil and boards don’t feel that they necessarily have the opportunity to influence the operations and the strategy of the company in a very meaningful way,” observed one of the directors in the study.

The nature of information flows to the board reflects this dynamic. Directors often receive either overly filtered information that limits the scope of board judgement, or overly voluminous data that lacks actionable insights. “I walk away from board meetings thinking, ‘What did I really learn?’ That’s not good enough,” commented one director.

A mix of disconnects, whether from a trust deficit or role clarity or boundary tensions, naturally impede board effectiveness. Overlay on this the part-time nature of the director role and information asymmetry, and the result is a boardroom environment that one board member describes as “shadow boxing.”

Board quality and effectiveness

40%

of institutional investors are targeting board quality and effectiveness for engagement with companies in 2025, up from only 13% in 2024.

What directors should know about the 2025 proxy season (via EY.com US)

Effective governance depends on boards and management teams openly identifying problems and opportunities and jointly determining the best path forward. The directors in our study consistently pointed to trust as the key enabler: “Understanding and trust are, to me, at the center of effective supervision,” one said.

- Build trust to enable open and candid discussion of the issues facing the organisation. Chairs and senior executives should discuss trust proactively and explicityly discuss mutual expectations.

- Reset board-management dynamics to prioritise listening, as well as silo-busting and inclusion.

- Promote director profesionalisation and give senior executives board experience to change their perceptions of board value.

“I think many people are more comfortable with looking at last quarter’s results than trying to wade around in the uncertainty of next year or three years from now.”

Board Director

E3. Exercise Foresight: Engage the Ecosystem to Improve Foresight and Sensing

Boards suffer from a lack of opportunity for future-oriented thinking, inadequate access to fresh perspectives and insufficient mechanisms for strategic exploration.

The current board model, often overly focused on backward-looking data and compliance, is ill-equipped for a future that is predicted to be faster, more complex and more fragmented. This systemic failure to prioritise future-oriented thinking leads to reactive governance as the pace of change quickens.

“You can have all kinds of data,” one director commented, “but if a week ago’s data is no longer relevant, so what? So, to me, it’s about trying to look around the corner, making sure you’ve got people around the table who understand how to operate within an increasingly complex world with flexibility and agility.”

The consistent director lament about the lack of opportunity to engage on the future points to a profound foresight deficit in boardrooms:

- Lack of time dedicated to strategy and foresight, hindering a board’s ability to guide the company proactively, especially through dramatic shifts and emerging risks

- Lack of fresh, diverse perspectives and inadequate access to expertise on emerging topics, limiting the board’s ability to bring creative approaches to new challenges

- Engage and expand your business ecosystem to obtain views from external stakeholders who can both provide and help interpret signals of change.

- Reset board-management dynamics to prioritise listening, as well as silo-busting and inclusion.

- Compose boards more dynamically (e.g., designating certain roles to have shorter duration or rotating experts) to inject fresh perspectives.

- Work in sprints with diverse teams to overcome the limitations of rigid committee structures.

“The role of the director is not just to have read the documents and have an opinion, it’s to be able to challenge the thinking.”

Board Director

E4. Encorauge Independence: Prevent Governance Failures with Curiosity and Critical Challenge

Board effectiveness depends on independent thought, curiosity and critical challenge, yet internal cultural pressures and consensus-seeking often stifle debate, risking governance failures. In the words of one director: “The role of the director is not just to have read the documents and have an opinion, it’s to be able to challenge the thinking. So how are you good at challenging thinking?”

Boards can face subtle yet powerful social and time pressures that can lead to conformity and groupthink. For example, the need to achieve unanimous voting can create a cultural penalty for dissent.

The pressure for consensus often brings with it a lack of critical challenge that can lead to institutional ignorance and ethical blind spots, significantly increasing the risk of corporate failures. Boards might be held accountable for something they were not equipped to see coming because they failed to raise the right questions or were not educated about a certain number of topics.

A board member said: “You almost have to systematise a contrarian view and not necessarily from being crazy disruptors all the time – that way you don’t get anything done — but more from pushing our thinking.”

