The EY Global Integrity Report 2024 highlights that ESG-related regulatory reporting and data integrity are top risks for organisations.

In brief

- Thirty-seven percent of organisations see complying with new and changing ESG regulations as the greatest challenge in meeting compliance obligations.

- Executives say they’ve undertaken a number of initiatives to address these challenges and they’re being transparent about it.

- Taking an integrity-first approach to ESG can help organisations to tackle immediate risks and achieve aspirational objectives.

As climate-related goals become obligations, and voluntary environmental, social and governance (ESG) efforts become mandatory, a quick scan of the market landscape reveals that the conversation around net-zero emission targets and broader ESG issues has shifted in tone over the last two years from boldly aspirational to compliant box-ticking.

In the past, many organisations set lofty goals, issued audited Global Reporting Initiative (GRI) reports and reported their climate impacts according to Task Force on Climate-related Financial Disclosures (TCFD) recommendations. By contrast, today’s conversations focus on ESG’s significant challenges and risks, particularly around changing regulation, a lack of harmonisation across sustainability reporting standards, and data integrity.

Rather than a race to the top, many organisations appear to be in a race to the bottom. Confronted with the need to publicly disclose progress toward their sustainability goals at a time when corporate disclosures are becoming more technical, complex and confusing, organisations are considering scaling back their targets either to what they know to be achievable and easy to measure, or to what is needed to meet current regulatory and compliance obligations. This may become even more prevalent, depending on the outcome of upcoming political elections in more than 60 countries in 2024. While the intentions behind developing stronger mandatory reporting requirements for companies are laudable, it may prove counter-productive as organisations divert efforts from meeting ambitious but hard-to-measure ESG goals to focus on compliance.

Yet, as ESG regulations rapidly evolve around the world, the practical approach of doing only what is required may quickly prove woefully impractical. According to the EY Global Integrity Report 2024, 37% of respondents cite keeping up with and complying with new and changing ESG regulations in various jurisdictions as one of the greatest challenges in their organisation in meeting their ESG compliance obligations.

Meeting regulatory requirements

37%

of respondents say that complying with new and changing ESG regulations is one of their greatest challenges in meeting ESG compliance obligations.

This is hardly surprising given the proliferation of ESG-related legislation around the world and the lack of harmonisation of sustainability reporting standards. From 2011 to 2023, more than 1,255 ESG regulations were introduced globally1. Notable examples of ESG-related legislation proposed or enacted in the last two years alone are detailed below.

- EU: Corporate Sustainability Reporting Directive (CSRD). Over the next three years, more than 50,000 organisations (EU and non-EU) will be required to report under the program. The CSRD is expected to make significant advancements in reaching Europe’s carbon-neutral goals by 2050.

- EU: On 24 May 2024, the Council of the European Union gave final approval to the Corporate Sustainability Due Diligence Directive (CSDDD). The CSDDD requires companies to conduct appropriate human rights and environmental due diligence. The due diligence obligations apply to the company’s own operations, as well as the operations of their subsidiaries and their supply chain partners. Companies will be held liable for the actions of their suppliers.

- EU: Carbon Border Adjustment Mechanism (CBAM). This encourages cleaner production in non-EU countries through fees charged by importers for the emissions embedded in their imports.

- India: The Business Responsibility and Sustainability Report (BRSR) came into effect in 2023 and is the first framework in India requiring eligible Indian companies to report metrics on sustainability-related factors.

- US: Securities and Exchange Commission (SEC) climate disclosure standards. In March 2022, the US SEC proposed rule changes to require registered companies to include specific climate-related disclosures in their registration statements and periodic reports. Such disclosures would cover information about climate-related risks that could have a material impact on their business, along with incorporating key climate-related metrics in their audited financial statements, including greenhouse gas (GHG) emission disclosures. In March 2024, the SEC adopted the final rules, but voluntarily stayed them in April pending legal challenges to the new rules.

