Toward a “new and improved” understanding of corporate innovation programs

Hype surrounding innovation often obscures the focused, multifaceted efforts that make breakthroughs possible. We look beyond press releases and buzzwords to understand what drives the successful corporate innovation programs that are recreating the enterprise.

Introduction

Innovation has an image problem. The “i-word” is invoked so often, and by so many, that it has come to mean at once everything, and as a result, nothing at all.

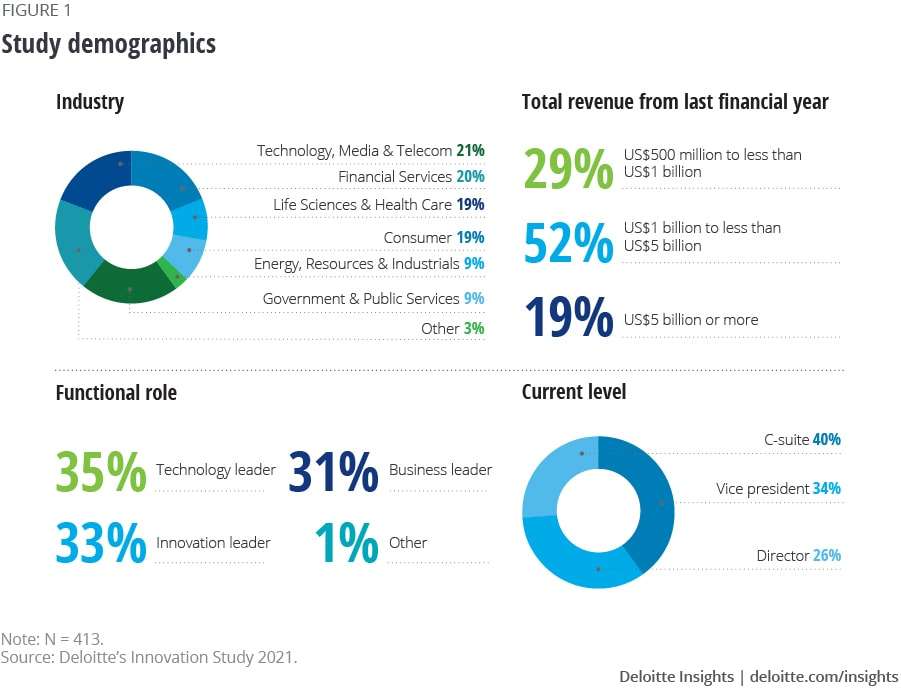

Yet, with Deloitte’s inaugural Innovation Study, we hope to clarify what this business-critical concept means to business and technology leaders working in the trenches today. To this end, Deloitte surveyed and interviewed more than 400 business, technology, and innovation leaders across six industries in the United States (figure 1) on the topic of innovation, and how they are moving beyond the buzzword toward a new and improved understanding of the state of corporate innovation programs. There are many studies out today that examine innovation through the lens of catchy models and philosophies. We take a different approach. We look under the hood to understand the investments, structure, operations, and performance of innovation programs and identify what leading companies are doing differently.

While our data reveals a gamut of strategies, operating models, and metrics, our findings are not simply a story of heterogeneity and divergence. True, today’s innovation initiatives come in myriad shapes and sizes, each with their own quirks and cultural curiosities. However winning innovation programs—those that drive their organizations’ broader success—converge on several key features that, importantly, can be learned and emulated.

About the study

Deloitte’s Innovation Study surveyed senior leaders from the fields of innovation, technology, and business functions. Participating organizations represent a broad array of industries, sizes, and business models. By digging deep into companies that reported high growth and leading innovation capabilities, we were able to unearth key insights into how corporate innovation succeeds today.

From Divergent Definitions to Common Core

For starters, it’s useful to deconstruct the i-word. When asked to define what innovation means in their organizational context, many survey respondents offered lengthy articulations. Multisentence (and even some multiparagraph) answers were common. For example, Jen Hartsock, CIO of Baker Hughes, speaks of two different types of innovation—one with a capital “I”, which is highly methodical, often sponsored by the organization using formal business practices, and one with a little “i”, which is something that anyone can do by finding places they can contribute to drive change and process improvements.

Others emphasized bespoke, sector-specific milestones and metrics (e.g., “cost-neutral reductions in trade-settlement times”). In looking across the range of responses, however, two clear characteristics persist: A successful innovation must be both new and improved. While this reductionist definition, reminiscent of a sticker on a bottle of laundry detergent, is simple, it’s by no means simplistic.

