2021 was an uncommon and tough year due to COVID19 guiding our lives. We’ve all had to adapt to “the new normality” and for many of us, it was about spending most of the time online.

Furthermore, COVID19 and climate emergency made Environment Social and Governance topics become top-of-mind among investors, consumers and companies boards.

There is a sense of urgency to build a better world than it existed before.

In this article, I’ll summarise key sustainability events defining 2021 and then present four sustainable ESG trends that will settle companies’ environment in 2022.

2021 Sustainability Summary

The world fought back against the pandemic, and in just one year, developed four vaccines and immunized half of the world’s population. Despite poor coverage in developing countries (6%) and new variants bringing back lockdowns, we hope to go back soon to a new normality.

We had the “Day of reckoning” for big oil. A court forced Shell to reduce emissions, an activist investor forced ExxonMobil to replace three board members better suited to fight climate change, and Chevron shareholders voted against their board to achieve faster-cut carbon emissions. Besides, Danone’s CEO stepped down after investors blamed him for failing to balance shareholder value creation and sustainability.

Complex Supply Chains designed to run efficiently failed under the pandemic. Restrictions, Brexit regulations, a ship stuck in the Suez Canal, extreme weather events and energy shortages impacted supply chains and prevented firms to meet their demand.

Finally, we had the Conference of the parties COP26, where countries and businesses increased their climate ambition. I’d highlight the IFRS foundation creation of the International Sustainability Standards Board (ISSB) among several announcements. The ISSB brings hopes of ESG reporting standardization.

ESG trends in 2022: Purpose-Driven Companies

Companies purpose has changed dramatically in the last few years from just profit generation. Now companies purpose aims to address pressure from employees, customers or regulators to reduce ‘negative externalities’ such as carbon emissions.

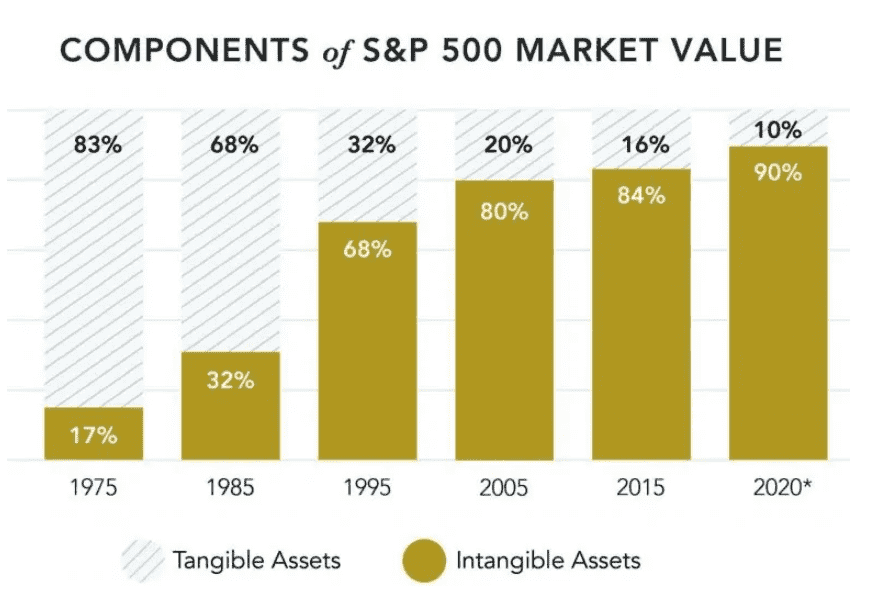

Moreover, the rise of intangible assets (90% of S&P500) such as human capital, customer relationships or brand value, very sensitive to ESG issues such as climate risks or social justice, has pushed companies to rethink their purpose.

As a result, companies such as Patagonia, Unilever or IKEA have started their journey to become purpose-driven companies. They aim to create value by positively impacting the planet and society while producing profits. They just give more than they take, a concept explained by Paul Polman‘s Net Positive book.

The net positive company will operate differently from what’s normal today. It will, for example, eliminate more carbon than it produces.

Paul Polman, former Unilever CEO

This new shift in companies value generation has given rise to investment that considers Environment, Social and Governance factors. As a result, ESG investment has almost doubled over the last four years, reaching $40.5 trillion in assets in 2020 (Opimas LLC).

In 2022, standards harmonization and policymakers will push for mandatory ESG reporting to protect investors and influence corporate behaviour.

Companies with a meaningful purpose, uniquely solve social problems in a profitable way and therefore retain their social license to operate over time. The recently published Integrated Thinking Principles Prototype presents a philosophy focused on value creation overtime for the enterprise and its key stakeholders.

Furthermore, measuring how a company delivers to its purpose and creates value beyond profits is challenging.

The Value Balancing Alliance and the Impact-Weighted Account Project work aims at measuring companies’ value creation by translating environment and social externalities into monetary values. The monetization of externalities informs the management in a language they speak.

Measurement of externalities will allow moving the corporate ESG agenda beyond current climate debate to areas such as the just transition, diversity and inclusion or loss of biodiversity.

