Doubts over the integrity and effectiveness of ESG data and reporting are undermining progress on critical challenges.

In brief

- Businesses and capital markets can be important to accelerating action on the world’s pressing sustainability issues.

- Doubts over sustainability claims could undermine the mobilization of capital behind ESG priorities as those in charge of reporting are not seeing much progress from ESG on their investment case.

- Improving corporate sustainability reporting is expected to play a critical role in driving understanding and value for both corporates and capital markets.

Driving tangible and impactful progress on sustainability imperatives, from the urgent need to accelerate decarbonization to improving diversity and social equity, is a collective responsibility, with critical roles for both governments and businesses. But as our sustainability crises mount, and doubts grow over the slow pace of progress, an active role for companies and financial markets has never been more important.

Today, historic levels of capital are shifting toward sustainability priorities. But, at the same time, this increases the need for more credible and useful sustainability data and reporting. However, trust in sustainability information is arguably declining rather than improving, as concerns about greenwashing (a process, when organization spends more resources on marketing itself as environmentally friendly than on actually minimizing its impact) and green-wishing (belief that voluntary sustainability efforts are closer to achieving the necessary change than they really are) increase. For example:

- Individual retail investors are concerned about whether the money they are channeling toward sustainable-labeled investment products is actually going to the companies they imagined to be part of the sustainability solution, and if so, how these companies demonstrate that they are achieving it.

- There is also a disconnect between investors and corporates on the sustainability reporting that companies disclose, and whether it is central to how investors make decisions and the efficient running of capital markets.

These sustainability data and reporting challenges could undermine the main hope for accelerated action on issues such as decarbonization – the mass mobilization of private capital in support of sustainable business practices.

To examine this critical topic, EY has conducted a thorough sustainability and reporting research that draws on the contrasting views of both companies and investors. And, as EY outlined in the 2022 EY Global Corporate Reporting and Institutional Investor Survey: How can reporting bridge the ESG trust gap? The research shows that investors and companies do not always see eye to eye on the strategy for long-term, sustainable value or whether today’s reporting offers enough insight into that strategy:

- 78% of investors surveyed think companies should make investments that address sustainability issues relevant to their business, even if it reduces profits in the short term, but only 55% of the company finance leaders that were surveyed are prepared to take that stance.

- 80% of investors surveyed say that too many companies fail to properly articulate the rationale for long-term investments in sustainability, which can make it difficult for them to evaluate the investment.

So how can companies and investors arrive at a better understanding of each other’s positions and translate targets into concrete action? The EY Global Institutional Investor Survey research – which focuses on the views of 320 senior investors at major buy-side institutions around the world who participated in the wider survey program – shows that there are three priorities for companies and those leading corporate reporting within their organizations:

- Unlocking action and creating more financial value by focusing on what is material and what really matters

- Putting in place the governance and accountability frameworks to drive results

- Taking a more ambitious, less incremental approach to sustainability outcomes, reporting and data assurance

In all, 320 respondents were surveyed from major buy-side institutions around the world. Over a quarter (27%) were chief investment officers, and respondents were drawn from 23 countries across the Americas, Europe, and Asia-Pacific. There was representation across different segments – banking and capital markets, insurance, and wealth and asset management – and one in five (20%) have assets under management of US$50b or more.

Chapter #1 – Unlock Action and Value by Focusing on What Really Matters

Reporting should provide sophisticated insights into material risks and also into value opportunity

Investors want companies to focus on the material sustainability risks and opportunities that drive long-term value, from the opportunity offered by renewables to the importance of business ethics to minimizing reputation risk. A relentless focus on what actually matters can unlock action and create more financial value.

