M&A trends are showing signs of a rebound; expect a jump in deals by year-end

Dealmakers are accustomed to facing uncertainty, but the scale and speed of COVID-19 sent shockwaves through the global economy and the mergers and acquisitions (M&A) market. We adapted to the challenges and the changes in ways of living and working. As business went largely virtual, so did deals.

The global fiscal stimulus packages provided by governments to counter the economic downturn have now topped US$10 trillion[1] and triggered strong rebounds across practically every financial market.

“The acceleration of the digital economy is forcing companies and dealmakers to rethink strategy and will fuel M&A opportunities.”

Brian Levy Global Deals Industries Leader, Partner, PwC US

Markets recover as investor confidence returns

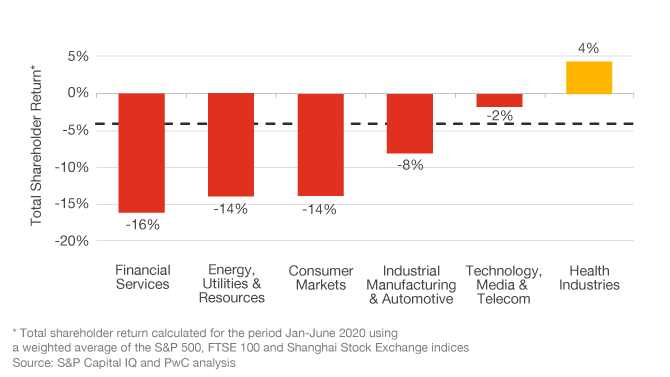

Most industries and regions are now seeing lower share-price volatility than in March and April, and the upward trend of major indices suggests investor confidence is returning. While several major indices are now only slightly below pre-COVID-19 levels, others have surpassed previous records. A comparison of the total shareholder return by industry of the S&P 500, FTSE 100 and Shanghai Stock Exchange for the first six months of 2020 shows how performance has varied widely, both by region and by industry.

The Nasdaq Composite fell close to 25% between 1 January 2020 and its lowest point on 23 March 2020. However, demonstrating the resilience of the technology sector, the index went on to reach successive all-time highs, ending June at 12% above where it started at the beginning of the year[2]. While the recovery in valuations may hinder some take-private deals, this confidence bodes well for other forms of dealmaking.

Private equity at the ready

We initially expected private equity (PE) firms to capitalise on lower valuations through public to private transactions, but the rapid recovery in equity markets closed this window too quickly for most to execute. PE, with its US$1.5 trillion[3] of dry powder, nonetheless remains ready to act, with particular focus on the many companies trading at significant discounts, despite the broader recovery of the indices.

PE firms and their portfolio companies came into the crisis riding a decade-long wave of growing transaction volumes, valuations and fundraising. That position of strength may prove a bulwark in the months ahead, especially for firms that have exercised prudence recently.

We anticipate that across industries, small- to mid-size businesses with less robust cash positions will struggle as government support dries up, presenting opportunities for PE funds to consolidate and professionalise industry niches.

“The situation for private equity will remain fluid, but we know with certainty those firms well-positioned to execute through-cycle M&A strategies quickly will be able to deliver more value for shareholders, employees, customers and the communities in which they do business.”

Will Jackson-Moore – Global Private Equity, Real Assets and Sovereign Investment Funds Leader, Partner, PwC UK

M&A looks set to rebound ahead of the global economy

The apparent disconnect between the economy and soaring financial indices has led many to question the sustainability of the rally; we believe M&A activity can lend credibility to the longer term sustainability with well thought-through deal valuations based on robust strategic analysis. Dealmakers will price the relative risks and opportunities within each industry and successful transactions will demonstrate greater confidence in the market.

Companies that approach M&A as part of a long-term strategic plan will be in a better position to capitalise on the opportunities presented in this challenging climate. In addition, history shows that those who engage in M&A early in periods of economic uncertainty see higher average returns than those who wait.

Several important indicators are flashing green for a jump-start in new M&A activity:

- Interest rates are at historic lows.

- Record levels of corporate cash and private markets capital.

- Banks are beginning to lend again and alternative capital sources are available.

- Liquidity in bond markets has returned and new issuances have increased.

- Bankruptcies and the number of distressed companies are likely to rise, especially as government support programmes expire.

- A strong US dollar promotes international opportunities for US investors.

Despite these strong fundamentals, volatility appears to be here to stay. Current COVID-19 cases continue to increase in many territories and fears of a second wave remain ever-present. Companies and investors are closely assessing the underlying business impacts, however it is unclear what the longer term effect will be on financial markets and CEO confidence. Additionally, the forthcoming US elections and global trade relations are casting further uncertainty over the future.

