- Economic and social progress has become decoupled, writes PwC Chairman Robert E. Moritz.

- A global standard for non-financial reporting is vital – and urgent – argues Moritz.

- Coupled with a broader view of value creation, this information will empower stakeholders as well as shareholders.

For many decades market economies were an almost unalloyed force for good, lifting billions of people out of poverty, enhancing opportunity and quality of life, and increasing life expectancy and security. Where markets flourished, both shareholders and broader society prospered.

In recent decades, however, economic and social progress across many nations have become decoupled. Economic disparity is rife and growing, as evidenced by the eight richest people in the world owning more than the poorer half of humanity. We are in a race against the clock to avert catastrophic effects of climate change. Technological disruption is creating widespread job insecurity. And so on.

There is an adage in design thinking that every system is perfectly designed to get the results it gets. In which case, the market system has a problem.

So, what do we do about it?

Part of the answer starts with a focus on the incentives that drive decision making. At heart, financial markets are a way of allocating resources where they can create most value. But, for that to work, we have to conceive of value in the right way and be able to identify it when we see it. At the moment, neither of those conditions is met adequately. Instead, the dominant conception of value is still too often purely financial, and too often short term. As a result, capital is not flowing at sufficient scale or speed towards addressing the biggest challenges the world faces.

Here are 3 steps to accelerate the change.

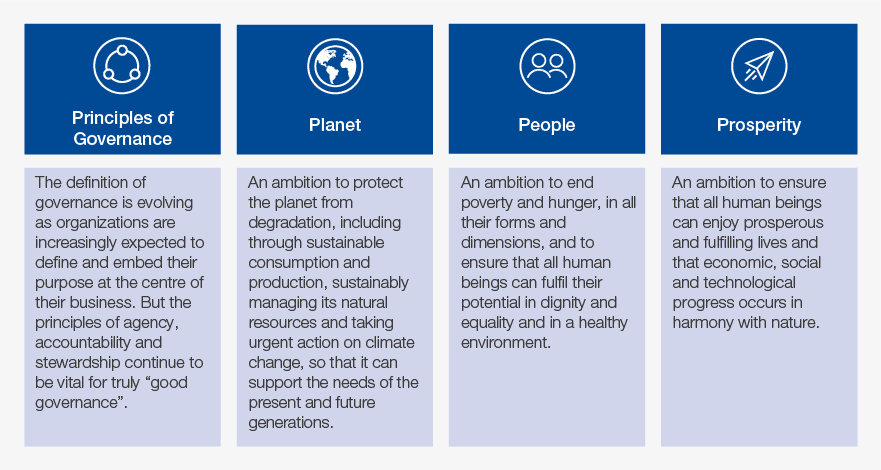

1. Redefine value

To address this problem we first need to ensure that markets adopt a broader concept of value than solely financial return. This is already happening with the increased focus on Environmental, Social and Governance (ESG) concerns in corporate strategy and investing, but the change is not fast or robust enough.

We need regulatory and policy changes that further enable shareholders and stakeholders to reward both enterprise and societal value creation. Arguably, in the long run these two forms of value creation align, but as Keynes noted ‘in the long run we are all dead’. In the face of urgent issues like climate change, the practical need is for markets to take a broader view of value, now – not to have a philosophical discussion about long-termism.

2. Harmonize the metrics

Second, both shareholders and other stakeholders need trustworthy information upon which to evaluate business performance against this broader conception of value. They can only reward value creation if they can meaningfully identify it.

That is where the courage to advance a global reporting system comes in.

Currently, the corporate reporting system does not provide stakeholders – including investors, customers, employees, policy makers and others – with the objective, relevant and timely information needed to differentiate between companies on value contribution beyond financial performance.

What’s needed is a form of reporting used consistently that measures both progress and comparability on a focused list of topics important for stakeholders. From there we can build as we continue the journey. The current growing list of measures, standards and metrics, and lack of consensus on interpretation, has created a situation where the same company can top one ESG index on performance and get a failing grade in another.

3. Create a new global reporting regime

Reporting has to change, and change fast. It took decades of creative, inclusive discussion and experience to get to the clear and widely accepted standards we have today for financial reporting. We need to get to the same level of clarity, specificity and trust around non-financial metrics – but within a couple of years not a couple of decades.

We need an Apollo program to develop the new global reporting regime, focused on a clear goal: a globally aligned set of reliable, comparable non-financial reporting standards. Today, no business can succeed without conforming to financial reporting standards. The same should be true for non-financial reporting, with equivalent levels of governance, assurance, incentives and sanctions for non-compliance.

The building blocks of such a system are out there. Standard setters have made tremendous progress around specific disclosures. Today’s announcement by The International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) of their intent to merge into a unified organization – the Value Reporting Foundation – is welcome news and a positive step forward. By integrating two entities that are focused on enterprise value creation, this merger represents significant progress towards simplifying the corporate reporting landscape.

Meanwhile, the EU is rapidly advancing the non-financial reporting agenda. And there is momentum within business. We recently worked with the World Economic Forum, the accounting profession and 120 leading companies in the International Business Council (IBC) to identify a global set of metrics based on existing standards. This is an important example of business leaders embracing enhanced disclosures and accountability linked to a broader conception of value creation.

At the same time, business, standard setters, policy makers and civil society need to work together to quickly drive global alignment on standards. These should address timeliness, as well as the content of reporting. Information must reflect more than a periodic, historical reporting perspective to address the pace of our world advancing at the speed of internet time.

The current focus on how business supports society in the context of Covid-19 creates a window where rapid progress is possible. Miss that window and fragmentation of standards could accelerate. This progress has to happen quickly, not just because we are running out of time to deal with climate change and economic disparity. It is also to help investors. According to one estimate, by 2018 over $30 trillion was invested using some form of ESG or sustainability criteria, and this figure is growing rapidly every year.

Knowledge is power. At the moment the only thing we can know about every company with a high degree of certainty is their financial performance. Therefore that is the metric that drives decision making. By broadening the knowledge that is out there, other stakeholders as well as shareholders will be empowered. It will be possible to align incentives – from management compensation to investment allocations to reputation – against a more robust, more rounded conception of value. By getting better information flowing, we can recouple economic and social progress, restore trust in market economies, and build a better tomorrow as the world emerges from the Covid-19 crisis. We all need to move with a sense of urgency. All companies and standard setters should be taking action now.

This article was first published here.

Image by Monsterkoi from Pixabay.

5.0

5.0