From trust to impact: Why family businesses need to act now to ensure their legacy tomorrow.

The COVID-19 pandemic has forced many family businesses to adapt or get left behind. Many have shown resilience, but can they continue to stay one step ahead, and take on the unexpected challenges of the future?

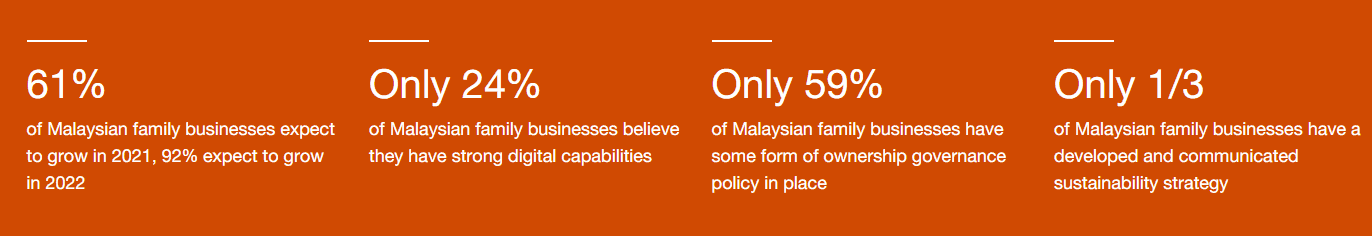

In PwC’s Family Business Survey 2021 – the Malaysian chapter, we explore how family businesses in the country plan to move forward from the pandemic – our insights drawn from 49 interviews with key decision makers in local family businesses (out of 2,801 total interviews globally). The methods of the past are no longer enough to ensure business sustainability. A new approach is required, one based on accelerated digital transformation, prioritisation of ESG goals and professional family governance.

Family businesses need to act now if they aspire to build a solid legacy for future generations. But are they ready?

Explore the survey themes

Back to business as usual in 2022

The experience of going through the COVID-19 pandemic has served as a wake-up call for many family business leaders. Many of them have doubled down their efforts to focus on expanding into new markets, while defending their core business. With plans to continuously adapt, manage risk, and to stay relevant, a relatively optimistic 92% of respondents anticipate the business to return to pre-pandemic growth rates in 2022.

61% of respondents are prioritising the increase in usage of new technologies, 59% each in (i) improving digital capabilities (ii) expanding into new markets/client segments and (iii) protecting their core business. With the Malaysian government planning out measures to promote digitalisation and sustainability, family businesses that have yet to place emphasis on these areas might find a need to shift their priorities moving forward.

Pressing the pedal on digital

Digital capabilities, once an option, are now a necessity. However, only 24% of Malaysian respondents say they have strong digital capabilities, while 76% believe they have a long way to go.

Family businesses will need to transform themselves digitally if they are to increase their relevance in today’s business climate. This transformation must come hand-in-hand with upskilling their workforce, and should be in line with the family’s shared long-term vision and values.

Who is succeeding the family business?

80% of Malaysian family businesses place protection of the family business as the most important family asset. If so, then why do only 59% of Malaysian family businesses have some form of ownership governance policy?

It is essential for family businesses to plan succession well, ensuring that the next generation is equipped with the necessary tools to drive the business forward in the right direction. Trust and communication among family members are key. However, only 45% of Malaysian respondents say that all family members involved have similar views/priorities about the company’s direction, while 57% say that relevant information is shared in a transparent and timely way between family members.

Family business owners would need to ensure that there is open and transparent communication and an ownership structure that’s carefully designed through an effective owner strategy. This would allow the relevant family members to understand their roles and contributions to the family business, and make their mark in the business landscape.

Future-proofing your business through ESG

Only a handful of Malaysian family businesses are prioritising environmental, social, and governance (ESG) initiatives, with only 12% planning to increase the organisation’s social responsibility and 6% planning on reducing the business’ carbon footprint. Meanwhile, only a third of Malaysian family businesses have a developed and communicated sustainability strategy.

This shows an inconsistency in translating core family values to actions which show commitment to ESG priorities. As investors increasingly expect companies to disclose and address ESG risks, a shift in mindset is needed to move sustainability beyond philanthropic and checkbox activities and into improving operational resilience such as managing vulnerabilities arising from ESG risks. This would help set the family business apart, giving them a clear competitive advantage and future-proofing their business.

The article was first published here.

Photo by Marvin Meyer on Unsplash.

1.0

1.0