The stakes around managing tax costs and risks are considerable. The C-suite should take steps to protect both financial outcomes and reputation.

- Two-thirds of C-suites are involved in managing tax profiles, an EY survey says.

- Despite the interest, just 24% have full visibility over all tax disputes.

- Three proactive steps can help effectively manage the five ways tax risk and controversy are on the rise.

The rapidly changing environment for tax risk and disputes is creating a dilemma for the C-suite.

Balancing overall efficiency with tax costs and tax risks – both financial and reputational – has been high on board, audit committee and C-suite agendas for some time. But the stakes in these calculations are rising just as the world begins to emerge from the pandemic. Deficits have soared in some countries, and reserves have been depleted in others. And now, tax administrations are focusing on more robust tax law enforcement.

This double impact comes as business leaders are under pressure to meet short-term performance objectives while simultaneously fostering sustainable growth. This changing environment is driving more tax disputes, higher financial exposures and greater risk to corporate brands – all things damaging to long-term value creation.

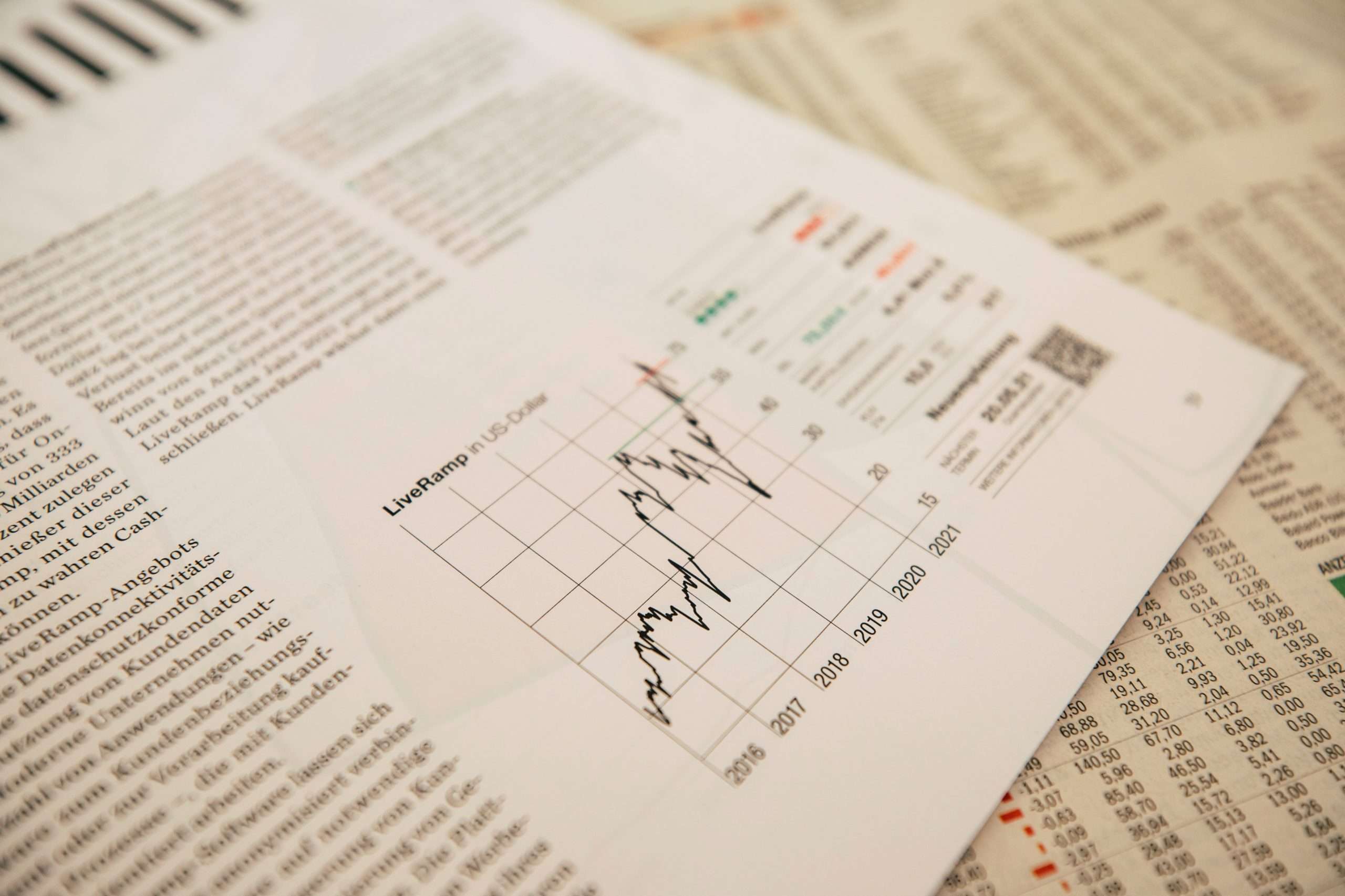

It’s little wonder then, that two-thirds of respondents in the 2021 EY Tax Risk and Controversy survey say C-suite executives, particularly those leading in enterprises that operate across borders in multiple jurisdictions, have become increasingly interested and more involved in managing their organization’s tax profile in the last three years. That’s a 14-percentage point increase since our 2017-18 survey, and we expect that proportion to rise as the C-suite becomes more familiar with the converging trends. This will make for a far more challenging tax enforcement environment over the next decade, as businesses take greater care in identifying and managing tax risks.

In this report we use the term disputes to mean significant enquiries, tax audits, court cases, litigation and any other disagreement a taxpayer has with a tax authority where a financial amount may be at risk.

The scope of evolving tax enforcement is daunting. Tax court cases now routinely involve disputes over hundreds of millions (sometimes billions) of dollars in taxable income adjustments, forcing business leaders to focus on both cost and reputation exposure. At the same time, a new wave of action against inequality and climate change has brought tax back onto the front pages, while increasing discussions around criminal sanctions as a lever in tax disputes is creating valid anxiety. These drivers are compounded by a new model for the automatic exchange of taxpayer information among tax authorities, something that is being coupled with impressive new uses of digital technology to assess taxpayers.