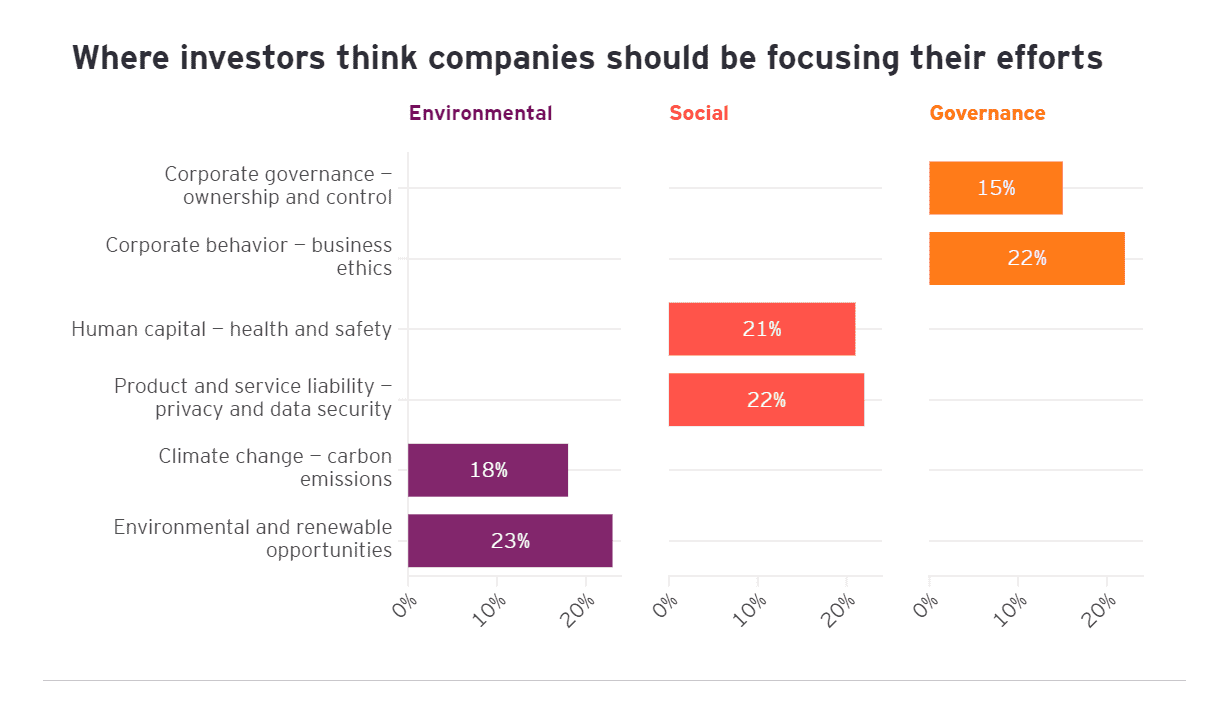

When the research asked investors where they thought companies should be focusing their efforts on when it comes to the three pillars of environmental, social and governance (ESG), the top two under each pillar were as follows:

This chart shows the percentage of where investors think companies should be focusing their efforts in terms of Environmental, Social and Governance pillars.

Environmental and renewable opportunities (23%), Climate change carbon emissions (18%), Product and service liability privacy and data security (22%), Human capital health and safety (21%), Corporate behavior business ethics (22%) and corporate governance ownership and control (15%)

Of course, focusing on what matters to investors can be challenging: those leading reporting in corporates have to interpret what it is that investors think as critical, and then build that understanding into their processes for measurement and reporting. If companies receive numerous questionnaires from investors on different ESG topics, it can be difficult to ascertain what is really critical among the varying information requests.

Investors do say they expect reporting to embrace a multi-stakeholder model where companies demonstrate the impact of decisions on different groups, from customers to communities. In the research, 82% of investors surveyed said that “as well as reporting on ESG issues that are material to investors and analysts, organizations need to do more to engage multiple stakeholders, such as governments, consumers, employees and local communities.” However, only 55% of the finance leaders surveyed felt that companies need to do more to engage other stakeholders.

Given that stakeholder groups – such as employees – could be looking for greater ambition from companies in terms of their targets and time frames for action on sustainability issues, this could leave some companies underestimating the strength of feeling in some stakeholder groups and being seen as part of the problem rather than part of the solution. In particular, the research shows a significant appetite for companies to decarbonize faster. Virtually all investors surveyed (99%) have either already aligned their portfolio to net-zero or plan to do so over the next two years.

Today, there is a disconnect between this significant investor focus on net zero and the progress being made. The world needs a 45% reduction in carbon emissions by 2030 to achieve the Paris Agreement goal of limiting global warming to 1.5 degrees Celsius, compared with pre-industrial levels.1 But with that date fast approaching, the recent EY Sustainable Value Study found that only 35% of companies have committed to cut emissions on or before that deadline.