Take away – Companies move from doing less harm to giving more than they take. Firms will need to publish material and quality ESG data to demonstrate their value creation beyond profits.

ESG trends in 2022: Net-Zero ambition

Countries and companies have taken responsibility for climate change and raised their carbon emissions reduction ambition. As a result, 90% of the global economy and a third of the 2,000 largest companies have net-zero pledges.

Two events will increase corporate Net-zero programs credibility and separate climate action from pure greenwashing:

The launch of the first science-based Net-Zero standard by SBTi. The initiative set guidelines and established a verification process to increase the credibility of corporate net-zero targets. Among several requirements, companies will need to reach deep decarbonization of 90-95% before 2050. Besides, companies will have to limit the carbon offsetting to a max of 10% of the firm’s emissions. This initiative will incentivize effective carbon emissions programs which invest in energy efficiency, circular programs and renewable energy.

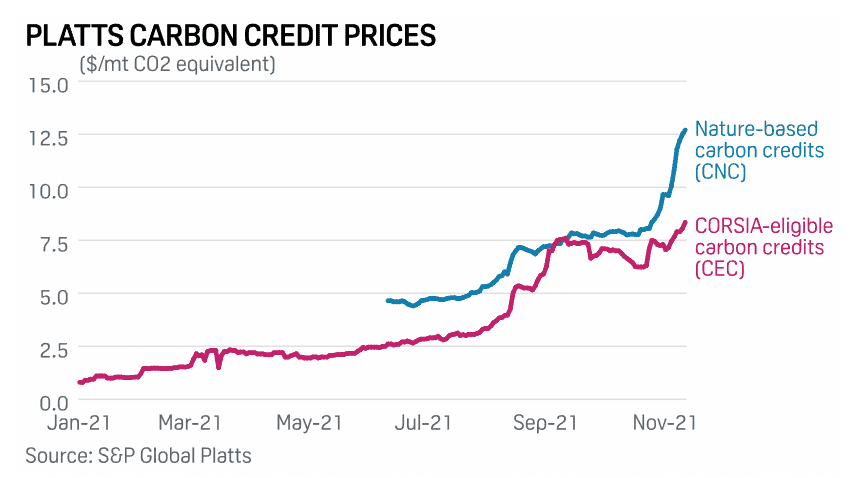

Carbon Offsets Market growth. Article 6 of the Paris agreement approval and the Taskforce on Scaling Voluntary Carbon Markets will play a key role in increasing carbon offsets quality. High-quality carbon offsets are a fundamental tool for eliminating unavoidable carbon emissions and thus attracting investors and companies. (read my article about carbon offset markets)

Take away – Net-zero ambition keeps on growing and with it the need for transparency about carbon emissions programs.

ESG trends in 2022: Sustainable Supply Chains

Investors, employees and customers are pushing companies to address ESG topics in their company strategy.

