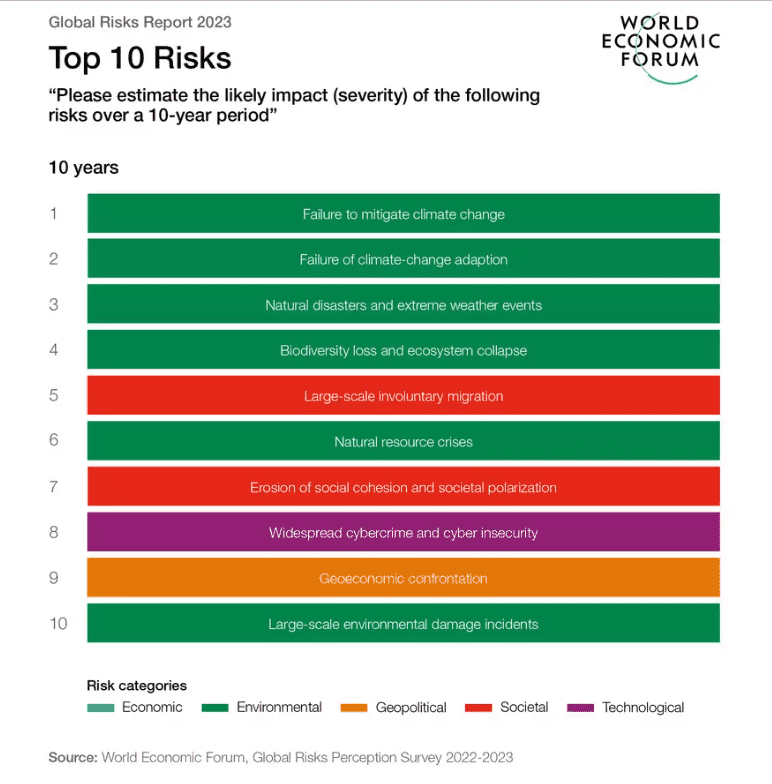

- In 2022, the world confronted highly connected, complex and dynamic political, economic and societal risks, as highlighted in the 2023 Global Risks Report.

- Business organizations were forced to examine their offering towards an effective net-zero transition while managing risks and building resilience in the face of ongoing economic shocks.

- With those twin pressures in mind, we asked business leaders what actions they are taking for a sustainability strategy that also foregrounds resilience.

In 2022, the world confronted highly connected, complex and dynamic political, economic and societal risks, as highlighted in the 2023 Global Risks Report. The resulting disruptions to food, energy, cyber, supply chain, financial and global security has shown how quickly unexpected shocks can imperil the race to achieve net zero emissions by 2050.

It presents a challenge that governments, businesses, and the public must face together: how to navigate geopolitically challenging conditions to achieve unprecedented systemic transformation that will decarbonize the world economy.

Business organizations are being called to examine their products, value chains and processes to put in place this net-zero transition while managing risks and building resilience in the face of ongoing economic shocks.

With those twin pressures in mind, we asked business leaders about the short and long-term actions they were taking on those fronts, and what their critical parameters were for a sustainability strategy that also foregrounded resilience.

“To embed net-zero principles into business strategy, companies need to start with their board first”

Bonnie Y Chan, HKEX Head of Listing

We believe that sustainability and resilient businesses go hand in hand because having ESG and net-zero principles integrated into business strategy only makes a company more agile and better prepared to deal with sudden change – whether that’s a broken supply chain, rising geopolitical tensions or the ongoing pandemic-related challenges. To embed net-zero principles into business strategy, companies need to start with their board first, as change is most effective when it comes from the top.

This means that board members need to champion a culture of good ESG management and adopt an “ESG mindset” when setting the strategic direction for their business. With the right mindset and investment tools in place, companies can then build an effective internal governance and implementation framework – covering areas such as risk management, measurement and reporting – to implement their climate strategy across the organisation.

With the right mindset and investment tools in place, companies can build an effective internal governance and implementation framework to implement their climate strategy.

Bonnie Y Chan, HKEX Head of Listing

At HKEX, we see ourselves as a change agent in Asia’s sustainability transition. As a regulator, market operator and listed company, we drive the sustainability agenda through listing regulation, advocacy and education to encourage cultural change within organisations. For example, we provide our markets with a clear framework and guidance through our Corporate Governance Code and ESG guide.

We also facilitate the creation of a vibrant sustainable finance ecosystem – through partnerships, products and people – to fund the transition to a more sustainable, low-carbon future. In October 2022, we launched a new carbon marketplace – Core Climate – connecting capital with climate-related products and opportunities in Hong Kong and beyond.

“As the climate changes or geopolitical tensions rise, deeper insights on managing them will make operations more resilient”

Amy Barnes, Head of Sustainability and Climate Change Strategy, Marsh

COVID-19. The war in Ukraine. Climate-driven increases in flooding, drought, and fire. Recent severe events highlight the fragility of corporate ecosystems.

Businesses that understand and manage complex risks can protect their bottom lines and stakeholders while transitioning to a more resilient model.

Identifying the parameters for resilience requires executives to consider risks of disruption beyond the boundaries of their own plants and assets. Corporate ecosystems extend to key suppliers and their suppliers, to the raw materials and infrastructure business continuity depends on – whether storage, shipping, logistics, packaging, power grids or fuels.

Businesses that understand and manage complex risks can protect their bottom lines and stakeholders while transitioning to a more resilient model.

Amy Barnes, Head of Sustainability and Climate Change Strategy, Marsh

Each business relationship creates a vulnerability and a need to understand how fragile it may make an enterprise. As the climate changes or geopolitical tensions rise, deeper insights about these exposures and how to manage them will make operations more resilient.

Marsh McLennan is building a unique platform to reveal vulnerabilities. Through a sophisticated combination of supply chain mapping, data imaging and climate science, combined with state-of-the-art risk modelling, we can help clients quantify the impact of specific risks in terms of downtime and financial loss. Armed with this, executives can take control of their risks and shape a sustainable and resilient strategy.

Risk resilience at the executive, board and risk manager levels emphasizes proactively making better risk-based decisions, rather than reacting to crises or events.

According to the 2023 Global Risks Report, organizations should focus their resilience efforts on expediting green energy, climate and nature investments; improving employee health and well-being; and strengthening cyber resilience.

For the green energy transition and adaptive risk mitigation strategies, in particular, expediting investments is essential for long-term climate resilience.

Despite increasing global investment in clean energy – expected to exceed $1.4 trillion by the end of 2022 – barriers remain to the transition to a net-zero economy. However, new approaches to risk modelling, assessment and allocation could help businesses, governments, and financial markets overcome these barriers and hasten the transition.

These approaches may be applied to newer energy security and sustainability projects that take advantage of green incentives intended to stimulate economies.

The article was first published here.

Photo by lahiru iddamalgoda on Unsplash.

5.0

5.0