- US: In October 2023, California’s Governor signed two climate-disclosure bills into law. These bills require public and private organisations with US$1b or more in annual revenue that do business in California to annually disclose their Scope 1, Scope 2 and Scope 3 emissions, according to the Greenhouse Gas Protocol. They will also have to obtain assurance on these disclosures. Organisations with US$500m to US$999m in annual revenue will have to disclose Scope 1 and Scope 2 emissions biennially based on TCFD recommendations. All organisations that operate in California will have to make net-zero emissions claims, or significant GHG reduction claims, beginning in 2024. The laws have been challenged in court, and the timeline for implementation remains uncertain.

Seven Areas Where Organisations Struggle Most

Based on the results of the EY Global Integrity Report 2024, as well as EY experience working with clients, there are seven areas where CFOs, chief sustainability officers (CSOs) and other senior executives struggle most to address ESG challenges:

- Mapping and measuring the sustainability journey. One-third (34%) of report respondents admit that they have limited reliable data to measure progress against performance targets. Measuring and reporting against ESG ambitions and targets drives the need for better, auditable data at the group level, often across multiple markets, business units and brands.

- Ensuring CSOs are more involved in key decision-making. But, for 29% of report respondents, there is a concern that, without the appropriate level of influence or power, they may not be getting sufficient dedicated resources and budget for ESG initiatives.

- Adding sustainability solutions to deal with regulatory requirements rather than building them in. This is an approach that gives the impression within and outside the organisation that ESG is an afterthought rather than an integral part of the organisation’s strategy, value creation and culture.