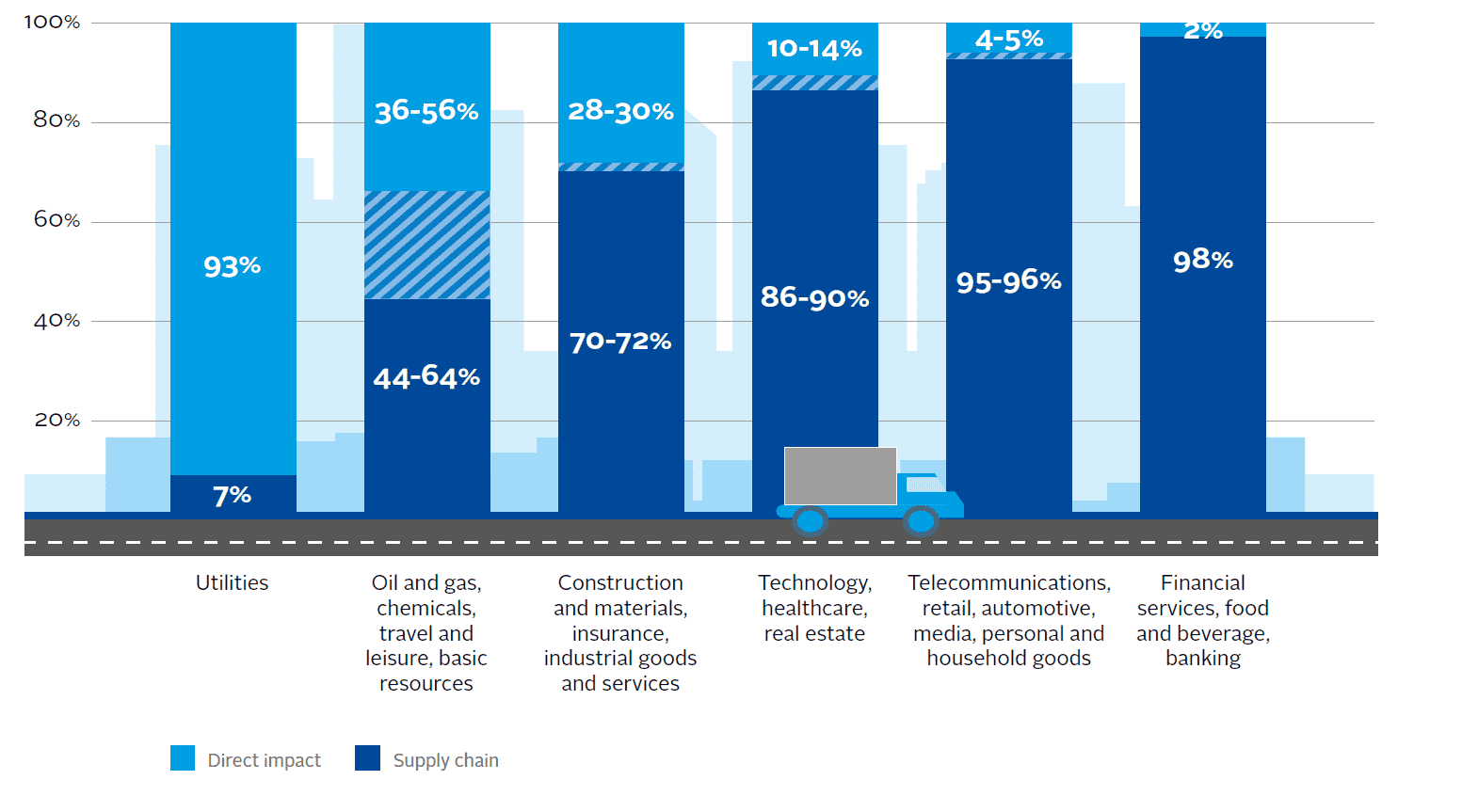

The majority of corporates find most of the risks and opportunities from their suppliers. As an example, according to CDP 2021 supply chain report, upstream emissions are 11.4 times greater than those related to a company’s direct operations. Besides, Looking by sector, UN’s Principles for Responsible Investing finds that 98% of the financial sectors’ and 90% of Real Estate environmental impact is in their supply chain.

Consequently, investors and customers demand increasingly supply chain information to understand the company’s exposure to ESG related risks.

Procurement departments have traditionally pushed suppliers to deliver on quality and lower cost. However, nowadays, you cannot run a sustainable company with an unsustainable supply chain. Therefore, procurement leaders need to focus also on ESG impacts.

This focus reduces for example human rights and corruption risks and captures opportunities for circularity and to reduce products’ embedded emissions.

Above all, a holistic approach to procurement reduces companies’ risks, improve brand value, and attracts investors, customers and talent.

The challenge is in the complexity of supply chains distributed in many countries and that go beyond direct suppliers. Collecting data and creating the right incentives to influence suppliers behaviour are critical strategies for corporate procurement. You can learn the challenges that companies face when developing a supply chain carbon footprint here.

Finally, getting suppliers’ ESG research is a trend that in 2022 will help companies identify outliers, prioritize spending on top performers and reduce supply chain ESG risks.

Take away – Staying under company direct control boundaries is not sufficient to reduce firms’ risks and capture opportunities coming from their supply chains.

ESG trends in 2022: Sustainability Reporting goes Mainstream

The rise in ESG investment has increased investors’ demand for quality and comprehensive non-financial information disclosures.

The current “alphabet soup” of voluntary standards and frameworks are not meeting such demand.

The new International Sustainability Standards Board (ISSB) will be responsible for developing a set of global standards “to meet investors’ information needs”.

The ISSB will sit alongside the IFRS’s International Accounting Standards Board, which oversees the standards governing financial statements. Since the ISSB is built on current standards is an excellent signal that it’s not trying to become a new alphabet letter.

Besides, the Value Reporting Foundation (SASB Standards + Integrated Reporting) announced the merger with Climate Disclosure Standards Board (founded by CDP).

These two events are a leapfrog towards simplifying and harmonizing sustainability reporting. Hopefully, sustainability reporting harmonization will not take the thirty years that it took to align on financial standards.

As I wrote in my article, the many sustainability frameworks suck companies resources and confuse stakeholders.

What society really needs is not just better reporting, but better companies, that are built to be resilient in the 21st century.

Jean Rogers, SASB Standards founder

Finally, as ESG issues become measurable and standardized, having ESG metrics into executive compensation will be increasingly seen in 2022. These incentives will ultimately move companies’ management away from current short terminism and profit maximization to long-term net-positive thinking.

Take away – Standards consolidation will reduce survey fatigue, improve ESG disclosures’ quality, and push ESG metrics into executive compensation.

Conclusions

To summarize, Purpose-driven companies, Net-zero ambition, Sustainable Supply chains and Sustainability reporting going mainstream are key ESG trends to watch in 2022.

They will create sufficient risks and opportunities to shake the way companies operate not in 2050 but in 2022.

Whether these ESG trends will be in 2022 just “blah blah blah” or make an impact will be down to governments, businesses, civil society, you and me.

Thank you for following my articles and sending me great feedback this year.

We will get through this pandemic, and we’ll come out of it stronger than before, looking at the future with hope.

During this holiday season again, please, stay safe, stay healthy.

5.0

5.0