These compounded shifts in tax administration are playing out as countries pivot to new and increased taxes, with governments looking to recover ground after spending trillions of dollars supporting and stimulating their COVID-19-hit economies. Taxes are already rising in several countries, and 51% of respondents expect higher direct taxes in the coming three years, with that figure rising to 66% in the UK and 93% in the US. More robust tax enforcement will play a key role in efforts to bring budgets back into balance as well, with 53% of respondents forecasting a rise in this area of activity – increasing to 61% in India, 68% in the US and 70% in Russia.

Despite the recent surge in C-suite interest and oversight of tax being fully warranted, many companies are unprepared to respond to higher tax enforcement: just 24% say they have full visibility of all their tax audits, disputes and litigation globally, and less than four-in-ten are protecting themselves against transfer pricing risks and extra costs (with transfer pricing confirmed as the leading tax risk in our survey for the fourth time and eight years in a row) by proactively using Advance Pricing Agreements, a common dispute prevention tool in this area.

Who’s at risk?

Not every business has experienced a large tax dispute in recent years, but all should be on closer watch moving forward, and all should prepare to steer their way through the transformed – and continually evolving – global tax risk environment.

Any cross-border enterprise that operates transfer pricing, has a mobile workforce, makes significant use of intellectual property, has intra-entity financing activity, performs intra-group services or includes elements of digitalization as part of its business model should be particularly on guard. But ongoing tax change affects companies of all sizes, particularly given the impacts of the digital economy.

Five ways tax controversy can cause disruption

For larger companies, those either growing quickly or already established across national borders, we have identified five key ways in which tax controversy has the potential to be enormously disruptive in the next few years if not addressed at a strategic level.