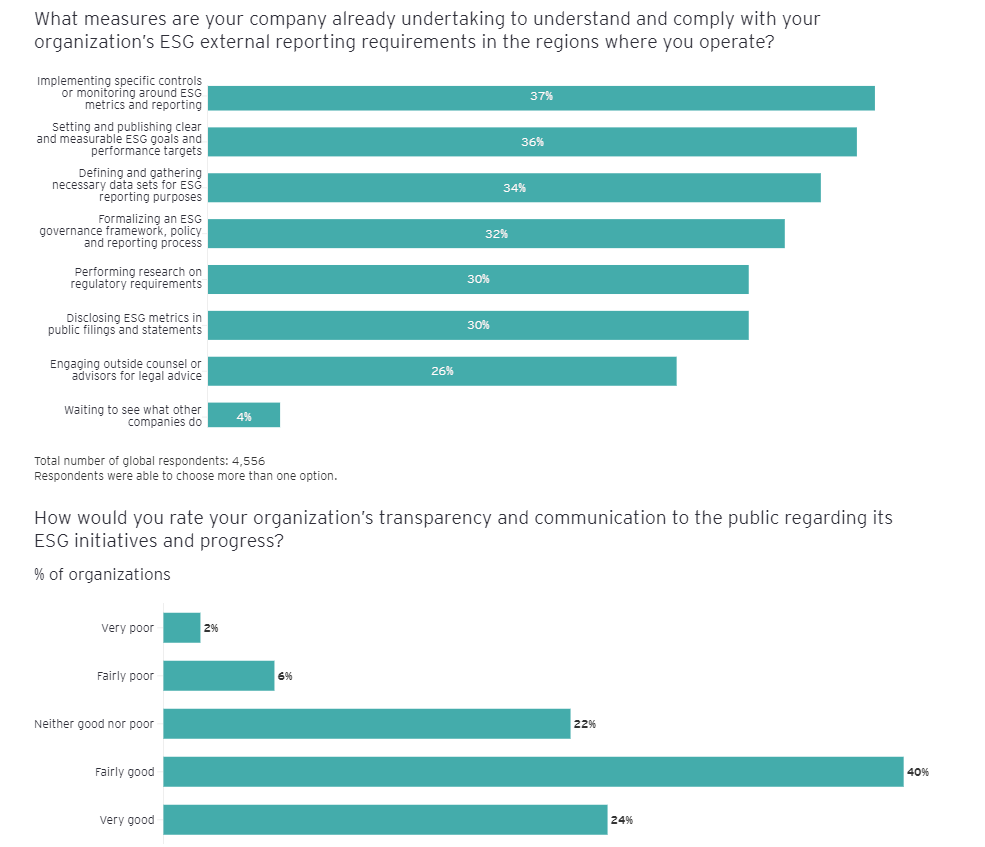

- Implementing the right processes, systems and internal controls to strengthen transparency and reporting. Organisations may also have to take additional actions to push ESG data to the level of financial reporting and ensure that it can withstand the rigor of an audit — a requirement by some of the new ESG regulations, including CSRD. In the research, organisations say they’re increasing their focus on ESG and have already undertaken several initiatives to comply with ESG external reporting requirements. Furthermore, nearly two-thirds believe their organisation is transparent about its progress. However, as legislation and regulations evolve, more will need to be done.

- Building a robust risk management program. While there’s increased focus on what to report and how to report, organisations are sometimes missing the critical need to build a robust risk management program around ESG activities. Having the structures in place to report is important. However, a risk management framework over business conduct — of both employees and third parties — in executing ESG initiatives has lagged. Organisations should be putting as much effort into risk management around non-financial reporting as they have around their financial reporting. Further, even when organisations do think about it, they focus on investor relations and marketing. However, the increase in regulations and disclosure requirements means that other parts of the business and processes now need to be included. Organisations will require a multi-disciplinary approach — which can be challenging for those who operate under a more decentralised and siloed structure.

- Avoiding the hidden perils of greenwashing. Employees who haven’t traditionally been involved in ESG reporting are being inundated with new requests for information, new acronyms and new standards. Most of these people are already carrying a full load with their regular roles and responsibilities. The more they are asked to take on additional roles, the more pressure they feel to get things done, even if some might not yet have the skills or knowledge to deliver what’s being asked of them.

- Bearing the weight of market and regulatory scrutiny, as well as the pressure to make meaningful advances in the organisation’s sustainability transformation.

These challenges raise the stakes significantly around the types and levels of risk organisations face, which can include regulatory risk, litigation risk, reputational risk and commercial risk — all of which can lead to accusations of greenwashing, greenhushing (underreporting or hiding ESG credentials from public scrutiny) or even fraud, if improperly managed.

Putting Integrity First, From Strategy to Execution to Reporting

While the challenges and risks stemming from the evolving ESG regulatory landscape may seem daunting, it’s allowing companies to take a more mature approach to how they’re focusing on their sustainability transformation efforts. It’s also important to recognise that organisations that reach beyond simply meeting regulatory or compliance requirements do so because they see the business benefit in deeply embedding sustainability into their core strategy.

A more mature approach to ESG requires organisations to have clarity of purpose, knowledge (often in the form of reliable data) and an actionable path forward — something many organisations still struggle with.

Organisations need to be comfortable speaking about the importance of ESG integrity as part of their corporate ESG strategy. Organisations also require policies and programs to make certain that ESG measures and reporting address both regulatory requirements in all applicable jurisdictions and fulfill the organisation’s stated ESG ambitions.

To become integrity-first on ESG, organisations will need to focus on five key areas:

