The Strategic Imperative: Beyond the Illusion of Oversight

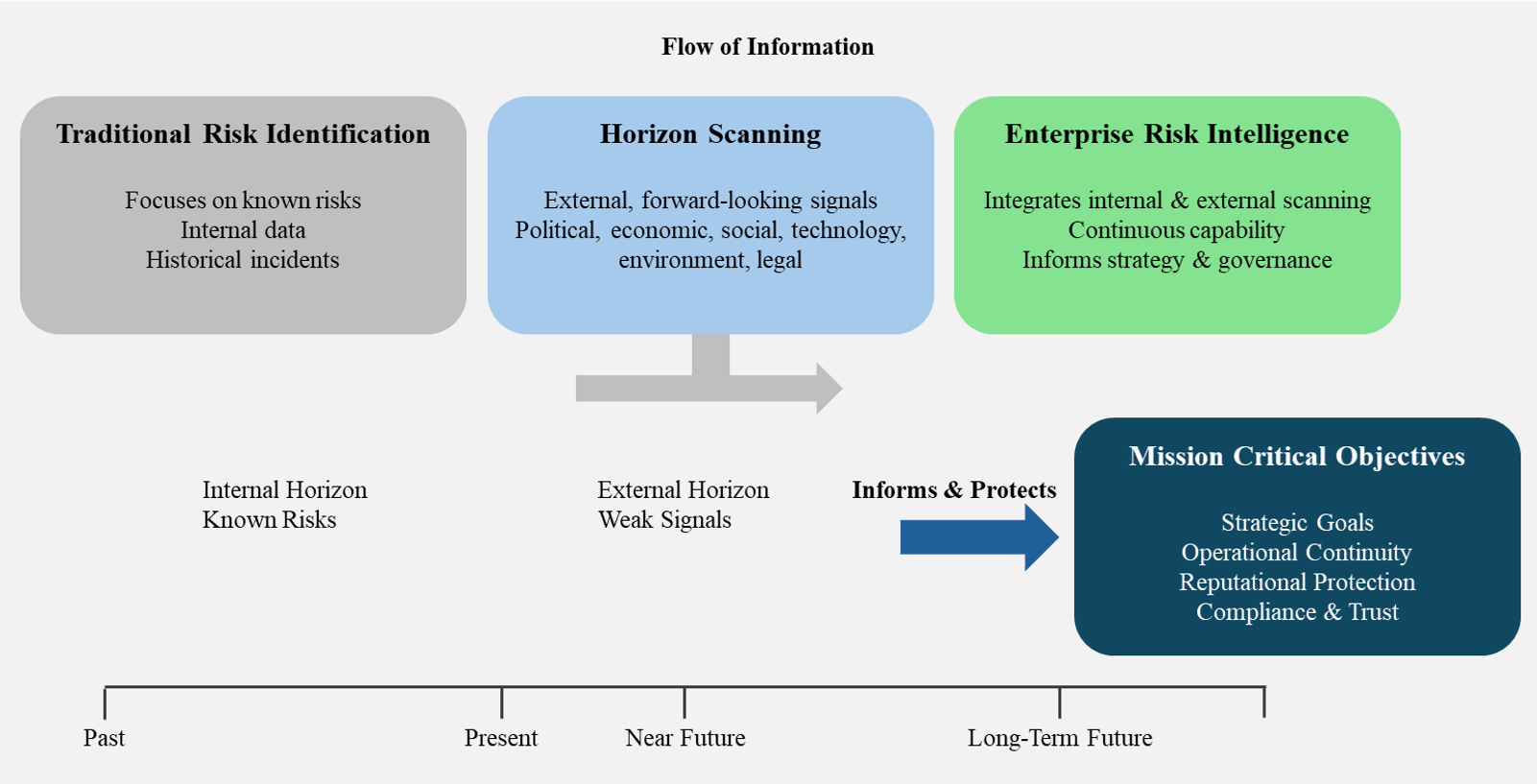

In the volatile landscape of 2025, the greatest risk facing Malaysian Boards is not the occurrence of an adverse event, but the failure of perception. Enterprise Risk Management (ERM) has largely devolved into an episodic, backward-looking exercise – a “risk management of nothing” that prioritises historical data over decision-ready foresight.

For the modern Director, inadequate risk identification is an existential threat to fiduciary integrity. When Boards rely on static risk registers, they are effectively navigating a supersonic business environment using a rearview mirror. To safeguard shareholder value and ensure long-term resilience, Boards must pivot from fragmented compliance checklists to a governance-forward architecture: the integration of Enterprise Risk Intelligence (ERI) with Mission Critical Objectives (MCO).

The “Anticipation without Agency” Paradox

Many organisations have attempted to modernise through “Horizon Scanning”. While this formalises external sensing of geopolitical and technological shifts, it often suffers from a fatal external fixation. It detects the storm on the horizon but ignores the rot in the ship’s hull.

This creates a state of epistemic imbalance: the Board possesses the foresight to see a threat but lacks the internal intelligence on culture, governance independence, and operational precursors to act decisively. This gap between anticipation and agency is where corporate value evaporates.

The Three Structural Blinds Spots

This paper identifies three “industry standard” practices that critically compromise board-level oversight:

- The Backward-Looking Bias: Traditional identification is anchored to historical incidents and audit findings. These privileges visible, familiar exposures while silencing the “weak signals” and emergent dynamics that precede systemic collapse.

- The Fragmentation Trap: When risk ownership is siloed across Audit, Compliance, and Business Units, accountability for cross-silo hazards weakens. The Board receives a “fragmented list” of data points rather than a synthesised, coherent narrative of organisational health.