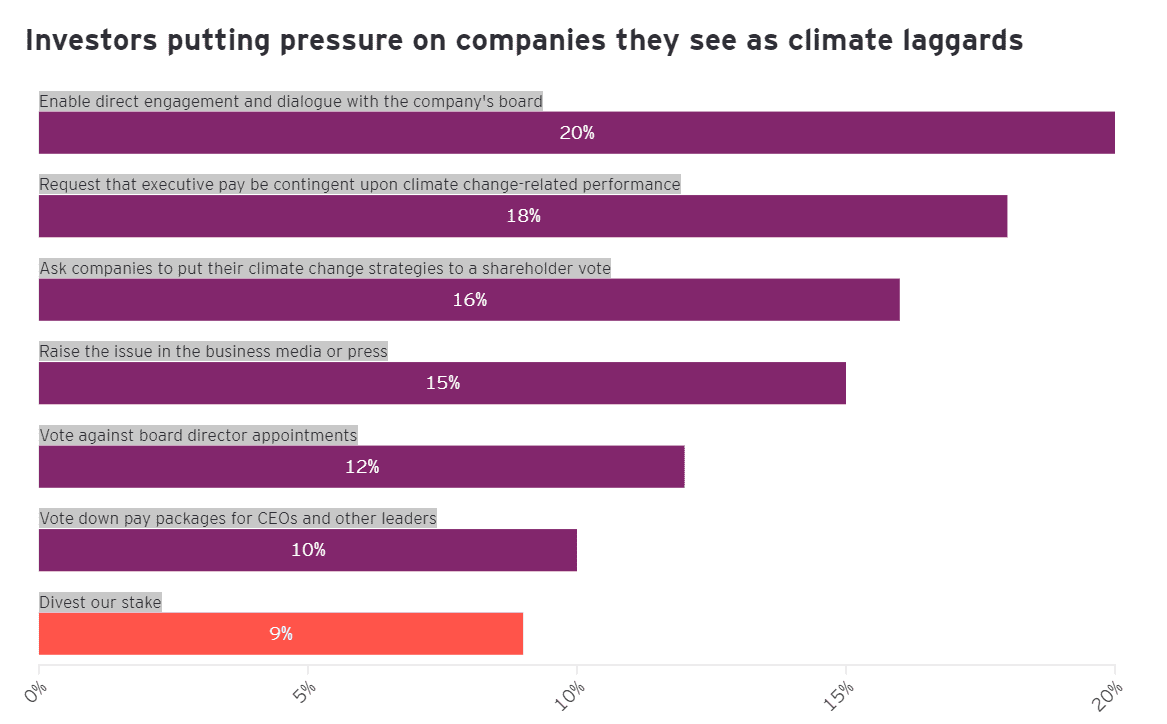

Investors are stepping up the pressure on companies who are seen to ignore the climate crisis or are moving too slowly. The research shows that investors will primarily use engagement tactics: initiating dialogue or asking for a greater focus on linking sustainability factors into executive remuneration. Around one in 10 (9%) said that divestment would be the most important step they would take.

This bar chart shows where investors are putting pressure on companies they see as climate laggards.

Direct engagement and dialogue with the company’s board (20%), Executive pay contingent upon climate change-related performance (18%), Climate change strategies put to a shareholder vote (16%), Raising the issue in business media or press (15%), Vote against board director appointments (12%), Vote down pay packages for CEOs and other leaders (10%) and Divest stake (9%)

This appetite for action puts a significant onus on the effectiveness of company climate disclosures. However, the EY 2022 Global Climate Risk Barometer, a comprehensive analysis of disclosures made by more than 1,500 companies across 47 countries, found that while more companies are reporting on climate risk, they are not always providing meaningful commentary about the challenges they face. For example, more than half of the companies surveyed (51%) are still either not conducting scenario analysis, or not disclosing the results.

Investors recognize that the move to net zero in their portfolios does not negate the need for transition finance. Only investing in green assets may not deliver the progress needed on emissions reductions – finance also needs to flow to the “brown,” high-emissions industries, such as power, where capital is needed to expand and scale new technologies. However, investors also recognize the difficult trade-offs required in driving net zero in their portfolio while providing capital for the transition from “brown to green.” As investors look to achieve the ultimate goal of net zero in their portfolio, 84% investors surveyed say it will be challenging to invest in companies that require capital to transition, like energy and power companies.

This lack of insight into challenges is perhaps reinforcing skepticism about companies’ sustainability reporting – both its credibility and also whether there is a true commitment to transparency:

- 76% of investors surveyed say “companies are highly selective in what information they provide to investors, raising concerns about greenwashing.”

