In 2022, as both the ongoing direct impacts and unexpected side effects of the COVID-19 pandemic continue to mount, the landscape of the business world is shifting yet again. An ongoing war in Ukraine, rising global inflation, fears of recession and the near-constant drumbeat of catastrophic environmental news and predictions are changing the geopolitical context. In the US, market turmoil, social upheaval, political polarization, looming midterm elections and uncertain regulatory developments make the landscape feel like uncharted territory. When the path is uncertain, boards are a source for constancy and guidance.

As shareholder and consumer expectations rise, our 2022 Annual Corporate Directors Survey shows that board oversight and board practices are shifting in response as directors navigate this new governance landscape.

Key Findings

As shareholder and consumer expectations rise, our survey of more than 700 public company directors shows that board oversight and board practices are shifting in response.

Directors Increasingly Critical of Peer Performance

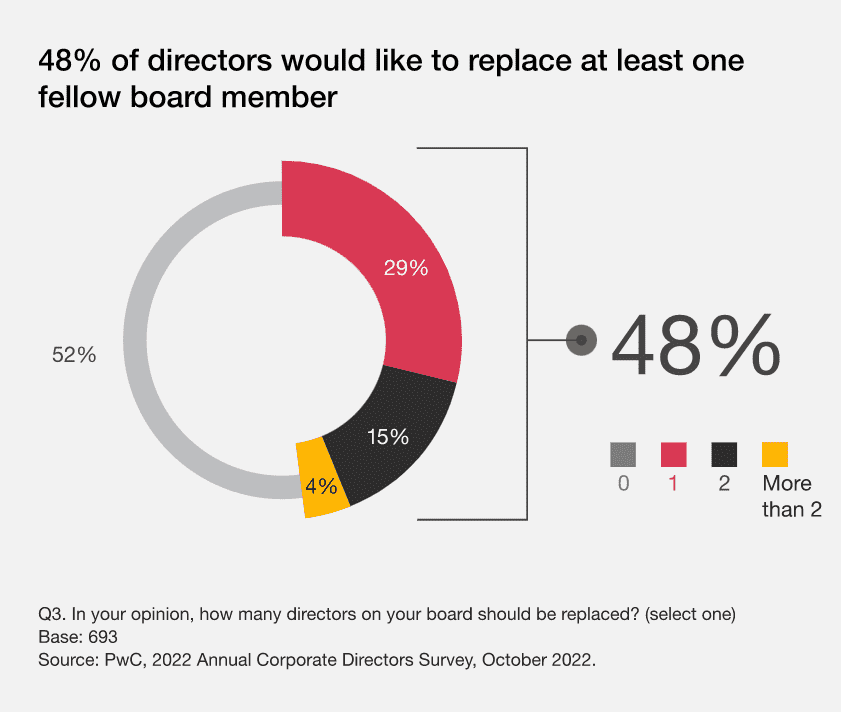

Almost half of directors (48%) think one or more directors on their board should be replaced. Nineteen percent (19%) would replace two or more of their fellow directors.

What’s more—directors are more likely to identify performance-related issues with their peers this year. Almost one in five (19%) say that fellow board members are reluctant to challenge management—up from 12% last year. Directors are also more likely to identify peers who overstep the bounds of their authority (17%, up from 11%). After a year when fewer voiced these types of complaints, directors seem more critical of their peers than in the past.

