While it seems corporate boards have been around forever, they only began appearing in the United States in 1811, when a New York State law first codified the practice of having elected directors serve in a supervisory role over a corporation’s management.

For many years, boards played a relatively passive role, changing little. In our era of shareholder/activist engagement, however, the prevailing view of the role of boards has shifted significantly. Boards are currently under pressure to perform, and many have voluntarily adopted practices known to elevate their effectiveness.

In addition to our day-to-day work with boards and regular contributions to a growing body of intellectual capital intended to guide boards toward proven practices, we at Korn Ferry have been longtime observers of the evolving governance scene. And it isn’t an exaggeration to say that boards have transformed themselves more during the past decade than in the two prior decades. Change is accelerating, not for the sake of change, and not merely because of the push of external forces, but because boards are beginning to recognise that by becoming a true strategic asset and partner to the CEO they can create significant value for shareholders as a source of competitive advantage.

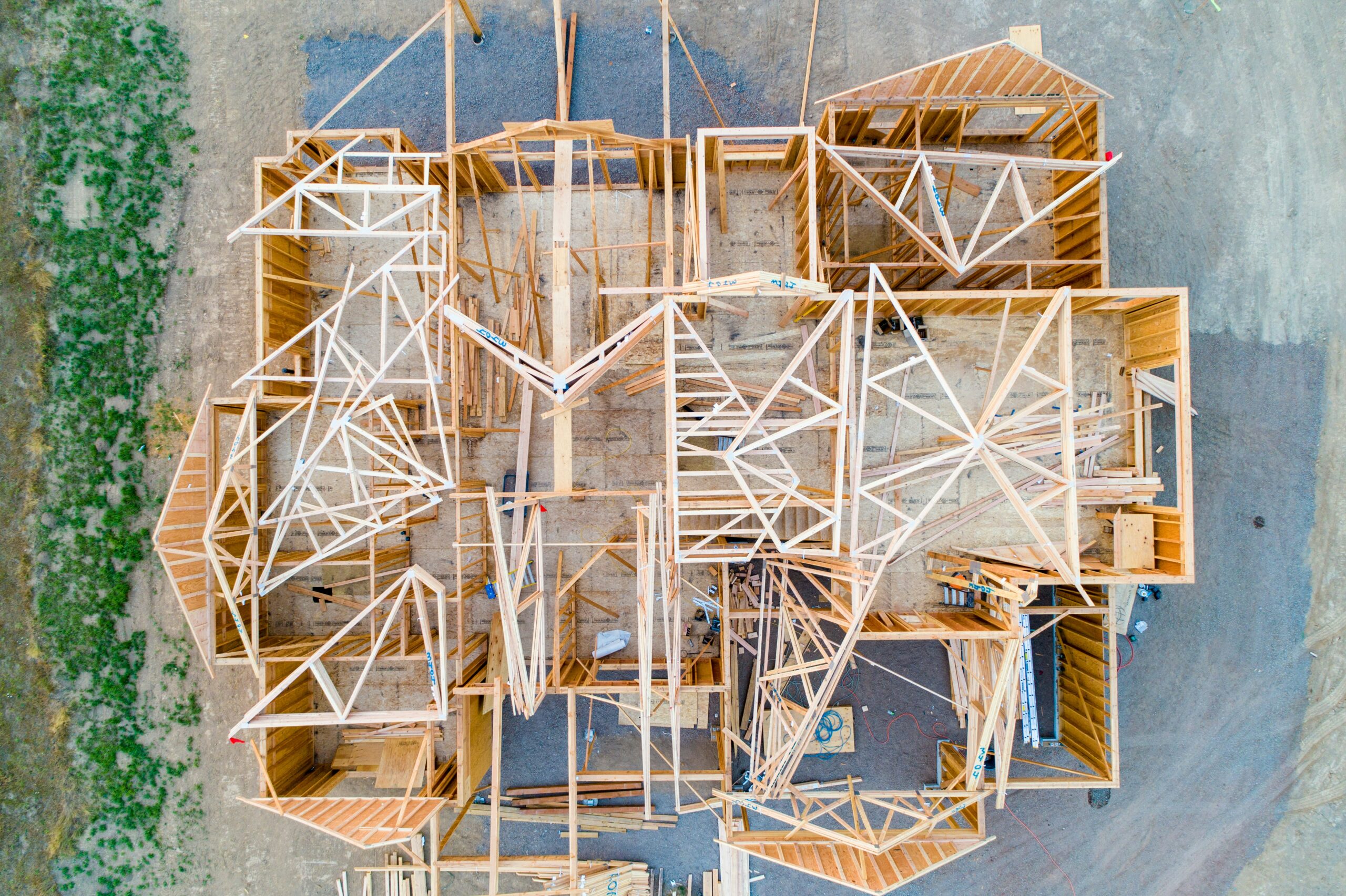

It takes some work to become a “black belt” board, but the practices these boards share are increasingly clear. While no board can expect to achieve this elite status overnight, and the journey may take some time, here is a basic blueprint to guide you in the right direction:

Build on the Right Foundation.

There are two pillars of leadership that form the basis for driving long-term shareholder value: the leader of the board and the CEO of the company. Aligning leadership structure to the needs of the company and enabling the highest degree of shareholder value creation are the ultimate responsibilities of corporate directors. While the need for strong, independent board leadership is widely acknowledged, the form it takes is evolving and tailored to the needs and culture of individual boards.

Renew and Remodel as Needed

No structure can be expected to last forever. Board leadership, composition and process are not static; rather, they change to align with shifting strategies as well as external factors, including macroeconomic forces and new competitors. The highest-performing boards now plan for board succession much as they would for CEO succession. That requires a keen understanding of the strategy, as well as the ability to identify directors with the skills and experience that sync with the strategy and will enable its success. In addition to what is listed on the prospective director’s résumé, boards should look beneath the surface for a strong track record of making good decisions. The same standard should be applied to directors currently on the board when undertaking a regular board evaluation, a crucial element of the board succession planning process. Diversity broadly defined—gender, ethnicity, age, geography and function—is an increasingly important consideration for all boards as they refresh membership. Structural changes may include adding new committees or altering the charter and responsibilities of current ones, as needed to reflect new board duties.

Invest in Quality

Just as you would invest in quality materials and an experienced contractor to build a house, in assembling your board “house,” be prepared to invest in the individual directors who will comprise your board team. The best directors are motivated far less by compensation than by the opportunity to work with peers and contribute their knowledge and experience, but everyone wants to be paid what they’re worth. Considering the significantly greater time, effort and expertise it now takes to serve on a board—and the greatly increased risk for directors—be prepared to pay for quality. In the end, the long-term value created by the most experienced, effective board team will come back to you manyfold.

The article was first published by Korn Ferry.

Photo by Avel Chuklanov on Unsplash.

4.0

4.0