- 88% surveyed say “unless there is a regulatory requirement to do so, most companies provide us with only limited decision-useful ESG disclosures.”

Value-Led Sustainability Takes Center Stage as Investors Seek Insight into the Climate Opportunity

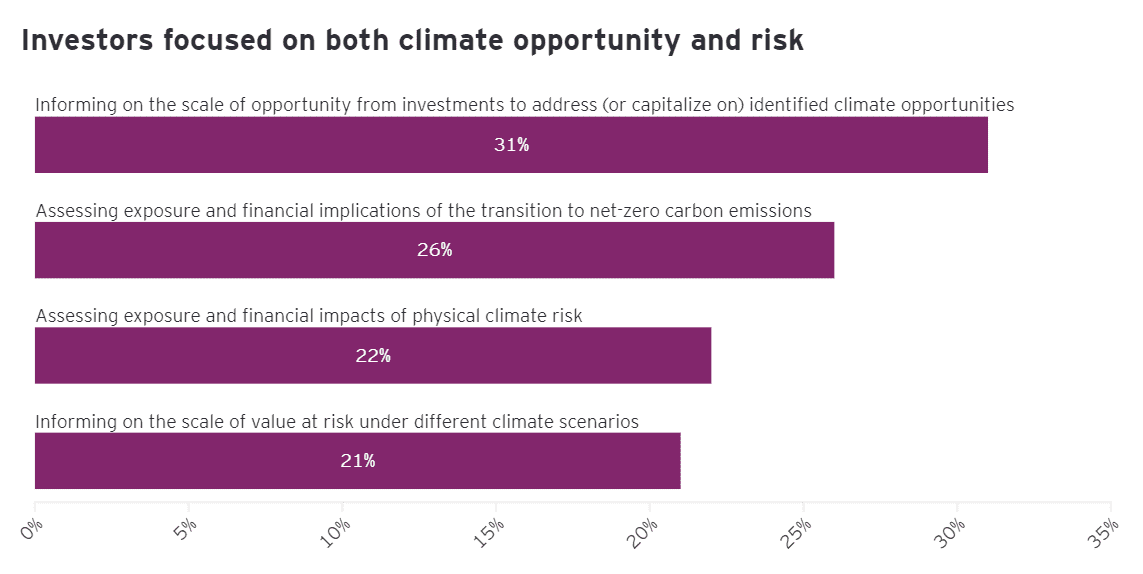

Given the urgency of addressing climate challenges, there is a concern that not enough attention is given to the opportunities to also create value. However, the research shows that investors are anxious that there be at least a balanced assessment of opportunity and risk. While many are most concerned that companies focus first and foremost on transition risk or physical risk, close to a third (31%) are prepared to say that the key issue for them is understanding how companies are targeting the opportunity offered by climate action.

This bar chart shows where Investors are focused on both climate opportunity and risk.

Informing on the scale of opportunity from investments to address identified climate opportunities (31%), Assessing exposure and financial implications of the transition to net zero carbon emissions (26%), Assessing exposure and financial impacts of physical climate risk (22%) and Informing on the scale of value at risk under different climate scenarios (21%).

This perhaps reflects that investors are, at the end of the day, focused on returns, and this therefore requires that companies improve how they link sustainability risks and opportunities to financial returns, such as earnings growth. The EY Sustainable Value Study found that comprehensive transformational approaches to sustainability return more value — financial, customer, employee, societal and planetary — than companies anticipate.

Understanding and communicating this link will require that executives have the right knowledge and expertise. For finance leaders, this will be greater sustainability literacy. For sustainability leaders in the business, this will equally be about building their financial literacy. Overall, in corporates today, there needs to be greater expertise and understanding on the link between sustainability priorities and financial value. Traditional economic models and expertise may not fulfil that role on their own.

Chapter 2 – Creating Governance and Accountability Frameworks to Drive Results

Investors seeking robust governance and board oversight around sustainability strategy and results.

Investors recognize that robust corporate governance – including a central and clearly defined role for boards – is critical if companies are to move from purpose statements to truly embed sustainability into their strategies and decision-making. There are three priorities when it comes to embedding sustainability into governance systems: effective board oversight, sustainability metrics and executive compensation, and strategic alignment.