New (but not necessarily new-to-world)

Many people mistakenly believe that innovations need to be jaw-dropping, new-to-world epiphanies. One innovation leader cautioned, however, that “there’s such a thing as too much novelty.” Truly new-to-world discoveries and inventions are typically the province of traditional R&D organizations, which are in turn, often capital-intensive cost centers. “We had to understand that innovation is not creating the next Post-it®—it’s incremental changes,” says Sathish Muthukrishnan, chief information, data, and digital officer at Ally Financial.

Indeed, our study reveals that new mixes or applications of known winners is a more common recipe for innovation success. Today’s innovators see themselves less as researchers and inventors, and more as composers, orchestrators, and cross-pollinators. “A lot of our innovation comes from experimentation with the new (customers, use cases, or technology) and the old (rewriting what we have done earlier),” Muthukrishnan adds.

Improved (as measured financially)

The second critical component to an innovation is its ability to deliver measurable improvement over a legacy alternative. “Oftentimes what’s categorized as innovation can more accurately be described as a new source of profitable growth,” says Renato Mazziero, vice president of Experience and Innovation at Thrivent. Or as another interviewee states, “People generally overweight the novelty standard and underweight the improvement standard. This is a mistake.”

While some value propositions (health care outcomes, or citizen engagement, for example) don’t immediately lend themselves to financial measures, the cost for equivalent outcomes, as measured in money, can be assessed. As one innovation leader notes, “We pivoted to a stronger grounding in strategic priorities and focus areas, as opposed to greenfield exploration of the world, so we could make a difference for the bottom line.”

The takeaway here is that inventors turn cash into new ideas, but innovators turn new ideas into cash. Innovations are ultimately measured by their financial contributions, not their patents or design awards. Or, as Steve Jobs said, “Real artists ship.”1

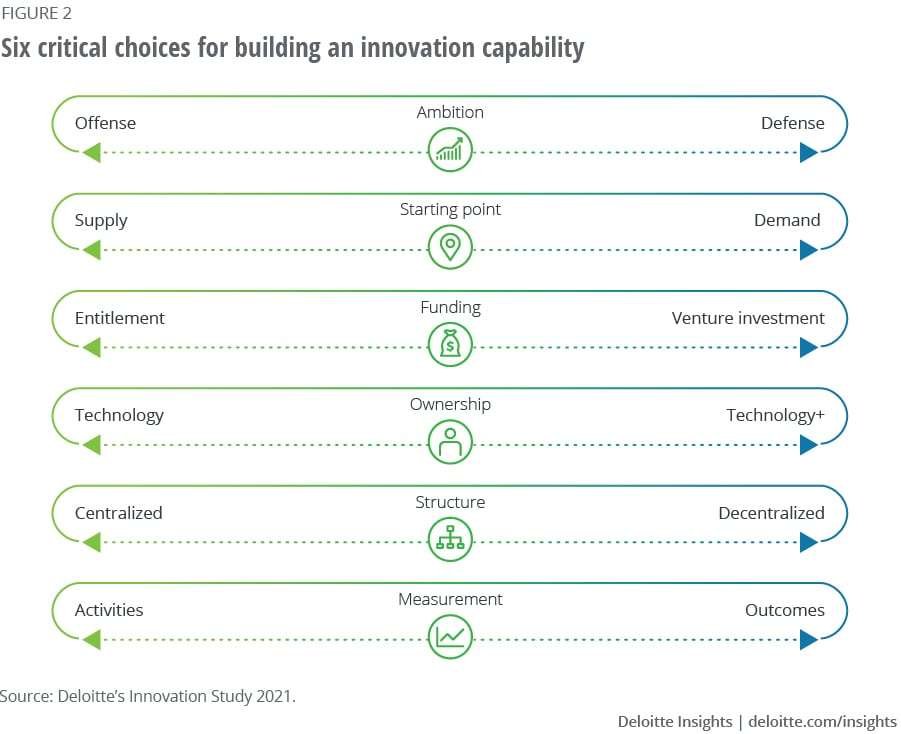

Innovation’s Great Debates

While “innovation management” is no longer the oxymoron it was 30 years ago, or even the “Wild West” of the last 15, our study reveals that there are still several critical choices facing organizations as they optimize their innovation program mechanics. Few lend themselves to elementary right-or-wrong answers, as business context may find one’s “no-brainer” to be another’s nonstarter. That said, our study reveals that leading innovators often prefer one choice over the other.