- The Tempo Mismatch: Annual or biannual risk cycles crystallise an organisational state that no longer exists by the time the report reaches the Board. In a high-velocity environment, episodic reporting is a recipe for strategic obsolescence.

The Solution: The ERI+MCO Framework

To transform ERM into a genuine strategic asset, Boards must implement a model that converts scattered signals into governed foresight. This framework demands a fundamental shift in the “attentional economics” of the boardroom.

- The MCO Anchor: The “Few That Matter”

Boards must orient all risk and assurance activity around a compact set of 5–8 Mission Critical Objectives (MCOs), the existential pillars of value creation and preservation. By anchoring intelligence to MCOs, the Board filters out the “noise” of fashionable risks and concentrates analytic energy on uncertainties with the highest potential impact. - Enterprise Risk Intelligence (ERI): Dual-Horizon Sensing

ERI is not a procedural tweak; it is a disciplined, continuous capability to detect and interpret signals. Unlike traditional models, ERI mandates symmetric attention to:- External Signals: Geopolitical shifts, regulatory trajectories, and technological disruptions.

- Internal Precursors: Cultural diagnostics, governance independence gaps, and near-miss telemetry

- Causal Narratives over Static Lists

The ERI+MCO model replaces low-utility risk registers with Intelligence Cards. These cards do not merely name a risk; they narrate how a weak signal travels through causal pathways to affect a specific mission outcome. They provide the Board with confidence levels, escalation triggers, and explicit “governance asks” for timely decision-making.

A Call to Action for Key Stakeholders

The ERI+MCO model is not just a theory; it is an actionable blueprint that redefines roles and responsibilities. The implications are a direct call to action for the primary stakeholders in the governance ecosystem.

| Stakeholder | The Old Way (The Problem) | The New Way (ERI+MCO Solution) |

|---|---|---|

| Boards of Directors | Passively reviewing static, historical risk registers. | Actively interrogating dynamics, forward-looking intelligence cards linked directly to the 5-8 MCOs they are fiduciarily bound to protect |

| Chief Risk Officers (CROs) | Acting as compliance custodians, often buried in reporting lines and struggling for strategic influence. | Evolving into strategic advisors who use the MCO anchor to provide independent, decision-ready foresight directly to the board. |

| Assurance Functions (Audit Compliance) |

Operating in siloed, checklist-based functions, creating redundant work and “false comfort” assurance. | Becoming an integrated assurance ecosystem that maps all coverage (cyber, safety, audit) against MCOs, eliminating gaps and costly duplications. |

| Executive Management | Decoupling strategy from risk, treating risk as a “cost of doing business” or a separate compliance exercise. | Fusing strategy, capital allocation, and risk by using ER+MCO to make trade-offs explicit and ground strategic bets in measurable resilience. |

| Risk Practitioners | Compiling lists and cataloging signals in complex, low-utility registers. | Synthesising narratives by building causal maps and decision-ready intelligence that connects weak signals to mission-critical outcomes. |

Table 1. The Way Forward

Practical Implications for Key Stakeholders

Synthesising narratives by building causal maps and decision-ready intelligence that connects weak signals to mission-critical outcomes.

- For the Board of Directors: Move from a passive review of historical registers to active interrogation of forward-looking intelligence. Demand reports that clarify the trade-offs between strategic ambition and operational resilience.

- For the Chief Risk Officer (CRO): Evolve from a compliance custodian into a strategic advisor. The CRO must have direct board access and controlled remuneration to ensure the independence required to surface “uncomfortable truths”.

- For Assurance Functions (Audit & Compliance): Transition from siloed, checklist-based work to an integrated assurance ecosystem. Map all coverage against the MCO uncertainties to eliminate redundant work and expose dangerous blind spots.

Operational Feasibility: A Lens, Not a Layer

Crucially, the ERI+MCO model is designed to improve informational quality without adding bureaucratic burden. It is a refinement of existing workflows. By integrating “weak signal” and “MCO linkage” columns into existing risk registers and board packs, organisations can achieve a high-leverage shift in oversight quality with minimal disruption.

Conclusion: From Cataloging the Past to Governing the Future

Traditional methods have failed the tests of tempo and integration. The ERI+MCO model provides Malaysian Boards with a practical blueprint to close the gap between anticipation and agency. By anchoring the technical work of sensing to the fiduciary purpose of protecting mission-critical outcomes, organisations can finally move beyond simply listing risks and begin to master uncertainty.

Dr. Shaharin is a Governance and Assurance professional with over 25 years of local and international experience transforming risk management from a compliance checklist into a driver of business value. His expertise spans complex and highly regulated sectors such as Banking & Financial Services; Railways & Logistics; FinTech; Property & Construction; and Oil & Gas, with a geographic footprint across Malaysia, Kuwait, Qatar, and the UAE. His professional insights and writing are rooted in this extensive field experience, offering a unique synthesis of real-world application and deep technical knowledge.

- Architect of Integrity Ecosystems: Served as the primary architect for a national banking institution’s corruption risk management ecosystem, building the entire framework from the ground up to ensure institutional integrity.

- Strategic Risk Leadership for Conglomerates: Driven the adoption of advanced risk frameworks for major conglomerates, ensuring resilience for some of the significant players.

- National Infrastructure Risk Specialist: Spearheaded the Enterprise Risk agenda for key national stakeholders, securing the operational readiness of major urban development and national railway assets.

- Champion of Governance Reform: A Ph.D. in Management, focused on corporate governance structural reform, he specialises in guiding Boards through complex regulatory landscapes.

Connect with Dr. Shaharin: shaharin.abdulsamad@gmail.com

Read the full academic paper here: The Objective-Centric Anchor.

The article was written by Dr. Shaharin Abdul Samad.

Photo by Diva Plavalaguna on Pexels.com.

5.0

5.0