Boards today are feeling pressure to make refreshments a priority. Shareholders are increasingly scrutinising board composition — asking whether the current makeup is best suited for today’s strategy — and some will even vote against individual directors if they feel they have seen too little progress toward reshaping the board.

Nominating/governance committees, who often take the lead in assessing and managing refreshment, should assess board skills, consider board refreshment, identify gaps and plan for succession, ensuring that these processes are robust and occur at least annually.

Assess Board Skills and Attributes

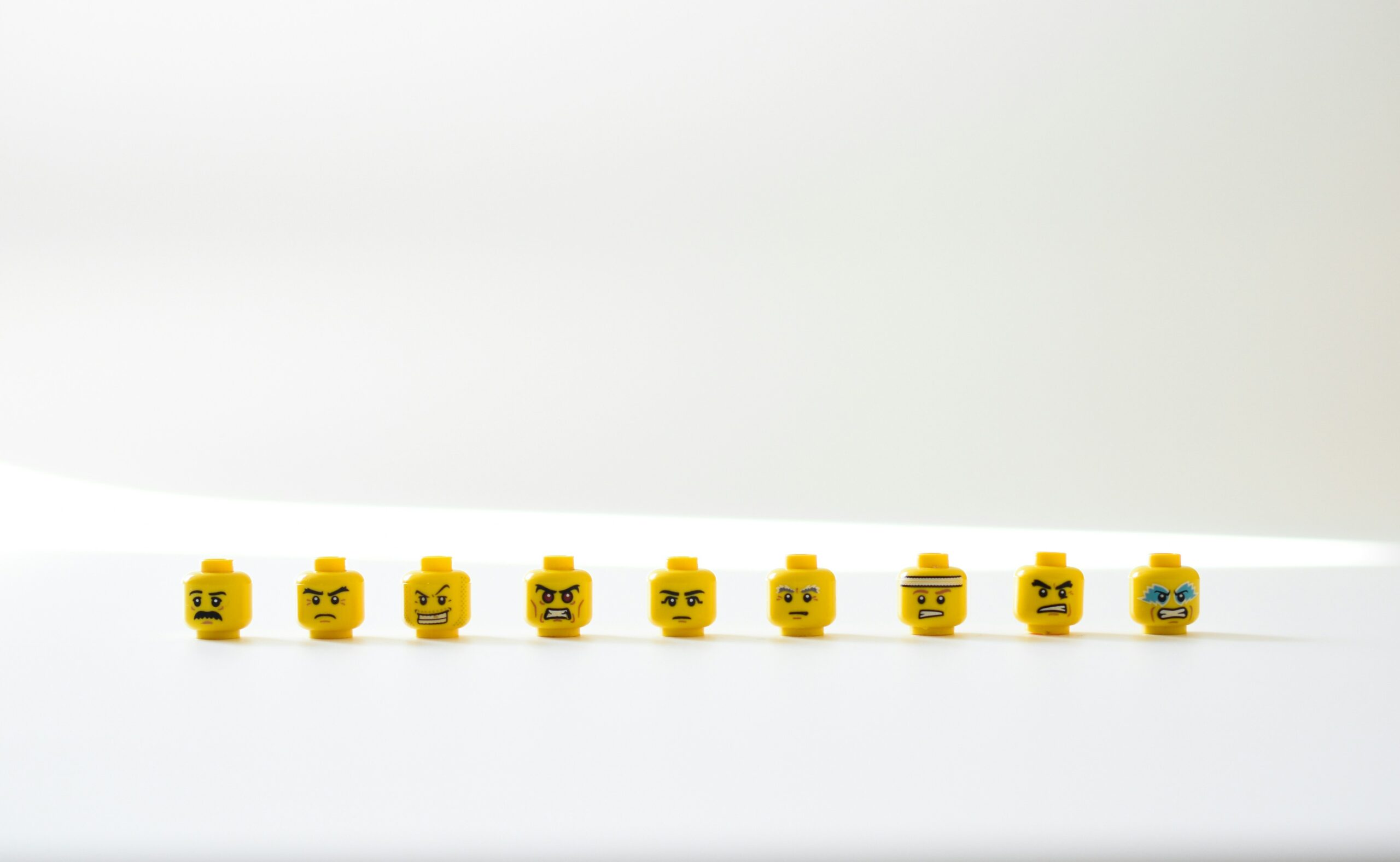

A board of directors is, of course, dynamic rather than static. The board is an assemblage of skills, experience, personalities and perspectives that must continuously adapt to the changing business environment and the company’s shifting strategy.

When evaluating the board’s skills, the objective is to compare the current directors’ suite of attributes with those matching the company’s future. Identify any gaps and incorporate this information into a plan to move the board toward an ideal makeup, aligning expertise and experience with strategic goals and business trends.

Tackle Director Tenure

Many boards look to mandatory retirement ages to spur refreshment. A smaller number of boards use term limits. But the keys to successful board refreshment are fostering a healthy attitude toward board tenure, guiding director expectations, and conducting effective board, committee and individual director assessments.

Nominating/governance committees should consider overall director tenure on the board. This is an area in which investors may be particularly interested. The committee should seek to balance fresh perspectives with institutional knowledge, looking to stagger board member turnover.

Take Action from Board Assessments

Regular board assessments are valuable tools — if they’re wielded effectively. Board, committee and individual director assessments can help the nominating/governance committee understand what skills are lacking, whether training or coaching is needed at the board or individual director level, and if individual directors have the essential skills and experience for the strategic challenges facing the company. The assessment process can help identify opportunities for improvement and needed changes, with the goal of optimising overall board composition.

Develop a Succession Plan

Nominating/governance committees should adopt a multi-year perspective toward director departures, proactively planning for expected and unexpected vacancies in the boardroom. It’s ideal to take a three-to-five-year view to properly plan and not fall back on an ad hoc approach when a director retires. And, of course, the nominating/governance committee needs a contingency plan for unforeseen departures.

While the nominating/governance committee is primarily responsible for succession planning, the full board should understand, review and agree with the plan. The plan also should be reviewed and updated at least annually.

Recruit the Close Gaps

With a comprehensive assessment of the board composition and known vacancies, nominating/governance committees are equipped with the necessary information to create the desired director profiles to fill open board seats. It’s important to recognise that one candidate may be unable to fill all the board’s needs. The nominating/governance committee will need to prioritise its needs to identify realistic candidates.

By actively engaging with prospective candidates over time, the committee can better assess not only whether they meet the necessary qualifications but whether they would be a good cultural fit.

Provide Transparency to Stakeholders

Increasingly, large investors, proxy advisory firms, and other stakeholders are paying close attention to board composition and want to better understand the board’s approach to refreshment.

The nominating/governance committee should work to stay updated on stakeholders’ evolving views on, and interest in, board composition and refreshment.

Conclusion

Who’s on the board holds immense importance. Board composition, in terms of both individual and collective quality and decision-making ability, directly influences board performance and long-term shareholder value. A board that proactively assesses its skill sets, addresses director tenure, incorporates outcomes from board assessments and plans for succession can help guide the company toward future success. Directors have the power to make real change happen — and enhance effectiveness when it’s needed most.

The article was published by PwC.

Photo by Jan van der Wolf on Pexels.com.

4.0

4.0