As for the term “leading innovators,” the study considers two dimensions/descriptions of leadership in innovation: growth and maturity. Specifically, this includes those (for-profit) companies that grew their revenues more than 20% in the last year (10% of respondents) and those organizations that self-report as having leading innovation capabilities (8% of respondents).

Ambition: Defense or offense?

At the heart of every innovation program lies the question “why?” Different organizations innovate for their own reasons, but most rationales ladder up to two postures: defense or offense.

Defensive postures focus on protecting the legacy organization. They typically embody a historical, conservative, and competitive worldview. Defensive reasons to innovate include, among others, delivering cost savings and efficiencies, and avoiding being disrupted by traditional or up-start competitors.

Offensive postures focus on transforming the organization. They typically take a forward-looking, pioneering, and creative worldview. Offensive reasons to innovate include the need to deliver differentiated growth and financial performance, or the desire to change an organization’s culture and brand.

Our study reveals that the single most common reason organizations embark on innovation (27%) is to deliver cost advantage or efficiencies—a primarily defensive posture. While this may be true for an average company, we find that high-growth companies (those that grew 20% or more in the last year) primarily pursued innovation to enhance financial performance, which is a time-tested offensive posture.

Our takeaway: Successful innovation models typically feature programs that focus on financial growth from the outset.

High performers play to win, as opposed to playing not to lose. Even innovators cannot shrink their way to long-term success.

Moreover, our study reveals that perspectives may change based on whom you ask within the organization. For example, tech leaders were more likely to say that their innovation ambitions are cost and efficiency driven, whereas business leaders said theirs are financial performance driven.

Starting point: Supply or demand?

For years, innovation practitioners have worked to disabuse civilian colleagues of the notion that impactful innovations must start with eureka moments. Our data bears this out, with the smallest percentage of leaders (15%) indicating that brainstorming new ideas is their starting point. Many programs (40% of respondents) instead kick off their process by looking internally for opportunities to optimize existing business operations. Another 25% do so by sensing and scanning the marketplace for new technologies and ideas.

Interestingly, higher-growth companies seem to spend less time looking inward. They are more apt to “lead with need,” prioritizing uncovering customer and stakeholder issues more than the broader set (23% vs. 18% of all respondents). They also lead less with process optimization (33% vs. 40%), and more with tech and market sensing (30% vs. 25%).

Our interpretation is that demand-driven models in which efforts are marshalled in response to identified customer and market opportunities, often correlate with success; supply-side innovation, that is, models rooted in blue-sky ideation and/or internal incrementalism, less so.

Funding: Entitlement or venture investment?

Our survey shows a variety of viable funding models for innovation programs, ranging from traditional top-down R&D allocations as a percentage of revenue to bottom-up, ad-hoc or project-based requests. Further interviews revealed that initiatives’ relative scope and impact may have implications for how innovation gets funded.

“Beneath a certain threshold, we can start with what’s best for the customer, but for larger investments, we need executive approval,” says one interviewee. In high-performing companies, innovation budgets are almost twice as likely to be funded by the business unit, as opposed to having a protected, recurring corporate budget. Furthermore, organizations with a self-described leading innovation capability are almost twice as likely to have iterative innovation budgets that are project based.

Consider this: When innovation budgets become a reliable appropriation, there can be lack of urgency for both efficiency and effectiveness. On the other hand, high-performance innovation outcomes often stem from iterative, product-centric funding and agile, meritocratic approval structures. In a venture funding mentality, incremental series funding is unlocked pending the achievement of clear, metrics-driven milestones. Further implied in this approach is the recognition among leaders that such venture funding isn’t a reward for achievements to date, but fuel for what teams intend to accomplish next. “Identify short-term pockets of value creation that allow you to fund growth and your team, instead of asking for lump-sums of money you can’t put to use,” says Mazziero.

Ownership: Technology or technology+?

For many leaders, especially technology leaders, innovation is fast becoming a part of their formal responsibility set, whether they are ready or not. Overall, 72% of survey respondents said innovation was driven through their technology function, the most common response by a significant margin. The next highest functions—strategy and operations—were cited as drivers by 48% and 43% of respondents, respectively.

Tech leaders’ innovation programs are more likely to feature a jointly owned innovation process between both business and IT (47% of tech leaders vs. 40% of all respondents). Tech leaders also differ slightly in the types of innovations they invest in. For one example, they are more likely to invest in product performance enhancements. It’s likely that technologists’ maker mindset figures into their bias toward “building better mousetraps.”