Diversity of Thought Comes in Many Forms

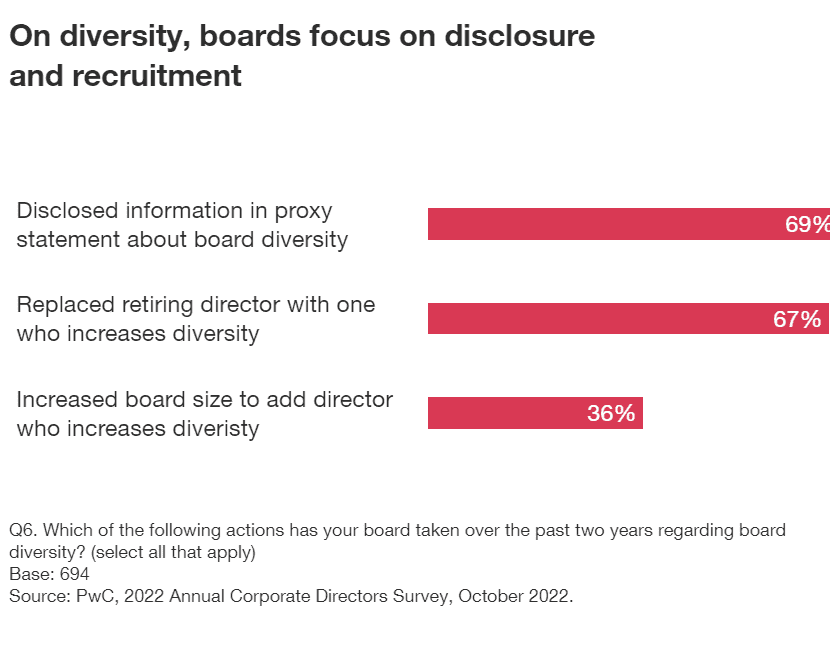

Almost all directors (96%) say their board has done something in the past two years regarding board diversity. Their most common action: increased disclosure. The percentage of directors saying their company disclosed information in the proxy statement about board diversity jumped 15 points from 54% in 2021 to 69% this year.

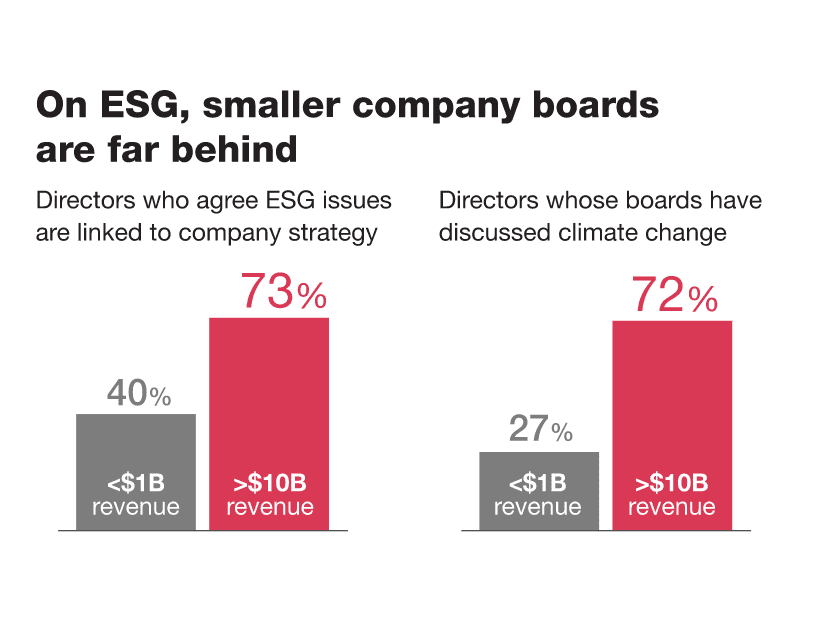

ESG Confidence is High, Even as Demands Grow

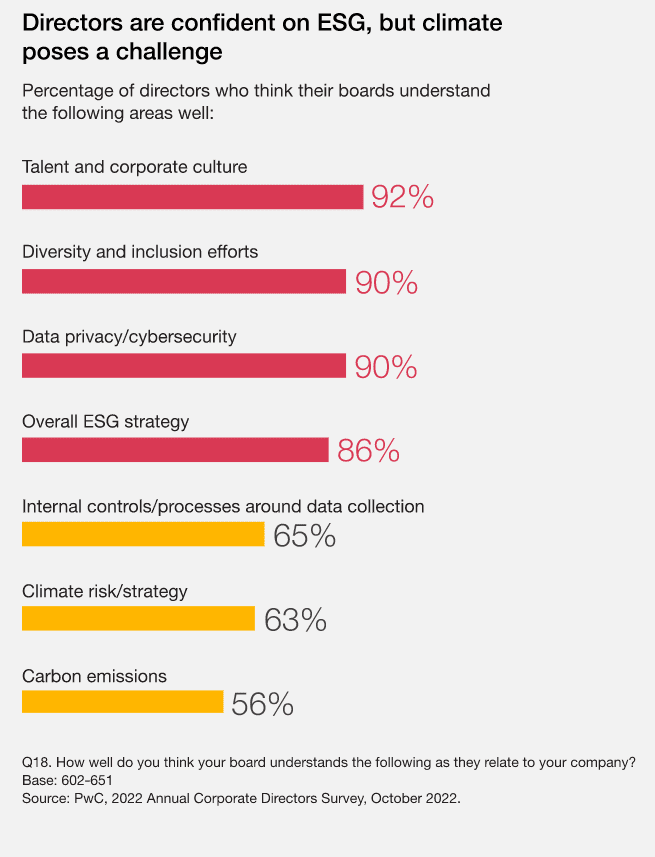

But directors are much less confident in emerging areas like climate risk and related regulations. Fewer than two-thirds of directors say their board understands the company’s climate risk/strategy or the internal processes and controls around data collection. And just more than half (56%) think they understand the company’s carbon emissions.

The article was first published here.

Photo by Rostyslav Savchyn on Unsplash.

1.0

1.0