- Cultivate a robust view of risk beyond reliance on the Chief Risk Officer’s opinion, advocating for direct, unfiltered data-driven insights, which be enabled by AI.

- Enhance internal audit’s role, positioning the function as independent eyes and ears for the board.

- Prioritise corporate culture by engaging directly with a borad range of stakeholders to gain unfiltered insights into the organisation’s culture and operations.

- Wider the director pool by looking for diversity in age (e.g., “next gen” shadow boards) and cognitive styles.

- Engineer a contration mindset through techniques that create permission for constructive debate (e.g., teams systematically arguing different sides of a decision).

“With an increase in complexity, having consistency and standardisation in a global organisation is really important, provided you understand and appreciate what potential limitations that could impose.”

Board Director

E5. Engineer Simplicity: Give Directors Greater Confidence in Their Governance of the Global Enterprise

The complex structures, numerous subsidiaries, and diverse jurisdictions of large global enterprises create governance challenges and make it difficult to know with real confidence what is happening across the breadth of the organisation.

And of course, the greater the number of moving parts, the greater the potential fault lines and points of failure:

- Vertically, between the board and CEO or executive team; between head office and regional executives, between regional executive teams and regional management; and between management and operators

- Horizontally, across markets and geographies

Any number of “dual disconnects” can occur between the following axes:

- Detection and interpretation of signals (trends, events, performance) and the resulting decision-making

- Between the decision-making and the resulting action-taking

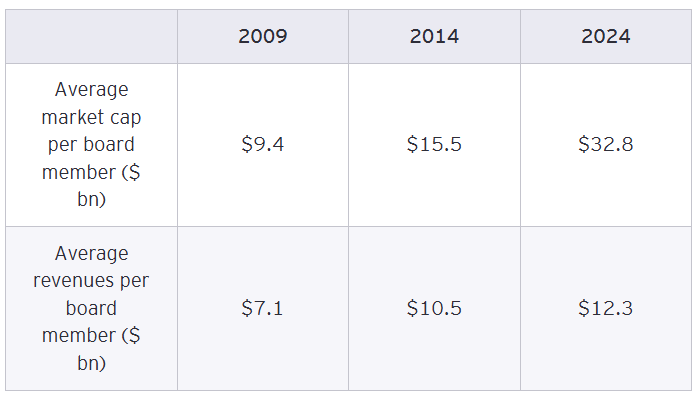

The “value at risk per director” has soared with the weight of responsibility continually increasing on the same number of shoulders. The same number of eyes and ears must process far more information with vastly more value at risk.

Average market capitalisation and revenues per director of the top 50 companies in the Forbes 2000

The challenges of achieving a reliable “line of sight” into risks, opportunities and performance issues – across different business units and operating divisions and multiple geographies – create a governance dissipation effect. These fault lines and possible disconnects make it far harder for a board to achieve justifiable confidence that they aren’t about to be badly surprised.

As a result, many of the directors interviewed prioritise simplifying and streamlining governance mechanisms. They see value in implementing principles-based governance frameworks that balance global consistency in policies, standards, processes, organisational and governance control mechanisms with necessary local adaptation.

“With an increase in complexity, having consistency and standardisation in a global organisation is really important, provided you understand and appreciate what potential limitations that could impose,” advised one of the study participants.

- Adopt a mix of “principles versus rules,” allowing for necessary local adaptation while ensuring adherence to core corporate values and global consistency.

- Obtain independent insight into local operations from internal audit. Consider support from external investigators or “governance as a service” organisations.

- Get closer to key stakeholders and material operations through direct exposure outside of formal board meetings or curated site visits.

- Consider opportunities for strategic simplification of ownership arrangements and organisational structures and standardisation and harmonisation of governance arrangements wherever possible (e.g., policies, processes, standards, systems and data).

“In my boardrooms, there’s really no access to data for asking, ‘What if?’ The use of data in the boardrooms is very static, not dynamic.”