Some tech leaders also have an increasingly notable focus on innovations pertaining to customer engagement (49% vs. 40%). As every company becomes a technology company, digital transformation initiatives find many tech leaders, especially product technology leaders, closer to enterprise customers than many of their C-suite peers.2

Interestingly, in high-growth organizations, finance departments are more likely to help drive innovation (45% of high-growth organizations vs. 30% of all respondents), dispelling the myth that the finance function only cares about reducing costs. A second noteworthy distinction for high-growth companies: Ownership of innovation is more evenly spread throughout the organization. Respondents with a self-reported leading innovation capability seem to agree: Half of them say their innovation ownership is spread throughout the organization, compared to a third of respondents on average. They are also more likely to have the strategy function help drive innovation.

The signal here is clear: Technology leadership is most frequently a key driver of the car, but the car drives better when product tech leaders inclusively invite copilots along for the ride. What’s more, leading innovation companies are less likely to share the wheel with traditional R&D than average.

Structure: Centralized or decentralized?

Our data suggests a slight tendency for successful innovators to hew toward a centralized innovation structure. However, interviews with study participants also find that the real drivers here are the degree to which the ideation and commercialization of “new and improved” capabilities in one’s sector requires deep (read, full-time PhDs’) expertise. In the energy sector, for example, where innovation frequently connotes complex scientific advances across an array of chemical, physical, and geological science and engineering, it’s perhaps no surprise that there’s a clear preference (51% of energy sector respondents) for centralized structures staffed by world-class experts. Contrast that with Technology, Media & Entertainment, and Telecom (TMT), where a preference for mixed, hybrid structures generally prevails (41%).

Long a mature leader in traditional R&D, the Life Sciences sector has embraced federated models (25%), which suggests that in domains requiring extreme depth of expertise (e.g., drug discovery), the cross-pollination of ideas between centers of excellence is critical. As confirmed by Alex Aravanis, CTO of Illumina: “We found that a decentralized model was unsuccessful because we didn’t have the critical mass to make big fundamental bets.”

There are pros and cons inherent in any operating structure. While technically demanding sectors understandably hew toward centralized innovation structures as a means of focusing scarce intellectual firepower, even they can realize the benefits of intentionally engineering connections between otherwise disconnected silos. “The larger organization has to be ready to catch up to what the innovation team is working on—that requires collaborating with the business,” says Priyanka Pushkarna, director of Emerging Technologies at Verizon.

Measurement: Activities or outcomes?

In our interviews, many innovation leaders revealed that measuring financial outcomes too soon risks massive disappointment, and worse, the premature destruction of morale and even the program itself. As one leader noted, “We have to get wins closer in, to be able to go further out and expand our innovation program.”

This isn’t a license to skip metrics and measures entirely, but rather, a challenge to stay patient and initially start measuring the activities known to correlate with eventual downstream financial returns. Examples include the number of innovation projects initiated, the number of hours spent on innovation initiatives, and the number of projects funded. Our study reveals that organizations with mature innovation programs are much more likely (50% vs. 39% of all respondents) to set targets and actively measure their ability to create and convert ideas into products.

It’s a mistake to measure nascent innovations using the same metrics we apply to fully established lines of business. “Trying to apply the metrics of the core business to innovation doesn’t work: It’s like trying to put a speedometer on a caterpillar or measure a wind turbine in butterfly wings,” says Tom Stat, founder of ELEVEN Consulting Group. The innovation process, even for ultimately lucrative innovations, features more in the way of learning than earning. Only when a given innovation has sufficiently matured, and specifically, when a given innovation has turned the corner toward industrialization, can one start to measure traditional financial outcomes and trajectories. “I prefer to get innovation done quietly and be louder once it’s creating revenue,” says one of our interviewees.

Our conversations revealed that there are nearly as many innovation operating models and program types as there are definitions for innovation. While none of them are necessarily right or wrong, each carries its own pros and cons.

-

Technology R&D

- 101: The time-honored tradition of funding deep specialists to conduct research into new discoveries, and in turn, new inventions. R&D groups are typically technically organized, with experts in science or engineering teaming to make breakthroughs.

- Strengths: Technical breakthroughs, protected by IP or as trade secrets, can be the fuel for quantum leaps and sustainable competitive advantages.

- Watchouts: R&D talent is expensive, and R&D programs are not typically organized to be direct profit centers. Moreover, even when breakthroughs occur, the path to monetization can be uncertain.