1. Make ESG a strategic priority and gain consensus around the alignment of priorities

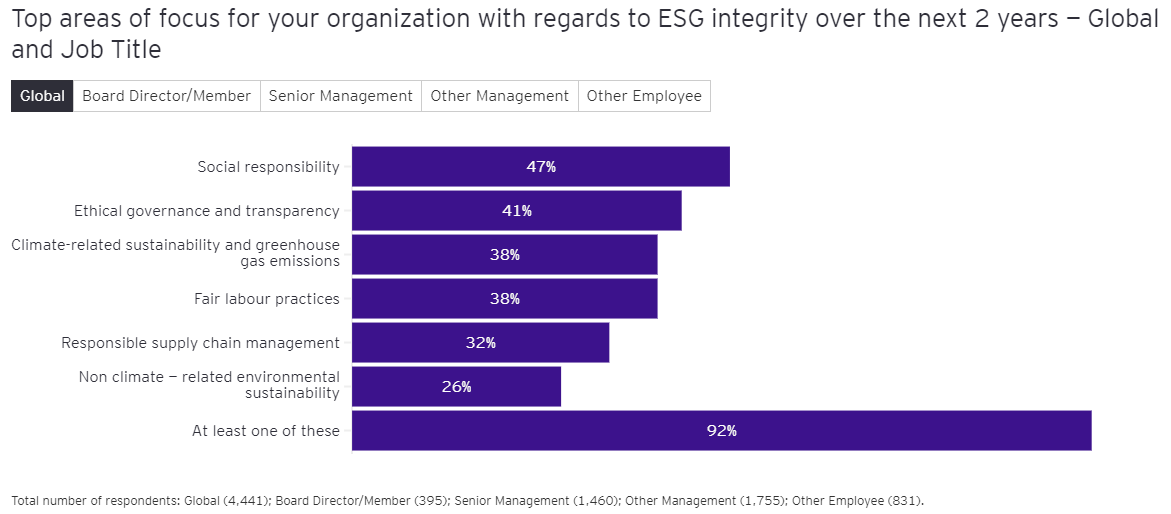

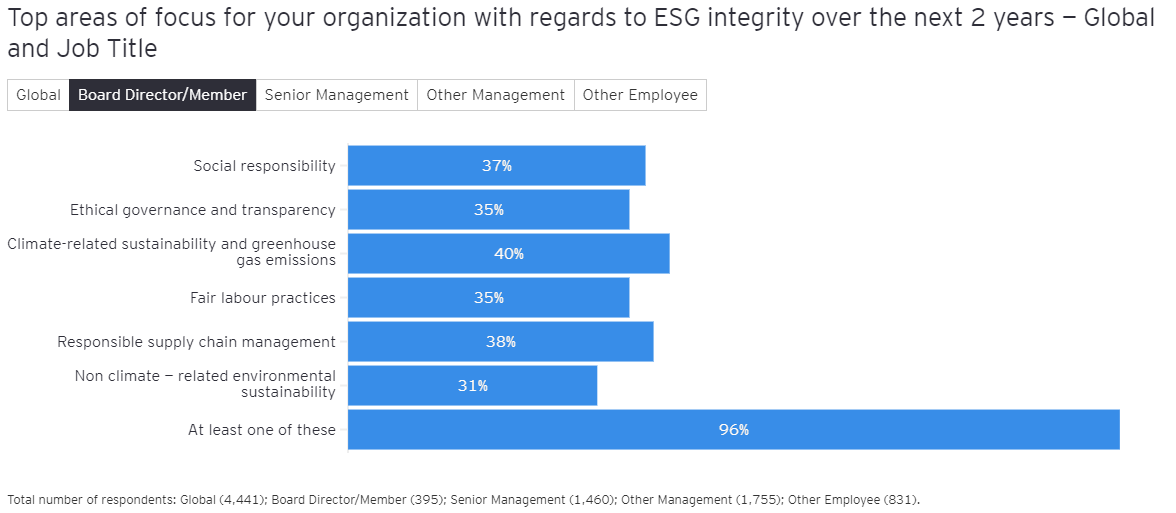

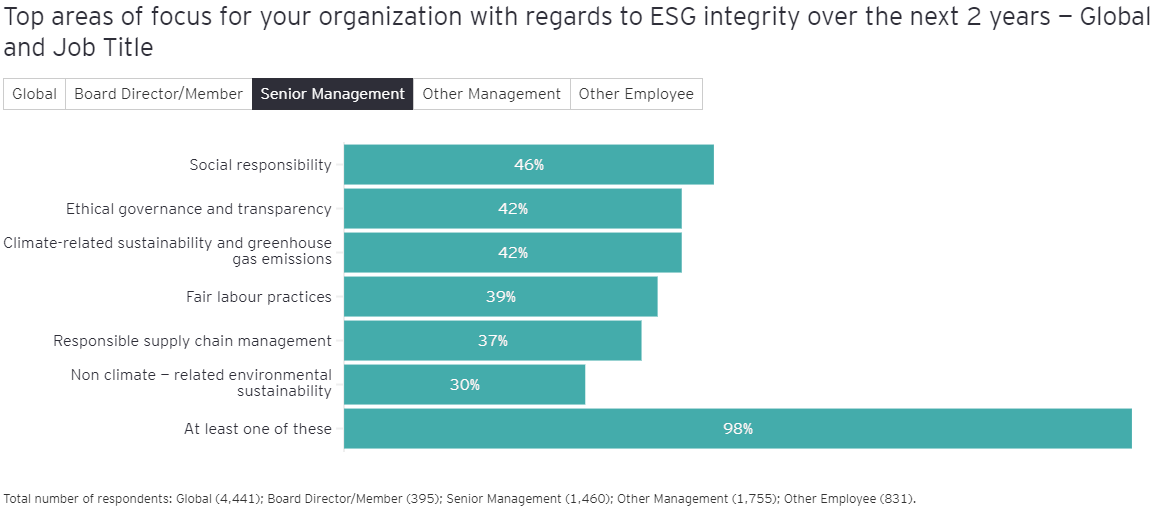

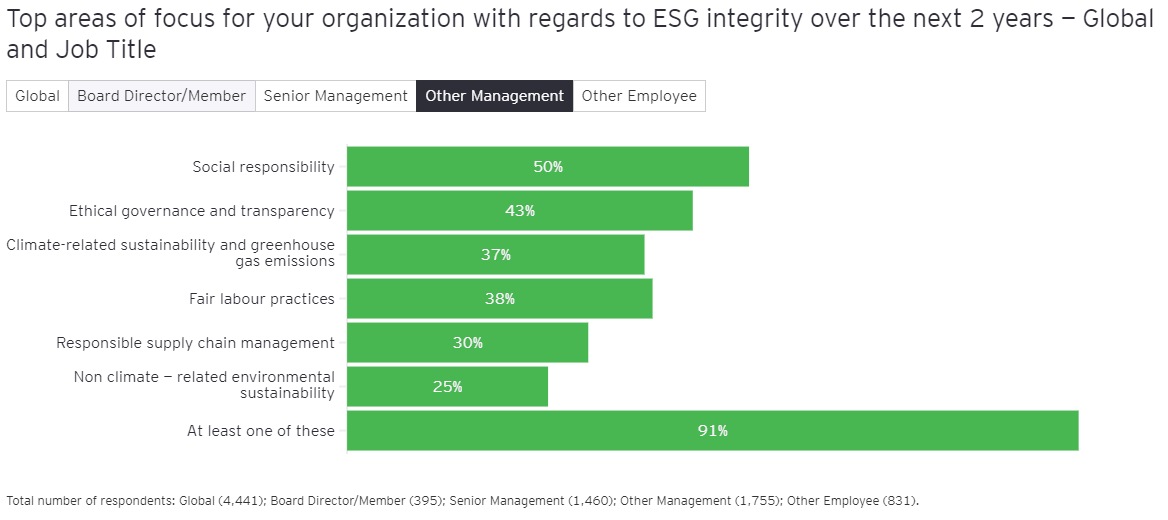

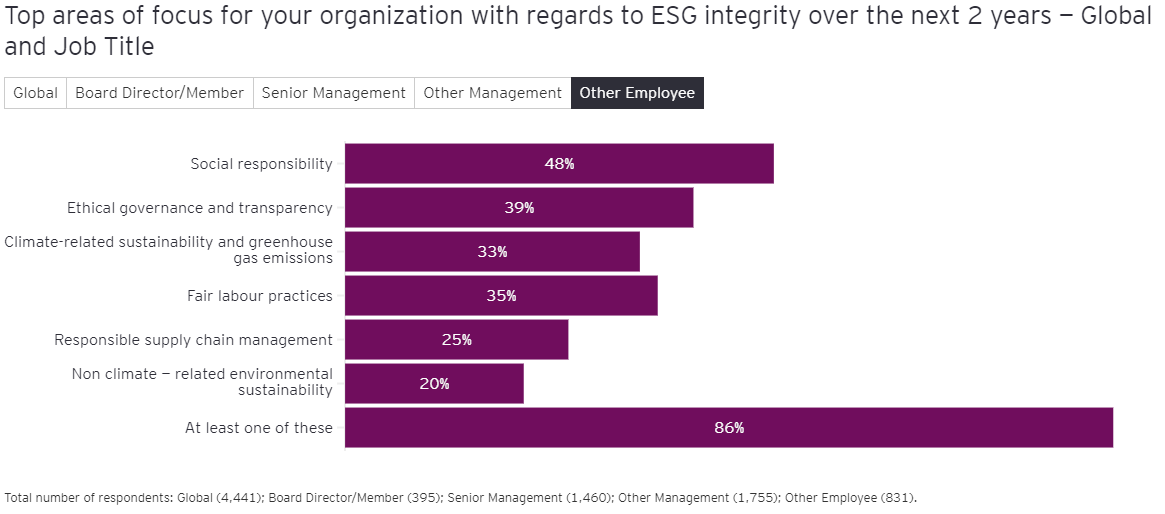

Overall, 62% of global respondents agree that their organisation makes ESG a priority. However, there is a perception gap between senior management’s confidence they are doing this (73%) and rank-and-file employees (52%). Further, there appears to be some discrepancy around the alignment of priorities. For example, while board members say their organisation is prioritising climate-related