Board Director

E6. Employ AI: Augment Board Capabilities as Part of Broader Enterprise AI Strategy

Despite AI’s transformative potential, boards fully acknowledge underutilising the technology in relation to enterprise and governance matters.

One director in our study was “blown away by how little boards really understands about AI,” despite its potential to “change absolutely every single job on the planet.”

This AI gap means boards are missing immediate and medium-term opportunities for enhanced efficiency and deeper insights into enterprise governance and operations. They are also ill-prepared to effectively oversee the enterprise-wide risks and opportunities that AI’s rapid evolution presents in a NAVI business environment. “In my boardrooms, there’s really no access to data for asking, ‘What if?’ The use of data in the boardroom is very static, not dynamic,” said one director, describing the current state. A director describes their unease and the opportunity they see for AI augmentation: “By the time you meet, the information is stale … It isn’t real-time, and that honestly scares me. There’s huge potential in getting real-time, data-driven insights and really enhancing our governance through technology.”

Increasing Focus on AI Governance

EY research reveals a growing focus on how AI is governed and the capabilities of directors.

- The percentage of institutional investors prioritising responsible AI for engagement rose from 19% in 2024 to 36% in 2025, according to the EY report, What directors should know about the 2025 proxy season (via EY.com US.)

- Proxy statements of Fotune 100 companies shows that nearly half cited AI in their descriptions of director qualifications, up from 26% doing so in 2024, according to the EY Center fro Board Matters 2025 proxy season review (pdf via EY.com US).

The use of AI by the board and the establishment of enterprise responsible AI framework are not separate, but integral. The well-documented risks of AI – such as reliability, explainability, compliance, ethics and transparency – exist as much in the board as in the broader enterprise.

- Establish a responsible AI framework for the enterprise to increase confidence in the technology, helping to free the organisation to pursue AI initiatives at speed.

- Set the board’s adoption within responsible AI framework, because issues such as data protection, reliability, explainability and compliance will come to the fore.

- Harness AI as a catalyst for human-centric governance, augmenting – not replacing – the board’s responsibilities (e.g., utilising AI for real-time, data driven insigjts and predictive analytics).

Conclusion: Seize the Opportunity to Reimagine

The prevailing sentiment from the interviews is a stark warning: the current governance model is under strain; without adaptation and change it is not a matter of if it will break, but when, and how boards choose to respond.

As one director grimly noted, “It will last until, like Rome, it burns up. It will last until there’s an epic failure. And then all of a sudden, there’ll be a depth charge and all the fish will swim in another direction.”

While not all directors feel the heat to this degree, the prevailing sentiment among study participants is that boards must recognise that “What got you here, won’t get you there,” as paraphrased from Marshall Goldsmith, the American executive leadership coach and author.

Recognising the risks and doing something about them are not the same thing. Without a breakdown or catastrophe, there’s often little impetus for change. It falls on the shoulders of board chairs, and board members willing to challenge the status quo, to highlight the dangers of inertia. This necessitates embracing continuous self-examination and adaptation before a crisis demands it.

It also requires a willingness to pursue a phased, multi-year governance program that moves beyond incremental change and considers more significant reform, or even fundamental transformation, where needed.

By reimagining governance mechanisms and embracing technological and cultural shifts through the virtuous cycle of the 6E agenda, boards can transform from sometimes reactive oversight-oriented bodies to agile, forward-looking strategic partners, helping to create organisational strength and sustained value creation in a dynamic global economy.

Special thanks to the following individuals who significantly contributed to this report and research: Dr. Dean Blomson, Independent Governance Researcher and EY alumnus; and EY researchers Sandeep Gupta and Swathi Sivaraman.

Summary

The EY Board of the Future research explores the question of whether the current governance model can be sustained through interviews with 21 non-executive directors from some of world’s largest listed companies. The study highlights the increasing risks faced by boards of complex global organisations in an increasingly (NAVI) business environment. Key findings center on a six-part action agenda for reimagining governance to create more strategic, agile and future-focused boards.

5.0

5.0