Effective Board Oversight:

While governance models and the role and responsibilities of boards of directors will vary by global region, boards should play a critical role in sustainability:

- Challenging management on its sustainability plans

- Overseeing execution and progress against pledges

- Engaging with investors about sustainability plans and progress

But for this to happen, companies will likely require that their board members have sufficient sustainability knowledge to fulfil that role. While there are senior leaders who combine both deep sustainability knowledge and the ability to operate at a board level, supply does not match demand. Until supply increases, board members – as a starting point – will need the knowledge required to analyze how the planet and society are changing, and what that means for the business. When the research asked investors to nominate the one area that would have the greatest positive impact on oversight, over one in five respondents (21%) selected “improving board knowledge and skills in ESG issues through exposure to external expertise and training.”

Strengthening Accountability by Introducing Non-Financial, Sustainability Metrics into the Compensation of Senior Executives:

When the research asked investors to specify the two main advantages of basing a significant element of executive pay against the achievement of sustainability goals, over a third of investors surveyed (37%) said that it is “ensuring that ESG issues are embedded into strategic decision-making”. This reinforces how important it is for investors that sustainability be considered not only as a peripheral issue, but also essentially be given the same importance that leaders usually place on traditional financial and capital allocation decisions.

It is, of course, challenging to design a scheme that will deliver accountability. It can be challenging, for example, to align short-term annual pay and bonus with sustainability goals that often have five- to 10-year targets. It is also no easy task to identify quantifiable metrics and then measure achievement against them. However, as this survey shows, a strong understanding of investors’ expectations when it comes to sustainability in compensation is a good start.

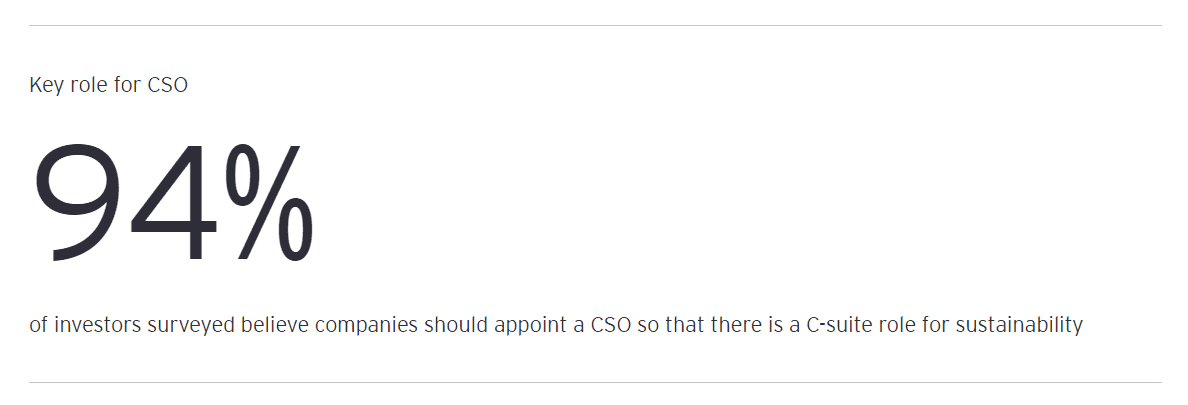

Clarifying the Involvement and Role of a Chief Sustainability Officer (CSO) to Elevate the Strategic Importance of Sustainability:

How companies organize themselves for sustainability will vary depending on a range of factors, from how complex their organization is to its level of sustainability ambition. However, the research shows that investors see CSOs as a crucial element of governance frameworks, perhaps reflecting some concern in the industry that current structures are not delivering.

Understanding why investors think CSOs are a good idea can perhaps shape what role and remit companies decide on. When the research asked investors to say what they saw as the main advantage of having this role, over a quarter (26%) said that a CSO can provide “a strategic view of the long-term ESG risks and opportunities that could impact the company’s business model.” In other words, investors first and foremost want to see sustainability treated as a material business issue. This perhaps reflects that investors are still concerned that there are too many organizations who see sustainability as a peripheral “activity” that has evolved out of corporate social responsibility, rather than a strategic priority.

