ACCORDING to the Institute of International Finance (IIF), global debt surged US$8.3 trillion (RM37.7 trillion) to hit US$305 trillion (RM1,385 trillion) at the end of the first quarter of 2023 (1Q23), and some US$45 trillion (RM204.4 trillion) higher than the pre-pandemic level.

With rising interest rates, all borrowers – governments, households and corporates – are saddled with a higher burden of servicing their respective debts.

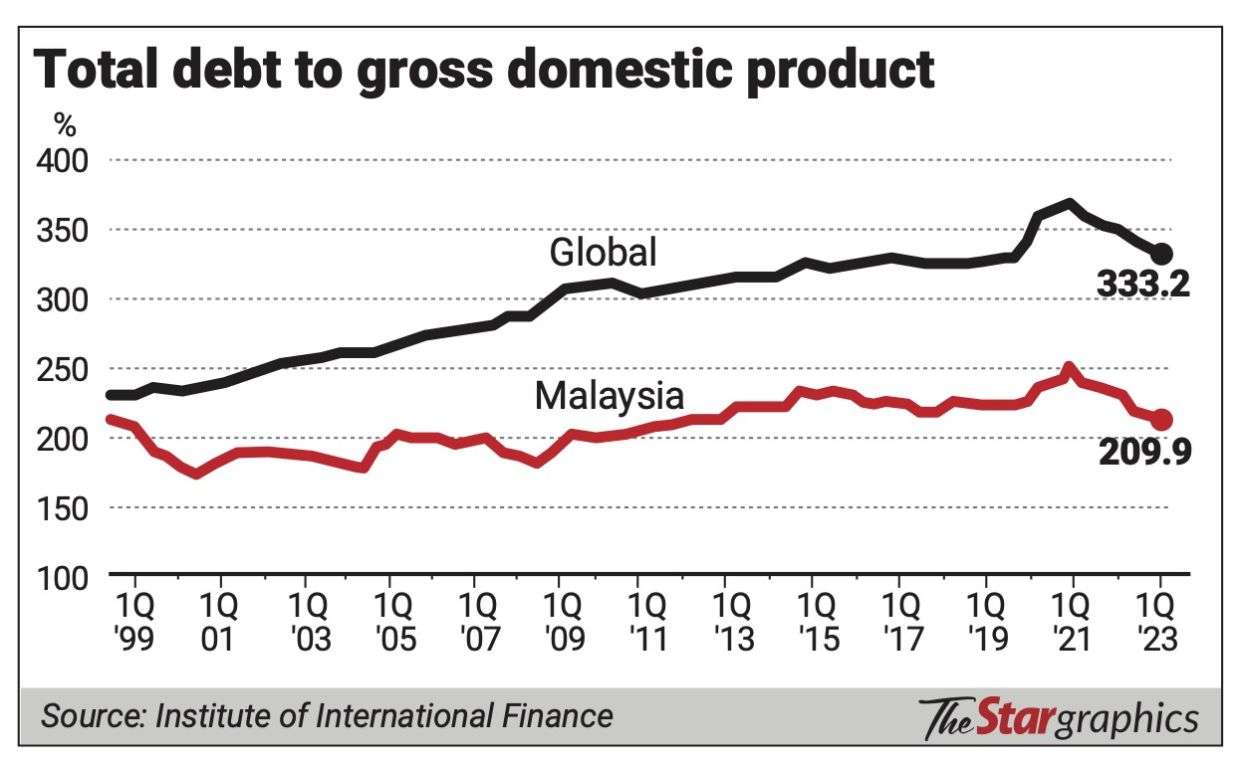

As a percentage of gross domestic product (GDP), the global debt-to-GDP ratio is now at 333%, with government debt-to-GDP at 95%, household debt-to-GDP at 62%, and corporate debt (including financial corporates) at 175%.

In the past 15 years, the use of debt to get out of economic troubles accelerated during the height of the global financial crisis (GFC) and most recently, the Covid-19 pandemic, which saw nations digging deep into the debt market to raise funds to support the ailing economies, household and businesses.

Good Debt, Bad Debt

Debt is not a dirty four-letter word when used effectively and efficiently to propel an economy or to invest in infrastructure development to lift the economic profile of a nation for the benefit of the people.

However, all debts taken out must be commercially viable and economically beneficial and not one that will burden the nation, and countries must also address issues related to debt (the debt service ratio, debt-to-GDP ratio) and not simply kick the can down the road for the next generation to take care.