Markets will also continue to be affected by wider global megatrends. We have already seen convergence across industries as technology continues to disrupt and fundamentally change many business models. Multinational organisations will also need to learn how to navigate in an increasingly localised world. There is a definite opportunity for companies to seize the moment and use M&A to rethink and adapt their long-term strategy.

M&A strategy with a value creation mindset

“The value gap created by COVID-19 means that an end-to-end value creation approach to M&A is more important than ever before.”

Malcolm Lloyd – Global Deals Leader, Partner, PwC Spain

Companies will need to repair, rethink and reconfigure their businesses. The initial focus has been on recovery of lost revenue, responding to operational disruption and protecting the safety of employees and customers. In the rethink phase, senior leaders are considering strategic capital allocation and reviewing what constitutes their core business. We anticipate businesses will engage in M&A with a value creation focus as they reconfigure their operations and look forward to the long term.

Successful dealmakers understand the importance of staying true to their long-term strategic intent. PwC’s “Creating Value Beyond the Deal” series shows 86% of buyers surveyed who said their latest acquisition created significant value went on to state that it was part of a broader portfolio strategy rather than opportunistic[4].

The private equity industry is still fairly young, though old enough to remember 2008. Two aspects of how the industry confronted the last economic downturn shows what may drive value in this one. Buying low is great if you can and it also aligns with strategy; those investors who have a value creation focus tend to outperform.

M&A trends in the first half of 2020

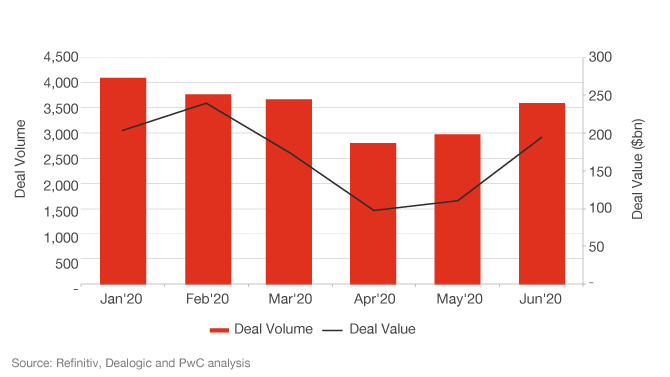

Heading into 2020, M&A activity was expected to decline from 2019 levels, mainly due to rising uncertainty around the global economy, trade tensions between the US and China, and the forthcoming presidential election in the US. The impact of the coronavirus then checked new M&A activity causing deal volumes to decline by 13% in the first half of 2020 versus the first half of 2019.

However, there are already signs that by the end of 2020 we will see a robust recovery in M&A activity. Deal volumes in June increased over April and May levels as many deal processes that were put on hold in the midst of the COVID-19 crisis resumed.

“The technology sector has been the most resilient with tech deals leading the way and digital acceleration driving convergence across industries.”

Brian Levy Global Deals Industries Leader, Partner, PwC US

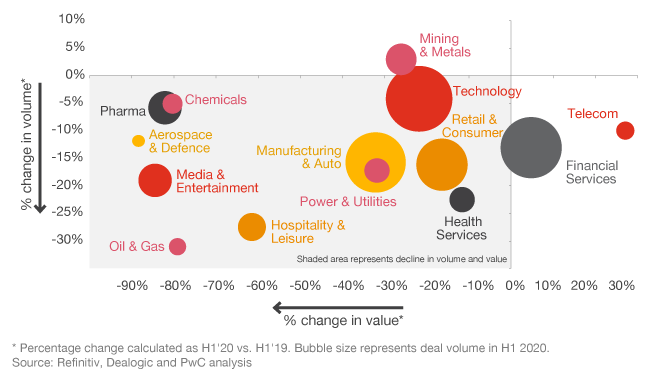

Deal values also fell during the first half of 2020, but by a much greater degree. Deal value trends varied widely by industry as Aerospace & Defence declined by almost 90%, whereas Telecommunications increased by close to 30%. Unsurprisingly, the number of megadeals declined sharply and deals announced in the second quarter tended to be smaller, more strategic bolt-ons and tuck-ins financed from corporate balance sheets.

Geographically, overall deal volumes and values across Asia Pacific remained more resilient than in other regions since their economies were the first to reopen as COVID-19 restrictions eased.

