In our previous post, we discussed the board’s role at each stage of the M&A process. In this second part of our M&A blog series, we’ll shed some light on another important role – the audit committee.

Traditionally, governance bodies such as the audit committee assists the board of directors in providing an opinion on the quality of financial statements and reporting. However, today these committees are facing increasing pressure to understand all aspects and stages involved when the company undertakes an M&A transaction, including significant M&A deals. Other than just the conventional financial and tax risk aspects, the audit committee’s responsibilities have expanded to include enterprise risk assessment and reviewing of conflict of interest situations as outlined by Bursa Malaysia. New regulatory developments may also have impacted the breadth and depth of these responsibilities.

Preparation for M&A

The approach the audit committee uses to test the management’s framework and processes would facilitate the board in its oversight role. The audit committee should be engaged from the very start of the M&A process. Some common issues faced during an M&A process would be the board and audit committee being brought into the process too late or too often, or the criteria used to assess targets not being aligned with value-creation strategies or desired synergies. Having the right strategy can be more important than price but associated risks will also need to be considered in the specific transaction context. Therefore it can be useful for the audit committee to carry out their duties with risk management in mind.

Several important questions the audit committee can ask include:

- Is the perception of strategic fit based on historical business achievement or merely on unproven and predominantly future expectations?

- Does due diligence take into account operational risks and compliance with environmental, health, safety, legal and regulatory standards which would impact the financial statements of the merged entities?

- Are sufficient resources being invested into analysing cybersecurity during the deal process?

- Is the deal value accretive? How does the deal affect the future returns on equity and assets of the enlarged group?

- Is there a well-thought out and robust due diligence and post-merger integration framework in place, as well as qualified ‘subject matter experts’ to advise management throughout the entire M&A process?

Due Diligence

There are several key areas of focus within the due diligence process, which the audit committee should understand and assess to form a view on walk-away issues, needed changes to the offering price, extent for contractual protections and post-acquisition matters. These information and insights can then be provided to the board of directors to gain a thorough understanding of the M&A transaction. The key areas of focus are:

-

Accounting policies, internal controls and risk management

The audit committee would need to recognise the accounting policy differences, if there are any, as well as new changes to the existing control structure. The audit committee should understand the robustness of internal controls and past deviations between management accounts and audited financial statements.

-

Financial and tax due diligence

Part of the financial due diligence exercise involves analysing and reporting on the quality of earnings and assets, tax and optimal tax-efficient structuring for the combined entity, as well as contingent liabilities.

-

Operational due diligence

For more significant transactions, the audit committee would need to go beyond the familiar accounting and financial due diligence and into the operational scope. These measures can provide a more holistic view of other risks that affect the transaction’s financial results. Some areas to look into are employee or management issues, operational trends and production related matters.

-

Deal terms

The audit committee can also look into assessing deal structure, language of the disclosure schedule, nature of indemnification and any escrow holdback for indemnification claims.

However other than valuations, price and legal issues, there could be other deal breakers:

- Insufficient preparation

- Negotiation behaviour such as selective disclosure or misrepresentation

- Cultural issues between different countries and territories, or organisational culture

- No buy-in from target management

- Exclusion from process due to perceived execution risk

Post Close

Many acquisitions strategies fail due to a lack of integration after the close of a transaction. Doing the deal is only a quarter of the entire process – the rest is making it fit. While this phase is not a conventional focus for audit committees, active oversight of the integration process can help confirm that shareholder value is kept, and the value of the transaction is realised.

Conclusion

As with the board of directors, the role of the audit committee has evolved over the years, with the emergence of new opportunities and risks. The audit committee is a central pillar of effective corporate governance, through its vital responsibility in ensuring the accuracy of financial reporting and monitoring of risk management. This underscores the significant role played by the audit committee in building trust in the business in the long run.

Still interested in this topic? Read more on Global M&A Industry Trends

This article was first published here.