-

Centralized innovation team

- 101: With a focus on design thinking, customer-centricity, and iterative prototyping, centralized innovation teams are typically multidisciplinary and diverse. Some do it all, overseeing an innovation from bright idea to full-scale solution. Others take a center of excellence (CoE) approach, staffing a lean team who partner with colleagues across the business. Still others facilitate intrapreneurship or open innovation programs.

- Strengths: Centralized innovation teams, be they dedicated or CoE, can stretch thinking, challenge orthodoxies, and drive an organization to a more profitable tomorrow.

- Watchouts: The ivory tower issue, real or perceived, is an ever-present risk. Rotational models help alleviate this risk at junior levels, but care should be taken to ensure that senior innovation leaders (whose roles are more often permanent) aren’t allowed to become too detached from the core business.

-

Distributed Innovation Teams

- 101: Innovation teams can also live in the trenches, sitting within business units. Vertically dedicated teams are typically leaner than their centralized counterparts, but enjoy a deeper understanding of needs, capabilities, and path to profitability. Likewise, functional, or horizontal, innovation teams (e.g., finance innovation, HR innovation) can avail existing command structures.

- Strengths: Distributed innovation teams are typically value-led and no-nonsense. It’s said that scarcity breeds innovation, and vertical and horizontal budgets are typically lean enough to weed out all but the most promising new concepts.

- Watchouts: As with any distributed strategy, redundancy and siloed thinking are perennial risks. Efforts to “share-out” wins (and lessons learned) are a constant requirement.

-

Ecosystem engagement

- 101: Increasingly, firms are looking externally for innovation inspiration. For some, it’s a matter of setting up outposts in innovation hotspots or forging alliances (with technology companies and/or universities) to increase emerging technology and business model fluency. For others, partnerships with startup accelerators/incubators are a means of seeing the future of a given industry, and investments or acquisitions in individual startups are a means of influencing that future.

- Strengths: By broadening one’s aperture to include “not invented here” capabilities, organizations can substantially accelerate their innovation ambitions.

- Watchouts: Integration complexities. Investments, acquisitions, and alliances that look to be clear and compelling dream teams often turn out to be integration nightmares.

Instead of choosing one, leaders should choose all that apply. Imagine you are working in cutting-edge technology, where a world-class R&D capability may be a given. It need not be your only innovation vector. Other pieces of your business (e.g., marketing, strategy) may benefit from liaising with a centralized innovation team, while still others (e.g., legal, a cash cow product line) might be encouraged to champion their own distributed/departmental efforts.

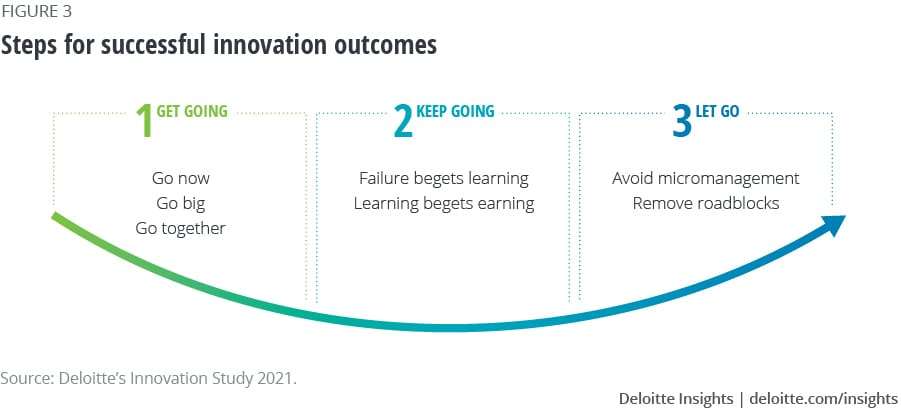

Not up for Debate: Get Going, Keep Going, and Let Go

Debates over innovation program mechanics notwithstanding, our research suggests that there are several “nonnegotiable” constants that correlate with successful innovation outcomes (read: New and improved bottom lines).

Get going

Successful innovation programs are kinetic—that is, they are less focused on theoretical concepts, and more on traction and concrete outcomes.3 They carry a bias toward movement and forward progress. In turn, the data would suggest that those interested in improving their own business outcomes ought to themselves pivot from talk to walk.

Go now

Our survey suggests that the presence of a formal innovation program pays clear dividends. Compared to the average, high-growth companies are twice as likely to have a leading innovation capability. In addition, the age (and, by implication, maturity) of an innovation program further correlates with its demonstrated success. Organizations with a leading innovation maturity were almost twice as likely as the average to have revenue increase by more than 20%. Interviews bear this out. Mazziero notes, “Having a clear strategy is essential. Within our organization, we reverse engineered what we wanted from innovation and focused our energy on delivering quick results, like unveiling a mobile app.”