Global debt today, based on IIF data, is equivalent to almost US$38,000 (RM172,577) per capita.

Every child born at the very second now inherits this debt right away and without the will to address the global debt phenomenon, the figures are just expected to go north.

Debt Ceiling

In the United States, and some other countries, a debt ceiling is used to ensure fiscal discipline among lawmakers, but often the ceiling itself is abused with lawmakers requesting higher limits to ensure the state remains in operation and to avoid a debt default.

The United States has been notorious in this, as the debt ceiling itself has been raised close to 80 times since 1960 and the current debt ceiling of US$31.4 trillion (RM142.6 trillion) will be in force until 2025 as the debt ceiling has been suspended by Congress.

Hence, instilling a debt ceiling, although an honourable gesture, has little meaning when lawmakers use methods to raise the ceiling time and again.

Higher Borrowing Cost

As we are aware, global interest rates have been heading north since early last year with some central banks on an aggressive tightening mode.

This was led by the Reserve Bank of New Zealand’s 525 basis point (bps) hike; followed closely by the Federal Reserve’s 5% hike, and the Bank of Canada and Bank of England’s 4.75% and 4.9% increase, respectively.

With higher global interest rates and higher debt levels, naturally, the amount set aside by borrowers has been rising rapidly in the past 18 months or so.

For every 100-bps increase in global interest rates and assuming half the debt is in floating rate, the borrowers’ cost of servicing debt rises by US$1.53 trillion (RM6.95 trillion) per annum.

With global interest rates higher by about 3% on average, borrowers are now paying approximately US$4.58 trillion (RM20.78 trillion) per annum, which translates to almost 4.5% of global economic output this year.

The higher repayment amount due to the increase in the borrowing cost could have otherwise been used for consumption or investment.

Impact on Malaysia

According to data provided by IIF, Malaysia’s total debt-to-GDP as at the end of 1Q23 stood at 209.9% as seen in the chart, comprising 83.7% of corporate debt to GDP (including financial corporates), 66.1% of household debt-to-GDP, and 60.1% of government debt-to-GDP.

After peaking at 245.1% as at the end of 1Q21, Malaysia’s indebtedness has improved gradually and is now down by some 35.2 percentage points.

When compared with global debt-to-GDP ratios, the gap between Malaysia and global ratios too have improved considerably to 123.3 percentage points against as low as just 18.6 percentage points in 1Q99.

This is largely attributed to the expansion of nominal GDP, which grew much faster than total debts.

In absolute terms and based on IIF data, Malaysia’s total debt stood at US$868.4bil (RM3.94 trillion) as at the end of 1Q23, up just 0.1% year-on-year.

As the government’s debts are entirely a fixed rate, the higher domestic interest rates have little bearing on the government’s finances, except for higher borrowing costs for new debts that are raised, as well as debts that are rolled over with new debt papers.

For the rest of the borrowers, the impact of higher interest rates will result in higher borrowing costs. Assuming that 60% of the total debts presently held by households and corporates (including financial) of US$619.5bil (RM2.81 trillion) are floating rate debts, borrowers have an additional burden of paying RM21.3bil per annum based on the 125 bps hike that we have experienced thus far since the Overnight Policy Rate was first raised in May last year. The extra cost of funding debts will result in lower investment and consumption for both corporates and households, which when measured against the size of nominal GDP, is approximately 1.1% of this year’s nominal GDP.

Is There A Crisis Brewing?

On the surface, it is hard to make the call. However, as central bankers are persistent in their pursuit to fight inflationary pressure, rates are likely not only to go higher but for a longer period, straining both the households and corporates of higher borrowing costs. Even for governments, an increase in rates is straining finances as short-term rates have risen to even surpass the 5% mark in the US and the UK, requiring governments to raise fresh debt papers to finance higher borrowing costs.

In the words of IIF, “the global economy faced a “crisis of adaptation” to rapid monetary policy tightening by central banks as the combination of such high debt levels and rising interest rates have driven up the cost of servicing that debt, triggering concerns about leverage in the financial system”. The crisis of adaptation is real and is here. As it is, households and corporates as well as governments to a certain extent are finding it difficult to manage rising borrowing costs and this may be made worse in the coming quarters if global interest rates do not ease from its pivot point.

The article was first published here.

Photo by rc.xyz NFT gallery on Unsplash.

5.0

5.0