Chapter 3 – Ambitious Approach to Sustainability Reporting and Data Assurance

Anticipate global reporting standards and drive effective assurance of sustainability disclosures

As the EY organization outlined in How can reporting bridge the ESG trust gap?, a company’s sustainability disclosures are one of the important insights that investors use to understand the impact of sustainability issues on a business’s performance, risks and long-term growth prospects. Today, 99% of investors surveyed utilize companies’ ESG disclosures as a part of their investment decision-making, including 74% who use a rigorous and structured approach (this 74% is a significant uptick on the minority — 32% – who were using a structured approach in the EY 2018 investor survey).

However, as that research has also shown, many investors do not feel their disclosure requirements are being met, with 73% saying that “organizations have largely failed to create more enhanced reporting, encompassing both financial and ESG disclosures, which is critical in our decision-making”. There are two priorities when it comes to addressing this disconnect:

- Getting ahead of emerging global reporting standards — avoiding incremental improvements to reporting and seeking to build a class-leading position

- Tackling the unique success factors involved in effective assurance of sustainability disclosures

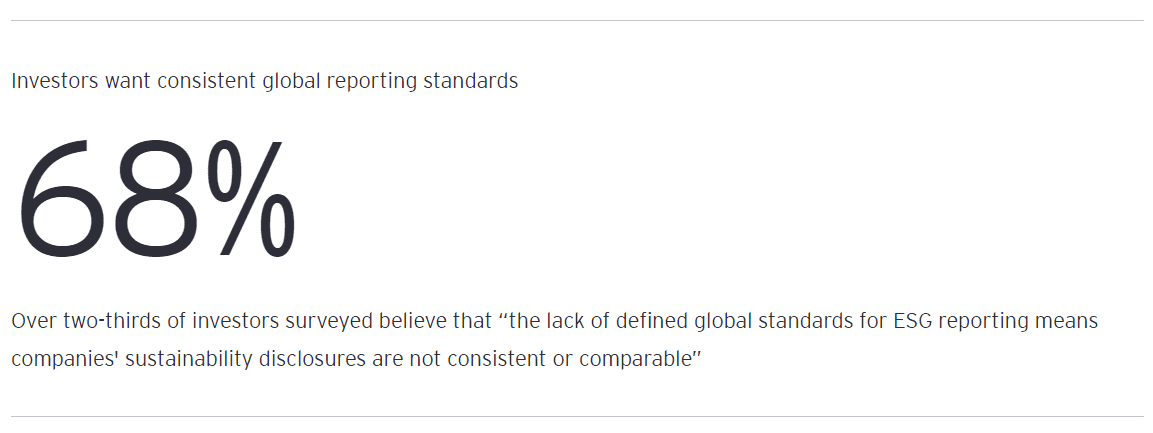

Getting ahead of emerging global reporting standards to seize an advantage and avoid incrementalism.

Investors are clear about the importance of globally consistent standards to improving the quality and transparency of corporates’ ESG reporting.

Today, there is encouraging progress in addressing that issue. Following the formation of the International Sustainability Standards Boards (ISSB) at COP26, the ISSB issued its first two exposure drafts (EDs) for comment on 31 March 2022: one on general disclosure requirements and a thematic ED on climate-related disclosure requirements. Subsequently, at COP27, the ISSB announced a range of initiatives to help jurisdictions prepare for implementation and its aim to issue final standards “as early as possible in 2023.”2

Timing of any adoption will likely depend on local jurisdictions, but it could be risky to wait for a full and complete “ruling.” Some companies — including competitors — could adopt the standards as early as possible on a voluntary basis. This will allow first movers to take an early lead on the industry’s sustainability narrative.

Getting ahead of the curve, and tackling some of the inevitable challenges involved, will also likely create improvements that investors and other stakeholders will welcome. A bold and forward-looking approach is likely to avoid the danger of incrementalism — where companies only look to emulate the reporting of their peers and therefore do not get ahead of the “pack.” With bodies such as the EU implementing mandatory sustainability reporting under its Corporate Sustainability Reporting Directive, as part of its wider European Green Deal initiative, best-in-class sustainability reporting will be key to seizing the opportunities of government investment in key economies of the world, including the US and Europe.