The interpretation here isn’t exactly rocket science: It’s better to have an innovation program than not, and it’s better to have a mature program than a nascent one. Akin to retirement savings, the best advice is therefore: a) start investing, and b) start yesterday. This recommendation might be more practically revised to: Start investing in your innovation capability today.

Go big

More than 300 years ago, Isaac Newton explained that Force = Mass x Acceleration, pioneering the idea that the force of an impact is a function of not just velocity, but of heft. As it turns out, this equation would appear valid for innovation impacts as well. High-performance innovation programs don’t just get going; they also go big. Tentative efforts—programs piloted with weak organizational commitment, awareness, and support—burn dimly, and briefly. Dedicated innovation leaders with bold mandates, dedicated resources, and hard capital to achieve them, are better equipped to avoid quicksand. As one innovation leader noted, “Many large companies get caught up in churn. Innovation can often be an experiment at best until it’s tested by an event like a recession or a CEO change.”

Business students the world over are familiar with the case study of 3M, whose bold innovation program was so central to its DNA, it developed the “Thirty Percent Rule,” wherein 30% of each division’s revenues must come from products introduced in the last 4 years.4 This is tracked rigorously, and employee bonuses are based on successful achievement of this goal. Such bold mandates put “new and improved” at the center of organizational operating models. Our survey data further bears this out: High-growth companies have a larger portion of their revenue coming from net new products and services.

Endemic to this “go big” theme are biases toward clarity, commitment, and accountability. Our data reveals that clearly defined teams led by clearly defined leaders with clearly defined mandates outperform diffused efforts. In fact, for many high-performers, innovation is not merely “a big deal,” but central to their brand, as they were much more likely to cite brand differentiation as a focus of their innovation agenda (48% of high-performers vs. 33% of average respondents). As Pushkarna, an innovation leader at Verizon, observes, “In today’s world, innovation is nobody’s exclusive business; it’s everybody’s business. For organizations to systemically benefit from innovation, you have to have teams dedicated to it and they should be rewarded for being catalysts of new thinking and connections in a world of silos, not just for ideas they help foster.”

In that vein, those with a leading innovation capability are much more likely to set targets and actively measure their ability to create and convert ideas into products (50% vs. 39% of average respondents).

Go together

Acceleration: check. Mass: check. But are your stakeholders, specifically your C-suite leadership, fully aware, let alone understanding, of the impact you are out to make? Our research demonstrates that organizations with a strong executive-level commitment to, and understanding of, innovation are more likely to report recent revenue growth. Moreover, those with a self-described leading innovation capability are more likely to say their C-suite is completely aligned with their innovation agenda (44% vs. 36% of average respondents).

When innovation teams are cloistered away, and work without alignment and support from the C-suite, their outputs, no matter how compelling, are more easily perceived as something to be passively critiqued.

Because early-stage innovation outputs are definitionally novel (i.e., unusual), and definitionally nascent (i.e., small potatoes relative to established lines of business), critical leaders receiving a pitch are sometimes wont to retreat to a defensive, “organizational antibody” response along the lines of: “This is interesting, but it won’t move the needle.” Or, invoking the classic venture capital line: Come back when you have more traction.”

“We learned that when you work too independently from the business, somebody owns every space we’re touching. There’s a certain human nature in pushing things away that you weren’t involved in from the ground floor,” says one of our interviewees.

By securing executive alignment early, and redoubling those connections often, the C-suite can be actively recast from critic to cocreator. Their posture, in turn, changes from “what’s wrong with your work?” to “how can we improve our work, together?” People support what they help create.

Keep going

A common finding in both our survey data and conversations is that innovation initiatives almost universally begin with optimism and goodwill, but many struggle to maintain momentum in the face of early setbacks. Our survey data shows that, on average, only half of all innovation efforts are achieving their desired value targets. This success rate increased, however, based on the percentage of time that a respondent spends on innovation.

Failure. In established organizations, we’re taught not to say the f-word. As heirs to historically successful organizations, enterprise leaders are often incented to not lose rather than win. Risks are costs and are thus minimized as opposed to managed in service of rewards and revenues. Alas, we cannot shrink our way to profitable growth.