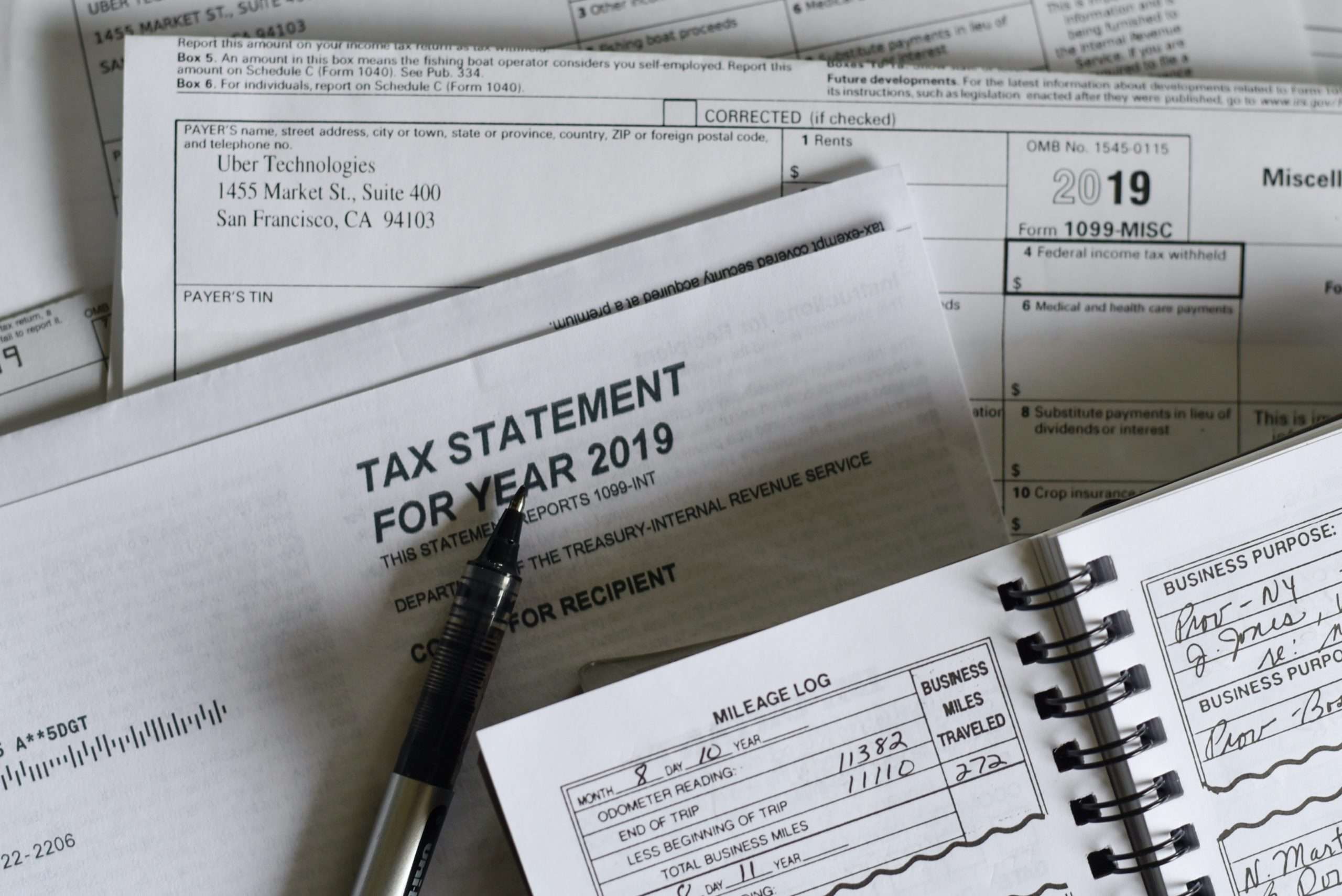

Photo by Nastuh Abootalebi on Unsplash.

5.0

5.0