The idea of doing well by doing good is mirrored in sustainable practices and in responsible investing that encompass global change and generate competitive returns. By using ESG (environmental, social, governance) criteria and combining negative screening – eliminating investments in products that conflict with social, moral, or ethical values (e.g., weapons, tobacco, child labour, environmental degradation) – with positive screening i.e. proactively making investments in companies that are creating a positive impact, institutional investors are increasingly making positive impacts on their businesses, communities, societies and the world.

Global ESG reality

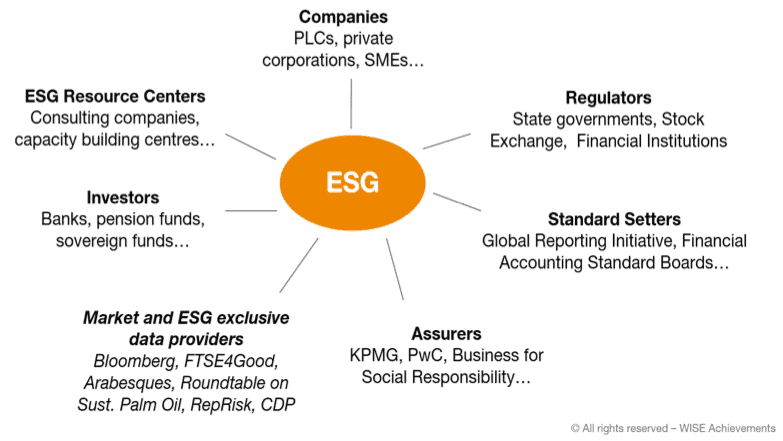

There are 120 ESG funds globally and the BlackRock, the world’s largest asset manager, predicted that the investment in ESG funds will rise to more than US$400 billion over the next ten years. Along the way, the whole ESG eco-system was built, improved and became efficiently functional.

Research conducted in 2016 identified almost 400 sustainability reporting instruments in 64 countries. Predictions say that by 2020 reporting instruments will be applied not just to large but to medium listed companies as well.

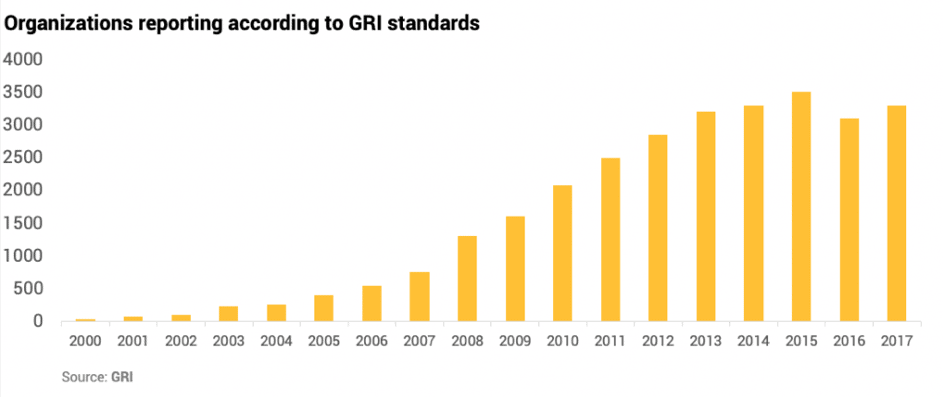

Being aware that sustainable practices will bring comparative advantage to their companies, new markets/consumers and long term benefits, the number of organisations publishing sustainability reports through the Global Reporting Initiative (GRI), the world’s most widely used sustainability report framework, increased from 43 in 2000 to 3,700 in 2017. Over 80% of the world’s large corporations currently provide ESG information to the market through the GRI.

Asian ESG reality

According to the Global Sustainable Investment Review 2016 in Asia (excluding Japan), the total figure of ESG funds was only US$52 billion, representing less than 1% of Asia’s total professionally-managed assets. The number of Asian signatories to the UN Principles for Responsible Investment (PRI) is just 153, out of a global total of 2,183.

There are several groups of reasons that can shed light on the rather slow pace of incorporation of ESG criteria into investment decision-making in Asia:

- Regulations/laws

- lack of commitment from regulatory bodies at national/state level to adequately govern implementation of ESG

- lack of relevant policies, regulations and institutional bodies that encourage (e.g. ESG tax incentives) and monitor the use of ESG criteria by investors and companies

- Data

- lack of depth of industry specific data and verification of the reliability of the data in making decision with an ESG lens

- lack of resources and expertise to interpret the data and differing standards on ESG

- Lack of knowledge and skills

- lack of knowledge and understanding about ESG criteria and GRI reporting among Board members and CEOs i.e. corporate decision makers

- lack of ESG resource/training centres that could provide relevant ESG information and training tailored to industry needs.

On top of these reasons, investors in Asia tend to believe they must choose between either ‘doing good’ or maximising profits. However, according to the recent research by Morgan Stanley it seems that sustainable investments appeal to a younger generation of socially conscious investors in Asia. With 35% of Asia’s wealth expected to change hands in the next five to seven years, ESG is going to be a hard trend for financial institutions in the Asian region to ignore.

What about Malaysian ESG reality?

ESG i.e. sustainability reporting is mandatory for publicly listed companies (PLCs) in Malaysia. While in theory these efforts indicate slow progression, no one is quite sure how many of Annual Disclosure Statements have been monitored and verified by Bursa Malaysia, how many PLCs have been delisted not just due to liquidity filtering but because they didn’t meet governance, social and/or environmental requirement, and no one knows if private companies are (or not) adopting sustainable practices.

However, regardless whether we are talking about PLCs or private companies, serious international investors lack verified sustainability-related data about Malaysian companies. Having in mind global pressure on companies to adopt sustainable behaviour and practices, repercussions for corporate inaction on ESG will rather soon take place.

At the moment Malaysian sustainability investing story has 3 parallel plots:

- ‘grow now, solve later’ – companies that primarily pay attention on profit making while leaving less important social and environmental programmes to their CSR departments, charity/corporate foundations or even PR/branding agencies. Not in line with ESG criteria.

- ‘quick fix’ – instead of incorporating ESG as part of their strategic direction, companies that lack understanding of the complexity of social and environmental issues support short term quick fix interventions that usually do not lead to any substantial or longer-term change. Not in line with ESG criteria.

- ‘making money more’ – conscious, forward looking companies are looking at sustainability/ESG requirements as opportunity zone in which profit making and doing social and environmental good go hand in hand. Zone in which making money is more valuable for both company and society is more important in a long run than just making more money for a limited amount of time. Perfect fit.

Before fast approaching ESG/sustainability reality hits your company and maybe even your job position, it might be useful to think what is the plot you would like to present as a value of your company’s long term stock portfolio?

This article is written by Dr Jasmina Kuka, CEO of W!SE (Working on Impact and Social Empowerment) and expert in impact assessment and sustainability practices.

Photo by Boxed Water Is Better on Unsplash.

4.8

4.8