In the startup community, failures are instead considered milestones to be celebrated.5 Not because founders seek to “lose,” but because they recognize that, in bringing new products and services to market, learning precedes earning. Startups call this iterative slog the search for “product market fit.” As an energy and resources innovation leader noted, “Innovation is to business-usual as chess is to checkers. You can’t win at chess without losing a few pawns.” Aravanis says: “Setting out to conquer what is difficult doesn’t always pay off, and fostering a company culture that punishes failure results in defensiveness and discourages tenacity.”

By embracing a founder—rather than steward—mentality, innovation leaders can engender an abundance, rather than scarcity, mindset. This involves a recognition that failure isn’t money wasted, but instead, invested—and that those learnings, made manifest in persistent pivots, is the recipe for (eventual) superior profits. According to our study, organizations with leading innovation maturity are more likely to consider failures as positive and celebrate lessons learned (78% vs. 54%).

“Innovation shouldn’t be pursued as a quick win—it takes years to be profitable,” says another innovation leader.

Let go

It’s been nearly 25 years since Clayton Christensen brought innovation to the boardroom with his bellwether classic, The Innovator’s Dilemma. Since then, a generation of theorists and practitioners have further formalized the space into the heavily stage-gated, carefully KPI’d discipline it is today. Eager to escape accusations of innovation being code for “playtime,” the field is now more buttoned-up, heavily degreed, and cuff-linked than many.

Our study reveals that despite this abundance of management best practices available today, leaders who proactively avoid micromanagement end up delivering more successfully. Erik Ross, head of Mergers & Acquisitions and Venture Capital at Nationwide Insurance, notes, “Innovation works when you push decision-making to the lowest level and let people make decisions … coach, don’t manage.” Indeed, another innovation leader adds, “As I’ve matured, I realized it’s my job to ask, ‘where are you stuck, and how can I help?’”

Survey data backs this up. Organizations with >20% revenue growth during the last 18 months were more likely to spread ownership of innovation throughout the organization (48% vs. 34% of average respondents). “The only way we create the next generation of innovators is by removing the constraints around what they think innovation means,” says Hartsock.

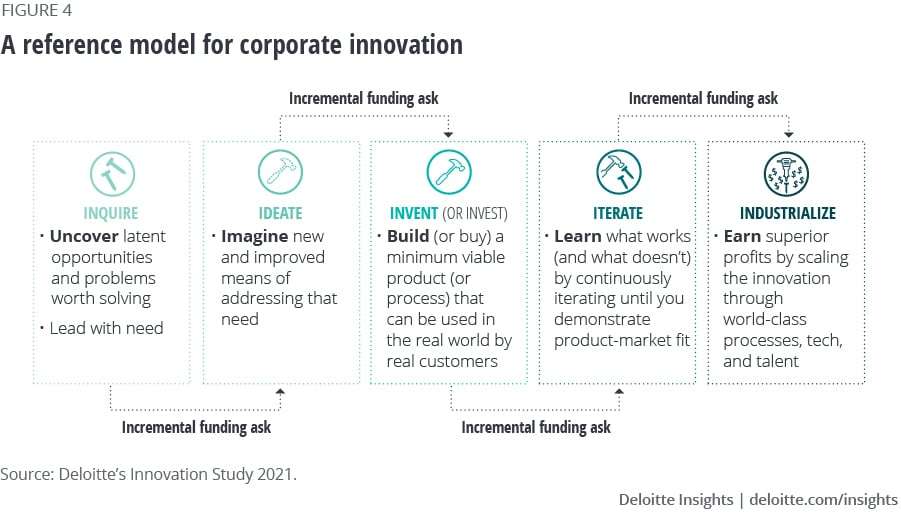

A Reference Model for Corporate Innovation

Given the preceding flurry of research findings, we don’t blame you if you’re wondering “now what?” For executives, information and insights, no matter how well-framed, are a means to an ultimate end: effective, efficient, profitable decision-making. In the spirit of this bias toward action, we present the following reference model for high-performance corporate innovation. Consider it a cheat-sheet of sorts, meant to inform, inspire, and guardrail your innovation efforts.

Inquire (a.k.a. lead with need)

On balance, the most successful innovation programs lead with need. They uncover opportunities worth winning, or problems worth solving, and only then move on to the comparatively glamorous (or at least, more recognized) work of dreaming up new ideas. As leaders, we’re apt to champion a solutions orientation. Many of us have received (or given) coaching to avoid admiring the problem. When it comes to innovation, time spent sitting with the problem is time well spent. By ensuring that downstream innovation efforts are in service of validated needs held by validated stakeholders, leaders can mitigate the age-old problem of building hammers in search of nails.