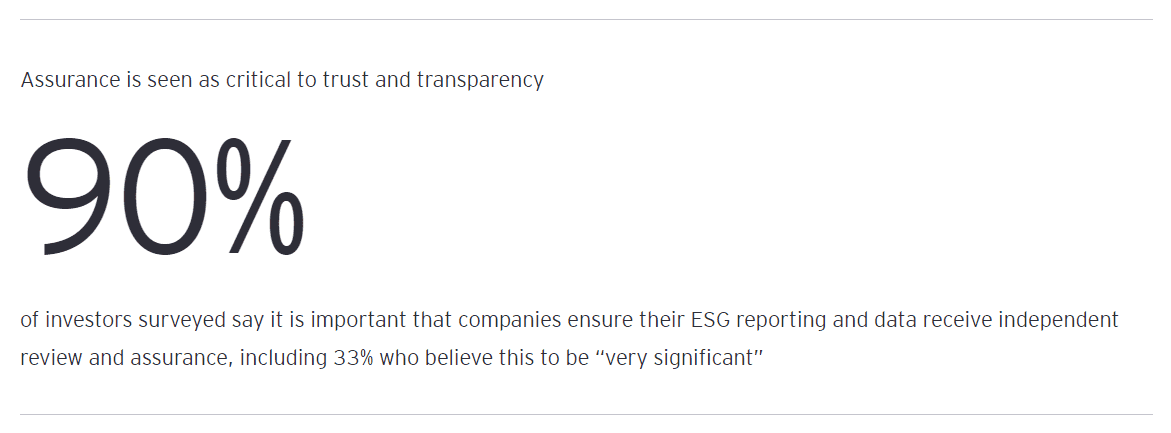

Tackling the Unique Success Factors Involved in Assurance of Sustainability Disclosures

The need for issuers to seek third-party assurance of their ESG disclosures is also gaining momentum fast. The investor community is very clear that it considers assurance to be a best practice when it comes to their confidence in the credibility of ESG reporting:

While companies do seek assurance even when it is not mandated, more and more regulators are giving it their attention. Assurance is already mandatory in some markets and, in the US, the SEC’s proposals for climate-related disclosures include an initial requirement for “limited assurance” of Scope 1 and 2 emissions and a subsequent movement to “reasonable assurance.”