sustainability, greenhouse gas emissions and responsible supply chain management, senior management, management and employees believe the top priority is social responsibility, followed by ethical governance and transparency. Not only do organisations need to establish their ambitions and strategic priorities around ESG, but they also need to focus on aligning their people and messaging around these priorities. Sometimes, when aligning around strategic ESG priorities, less can be more. Organisations will want to consider focusing on where they can have the greatest impact and do it well, given their industry and size, for example. Leaders will also want to make sure that there is clear tone from the top on the importance of ethical conduct around ESG.

2. Clarify who owns ESG within the organisation

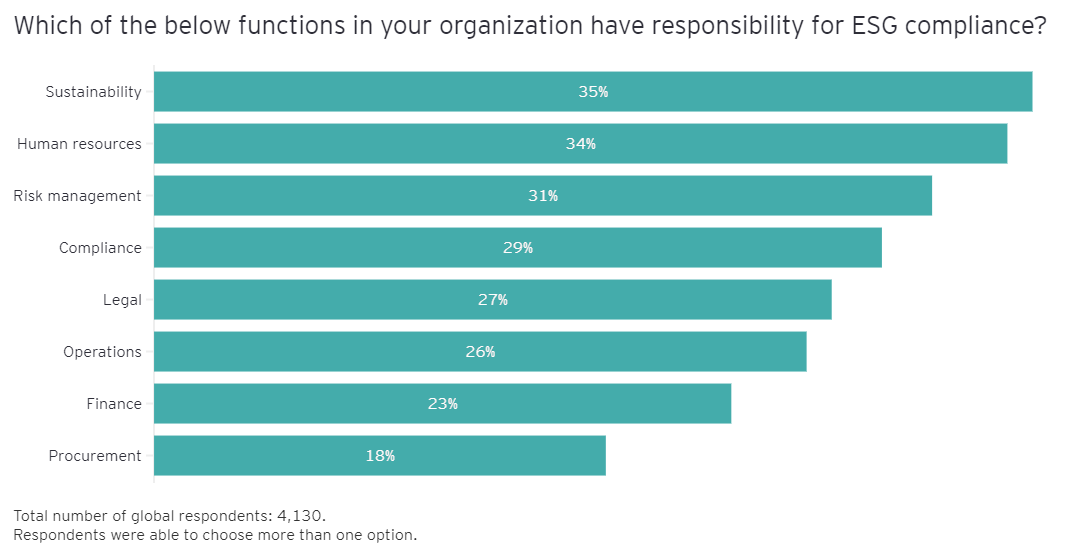

Part of the reason for varying ESG priorities within the organisation may be because typically no single business function owns ESG. If ESG objectives are shared among various functions, there is a need to revisit governance structures and establish well-defined roles and responsibilities with clear accountability among all stakeholders. It’s also important to understand individual capacities. If additional skills, experience or resources are needed, organisations should prioritise their investments.