Ideate (a.k.a. a little new and a lot improved)

Entire books, nay, entire bookcases, are filled with tips and tricks to cook up winning ideas. Our small research-based contribution to the corpus: Remember that an idea’s degree of novelty matters less than its degree of improvement. Eureka inventions are, on balance, less likely to generate superior profits than new integrations (or applications) of proven winners.

Invent/invest (a.k.a. build or buy)

With your need validated, and your idea articulated, it’s time to turn the corner from talk to walk. Whereas needs validation is cathartic fun, and ideation is creative fun, building a minimum viable product (MVP) is comparatively costly and skills-intensive. Understandably, many established organizations opt instead to invest in third-party capabilities rather than invent their own. Both strategies can drive positive financial outcomes, but the key leadership takeaway is hiding in plain sight in the term MVP: Funding anything less than a viable (i.e., usable) first effort will result in frustrated stakeholders and insufficient learnings. On the flip side, funding anything more than a minimum first incarnation will result in waste. “Aim for the goldilocks zone,” advises one innovation leader. “Good enough to get going, but not so good you’ll miss it when it grows up.”

Iterate (a.k.a. learning precedes earning)

If our research findings make any one point clear, it’s that those organizations who see failure as a feature, as opposed to a bug, tend to prevail at sustained innovation. As discussed earlier, failure is code for learning, which is, in turn, code for iterative optimization. Established organizations carry an understandable penchant for perfectionism. Leaders would be wise to refrain from holding early-stage innovations to traditionally lofty standards. Famed venture investor Steve Blank said that startups are not businesses, so much as they are a temporary “organization formed to search for a repeatable and scalable business model.”6 And so it might be said about a corporate innovation in its trial-and-error journey from MVP to product-market-fit (or more traditionally, from cost-center to profit-center).

Industrialize (a.k.a. fuel the fire)

Scaling is typically the hardest step for startups, but on balance, the most natural advantage for corporate innovators. As enterprise leaders, we might rightly decry red-tape, orthodoxy, and governance as impediments to the preceding activities, but when it comes to turning little winners into big winners, that’s what established corporations do best. Our advice to leaders here: Once your adolescent innovations have demonstrated promising unit economics, fuel the fire by both supporting (talent, tech, and process, to name a few) and promoting it (both internally and externally where appropriate) in earnest. A friendly watch-out, however: Don’t rush to turn the reins over to your traditional product and financial managers too soon. Though no longer acorns, even saplings require a slightly different level of care and feeding than your established oaks.

Finally, fellow innovator, a reminder that eventually, with proper nurturing, your saplings will themselves become mighty oaks that your successors, and even competitors, may come to recognize as best practices. With any luck, your pioneering innovation might one day be seen as a legacy orthodoxy itself in need of fresh thinking, of disruption.

Don’t let this realization dissuade you. Let it propel you. Such an outcome means you’ve succeeded in creating something lasting—a foundation for future innovators, shoulders worth standing on.

- The expression “Real artists ship” is attributed to Steve Jobs, as per Quote Investigator .View in Article

- Khalid Kark et al., The new CIO: Business-savvy technologist , Deloitte Insights, April 10, 2020.View in Article

- Kark et al., The kinetic leader: Boldly reinventing the enterprise , Deloitte Insights, May 18, 2020.View in Article

- Vijay Govindarajan and Srikanth Srinivas, “The innovation mindset in action: 3M Corporation ,” August 6, 2013. View in Article

- FailCon website, accessed August 30, 2021.View in Article

- Steve Blank, “What’s a startup? First principles ,” steveblank.com, January 25, 2010.View in Article

We would like to thank, Sonal Naik for helping us design and deliver on the promise of this bold innovation survey. Douglas McWhirter for helping us craft the story with your one-of-a-kind eloquence and editing mastery.

Bill Briggs, Louis DiLorenzo, Jr., Stephanie Rowe, Tom Schoenwaelder, Tim Smith, Geoff Tuff, Jeffrey Wordham, Lauren Wise, and Kenneth Akpati for your expert review of this material and your championing of “new and improved” innovation throughout Deloitte.

Kelly Gaertner and Abhijith Ravinutala for your operational support and execution in getting this over the finish line.

Rithu Thomas, Preetha Devan, Blythe Hurley, and the entire Deloitte Insights team for continuing to provide outstanding editorial and production support.

The article was first published here.

Photo by Skye Studios on Unsplash.

5.0

5.0