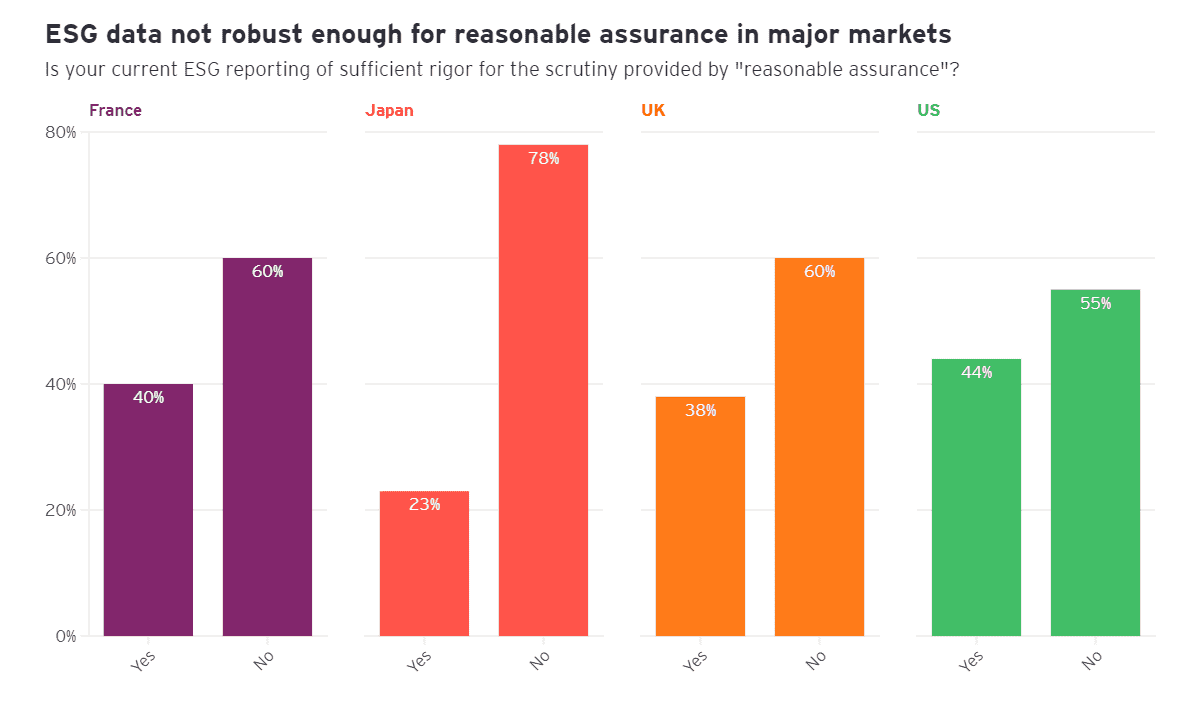

This development raises the question of whether companies believe their current data is of sufficient rigor to pass the scrutiny of assurance. As the EY organization outlined in How can reporting bridge the ESG trust gap?, when finance leaders were asked whether their current ESG data would pass the scrutiny offered by reasonable assurance, 41% said it would not. And, there are a number of countries across the Americas, Europe and Asia-Pacific where those finance leaders saying “no” are in the majority:

This bar chart shows how ESG data is not robust enough for reasonable assurance in major markets, in response to the question “Is your current ESG reporting of sufficient rigor for the scrutiny provided by ‘reasonable assurance?'”

France (Yes is 40% and No is 60%), Japan (Yes is 23% and No is 78%), UK (Yes is 38% and No is 60%), US (Yes is 44% and No is 55%)

Advanced technologies, including AI, could be crucial to addressing that shortfall and building the quality of sustainability data. They can be used to orchestrate the very complicated and federated work to secure the data, as well as to analyze it and spot anomalies and risks.

Making considered and intelligent choices about the remit and role of finance and internal audit teams will also be critical. Financial controllers bring significant firsthand experience of financial statement assurance and data quality issues that can be used to design the framework for nonfinancial assurance and how the “lines of defense” work. However, this will take careful design given the nature of the data. Take lines of defense to test greenhouse gas emissions data as an example. While a finance person can check if it has been properly calculated, it may take a specialist within the business, such as an engineer, to properly scrutinize the data. Defining who sits in lines of defense is just one of the issues that needs to be resolved.

Chapter 4 – The Way Forward

Research shows these four key principles would be crucial for companies with long-term ESG focus.

Having a more nuanced understanding of investors’ needs is useful beyond the requirement to have a healthy relationship with capital markets — it can also stretch your thinking and provide a framework for how companies can earn the trust of all their stakeholders, from customers to employees. Based on the research, there are four priorities for companies that want to be seen as long-term focused, trusted and attuned to society’s expectations:

- Reassess net zero and broader sustainability strategies, using sophisticated scenario analysis to stress-test assumptions, and build a complete understanding of the financial risks and opportunities that climate change, impacts on nature and social issues present to the business. Strike a balance between risk and opportunity analysis, understanding where action can deliver financial value, from better employee retention and less churn to driving customer purchasing decisions.

- Ensure boards have the structures, reporting insight and knowledge needed to fulfil their sustainability role — challenging management on its level of ambition, monitoring progress against targets, and liaising with investors and other stakeholders. While board structures and processes will also need to change, the focus should also be on how board members think — putting in place learning and development initiatives so that board members can push for innovation, question assumptions and biases, and steer through the complexity of a fast-changing sustainability landscape.

- See the design and implementation of the ISSB’s new sustainability reporting standards and other likely EU and SEC standards as an opportunity to be a first mover with your reporting — get ahead of the emerging standards rather than wait for the final picture to emerge and aim beyond incremental improvements to set yourself the goal of being a class-leader in sustainability reporting.

- Prepare for more widespread sustainability reporting assurance. This fast-developing area raises significant issues for management teams, who will need to prepare the organization as a whole for assurance. Organizations are likely to need to develop new processes, controls and data streams. New accountability models and an assurance framework — including lines of defense — will need to be developed. This is expected to be a significant and fast-paced learning curve for many.

- “For a livable climate: Net-zero commitments must be backed by credible action”, United Nations: Climate Action, accessed 19 April 2023. https://www.un.org/en/climatechange/net-zero-coalition

- “ISSB at COP27: ISSB makes key announcements towards the implementation of climate-related disclosure standards in 2023”, IFRS, 8 November 2022. https://www.ifrs.org/news-and-events/news/2022/11/issb-cop27-progress-implementation-climate-related-disclosure-standards-in-2023/

Summary

Public commitments to sustainability are common. While this is necessary and laudable, the slow progress on a range of matters, from the greening of the economy to improved leadership on diversity, is turning the spotlight on progress as much as promises. By getting companies and investors on the same sustainability page, there is a better chance of achieving results at the scale and speed that our planet and society require.

5.0

5.0