- Create financial exposure:

Multinational companies are now at a higher risk of experiencing double taxation and tax disputes, ranging from bilateral disagreements between countries on who has the right to tax, to tax audits and major litigation. Penalties, interest and surcharges resulting from tax assessments first raised 5, 10, even 15 years ago often grow to be punitive, while overall provisions for tax costs may rise among companies failing to take the right steps to reduce the incidence and severity of tax disputes before they arise. Importantly, these tie up working capital, further shackling investment plans. - Put corporate brand and reputation at risk:

How much businesses “contribute” to society via taxation – both directly and indirectly – has been a subject of intense public interest for more than a decade. That debate is being stoked further by calls for higher levels of equality and greater support of sustainability goals which can be met via new taxes on wealth and higher corporate income taxes (already announced or promised in several countries). It’s also seen as a justification for climate-related tax measures gaining popularity, in the European Union (EU) and several countries. - Be a barrier to effective deal-making:

In a world of shifting tax risks, ongoing tax disputes may cause a lower number of deals to progress successfully. No deal is without risk, but uncertainties in tax positions, significant ongoing disputes or a provision for tax in the financial statements can often be viewed as a negative by acquirers, slowing down or even causing a potential transaction to fail. - Bring the business to a halt – literally:

Tax disputes can tie up resources, cash flow and the attention of business leaders. Legitimate requests for refunds of tax can sometimes go unanswered or delayed as the dispute progresses, creating cash flow issues or a submission for a new refund can lead to an automatic tax audit. And in the most serious of cases, countries have stripped multinational companies of their license to carry out business as a lever to encourage them to address a significant ongoing tax dispute. - Lead to criminal sanctions being applied – even across borders:

One result of the more intense public focus on tax has been a push by some countries to hold companies and their officers accountable. New and evolving tax laws in many countries (including most recently France, Germany, Poland and the UK) may apply civil or criminal penalties for infractions that range from something as simple as the omission of data in a tax return, to gross negligence or, more egregiously, the failure to disclose a Permanent Establishment (effectively an unregistered ongoing concern) in another country. More than a quarter (27%) of respondents foresee more criminal penalties being applied in the coming three years. Importantly, many new and proposed criminal tax laws now include an element of extraterritoriality: in effect, corporate officers who may ultimately hold responsibility for a tax decision or tax filing, even if based in another country, may find themselves prosecuted by a foreign territory.

What the C-suite can do about tax risk and controversy

The positive news is that there are several clearly established leading practices that can be adopted now to best position your enterprise. Broadly, these actions occur across the three core phases of the tax controversy lifecycle, with a key focus on preventing disputes from arising in the first place:

- First, put in place the interlinked people, tax and business controls, and global technology that will help your enterprise assess its spectrum of active tax risks – globally and in real time

- Second, better manage ongoing tax risks via a comprehensive strategy that continuously refines these controls and makes use of all available dispute prevention and resolution tools and programs

- Third, when any tax disputes do occur, secure a rapid, effective resolution, ideally allowing your company to move forward free of unwanted litigation and the commonly resulting tax provision

Many multinational companies have historically focused, sometimes to the point of exclusivity, on that third and often final step, missing the opportunity to reduce the likelihood of tax risks turning into tax disputes in the first place. There is a different way, though, based on earlier, more proactive management of tax risks and focused on transparency, proactivity, consistency and predictability.

Preparing for the evolving tax enforcement environment requires investment and commitment, and may also require a re-think of plans at the executive layer – especially if the 79% of executives in the 2020 EY Tax and Finance Operate survey follow through with their planning to reduce the cost of their tax and finance function over the next two years. But while such impulses to cut costs are near universal in challenging times, being unprepared for future tax risks may be more costly in the long run.

Fully-fledged transformation to your future state tax risk and controversy model does not need to occur overnight. Those companies that we believe are making the strongest progress in this space all took time to carefully identify the highest value, most immediate priorities – the proverbial low-hanging fruit – while simultaneously defining which other leading practices should form their longer-term strategic road map for change. In effect, they are building their Tax Controversy Department of the Future – not all at once, but piece-by-piece, and with a clear future state in mind that allows for adaptability.

The C-suite should consider supporting – or even spearheading – this effort within their organizations.

Summary

C-suite executives have become more engaged in helping their organizations manage their tax profiles in recent years. But rapid developments in the tax risk and controversy environment make concrete actions necessary to help protect both organizations’ bottom line and reputation.

The article was first published here.

Photo by Chris Davis on Unsplash.

5.0

5.0