M&A is key to corporate recovery strategy

A recent PwC COVID-19 survey of more than 900 global CFOs showed M&A will feature in companies’ recovery strategies. A quarter of respondents said they would use M&A to rebuild or enhance their company’s revenue streams[5].

M&A remains uniquely positioned to drive transformation at speed and we also anticipate continued use of M&A for innovation and R&D. Digitalisation is accelerating existing trends and resulting in more cross-industry deals involving technology. We expect this will lead to robust volumes of bolt-on and tuck-in investments.

Smart deal structuring is key to enabling strategic acquisitions to move forward in this challenging environment. Stock-based transactions are more likely to be used as a means to address relative valuation uncertainties and as companies look to preserve cash. Earn-outs present an alternative structure to share the risk. Other structuring considerations, such as growth capital investments, partnerships and alliances, will promote collaborations that leverage capabilities and increase growth opportunities.

Future drivers of M&A activity

Digital transformation has taken on a new sense of urgency. Society has become more home-centric and the underlying technology to support remote working, education, shopping and entertainment is critical. The speed at which demand has increased for these products and services favours a buy versus build strategy.

Across industries, we anticipate large-scale divestiture of non-core activities to improve financial resilience, de-leverage balance sheets, free up capital for reinvestment and de-risk operations through simplification. Portfolio reviews by both private equity investors and corporates will lead to more M&A.

Companies will seek to bolster operational efficiency to better position their businesses in a recession or to prepare for future waves of the COVID-19 pandemic. They can de-risk their operations by building greater choice into their supply chains through diversification, simplification, on- or near-shoring and vertical integration.

Environmental, social and governance (ESG) factors (including diversity and inclusion) are very much on the minds of investors, corporate leaders and governments. Investors are increasingly allocating capital based on a company’s ESG performance[6].

During the 2008/9 global financial crisis, many investors deprioritised ESG to focus on solvency. Since then, corporates and private equity firms have increasingly committed to ESG goals and to evaluating future investments through an ESG lens. Now, COVID-19 is viewed by some as an opportunity for both governments and businesses to make a stronger commitment to ESG as the economy recovers. Some governments have imposed environmental conditions on financial bailouts to directly tie funding to ESG actions, such as expanding adoption of electric vehicles.

Global M&A Outlook

The first half of 2020 has seen far-reaching disruption to lives and businesses across all territories and industries. We believe M&A will be a cornerstone of the recovery as companies seek to act with agility to repair, rethink and reconfigure their businesses. Dealmakers should consider the following to increase the success of their transactions:

- Ensure strategic deal rationale: companies with a clear, long-term strategic M&A plan aligned to corporate strategy and value creation, rather than an opportunistic mindset, are likely to make successful deals in this market.

- Perform robust due diligence: boards and investment committees need to understand the impact of COVID-19 and ESG considerations for any transaction if it is to create value in the long term.

- Embrace analytics and digital innovation: dealmakers should look to leverage data and analytics to uncover opportunities and risks, and embrace new digital tools such as drones to conduct virtual site visits.

Footnotes:

[1] Source: Gita Gopinath, “Reopening from the Great Lockdown: Uneven and Uncertain Recovery”, IMF Blog, 24 June 2020, accessed 20 July 2020

[2] Source: Nasdaq Composite Index, accessed 20 July 2020

[3] Source: Preqin Ltd

[4] Source: “Creating value beyond the deal“, PwC, accessed 20 July 2020

[5] Source: PwC’s COVID-19 CFO Pulse, 1-11 June 2020. See “PwC’s COVID-19 CFO Pulse”, PwC, accessed 20 July 2020

[6] Source: Celine Herweijer and Will Evison, “The environmental opportunity created by COVID-19”, strategy+business, 5 June 2020, accessed 20 July 2020

About the data

We have based our commentary on M&A trends on data provided by industry-recognised sources. Specifically, values and volumes referenced in this publication are based on officially announced transactions, excluding rumoured and withdrawn transactions, as provided by Refinitiv as of 30 June 2020, and supplemented by additional information from Dealogic and our independent research. This document includes data derived from data provided under license by Dealogic. Dealogic retains and reserves all rights in such licensed data. Certain adjustments have been made to the source information to align with PwC’s industry mapping. We define megadeals as transactions with a deal value greater than US$5 billion.

Read more on Managing Risk in M&A: The Board’s Perspective

Read more on Managing Risk in M&A: The Audit Committee’s Involvement

This article was first published here.

Photo by Devon Janse van Rensburg on Unsplash.

5.0

5.0