3. Design and implement an agile ESG governance framework and processes that allow the organisation to pivot as regulations change

This is particularly important as new regulations, such as the EU’s CSRD, are enacted. First, implement a comprehensive risk assessment methodology that can incorporate new ESG areas and respond to changing international standards. Use risk assessment output to identify areas for improvement within ESG programs from a governance perspective, and develop measures in the form of KPIs and key behavioral indicators (KBIs) against which to measure progress. This includes embedding KPIs and KBIs to track progress and enable accountability for the company’s ESG activities and performance.

4. Implement a robust reporting process to ensure data integrity

One-third of respondents (34%) identified unreliable, inconsistent or inaccurate data as the greatest ESG compliance challenge. A similar number (34%) identified a top priority as defining and gathering necessary data sets for ESG reporting. Data integrity is a significant risk area within ESG reporting and complying with regulatory requirements. It also risks the transparency of disclosures. Companies should leverage technology and automation to build workflows that gather, compute and monitor performance metrics in a consistent and reliable manner. Non-financial ESG disclosures should be incorporated into existing disclosure and control procedures for external financial reporting, with tested internal controls and record- retention policies that provide assurance in the quality and reliability of ESG reporting. If the organisation has confidence in its non-financial ESG data and due diligence processes, it will have more confidence in both its financial and non-financial disclosures and reporting.

Data integrity issues

34%

of respondents cite unreliable data to measure progress against performance targets and use for ESG-related reporting as a top challenge.

5. Create an effective communication plan that educates, drives consensus and builds trust

Although there is always the potential for fraud through misstatements, these misstatements may not stem from a deliberate intention to deceive, but rather from a lack of familiarity or lack of training and education around collecting non-financial data and implementing the right internal controls. Organisations need to make certain that their employees have the necessary knowledge. For example, only 19% of employees profess to understand ESG regulations and their impact on the organisation, according to the EY Global Integrity Report 2024. Increasing the ESG IQ of employees inspires them to take an active role in reaching ESG goals. Moreover, enhancing transparency in a company’s ESG agenda builds employee trust.

Knowledge of ESG regulations

19%

of employees say they understad ESG regulations and their impact on the organisation.

Being aspirational about ESG goals remains important. In a super election year, sustainability will either rise or fall on the global political agenda, depending on election outcomes. Regardless of political developments, organisations have the option, and an obligation, to stay the course on ESG — to be ambitious, bold, ethical and authentic in setting, meeting and accurately reporting on established ESG targets, while remaining proactive about the potential risks. This doesn’t mean trying to “boil the ocean” around ESG. It’s more important to focus efforts on where the organisation can have the most impact and where it can be the most accountable. It’s about setting feasible targets that balance bold ESG ambition and ethical behavior with compliance.

At the end of the day, organisations need to decide whether they want to join the race to the bottom and focus solely on meeting regulatory and compliance obligations, or whether they want to commit to what this exercise is really about: business responsibility and long-term value creation.

Summary

As voluntary efforts around ESG become mandatory through a raft of new laws, regulations and disclosure obligations, the tone and nature of conversation — and effort — is shifting. The EY Global Integrity Report 2024 reveals that organisations have moved from setting aspirational targets to doing only what is necessary to meet regulatory requirements and compliance.

- “ESG regulations have increased 155% in the last decade,” Edie website, edie.net/esg-regulations-have-increased-155-in-the-last-decade/.

The article was first published by EY.

Photo by Mike Enerio on Unsplash.

5.0

5.0